Dr. Ajay Shah, Cofounder of the XKDR Forum, talks to us about ways to achieve effective governance. He discusses politicians’ engagement with citizens and systemic issues and stresses electoral accountability. Dr. Shah notes that an entrepreneurial spirit and managerial approaches are essential to confront challenges. He emphasizes organizational efficiency in governance and urges transparency and decentralized measurement. He also proposes that policymaking should incrementally integrate digital tools and prioritize foundational organizational functions, such as HR and finance, to ensure effective governance in India.

Empowering female smallholder farmers with gender-responsive agri-finance solutions

Grace is a smallholder farmer in Uganda whose cultivation depends on seasonal rainfall. She relies solely on her half-acre land for income, while unpredictable weather limits her productivity. Grace would be able to transform her agricultural practice if she had access to an agricultural loan. She could then buy an irrigation pump and start cultivation all year round. This would improve her crop production and potentially increase her yield by 50%. However, banks are unwilling to lend to her because she lacks a land title. Countless women like Grace continue to face an uphill battle to access formal finance to transform their agricultural livelihoods.

Agriculture is Uganda’s largest source of employment. It employs 66% of the population. Women like Grace contribute 72% of the agricultural labor force. Yet, female farmers have less access to productive assets, which include financial services. The World Bank estimates that the reduction of gaps in access to assets for female farmers can lead to a 20 to 30% yield increase per household.

Access to agricultural finance and its use are low in Uganda. Only 11% of the population borrows for agriculture. MSC conducted research on smallholder farmers in Uganda to understand the challenges they face when they access credit. The study found that high interest rates and lack of collateral are common issues, especially in areas where land ownership depends on informal customs and traditions. This limitation restricts their access to financial services and full participation in the agricultural value chain. Additionally, the limited presence of financial institutions in certain regions further restricts farmers’ access to financial services.

The seasonal nature of agriculture also poses challenges for farmers as it leads to income irregularities for them. As a result, they struggle to repay loans regularly. Smallholder farmers can earn as much as USD 7,568 in the harvest months and as little as USD 54 in the lean months, which highlights their financial constraints. Some respondents cited challenges with monthly charges on financial accounts, which are difficult to manage due to agriculture’s seasonal income patterns.

