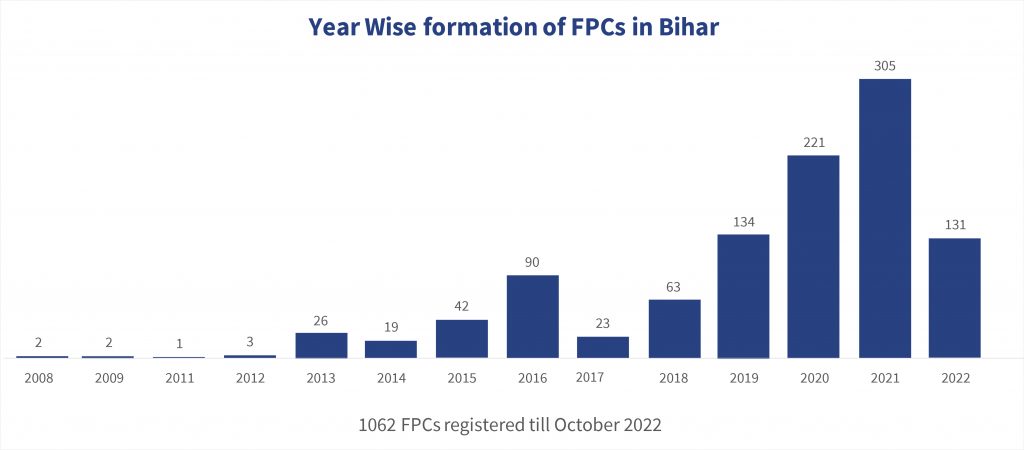

Small and marginal farmers (SMFs) in Bihar face challenges related to scale, crop diversification, cultivation costs, and price realization. The collectivization of smallholders through farmer producer companies (FPCs) has gained substantial momentum in recent years. FPCs bring together cooperative values with a corporate governance structure and have become the preferred legal form for farmer collectives. A study conducted by MicroSave Consulting in 2022 examined 35 FPCs across 10 districts in Bihar to better understand their functioning and challenges. This blog shares key findings from the study, which you can find here on the MSC website.

Small and marginal farmers (SMFs) in Bihar face challenges related to scale, crop diversification, cultivation costs, and price realization. The collectivization of smallholders through farmer producer companies (FPCs) has gained substantial momentum in recent years. FPCs bring together cooperative values with a corporate governance structure and have become the preferred legal form for farmer collectives. A study conducted by MicroSave Consulting in 2022 examined 35 FPCs across 10 districts in Bihar to better understand their functioning and challenges. This blog shares key findings from the study, which you can find here on the MSC website.

Key insights from the study

1. Farmer Mobilization

The collectivization of smallholders through FPCs has gained momentum in India, as it helps reduce input and marketing costs by achieving economies of scale and improving bargaining power. Members play a crucial role in attracting capital and patronage, and pooling financial resources and market access through FPCs improve the income of SMFs. FPCs require a minimum of 10 shareholders, but the median FPC membership base in Bihar is 275, with 55% of FPCs having a membership of less than 300. FPCs with fewer members upon formation usually have limited capital mobilized, resulting in many remaining dormant after incorporation. Only 47% of FPCs commenced business activities within three years of formation. Operational FPCs had a larger membership base averaging 485 members. Member mobilization at the time of registration is crucial for FPCs to start and sustain their business operations.

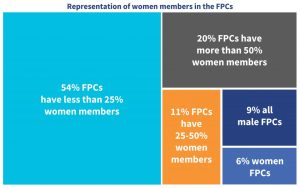

2. Inclusion of women and landless farmers

2. Inclusion of women and landless farmers

Women constitute a significant proportion of the agricultural workforce in India, but their participation in FPCs is limited. Women make up only 40% of the total membership base of the FPCs studied, and their participation in leadership and governance roles is also limited. Fifty percent of FPCs had a single woman representative on the Board of Directors (BoDs) – primarily driven by a mandatory requirement, but 20% had no female representation at all. This highlights the need for concerted efforts to promote women’s participation in FPCs, and state and central governments in India should develop policies to incentivize the inclusion of women in FPCs.

