Only 10% of rural people in India have access to formal credit. The lack of financial history and limited digital literacy makes it difficult for them to avail of loans from formal institutions.

Prakash is a 28-year-old self-employed milk vendor from Kurawar village in Madhya Pradesh. His customer footfall reduced during COVID-19. He could not sell milk to the nearby dairy due to restrictions on travel, and his income reduced. Many others like Prakash had to use their savings to sustain their families during the pandemic. After the situation improved, Prakash needed a working capital loan to expand his business. He asked his friends and relatives about formal institutions where he could get credit. Prakash had never availed a loan before the pandemic. Banks and NBFCs would not give him a loan since he lacked formal credit history.

He spoke about his problem to Kashi, a fellow merchant. Kashi explained how he could use the FLYK application on his smartphone to get a loan to stock his kirana store. This got Prakash interested to understand the process of application.

Many credit FinTechs in India offer solutions to the unbanked and underbanked, with easy digital application processes. Yet they face several hurdles while lending to rural borrowers. Such challenges include limited financial awareness of borrowers, language barriers, lack of income proof, and limited availability of data. FLYK is one such startup that provides credit to the underserved with a specific focus on a simple digital application process.

An idea that pivoted to fulfill the needs of the rural segment

FLYK’s founder Apratim Ganguly had struggled with the rigid norms of the lending system when he applied for a credit card. The bank did not process his application despite his income, lendable CIBIL score, proper documentation, and digital literacy. Apratim realized he was not alone, and young people like him had a need for credit. He developed the idea of lending small ticket-size loans to young people like college students who faced a shortage of money in the absence of income.

Apratim introduced FLYK for such borrowers to avail of loans without a credit history. FLYK’s algorithm analyzes a customer’ eligibility based on data collected by the platform. Apratim realized that FLYK’s scope of lending could include rural borrowers too. He ran a pilot across selected villages near Bhopal and decided to push ahead with rural borrowers after receiving a positive response.

From dreamers to creators

FLYK was Apratim’s second startup. He had met Prafful while developing his first app. Prafful was drawn to startups that worked to make a social difference. Apratim and Prafful decided to build the platform together to enable meaningful change for rural customers through loan services.

FLYK was Apratim’s second startup. He had met Prafful while developing his first app. Prafful was drawn to startups that worked to make a social difference. Apratim and Prafful decided to build the platform together to enable meaningful change for rural customers through loan services.

FLYK and CRN

We now return to our milk vendor from Madhya Pradesh, Prakash, who was in conversation with fellow vendor Kashi. Kashi explained the concept of the Combined Responsibility Network (CRN), through which FLYK lends. He warned Prakash to thoroughly screen the person he plans to add to his network, as an unscrupulous member would hurt his score.

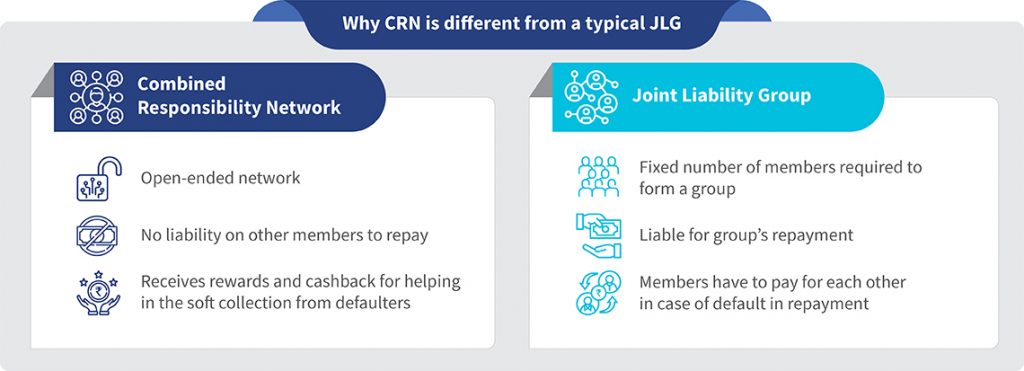

A borrower can join a pre-existing group on the FLYK platform through CRN or add more members through it. FLYK’s underwriting assessment system for lending combines the study of borrower behavior and alternative data. Any bad repayment behavior affects all group members’ credit standing and the services they can access. The CRN-based approach differs from the traditional joint liability group (JLG) approach that underpins much of global microfinance.

FLYK offers incentives to borrowers to avail platform services like money transfer, credit, soft collections from defaulters, and to refer other customers. Borrowers receive monetary and non-monetary rewards like larger ticket sizes, better interest rates, and cashbacks. If a borrower helps with loan recovery from their network, they get a monetary reward on the FLYK app. Besides motivating borrowers to use the FLYK platform more, the reward system also helps rural borrowers learn the digital process flow as they encourage and support each other to use the app.