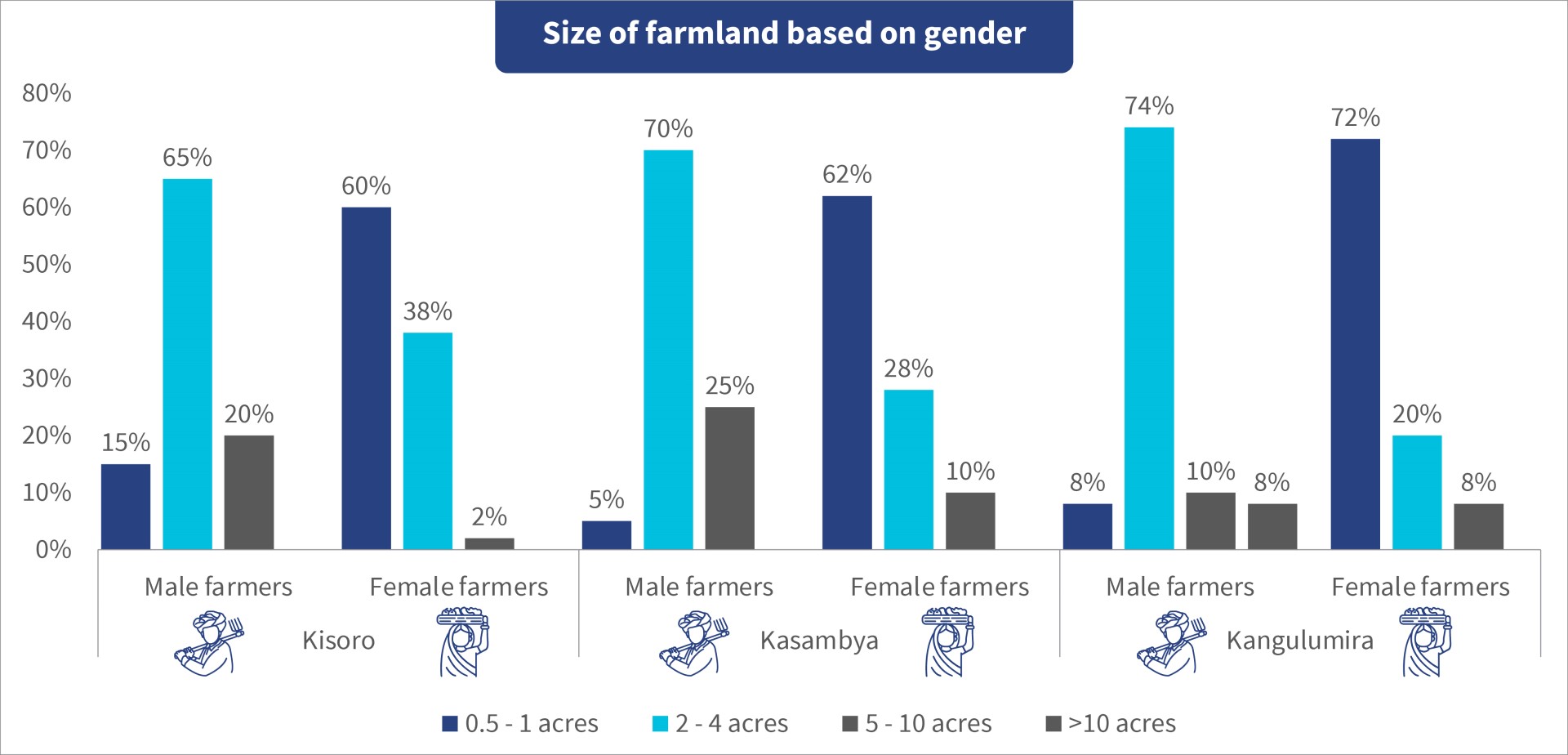

As noted above, land ownership among women is often informal, which leads to limited control over land transactions. Women own smaller plots of land, which range from 0.5 to 1 acre.

Additionally, men are the primary decision-makers in agricultural and household matters, which can limit women’s autonomy in the choice of crops, farming techniques, and access to financial services. Figure 1 shows this disparity. It is an extract of findings from three towns in Uganda based on MSC’s study. It shows that male smallholder farmers manage larger plots of land. In contrast, female farmers mainly engage in farming activities on smaller plots. This gender-based distribution highlights the need for interventions to address these inequalities and empower women in agriculture.

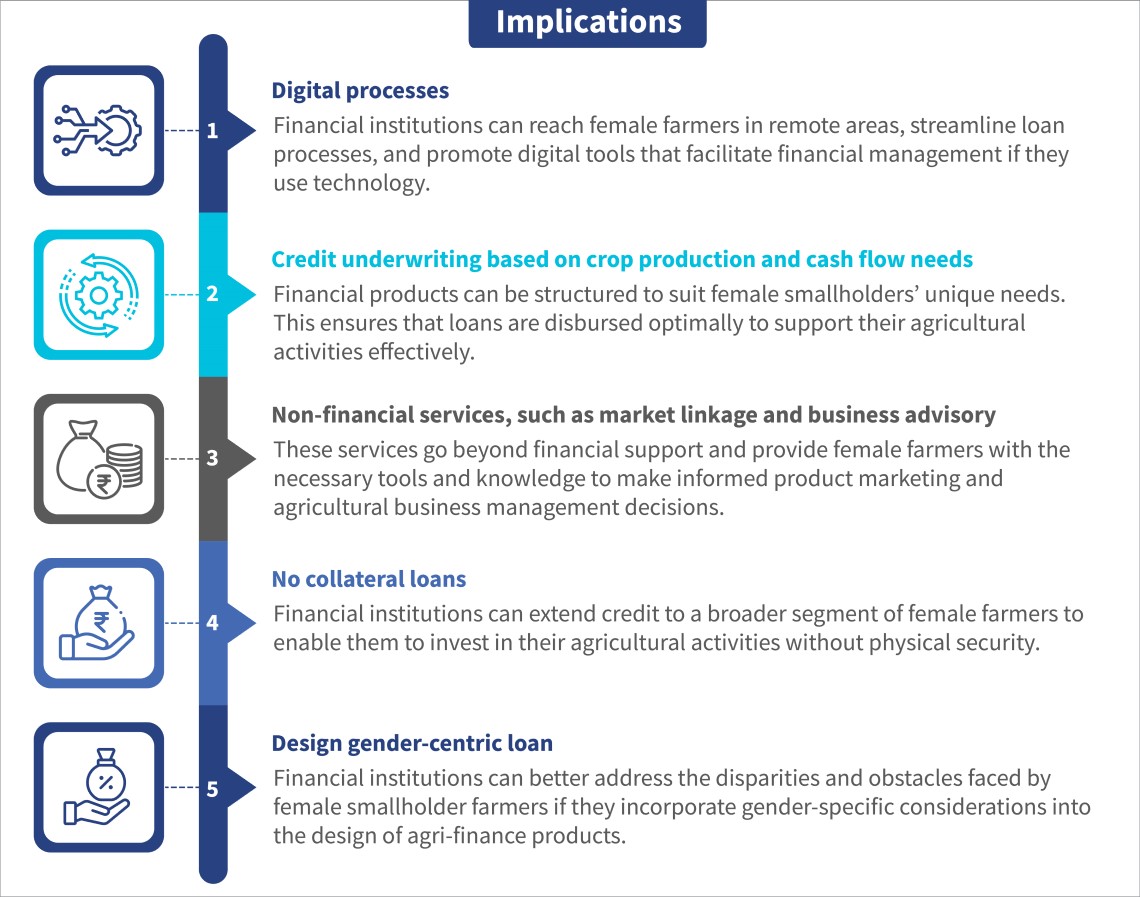

Financial inclusion for female smallholder farmers is not limited to access to credit. It also involves the design of products that address their unique challenges and empower them economically. The figure below shows some key implications in the design of credit products specifically for female smallholder farmers, which MSC identified during our recent study.

