Transforming cash in/cash out – Leveraging the potential of female agents

MicroSave Consulting (MSC) is a boutique consulting firm that has, for 25 years, pushed the world towards meaningful financial, social, and economic inclusion. These podcast series are hosted by MSC for dedicated founders, start-ups, investors, and other stakeholders in the startup ecosystem. Through this bouquet of curated conversations around developments in the financial inclusion space, we offer insights and lessons based on our research and expertise.

In this podcast, “Transforming cash in/cash out – Leveraging the potential of female agents,” we deep-dive into the landscape for female agents and the challenges they face and discuss opportunities for female CICO agents. We chat with Shelley Spencer, Founder and CEO of Strategic Impact Advisors, a global consulting firm committed to spreading the use of digital technology for financial inclusion and the development of communities and individuals. This podcast is a part of a broader effort of MSC to facilitate discussions on CICO networks through frameworks and collaterals such as blogs, focus notes, and reports.

Future of agent networks – What do we envision agent networks to look like in the future?

MicroSave Consulting (MSC) is a boutique consulting firm that has, for 25 years, pushed the world towards meaningful financial, social, and economic inclusion. These podcast series are hosted by MSC for dedicated founders, start-ups, investors, and other stakeholders in the startup ecosystem. Through this bouquet of curated conversations around developments in the financial inclusion space, we offer insights and lessons based on our research and expertise.

Agent networks across the globe play a critical role in enhancing financial inclusion at the last mile. Evolving country landscapes have led to newer business models of agent network management. In this podcast, listen in to Emilio Hernandez, Senior Financial Sector Specialist at the Consultative Group to Assist the Poor (CGAP). Last in a three-part series by MSC on the multiple facets of agent networks, this podcast sheds light on the Future of Agent networks. It highlights the evolving business models of agent networks, the different factors that lead to their evolution, and the impact of the evolution on the agent lifecycle.

Are you designing a behavior change communication message to encourage the use of agent banking among the LMI women in rural areas? Here is what you need to know.

They are often illiterate. Only some have an active bank account or a mobile phone. They largely remain at home, engaged in household work. Most are risk-averse, and depend on each other’s experiences and male household members to make financial decisions. They are women from the low- and moderate-income (LMI) segment in rural areas.

These specific factors make rural LMI women one of the most challenging segments for any financial services provider. Yet they make up almost half of the rural LMI populace and need customized financial products and services to suit their specific requirements. At the same time, they need to be reached and sufficiently enthused about the offering – so behavior change communication becomes critical.

Airtel Payments Bank, a leading scheduled payments bank in India, has tried to serve this segment with innovative product offerings, such as a feature-loaded Bharosa account. However, communicating product features is not easy with women mainly confined to their homes. MSC collaborated with Airtel Payments Bank and piloted an audio message to address this problem. The pilot results show that women who heard the audio clip saved 54 times more than women from similar geographies whom the message did not reach. You can see the entire pilot journey here.

Based on this work, it is clear that short, easy-to-absorb, and relatable messages disseminated in regional languages through a carefully matched channel result in powerful communication to the LMI women in rural areas.

