Chhotastock is a FinTech startup from Bengaluru in India that works to transform how individuals access and manage finance and investments. It seeks to democratize investments and make them accessible to everyone.

This blog looks at Chhotastock, part of the Financial Inclusion Lab accelerator program, which is supported by some of the largest philanthropic organizations across the world—Bill & Melinda Gates Foundation, J.P. Morgan Chase & Co. Foundation, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

The stock market, measured by the Sensex in India, has grown by 12% annually over the past 10 years. This growth has drawn millions of new market investors market who seek better financial returns. Supply-side ecosystem players should continuously innovate and strengthen their offerings to accommodate the diverse needs of young new-age investors. Let us see how Chhotastock does its bit to add value to the ecosystem.

Investors in India’s smaller towns have historically struggled to invest in capital markets. Take the example of Anthony, a recent college graduate with an information technology (IT) degree from Patna in Bihar state. He is tech-savvy but lacks the financial acumen to decide which financial instrument will provide solid returns, considering his time horizon and available funds. His income is limited as he has started his career in an entry-level position. He wants to save a fixed monthly amount for higher studies and has been exploring interest-bearing investments for his limited surplus income.

Millions of people like Anthony need more knowledge and market exposure to start their investment journey. These people struggle with choice and information overload as they deal with the complexity of a wide range of investment offerings.

Why Chhotastock?

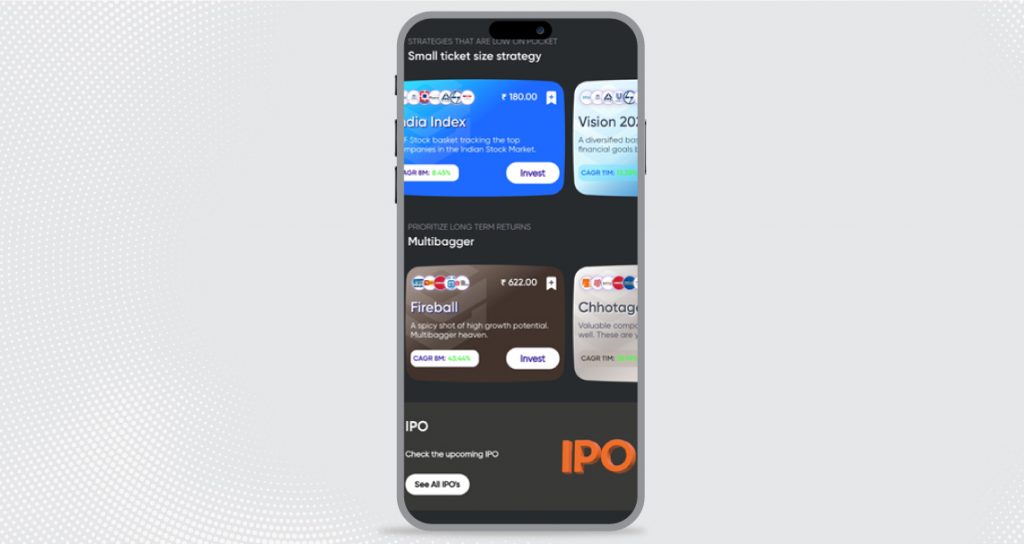

The Chhotastock platform offers to take young, non-professional investors in tier 2 and 3 Indian cities on a simple, reliable investment journey. The app provides market-linked investment opportunities in equity, debt, and peer-to-peer (P2P) lending. The offerings cater to the needs of Gen Y and Gen Z customers who seek active investment strategies with higher returns than traditional options, such as bank deposits. The platform hopes to build trust through a transparent onboarding process and allow customers to transact without hidden charges. It does not access unnecessary cross-application data points, including messages and emails.

Chhotastock intends to create wealth for the country’s 290 million underserved small investors and make investing accessible, fun, and engaging. The company launched a revised app in February 2023 to achieve this goal. The updated app gamifies the investment experience, which results in an engaging tool for young individuals with small surplus income for mid- to long-term investment opportunities. Chhotastock’s primary offering includes small-ticket debt and equity baskets in which investors can invest as little as INR 100 (USD 1.2) based on specific themes or goals.

The platform primarily has three sources of income: account opening fees, subscriptions, and commissions—for a scaled-up version of the product with unlisted equity buckets, IPOs, and mutual funds order management system. It also plans to introduce additional features to offer users the most popular or high-yielding strategy options. Additionally, Chhotastock earns SDK (software development kit) fees and affiliate commissions from brand associations.

An investment app for Indian youngsters

Chhotastock’s target market stands on the following three tenets.

(a.) An increasing number of new investors joining the stock market are in the 21-30 age bracket. Chhotastock wants to tap into this growing target market while easing its concerns and providing users with opportunities to invest in equities and debt with low-risk profiles.