Recommendations to change the status quo

Promote gender equality in land ownership: Government agencies and policymakers should implement policies that promote gender equality in land ownership and ensure secure land rights for women. Additionally, support programs should facilitate women’s access to land rental agreements and promote gender-inclusive rental practices. In Rwanda, the land tenure regularization program ensured women’s land rights and increased productivity and income for female farmers.

Grant access to legal titles: Advocate for legal reforms that grant female smallholder farmers secure land ownership rights and access to legal titles. The land titling project was one such initiative that positively impacted Peru. It improved women’s access to land titles and enhanced their economic security and decision-making power.

Increase access to digital channels: Financial institutions and lenders should develop initiatives that provide training and resources to help female farmers overcome digital barriers and use technology for agricultural credit. myAgro, a social enterprise in West Africa, has significantly enhanced its engagement with female farmers, who now represent 65% of its clients. The organization offers a savings program that empowers smallholder farmers to afford essential agricultural inputs, such as seeds and fertilizers, through a prepaid scratch card system.

Enhance women’s participation in decision-making processes: Stakeholders should establish programs that empower women to participate in decision-making processes, provide training on marketing strategies, and promote gender equality in agricultural organizations. The FAO has established Dimitra Clubs in Africa, which are community-driven platforms in several African countries. These countries include Burundi, Burkina Faso, Central African Republic, the Democratic Republic of the Congo, Kenya, Madagascar, Mali, Malawi, Mauritania, Niger, and Senegal. These clubs empower rural communities, particularly women, through enhanced participation in community life and decision-making processes. Africa has 600 Dimitra Clubs, and 60% of the members in these clubs are women.

Segment female smallholder farmers: The segmentation of female smallholder farmers into subgroups should be a fundamental step in the design process and the development of such gender-tailored products. This segmentation reveals the nuanced similarities and differences among women and informs product uptake and usage patterns. One Acre Fund focuses on smallholder farmers, many of whom are women. Its programs often tailor support to the unique challenges faced by female farmers. It recognizes that women may have different levels of access to land and resources than men. This tailored support implicitly involves segmentation, which acknowledges and addresses the specific barriers that female farmers face.

Conclusion

The market demand for gender-responsive agri-finance credit signals a growing interest to address gender disparities within the agricultural sector. Moreover, the research planning, implementation, and prototype design processes must consider gender. Qualitative research methodologies, such as human-centered design (HCD) or MSC’s Market Insights for Innovation and Design, enhance the efficient design of impactful solutions and cater to the diverse needs of female smallholder farmers.

Collaboration among banks, FinTechs, MFIs, and development partners is essential to seize opportunities to improve female smallholder farmer’s access to credit. MSC’s support to such institutions has been pivotal in the development of credit products tailored to empower female farmers. Through such tailored solutions, women like Grace would no longer need to depend on the vagaries of unpredictable weather and look forward to a better and more secure future.

Unlocking access to formal credit for farmer producer companies (FPCs): Lessons from JEEViKA’s work in Bihar

Credit is an important driver that fuels the growth of business enterprises. MSC’s diagnostic study of FPCs in Bihar also highlights access to capital as a vital factor that sustains FPCs. FPCs raise capital in two ways—equity raised through members and external debt. Smallholder farmers are the majority shareholders of FPCs, so their equity contribution is typically low. Moreover, poor capitalization of FPCs in India compels them to seek debt to fuel their expansion. However, FPCs struggle to access credit, which also hinders their growth. In Bihar, only 11% of FPCs applied for institutional credit from banks or non-banking financial companies (NBFCs), and only 9% received approval for their credit applications.

FPCs have huge potential despite the poor credit flow. The estimated size of this segment is around INR 6 billion (USD 72 million) and is projected to grow rapidly, given the thrust from the central government and many state governments. Various institutions, banks, and NBFCs provide credit to FPCs. However, FPCs receive most of the credit from three to four NBFCs only.

JEEViKA-promoted FPCs were also in a similar bind. They could not expand their business due to the lack of affordable working capital. The JEEViKA state team identified this challenge and undertook a focused effort with MSC’s technical support. This effort sought to address the lack of access to formal finance for operations. We undertook various activities over 12 months. This led to a substantial push on credit provision for FPCs, and eight JEEViKA-promoted FPCs raised INR 55.4 million (~USD 600,000) in debt from three commercial banks and two NBFCs. The loans included a mix of warehouse receipt finance, cash credit loans for working capital, and term loans to set up a processing unit.

This blog shares the lessons and approaches that JEEViKA took to overcome the barriers FPCs face when they access credit.

Why do commercial banks hesitate to lend to FPCs?