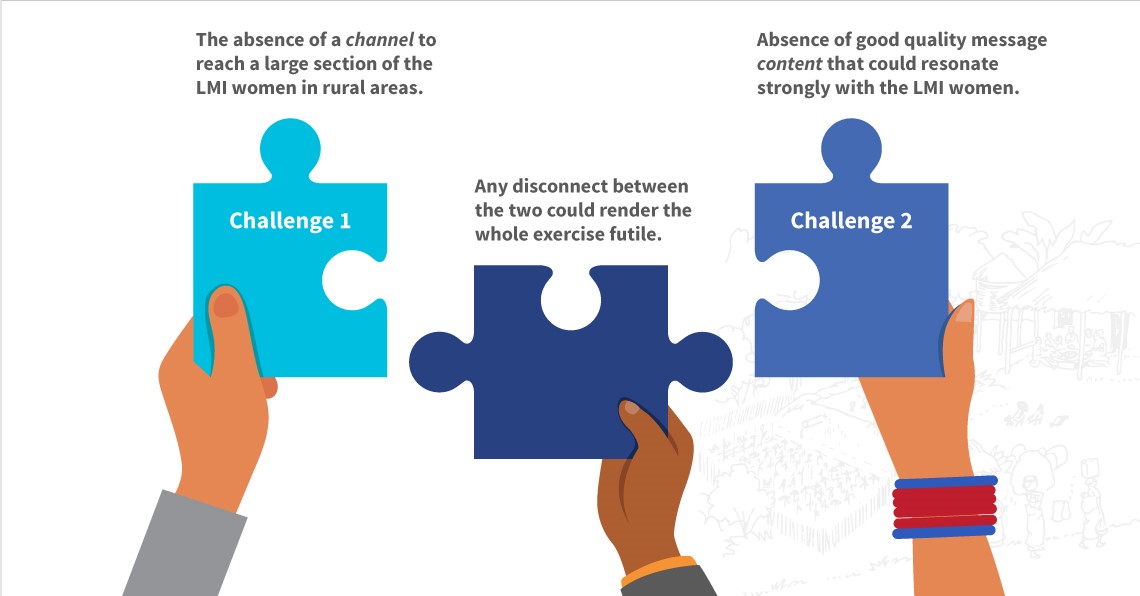

Channel and content: Bridging the two pillars

A suitable response to the unique challenges faced by different target segments requires coordination between the message script and its dissemination medium. If these two do not operate in harmony, the communication will not affect the desired behavioral change in the target segment—no matter how strong they individually are.

Primary research in a few select geographies is needed to identify the channel and specific message content that syncs with it. A well-rounded primary research exercise provides context-sensitive insights to help design the message and deliver it. We used the same approach and gained important input for the message content and dissemination options suitable for rural women.

Resolving the channel challenge

When designing for the rural LMI segment, the message script depends heavily on its channel. The words in a wall painting, for example, will be very different from those used in an audio clip to convey the same message. Therefore, one must choose a channel first and then draft the message content. We found the following behavioral traits and life realities to be critical while communicating with the target segment of rural LMI women:

1. Low literacy levels: Most women in Indian villages cannot read. So we cannot use written material to communicate with them. And it is difficult to convey relatively complex ideas through picture- or icon-based, oral-friendly, communication materials.

2. Low mobile phone ownership: Only a few rural women of the LMI segment own mobile phones. The few who owned one mostly had a basic handset. The lack of mobile phones leaves no chance to use social networking platforms like WhatsApp or Facebook; or even communicate with them through Interactive Voice Response System (IVRS) or bulk voice messages.

2. Low mobile phone ownership: Only a few rural women of the LMI segment own mobile phones. The few who owned one mostly had a basic handset. The lack of mobile phones leaves no chance to use social networking platforms like WhatsApp or Facebook; or even communicate with them through Interactive Voice Response System (IVRS) or bulk voice messages.

3. Low mobility outside the household: Women in villages do not move out too often or do so for short intervals. So, if you want to connect with them outside their houses, you will have to contact them during those limited opportunities and design a communication strategy accordingly.

4. Low reachability, even within the household: Social norms in rural areas imply that women interact primarily with other women in their community. They are neither encouraged nor feel comfortable talking to people they do not know well. This norm limits the chances of connecting with them inside their homes and virtually eliminates the possibility of deploying any male agents to establish this connection.

A typical public announcement system used by Airtel Payments Bank team

We chose a portable loudspeaker for our work with Airtel Payments Bank. It would play an audio clip designed around the communication theme at various places in the village.

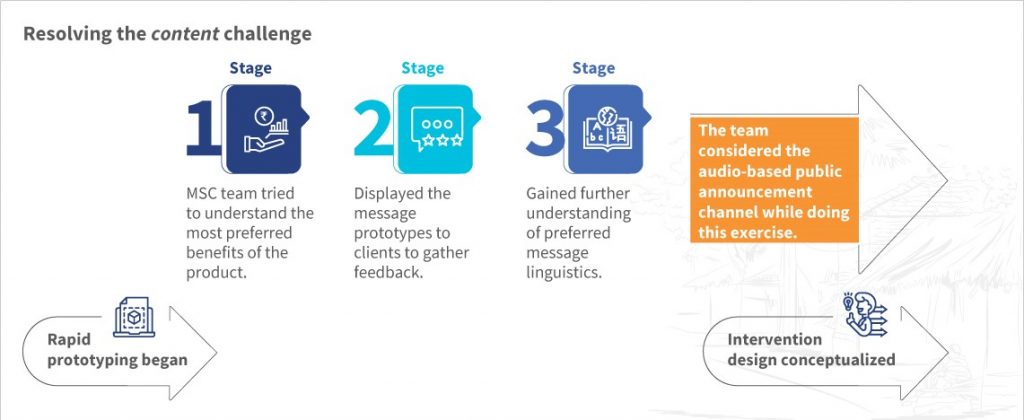

Resolving the content challenge

Once you have zeroed in on how to disseminate the message, the next immediate task is to develop a script. The behavioral research can provide inputs like the duration, language, tone, and script flow to design the message script. We used a rapid prototyping tool for the Airtel Payments Bank project. As part of this exercise, we read out some prototype messages to the women. Their verbal and nonverbal responses helped us understand their preferences regarding various message attributes.

