This blog is about a startup under the Financial Inclusion (FI) Lab accelerator program’s fifth cohort. The Lab is supported by some of the largest philanthropic organizations across the world – Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

The FinTech market in India is estimated at USD 31 billion in 2021, around 6% of the overall financial market valued at USD 500 billion. Over the next five years, the FinTech market will grow annually at 22% and become more mainstream than today.

Lending FinTechs comprise 16% of the 6,300 odd FinTechs countrywide. Many try to cater to the sizeable unmet credit demand of almost USD 200 billion within India’s micro, small, and medium enterprise (MSME) sector. FinTechs in this highly contested space differentiate themselves based on the efficacy of their digital credit offering to the underserved.

According to the Reserve Bank of India, digital loans increased twelvefold to INR 1,41,821 crore (USD 18.3 billion) from FY 2017 to FY 2020. The share of non-banking financial companies (NBFCs) in the digital lending ecosystem increased from 6.3% in FY 2017 to 30.3% in FY 2020. The increase can, in part, be attributed to many new-age FinTechs tapping into the loan books of NBFCs to funnel credit to last-mile customers. Despite this tremendous growth, digital lending comprises of just around 1% of the total lending in India, with private commercial banks still dominating the space.

Credit is not distributed equitably in India, especially among underserved and unserved populations. At the end of 2021, more than 50% of Indians remained credit unserved. This customer segment lacks formal credit history, making it difficult for traditional financial institutions to analyze their credit behavior. This segment is known as “credit invisible.”