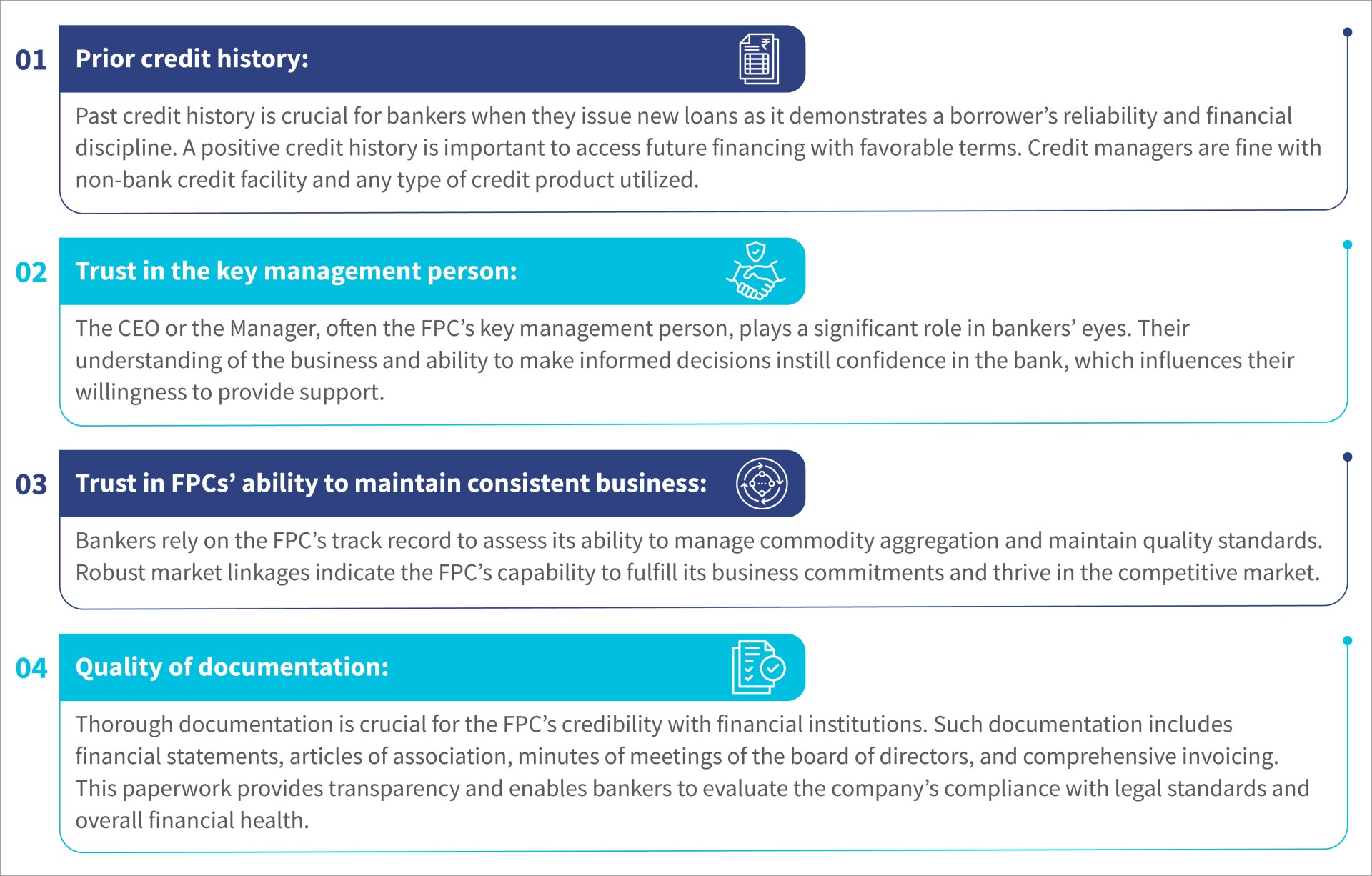

Banks typically assess creditworthiness based on factors, such as business plans, audited financial statements, and mobilized share capital. As a result, FPCs focus much of their technical advice and capacity-building initiatives on these aspects to get credit from banks. However, our experience shows that these factors are critical but not sufficient on their own. One of the reason is a majority of the FPCs formed in India are in their nascent stage and as a result the financial statements look weak. Local branch managers and regional credit appraisal teams are accountable for loan sanctions and repayments and often make the banks’ credit decisions. FPCs must ensure they are comfortable signing the loan agreement. Following are some additional factors that affect banks’ credit decisions:

What approaches did JEEViKA-promoted FPCs take to access commercial finance?

With the above insights, the JEEViKA team took the following strategies to ease barriers and enable the FPCs to access commercial bank credit:

1. Used warehouse receipt financing as an entry point: Financing against stored produce represents the most practical means for an FPC to obtain institutional credit. FPCs typically lack assets to offer as collateral as most are new and small, have limited business transactions, and lack credit history. Additionally, their board of directors and promoters often have limited net worth.