This stage revealed the following critical features essential to the communication message:

- Short: The message must be brief and focus on three or four critical features without getting into details. A brief message is essential due to the limited exposure of rural LMI women to any formal financial services and their narrow attention span. Often, complexities of the design process are visible in the final output. For example, this message is simple, but the sheer length and the resultant information overload put off an LMI customer.

- Easy to understand: The message should be straightforward for the audience to assimilate. Since we intend to talk about financial services, this feature will not be easy to incorporate. A message like this can quickly fail if we use complex terms.

- Relatable: The situations used in the message must strike a chord with the audience. We discovered during our research that the script should talk about the near-term benefits of visiting Airtel Payments Bank agents that make sense to rural LMI women.

- Use a familiar tone and language: No prizes for guessing that the message needs to be in regional languages. Moreover, we found that a female voiceover better suits messages that target rural women simply because they sound familiar.

An ideal communication message will have all the features listed above simultaneously. They all work together, not in silos. The absence of one can considerably weaken the communication.

Results

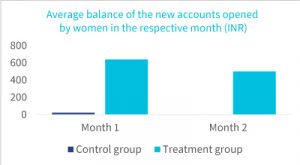

Based on our research, we designed an audio clip for Airtel Payments Bank and piloted it at a few agent locations. As a result, women in these locations opened more accounts and saved more money, thereby enhancing agent income.

Enthused by the pilot results, Airtel Payments Bank has added the audio clip to its existing communication campaign and is currently expanding its outreach to about 1,000 new cash in/cash out agent locations each month. The bank believes this initiative will allow them to offer a range of financial services to rural women, and also open new doors for connecting with other difficult-to-reach client segments.

Enthused by the pilot results, Airtel Payments Bank has added the audio clip to its existing communication campaign and is currently expanding its outreach to about 1,000 new cash in/cash out agent locations each month. The bank believes this initiative will allow them to offer a range of financial services to rural women, and also open new doors for connecting with other difficult-to-reach client segments.

Where to from here?

Women play a pivotal role in running our economies. However, many of them remain financially excluded for various reasons, such as the lack of access to products and services tailored to their needs. Airtel Payments Bank and MSC have shown that we can design and deploy behavioral communication to nudge rural LMI women to use financial services through agent points. With its deep understanding of gender and expertise in behavioral research and design, MSC remains committed to supporting organizations like Airtel Payments Bank in making their services penetrate deeper into this challenging segment.

The authors thank Nitish Narain and Zeeshan Ali for contributing to this blog.

Course for Business Correspondents (BC) in the Indian banking scenario

The Government of India and the Reserve Bank of India have taken several initiatives to enhance financial inclusion over the years. Approximately 100,000 agents attempt the IIBF BC/BF exams annually—many of them fail. In 2019-20 and 2020-21, out of the 97,169 agents that gave the exam, around 32,949 (34%) failed the exam, even after several attempts. We have designed a course for Business correspondents in the Indian banking scenario. This course is designed for those business correspondents who will appear for the IIBF examination or seek to start their journey as a BC to bridge the gap in financial inclusion in India. Click here to know more about our training course.

Behavior change communication to encourage the use of agent banking among rural LMI women—Airtel Payments Bank

While rural CICO agents may have various offerings, a weak client communication strategy often fails to highlight these offerings to potential customers. As a result, the product uptake at these agent points remains low, hurting their incomes. Airtel Payments Bank, a scheduled payments bank in India, had tailored its Bharosa account to suit the small savings needs of its rural clients. However, its agents could not get the required footfall in their outlets due to low client awareness. To solve this, Airtel Payments Bank sought MSC’s support to develop a client communication message that focused on behavioral communication around small savings. It was piloted in a rural area where the bank had planned to expand its operations. This video takes you through the entire journey of this pilot. It looks at the behavioral communication design process, the results of the pilot exercise, and some critical sectorial lessons it offered.