Progress for FLYK

With 8,000+ successful downloads, FLYK is taking its first steps toward success. The startup has processed about 1,508 loans until April 2022 and envisions expanding rapidly. Out of 635 users, FLYK has an 86% retention rate on its platform.

With 8,000+ successful downloads, FLYK is taking its first steps toward success. The startup has processed about 1,508 loans until April 2022 and envisions expanding rapidly. Out of 635 users, FLYK has an 86% retention rate on its platform.

Besides the numbers, Apratim is happiest when people like Prakash call him to thank him for the services they receive and leave positive feedback. For the FLYK team, such moments spark the motivation to spread the network further.

Where a challenge arises, so does a solution

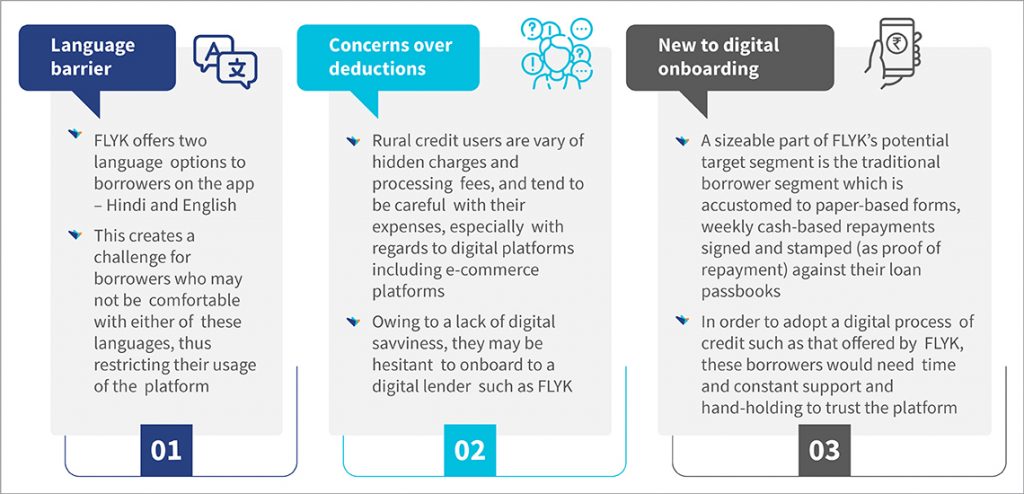

Addressing the various needs of the rural customers can be difficult due to their low awareness and reluctance to change. Yet FLYK sees rural customers as an opportunity to grow and improve for its platform.

Customer challenges to adopting FLYK

Customer challenges to adopting FLYK

During the pandemic, FLYK struggled to connect with borrowers in the field, so it could not gather vital insights into its borrowers’ credit aspirations. However, this proved to be an opportunity since the team could double down on developing the app and its customer interface. As the team seeks to expand, it continues to play multiple roles to complete tasks effectively.

Support from the FI lab

Earlier, FLYK mainly focused on product development. With MSC’s help, FLYK identified the need to shift the focus toward borrowers. MSC helped FLYK understand potential partnerships to scale up FLYK’s business. Through this research, MSC gathered insights on how FLYK can quickly onboard and train such potential partners.

Future milestones

FLYK’s vision is to become an umbrella platform for various financial and non-financial services. FLYK plans to expand across different geographies, increase its outreach toward the deeper ends of the rural population, and emerge as a holistic financial well-being platform. People like Prakash, who had lost hope of receiving credit earlier, now see a ray of hope through FLYK.