Our experience indicates that warehouse receipt financing (WRF) and invoice discounting are effective products that can help FPCs establish credit relations with formal institutions. Warehouse receipt financing is provided against produce stored in accredited warehouses, which makes it particularly beneficial for FPCs that need temporary storage.

Three JEEViKA-promoted FPCs initiated formal mainstream finance through loans against warehouse receipts worth INR 10 million (~USD 125,000) , INR 15 million (~USD 188,000), and INR 10 million (~USD 125,000) to store 2,193 MT of maize, 250 MT of lentils, and 500 MT of maize and wheat, respectively. After they sold their produce, they repaid the loan amount in full and repeated this cycle in the following season. This process helped the FPCs show the reliability of their business operations and establish creditworthiness. After two cycels of WRF, all three of them eventually got access to cash credit facilitity of commercial banks to finance their working capital needs.

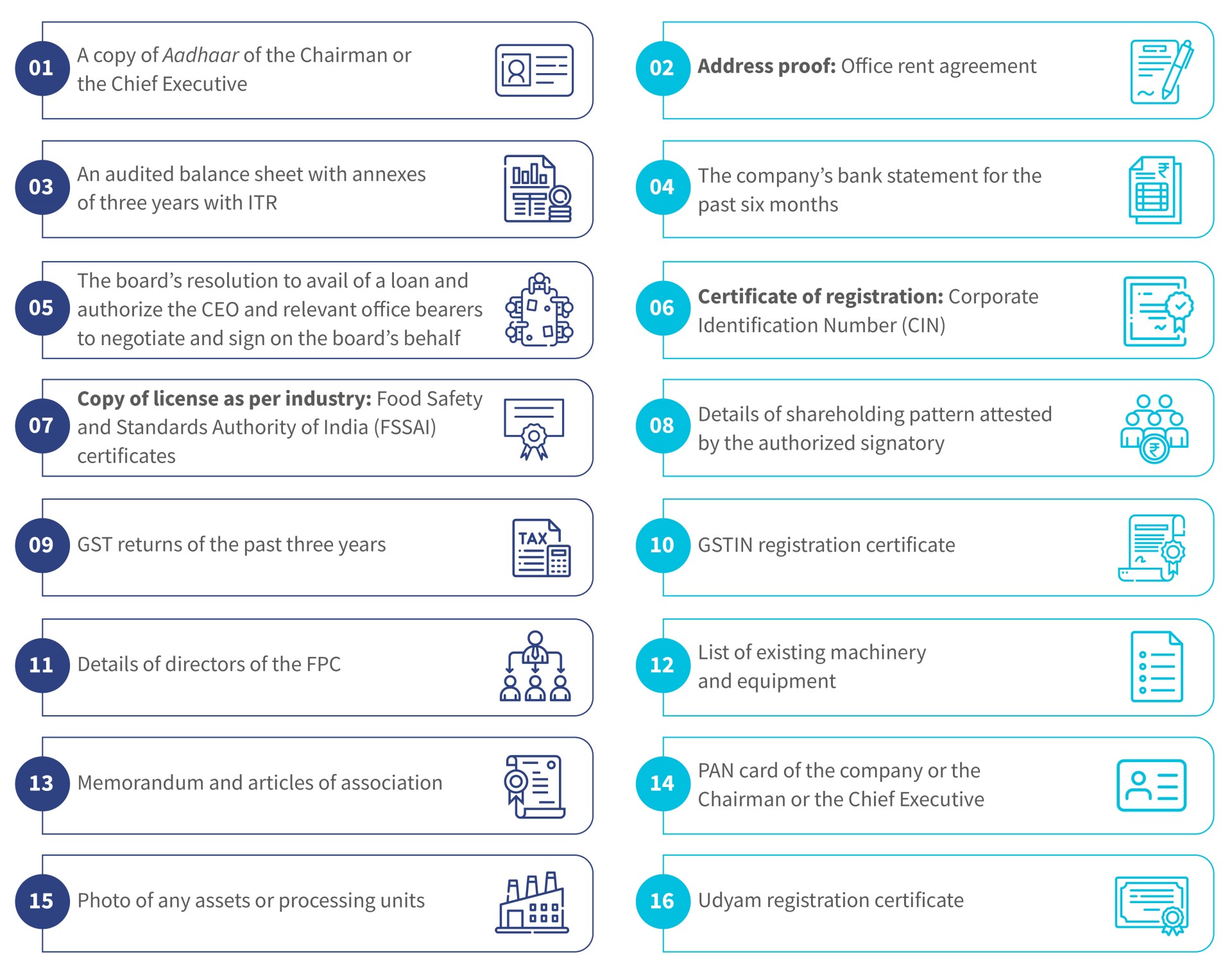

2. Kept documents ready: JEEViKA identified the documents needed for working capital and term loans and ensured that the FPCs kept these updated. Any additional requests for documentation were tracked centrally, and FPCs ensured to respond on time. Timely response to queries also adds to the FPC’s professionalism and builds the confidence of the bank credit staff. Table 1 shows that the bank asked for around 16 documents for a working capital loan.