(b.) An increasing number of youngsters have joined the market, but many remain dormant. As per the National Securities Depositories Limited (NSDL) and Central Depositories Services (CDSL), demat accounts in India increased by 145% from 40.9 million in March 2020 to almost looks stuck to 100 million in 2022. Yet around 75%-80% of these accounts remain inactive. The dormancy stems primarily from retail investors’ busy schedules, negative experiences with an agent or broker, and lack of awareness of trustworthy investment platforms.

(c.) Young Indians are hooked on fantasy sports, potentially leading to poor financial health. India has the largest fantasy sports user base worldwide, with 130 million customers and a market size of INR 346 billion (USD 41.73 billion) as of March 2021. Indians love gamified experiences. Chhotastock is betting on its gamified user journey to encourage users to learn about financial markets, grow their investments, and improve their financial health.

Founder’s journey

Like many engineering graduates, Chhotastock’s Founder, Mithun, started his career as an Engineer at Wipro, after which he worked with India’s largest trading platform. Eventually, he launched Blitz, a venture focused on algorithmic trading for index futures. The firm successfully met its targets and generated profits. Following Blitz’s success, Mithun saw an opportunity to address the needs of those eager to invest in India’s booming market yet lacked the awareness to take the plunge.

Chhotastock is Mithun’s attempt to address this gap by using knowledge and tools from earlier ventures to build a platform that makes equity investing accessible, simple, and less time-consuming. Mithun has made peer-to-peer (P2P) investments possible and enabled alternative investment opportunities for platform users. P2P investments are also linked to the functionality of Save Now Buy Later. Customers can invest in the P2P debt market and use the proceeds to purchase aspirational goods, such as mobiles and laptops. Mithun considers this a milestone for Chhotastock since it offers a better alternative to the current buy-now-pay-later (BNPL) offerings that promote using credit for consumption needs.

The journey so far

Chhotastock started as a B2B2C model offering easy plugins for Siply’s customers. After its products succeeded on Siply, it attracted other companies that wanted to diversify investment solutions for their customers. In October 2022, Chhotastock launched a standalone B2C platform.

In the 10 months since Chhotastock’s B2C app launched, it reached the second spot on the Google Play Store in the FinTech category. It also earned a place among the top 500 wealth tech startups that could potentially revolutionize the FinTech ecosystem and democratize the investment space. It has also reached a registered user base of 3.1 million, with more than 40% of users coming through its mobile application.

Chhotastock plans to launch a fleet of enhancements and features to facilitate financially literate and investment-ready youth. The primary target segments include customers from tier 2, tier 3, and smaller cities, primarily first-time investors who are new to the job market, part-time workers, gig workers, and students who have spare money and wish to learn to invest using a gamified approach. With this, Chhotastock hopes to break this segment’s psyche of high dependency on credit and put them on the path to invest and achieve their financial goals.

Chhotastock’s challenges—and its gamified response

Chhotastock lowers the investment hurdle for its customers when they sign up by keeping the initial investment at a low INR 100 (USD 1.22). Yet the platform faces several challenges, including the high churn rates InvestTechs typically encounter, choice overload, and lack of customer discipline to continue investing. Chhotastock plans to gamify the investment experience further. It has introduced in-house games to create the initial hook and ongoing user engagement. Additionally, the app represents the customer’s investment experience through levels and hurdles, giving it a more gamified feel. Its leaderboard prompts competition among users to invest regularly to reach the top rank and receive exciting rewards.

FI Lab support for Chhotastock

The FI Lab’s technical support Chhotastock consisted of capitalizing on its strengths to transform the startup into a preferred investment platform. The Lab helps Chhotastock build a digital marketing strategy to reevaluate its digital journey, positioning, and customer segmentation through different media campaigns. Influencer marketing will seek to bolster Chhotastock among the target audience further, increase the number of registered users, and improve traction—including average spending on the platform.

What next?

Chhotastock has a clear vision to build a trusted investment platform for Bharat and intends to introduce new financial products. One such offering is social trading to help investors follow Chhotastock expert investors and replicate their strategies in their investment portfolios. Thanks to its innovative and customer-centric design approach, Chhotastock is on the path of rapid growth as participation in capital markets intensifies. If it continues apace, Chhotastock is poised to emerge as a vital player that will redefine the investment journey of customers like Anthony and countless others in India.