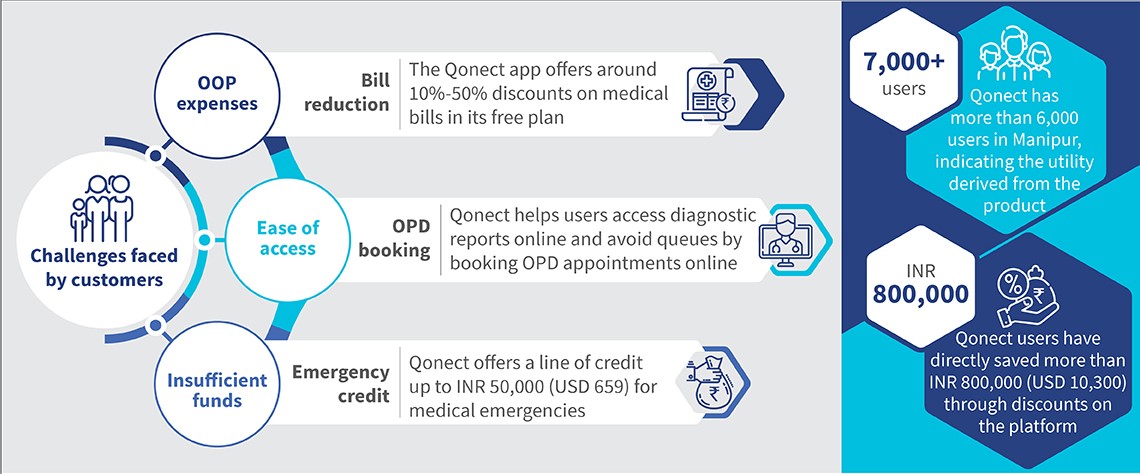

medical bills. Customer impact is the guiding force that drives product design and business decisions at the Qonect headquarters. The struggle for money and handling the trauma of a medical emergency may have developed the extraordinary amount of empathy that is evident in Lian when he talks about Qonect helping thousands of users in Northeast India get access to timely and affordable medical services.

medical bills. Customer impact is the guiding force that drives product design and business decisions at the Qonect headquarters. The struggle for money and handling the trauma of a medical emergency may have developed the extraordinary amount of empathy that is evident in Lian when he talks about Qonect helping thousands of users in Northeast India get access to timely and affordable medical services.

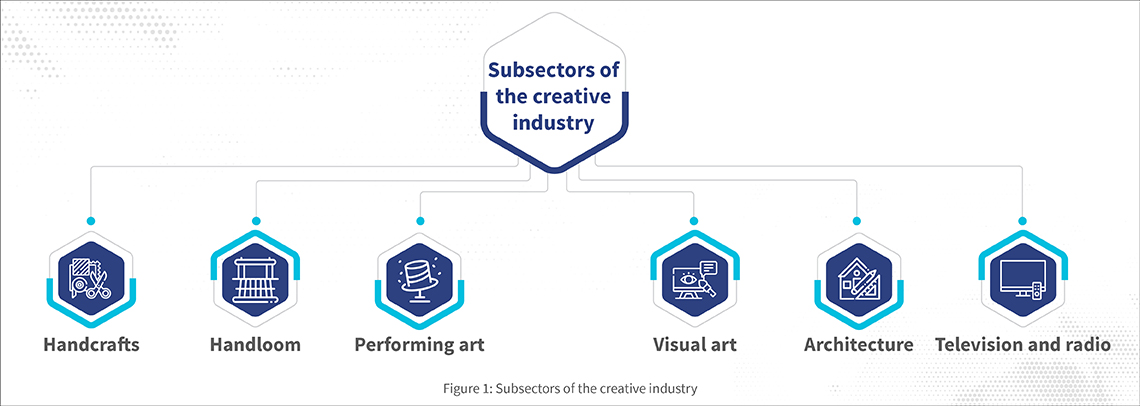

To understand the silk industry and its supply chain, Raghu decided to visit India. He met several silk farmers from different clusters and weavers for the next few weeks. During his stint, he observed the deplorable condition of the handloom weavers. Most of them lived hand to mouth as they

To understand the silk industry and its supply chain, Raghu decided to visit India. He met several silk farmers from different clusters and weavers for the next few weeks. During his stint, he observed the deplorable condition of the handloom weavers. Most of them lived hand to mouth as they

It is barely 6:30 am when the first mobile money outlets start to open in Soubré, a cocoa-producing town southwest of Côte d’Ivoire. New blue signs with a penguin mascot from

It is barely 6:30 am when the first mobile money outlets start to open in Soubré, a cocoa-producing town southwest of Côte d’Ivoire. New blue signs with a penguin mascot from  Wave’s service model is innovative and addresses many of the longstanding pain points of agents. These issues include high transfer fees and double charges for any transaction—the sender pays a charge when sending, and the receiver pays a charge when receiving. Other problems include a restrictive account opening procedure and issues with liquidity.

Wave’s service model is innovative and addresses many of the longstanding pain points of agents. These issues include high transfer fees and double charges for any transaction—the sender pays a charge when sending, and the receiver pays a charge when receiving. Other problems include a restrictive account opening procedure and issues with liquidity. Wave’s commission model is based on the volume of daily transactions compared to other operators who apply a per-transaction fee—a model agents prefer. The public’s preference for Wave has caused many transactions to be switched from other operators. The changes in commission levels and the choice for Wave transactions create uncertainty in the total commission package agents earn every month.

Wave’s commission model is based on the volume of daily transactions compared to other operators who apply a per-transaction fee—a model agents prefer. The public’s preference for Wave has caused many transactions to be switched from other operators. The changes in commission levels and the choice for Wave transactions create uncertainty in the total commission package agents earn every month.