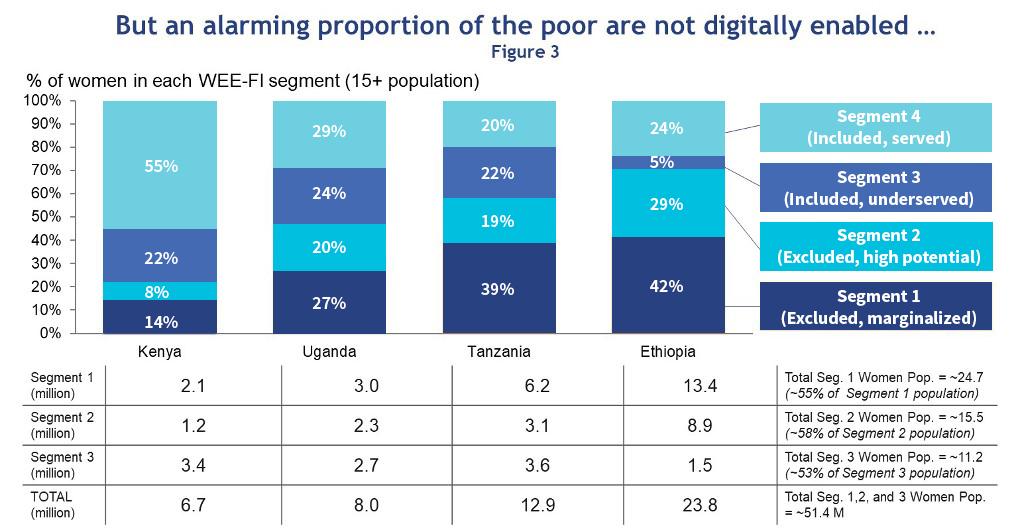

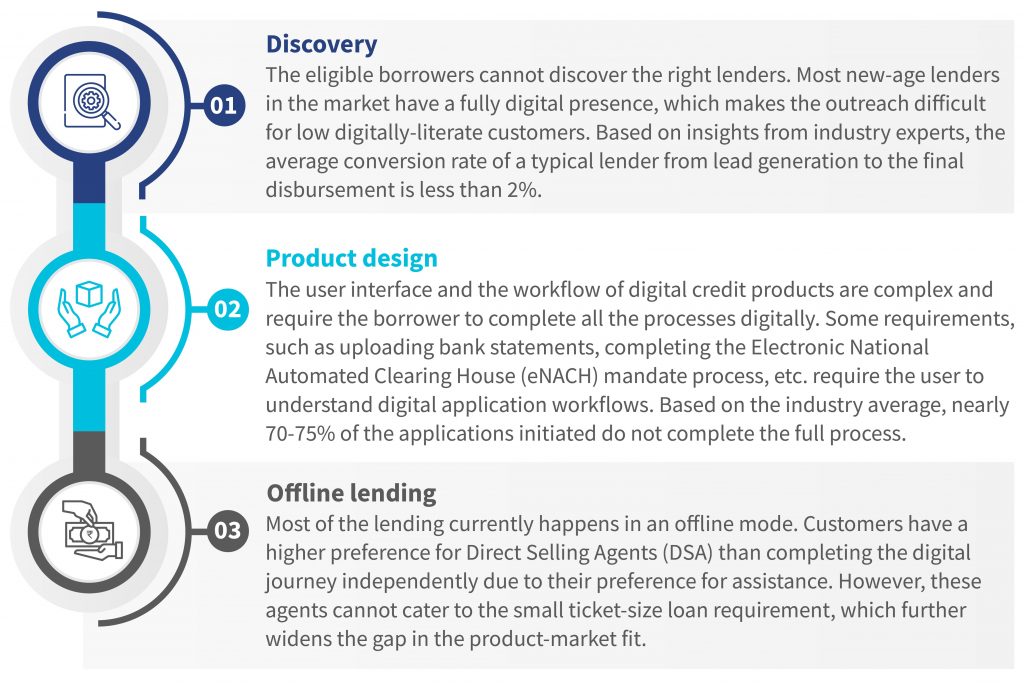

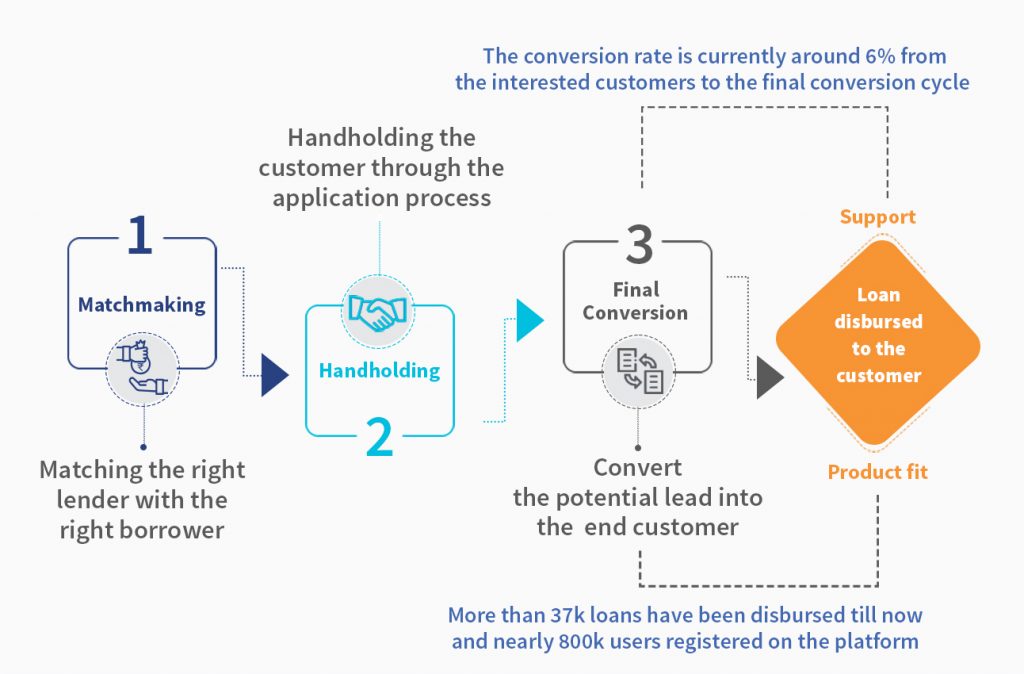

CreditHaat has identified the following three significant gaps in the distribution funnel of credit product workflows:

Figure 1: Gaps in the credit distribution funnel

The light bulb moment

Tanuj Sinha, the founder of CreditHaat, is an entrepreneur who investigates market gaps and creates innovative and scalable solutions to address them. His previous startup, Finlok, influenced him to develop the idea of CreditHaat. Finlok was a digital platform that provided financial services to the traditionally underbanked customer segment. It was based on a chit fund—a saving and borrowing financial instrument in which a group of subscribers contributes a fixed monthly amount for a set period, and members receive returns and take loans based on their contributions. As Finlok grew, Tanuj identified a large customer base keen on availing credit products.

Due to the limited visibility of digital lenders, clunky user interfaces of mobile applications, and complex documentation processes, these customers could not access the right credit providers and navigate the loan application process. Tanuj identified the broken distribution chain for credit products as a significant gap that needed urgent attention. He created a digital credit marketplace solution to bridge this gap, which matches potential borrowers from the credit-invisible segment with relevant credit providers.

Further, the exciting opportunity and potential to make a large-scale impact attracted Awdhesh and Archana to join the core team. Before joining CreditHaat, Awdhesh worked with PaisaBazaar, where he was part of the growth team, and Archana has worked with Bajaj Finance and Digit Insurance previously.

Figure 2: The CreditHaat team

What does CreditHaat do differently?

The CreditHaat platform has created a comprehensive loan marketplace with a simplified lending funnel to bridge the gaps outlined in Figure 1. The platform has registered 800,000 users and has disbursed more than 37,000 loans worth INR 250 million (USD 3.3 million). The focus is on handholding customers through the lending funnel while ensuring that they match with the right lender at the best possible interest rate to prevent drop-outs. The customer can find a suitable lender and complete the journey with operational support from the back-office team, as outlined in Figure 3 below.