This blog post is part of a series covering promising FinTechs making a difference in underserved communities. These startups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative, co-powered by MSC. #TechForAll #BuildingForBharat

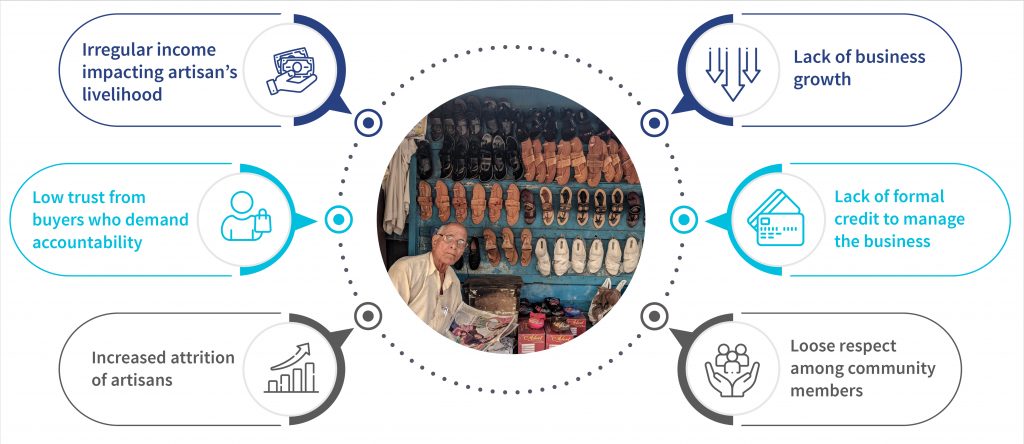

Kaarigar Mandi was founded in 2019 Ankit Kumar, Gagan Mukhi, and Dr. Hifza Afaq. Before Kaarigar Mandi, Ankit used to work as an e-commerce consultant for domestic footwear brands in Agra. He met various footwear artisans in the factories during his stint. These artisans owned small handmade footwear manufacturing units. But rapid industrialization in the sector led them to lose their clients and business. During conversations with these artisans, Ankit realized that their footwear craft was high quality. Yet sub-par raw materials and lack of standardization led to low-quality end products.

Kaarigar Mandi was founded in 2019 Ankit Kumar, Gagan Mukhi, and Dr. Hifza Afaq. Before Kaarigar Mandi, Ankit used to work as an e-commerce consultant for domestic footwear brands in Agra. He met various footwear artisans in the factories during his stint. These artisans owned small handmade footwear manufacturing units. But rapid industrialization in the sector led them to lose their clients and business. During conversations with these artisans, Ankit realized that their footwear craft was high quality. Yet sub-par raw materials and lack of standardization led to low-quality end products.