Table 1: List of documents required by a commercial bank for a cash credit loan to an FPC

3. Engaged with bankers to educate them on the business status: Under the guidance of the state office, JEEViKA-promoted FPCs actively engaged with their bankers and provided detailed insights into their business, which included sales turnover, margins, market partnerships, and growth potential. CEOs received soft skills training to enhance their confidence and communication abilities. This proactive approach built trust and showcased the CEOs’ competency to bank branches and credit managers. Additionally, JEEViKA discovered that local branch managers were unfamiliar with lending rules for FPCs. This feedback prompted JEEViKA to relay the information to commercial banks’ regional offices to ensure the dissemination of suitable lending guidelines to branch teams.

4. Used central programs, such as PMFME and AIF, for term loans: Central programs, such as the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) and the Agriculture Infrastructure Fund (AIF), can help FPCs secure term loans. Under pressure to show progress in these government-backed initiatives, banks are more inclined to extend credit to entities that align with the programs’ objectives. FPCs can proactively ensure that their business models and documentation meet the eligibility criteria to tap into these programs effectively. Two JEEViKA promoted FPCs secured term loans of a combined USD 175,000 for setting up of a wheat flour and mustard oil processing units under the PMFME scheme by developing robust business plans. Their applications for subsidy were approved by the Department of Industries, Government of Bihar and this in turn convinced the banks to process their term loan applications.

Access to credit is a critical missing piece for FPCs to scale up their services. Operational, financial, and business sustainability are critical to ensure bank linkage for early-stage FPCs. However, FPCs can also adopt softer approaches to overcome the barriers to access to formal finance. These approaches include the demonstration of the key management person’s competency and business competency, the development of credit relationships with non-banks, sound partnerships for market linkages, and the use of government programs.

The financial needs of smallholder farmers in Uganda

Smallholder farmers represent approximately 85% of all Ugandan farmers. They contribute an impressive 80% to the country’s food crop production. However, despite their vital role, only a mere 12.2% of the total banking sector credit is directed toward agriculture. The banking sector largely favors large-scale farmers. This glaring discrepancy underscores the unmet financial needs of smallholder farmers. Our video delves into the current landscape of agricultural products in the market and evaluates smallholder farmers’ access to financial resources. It also presents practical recommendations for key stakeholders to bridge the gap in agri-finance for smallholder farmers. These stakeholders include development agencies, financial service providers, and governments. Watch the video to learn more.

From ponds to plates: The enhancement of nutrition through fish consumption in Bihar, India

Highlights

- Bihar’s ponds offer a unique solution to malnutrition: The provision of support to small-scale fisheries for economic growth and enhanced food security;

- World Fish and MSC empower women-led fish-producing groups (WFPGs) in partnership with the Bihar government. They address the supply and demand sides for sustainable nutrition;

- Innovative strategies include pond-based livelihoods and engagement in social behavior change (SBCC) activities to improve dietary diversity, address malnutrition, and improve nutrition outcomes for the state.

Introduction

The Indian state of Bihar has a distinctive advantage when it comes to ways to address its nutrition challenges: its ponds. The state is dotted with water bodies that can help develop small-scale fisheries—a promising strategy to improve livelihoods, combat malnutrition, and enhance food security. The state envisions a holistic development model that uses its aquatic ecosystems for economic growth and social well-being. The ponds provide a unique opportunity to make routine fish consumption more accessible and affordable for people in the communities associated with WFPGs in Bihar. Currently, the state’s fish consumption falls notably below the international and national averages.