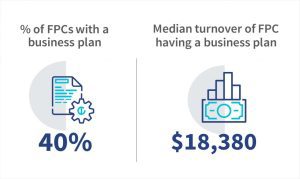

3. The importance of a business planning

Business planning is crucial for FPCs as it provides a roadmap for their vision and strategies to maximize profits and minimize risks. However, only 40% of the FPCs in the study had a business plan. FPCs with a business plan had higher revenue and were able to diversify their activities. The majority of FPCs lack awareness on the importance of business planning, and only 22% reported receiving training on the topic. Business plan capacity building efforts of FPC promoting agencies are constrained due to a lack of expertise and involvement of member farmers and BoDs, leading to a lack of direction and financial sustainability for FPCs.

Business planning is crucial for FPCs as it provides a roadmap for their vision and strategies to maximize profits and minimize risks. However, only 40% of the FPCs in the study had a business plan. FPCs with a business plan had higher revenue and were able to diversify their activities. The majority of FPCs lack awareness on the importance of business planning, and only 22% reported receiving training on the topic. Business plan capacity building efforts of FPC promoting agencies are constrained due to a lack of expertise and involvement of member farmers and BoDs, leading to a lack of direction and financial sustainability for FPCs.

4. The state of FPC business activities

The average turnover of mature FPCs in FY 2020-21 was USD 22,100 while those between 3-5 years of age was USD 17,620 and FPCs formed during the last 3 years had an average turnover of USD 7,120. Output aggregation and input sales are the most common business activities for FPCs. 48% of FPCs diversified their business activities with at least two business lines, but profitability is not necessarily correlated with the number of business lines. FPCs should prioritize proper business planning and a balanced mix of business activities. The average per-member business volume in mature FPCs was USD 55 while the average per-member business volume in FPCs between 3-5 years and less than 3 years was USD 20 and USD 4, respectively.

The average turnover of mature FPCs in FY 2020-21 was USD 22,100 while those between 3-5 years of age was USD 17,620 and FPCs formed during the last 3 years had an average turnover of USD 7,120. Output aggregation and input sales are the most common business activities for FPCs. 48% of FPCs diversified their business activities with at least two business lines, but profitability is not necessarily correlated with the number of business lines. FPCs should prioritize proper business planning and a balanced mix of business activities. The average per-member business volume in mature FPCs was USD 55 while the average per-member business volume in FPCs between 3-5 years and less than 3 years was USD 20 and USD 4, respectively.

5. Insufficient access to capital

FPCs require capital for building institutions, operations, and infrastructure investments, but access to credit remains a challenge. Most FPCs rely on paid-in capital and short-term borrowing from informal sources, with 47% reporting using short-term borrowing from members or other informal sources. Accessing equity grant and credit guarantee schemes is also difficult due to lack of awareness and cumbersome processes. Only 11% of FPCs applied for institutional credit from banks or NBFCs, and only 9% received approval. Many FPCs lack the necessary expertise or resources to meet the requirements for formal credit, and financial institutions often require personal guarantees or collateral from BoDs, which is discouraging for SMFs who lack assets to pledge.