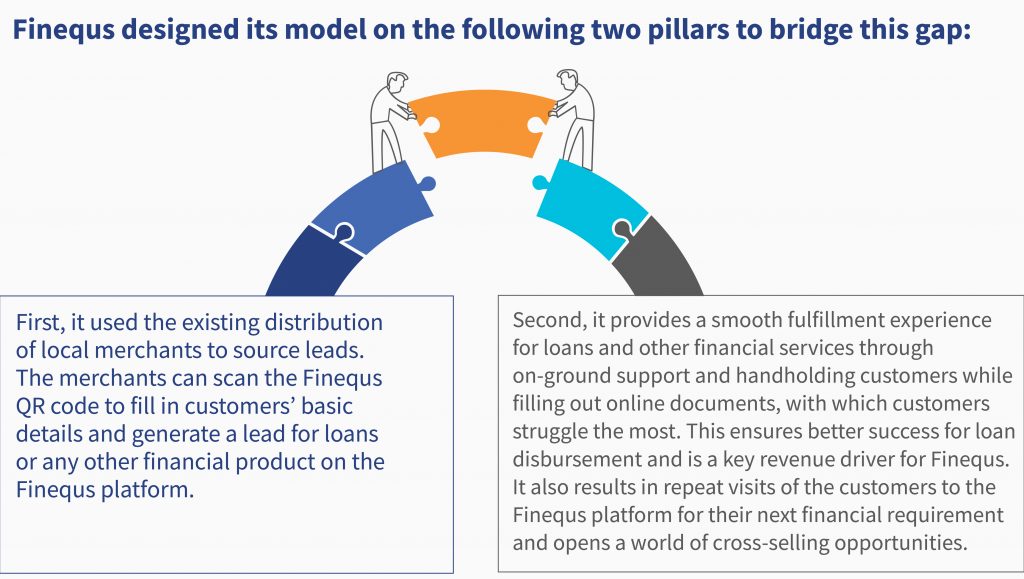

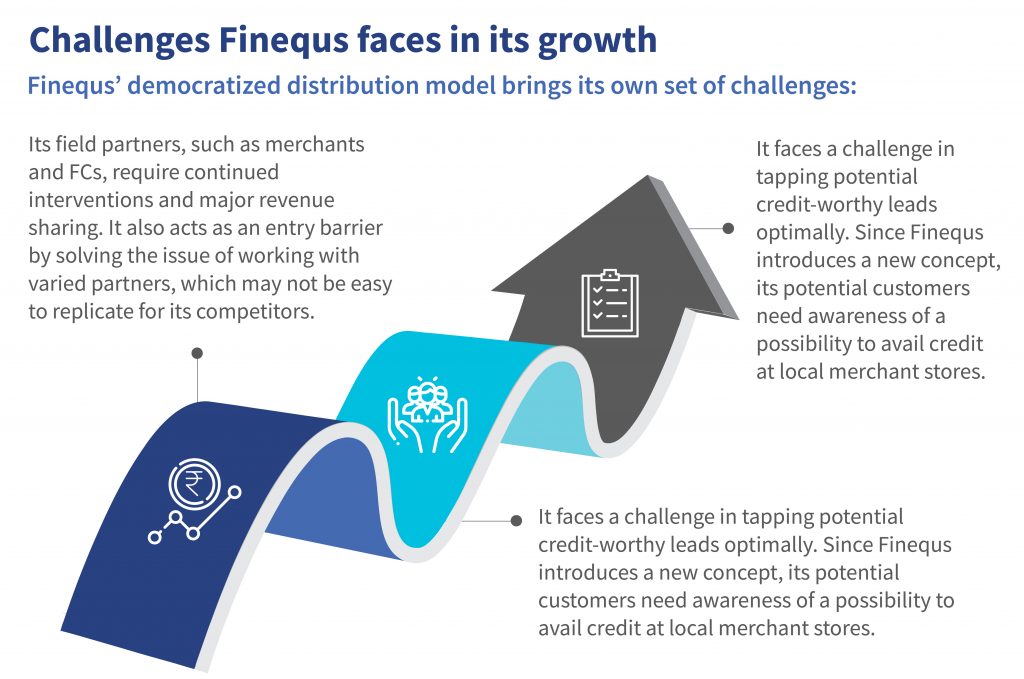

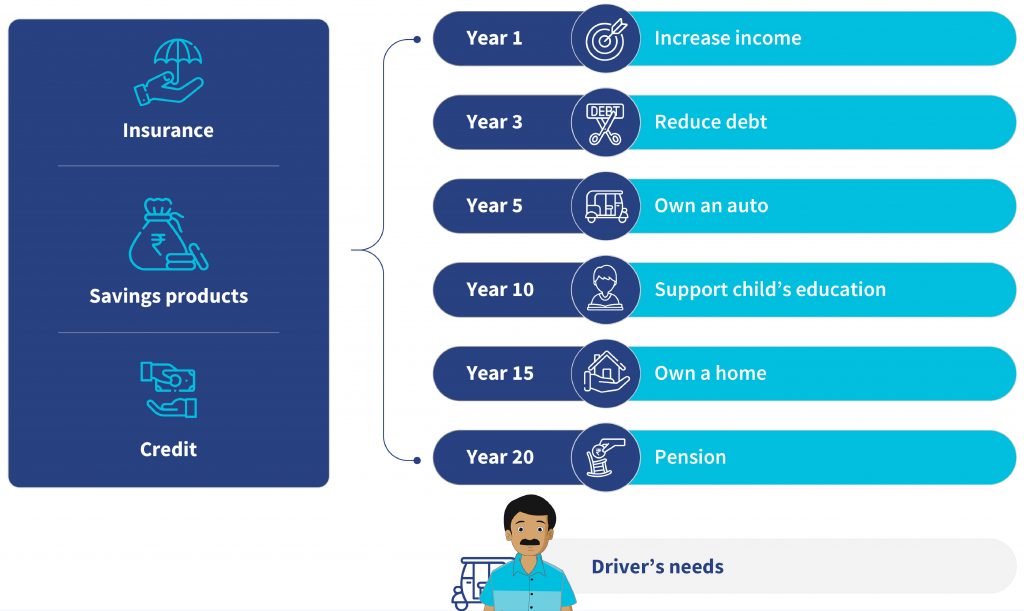

Krishnan used his rich and varied banking experience across premier private and multinational banks to understand the limitations of the traditional financial ecosystem to reach the underserved segments of society. Even the FinTechs operating for a considerable time cannot reach the masses. Gaps, such as trust in the digital medium and the savviness of users to avail digital loans of their own, limit the uptake of formal credit products. Finequs saw this opportunity and decided to operate at the

Krishnan used his rich and varied banking experience across premier private and multinational banks to understand the limitations of the traditional financial ecosystem to reach the underserved segments of society. Even the FinTechs operating for a considerable time cannot reach the masses. Gaps, such as trust in the digital medium and the savviness of users to avail digital loans of their own, limit the uptake of formal credit products. Finequs saw this opportunity and decided to operate at the