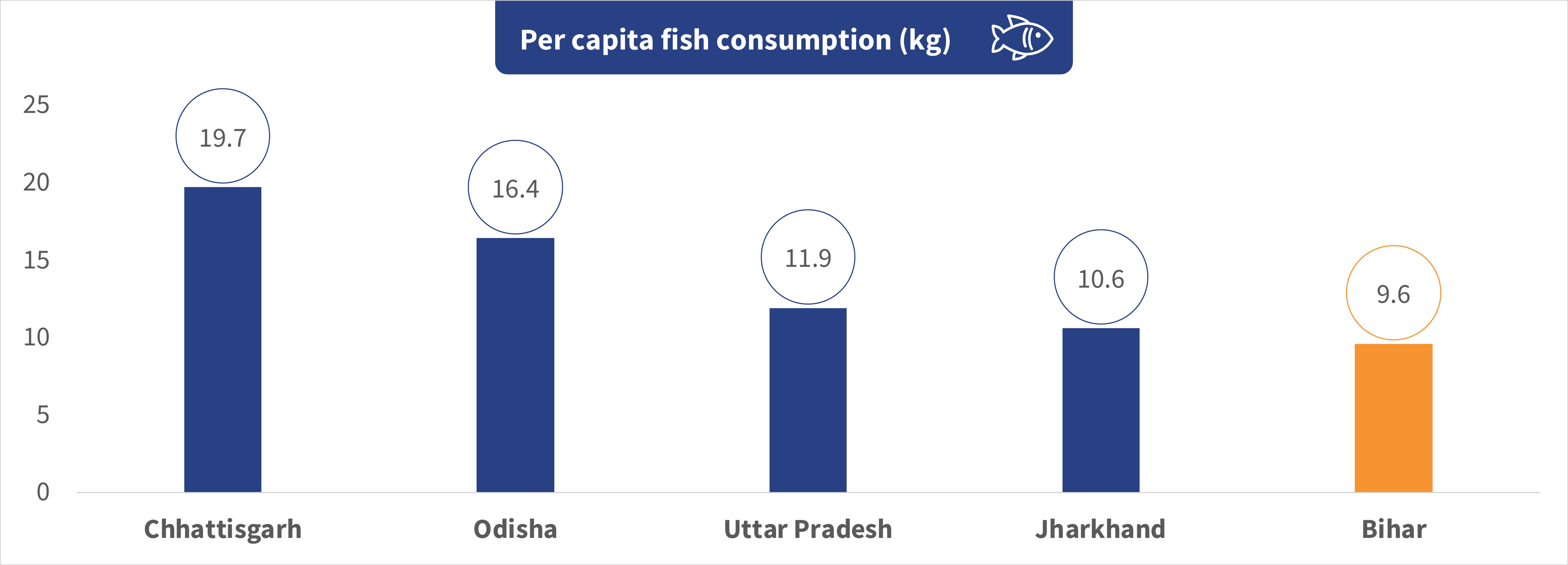

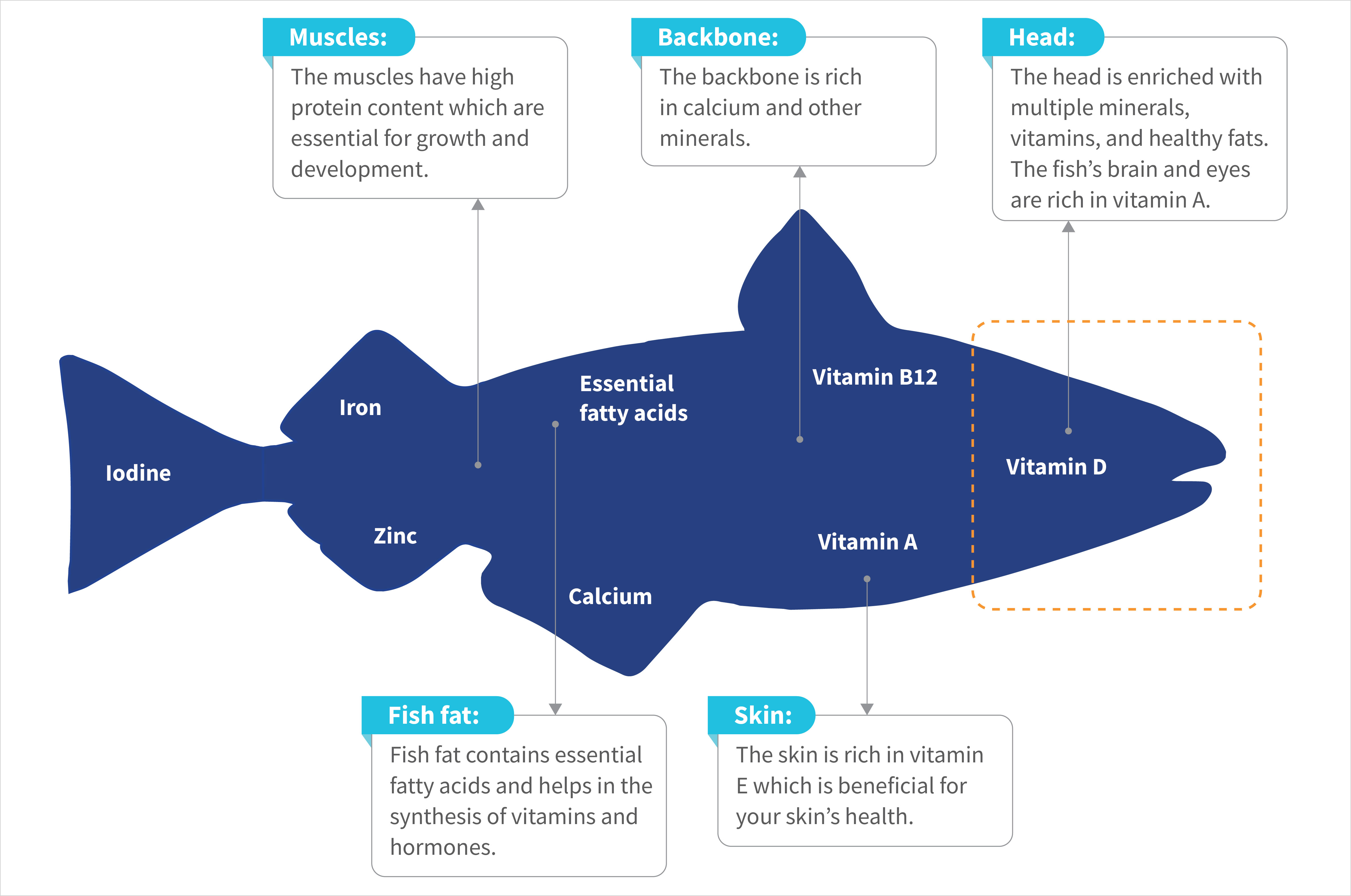

As per the Organization for Economic Cooperation and Development (OECD) and the Food and Agriculture Organization’s (FAO) 2019-20 estimate, the global per capita fish consumption is 20.5 kg, whereas Bihar records a mere 9.6 kg per capita. This disparity extends beyond international standards to compare unfavorably with peer states in India, which include Jharkhand, Odisha, Uttar Pradesh, and Chhattisgarh. This lower-than-average consumption is significant if we consider the nutritional powerhouse that fish represents—it is rich in high-quality protein, omega-3 fatty acids, and essential vitamins and minerals.

Although the state has made significant progress to reduce malnutrition, it still grapples with high levels of undernourishment and micronutrient deficiencies. Stunting affects a staggering 42.9% of children under five, which surpasses the national average. Additionally, 41% of Bihar’s children experience underweight issues. Anemia is prevalent, which affects 69.4% of children and 63.5% of women in the 15-49 age group. This indicates widespread health concerns. Paradoxically, 2.4% of children under five and 15.9% of women face obesity issues. These statistics underscore the urgent need to address Bihar’s nutritional deficiencies.

World Fish and MSC have been providing technical support to empower FPGs in collaboration with the Bihar government’s Bihar Rural Livelihood Promotion Society—JEEViKA. This presents a promising pathway. These efforts enhance economic prospects and are key to mitigate Bihar’s persistent nutritional challenges. The state’s proactive approach to promote fisheries aligns with the imperative need to counteract the multifaceted nutritional concerns, which ensures a healthier future for its communities.

Fish’s role in better health outcomes

In Bihar, the integration of fish into dietary habits is a significant avenue to improve nutritional intake, especially for adolescent girls, pregnant women, and young children. However, we identified various challenges through our interactions with the region’s WFPGs. These include limited access to fresh fish due to limited availability, cost, nutrition literacy, and cultural beliefs. A senior FPG member said, “Small children cannot eat fish due to sharp bones present in it. Moreover, till the time the child’s head is not shaved (tonsuring ceremony), the mother is not allowed to eat any non-vegetarian food items.”