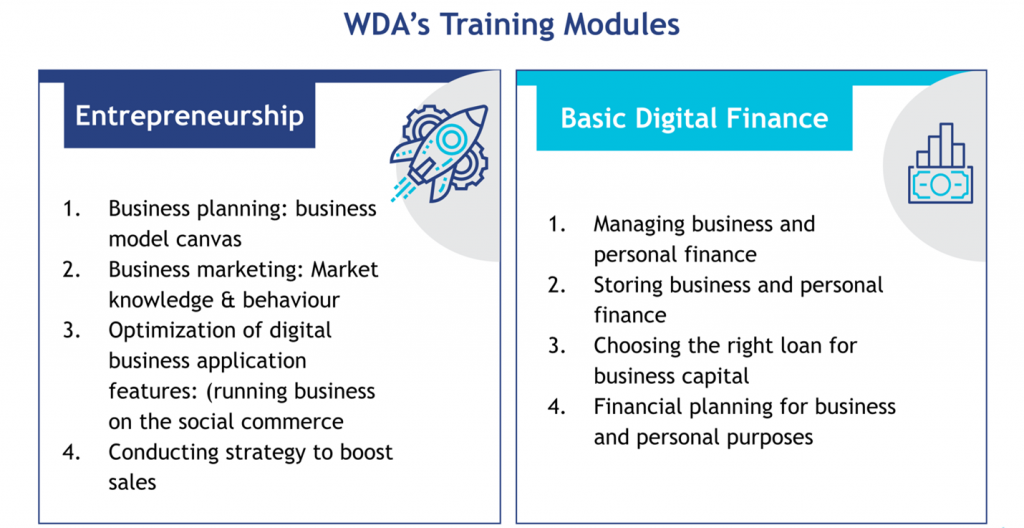

6. Gaps in Training and Capacity Building for FPCs

FPCs and their PAs require a distinct skillset to manage business functions, membership mobilization, and statutory regulations. Capacity building efforts offered by institutions are limited and neglect important areas such as business planning, credit assessment, value chain-specific training, market linkages, statutory compliance, and convergence. Moreover, finding qualified trainers with an understanding of rural dynamics, FPC management, and agriculture value chains is challenging. FPC promoting agencies also focus on conducting one-time training programs without ongoing support or follow-up, hindering long-term success. To address these issues, systematic capacity-building efforts with periodic refresher and follow-up training are necessary to help FPC members adapt to changing circumstances and succeed in competitive markets.

FPCs and their PAs require a distinct skillset to manage business functions, membership mobilization, and statutory regulations. Capacity building efforts offered by institutions are limited and neglect important areas such as business planning, credit assessment, value chain-specific training, market linkages, statutory compliance, and convergence. Moreover, finding qualified trainers with an understanding of rural dynamics, FPC management, and agriculture value chains is challenging. FPC promoting agencies also focus on conducting one-time training programs without ongoing support or follow-up, hindering long-term success. To address these issues, systematic capacity-building efforts with periodic refresher and follow-up training are necessary to help FPC members adapt to changing circumstances and succeed in competitive markets.

FPCs have the potential to be a powerful tool to improve the livelihoods of SMFs. However, it is important to note that the promotion of FPCs alone is not enough to ensure their long-term success and sustainability. They must be nurtured and supported with strong structures and mechanisms to help them grow and mature over time.

This study has identified several critical levers that could help unlock the potential of FPCs in Bihar. These include targeted and sustained efforts to increase the membership base through awareness building, policy interventions that promote the inclusion of women and landless farmers in FPCs, a systematic approach to capacity building that includes periodic refresher and follow-up trainings on key topics that affect FPC sustainability, and improved access to adequate financial resources to commence and sustain businesses operations and develop the business acumen of FPCs.