Figure 3: The CreditHaat lending model

The loan ticket size ranges from INR 2,000 to INR 1 million (USD 26 to USD 13,000), with tenures ranging from 62 days to five years. CreditHaat uses several channels to source customers to cater to different segments and preferences. They include fully digital acquisition and assisted acquisition through local partnerships (like business correspondents) and on-the-ground field staff for digitally inactive customers. The platform also captures additional customer data, such as demographic and income patterns, to create user profiles and personas. CreditHaat uses this data to gather insights and predict customers’ financial behavior and potential credit needs. This information helps lending partners when designing credit products for the credit-needy segment.

Impact on the low- and moderate-income (LMI) segments

CreditHaat primarily caters to customers from the LMI segment. It acknowledges the unique challenges these customers from less developed geographies grapple with. Nearly 70% of its current customer base has a total monthly household income of less than INR 25,000 (USD 325) and resides in non-metro cities. The focus is to get the right product-market fit so that customers can reach the right lender that offers them a suitable credit product.

The team believes in simplifying access to credit. It also provides an assisted model involving field agents called “Sahayaks,” who handhold customers throughout the onboarding process till disbursement.

Support from the Financial Inclusion lab

Support from the Financial Inclusion lab

CreditHaat wants to expand its partnerships-based acquisition model by onboarding aggregators in the financial inclusion space. It intends to use the aggregators’ agent network and reach out to the target LMI customers. MSC and CIIE.CO supported the startup by developing a strategy to partner with aggregators, such as BC Network Managers (BCNMs), cooperatives, microfinance institutions (MFIs), and farmer producer organizations in its target geographies of tier 2 and tier 3 cities.

MSC developed a detailed approach for CreditHaat to target suitable aggregator partners. The CreditHaat team can use it to prioritize and onboard strategically relevant aggregator partners to enhance its visibility and outreach further among the target customer segments.

The future

CreditHaat has successfully navigated the challenges of building a startup over the past two years by managing available resources efficiently. With multiple partnerships already in the pipeline and the team’s indomitable spirit, its goal is to reach 5 million customers by July, 2023.

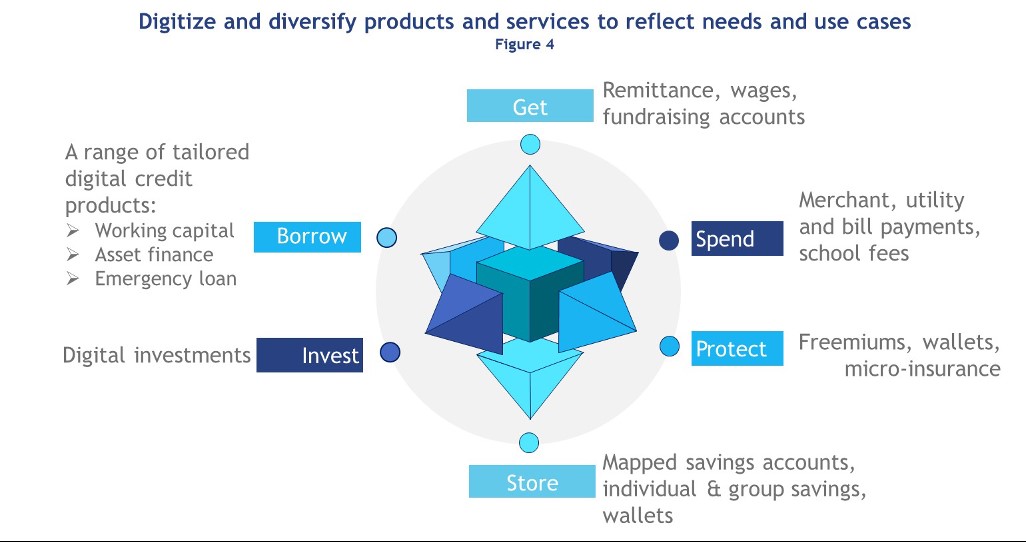

As a part of its long-term goal, the startup plans to diversify its product suite by offering investment, savings, and insurance products via its digital platform. CreditHaat aspires to add more aggregator partners to mobilize their existing field force and serve much-needed small-ticket credit products to LMI customers.

This blog post is part of a series covering promising FinTechs that make a difference in underserved communities. These startups receive support from the Financial Inclusion Lab accelerator program. The FI Lab is a part of CIIE.CO’s Bharat Inclusion Initiative is co-powered by MSC. #TechForAll, #BuildingForBharat.

These challenges compelled IIM Indore alumnus and Chartered Financial Analyst

These challenges compelled IIM Indore alumnus and Chartered Financial Analyst

Fresh graduates in India lack employability skills in the tertiary sector, while agricultural employment continues to plummet. As a result, many continue to join India’s sizeable blue- and grey-collar workforce.

Fresh graduates in India lack employability skills in the tertiary sector, while agricultural employment continues to plummet. As a result, many continue to join India’s sizeable blue- and grey-collar workforce.

Entitled acknowledges it is essential to reach workers through their employers and an interface they can trust. At present, Entitled communicates with its beneficiaries using a WhatsApp chatbot.

Entitled acknowledges it is essential to reach workers through their employers and an interface they can trust. At present, Entitled communicates with its beneficiaries using a WhatsApp chatbot.