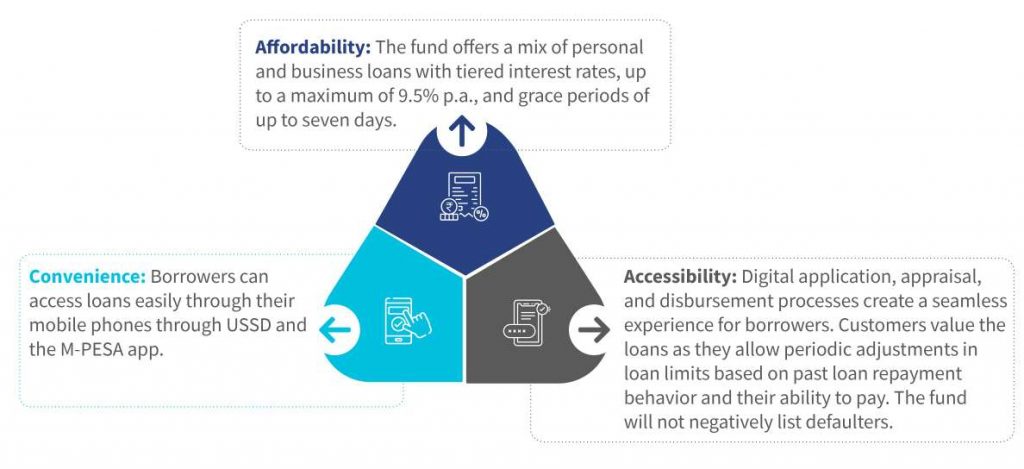

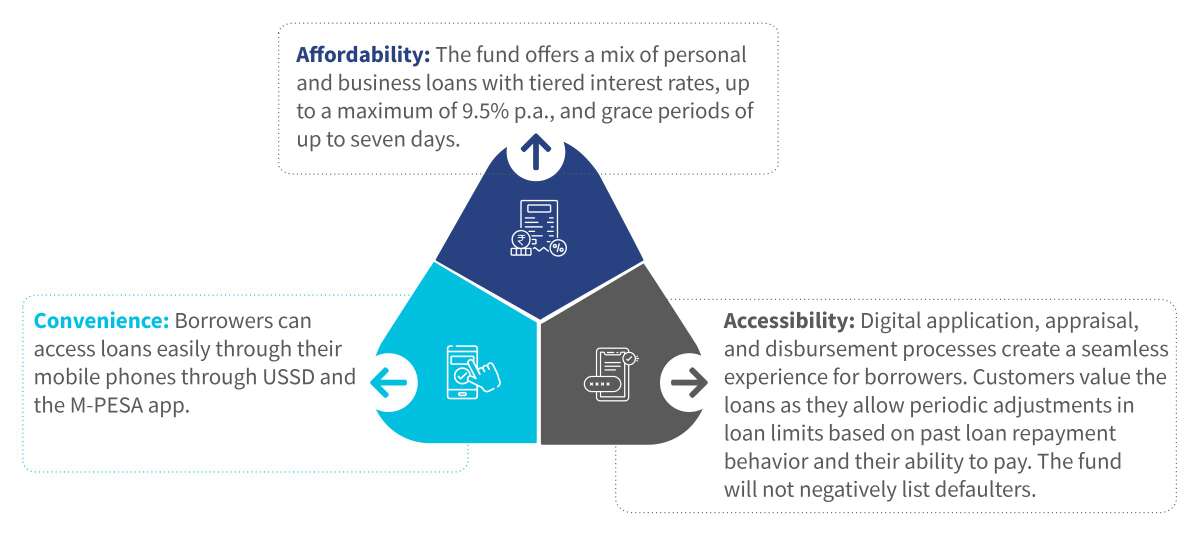

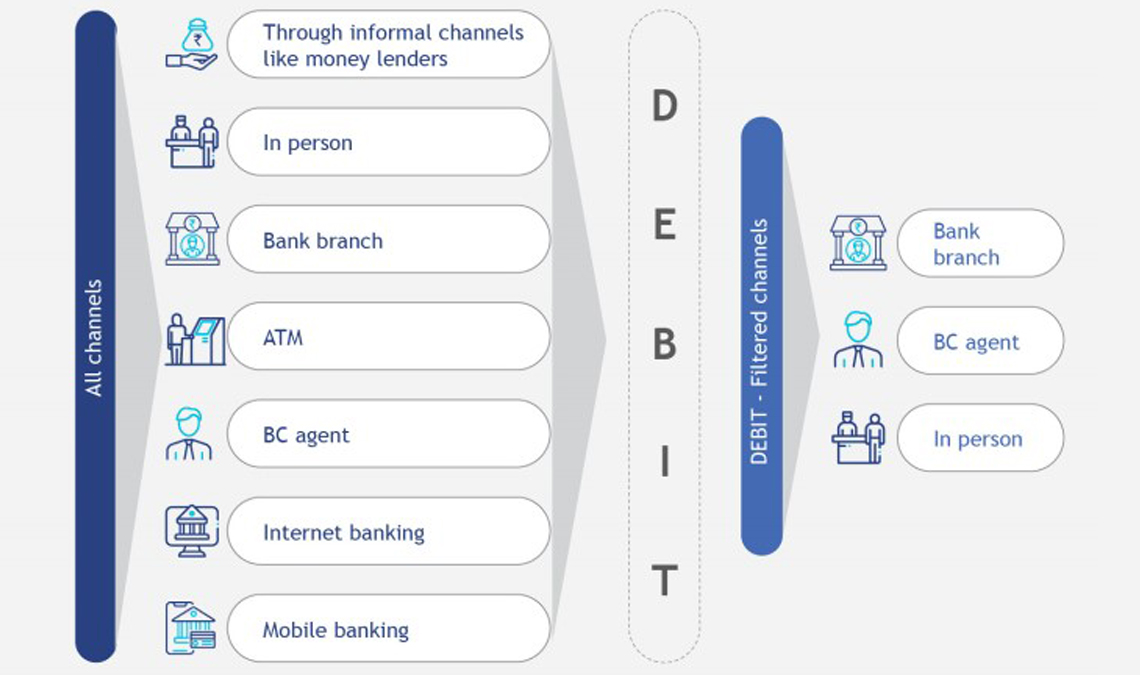

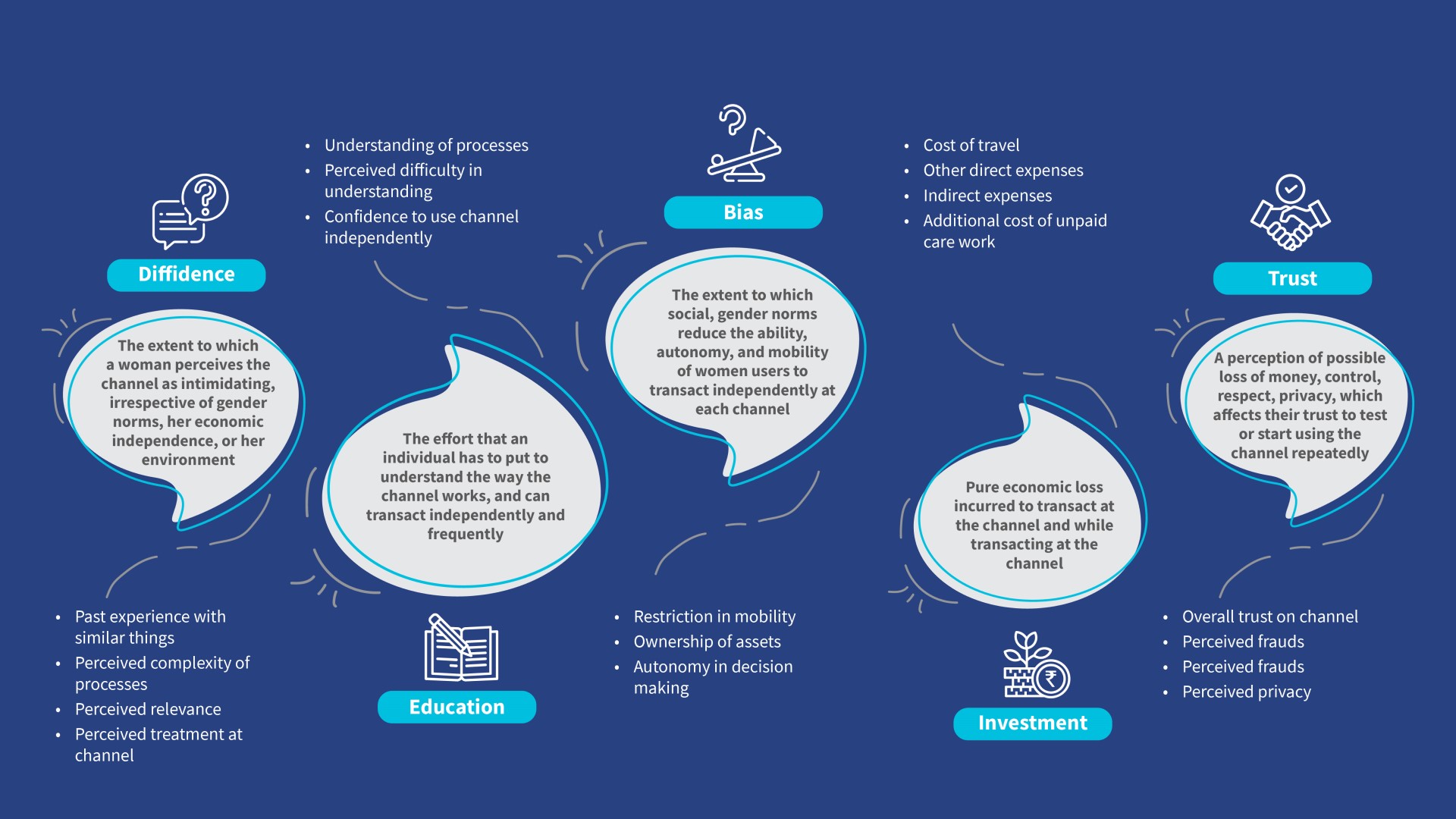

At MSC, we sought to understand how low- and moderate-income women choose a channel for financial transactions. This led us to follow women’s customer journeys across various geographies and distill crucial factors that determine their choice of channel. We used MSC’s DEBIT framework,

At MSC, we sought to understand how low- and moderate-income women choose a channel for financial transactions. This led us to follow women’s customer journeys across various geographies and distill crucial factors that determine their choice of channel. We used MSC’s DEBIT framework,

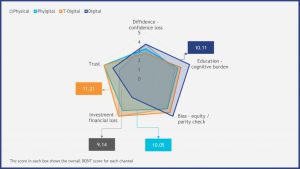

Here is an example from our DEBIT Kenya research for a proxy M-PESA user. The graph captures higher scores for M-PESA, which means that the perceived loss of using M-PESA is higher among these women. They are yet to transition to M-PESA due to a lack of personal ID.

Here is an example from our DEBIT Kenya research for a proxy M-PESA user. The graph captures higher scores for M-PESA, which means that the perceived loss of using M-PESA is higher among these women. They are yet to transition to M-PESA due to a lack of personal ID.