We developed a comprehensive strategy that addresses both the supply and demand sides of the nutritional equation. Our initiative recognizes the multifaceted nature of nutritional challenges in our collaboration with the Bihar government. This holistic approach boosts fish availability through the activities of fisheries. It also delves into the intricate fabric of nutritional literacy and cultural dynamics. We intend to foster a sustainable and impactful nutritional transformation in Bihar through engagements with WFPGs and the creation of a cadre of “Matasya Sakhis” for support.

We have achieved substantial progress on the supply side through fisheries activities in 118 ponds across 112 village organizations. The JSPVAT fisheries teams extended technical support to each FPG. This encompasses crucial aspects, such as pond maintenance, polyculture, the introduction of small fish (mola), and the establishment of linkages with markets. This comprehensive approach has created livelihood opportunities for approximately 80,000 households and reduced the farming period in intervention ponds to four months from a year. This has allowed for two to three additional farming cycles annually. More than 200 individuals have received training. 142 have successfully established themselves as fish vendors in nearby markets, which further contributed to the local economy.

Simultaneously, our innovative strategies on the demand side intend to revolutionize nutritional awareness. Initiatives include SBCC activities, such as the creation of engaging puppet videos tailored for children and recipe videos that offer step-by-step guidance on the preparation of fish powder and paste for safe consumption by children, among others. JVSPAT Fisheries team provides periodic training on nutrition education to WFPG members and their families. This has led to a notable 10% rise in fish consumption within WFPG families.

These dynamic endeavors complement the supply-side progress, which fosters a culture of informed nutritional choices within the communities we serve. Moreover, our commitment to nutrition literacy extends to impactful residential training programs for “Matasya Sakhis.” This specialized cadre plays a pivotal role to support FPGs on both supply and demand aspects. The training sessions cover a spectrum of elements, which range from technical intricacies and gender perspectives to comprehensive insights into nutrition. The sessions emphasize the significance of a balanced diet, the importance of food diversity, and the inclusion of small fish, such as pothia and mola, among others. These trained individuals become key facilitators to disseminate nutritional knowledge within their communities.

Additionally, information, education, and communication (IEC) materials are crucial to our strategy. Various posters, banners, and pamphlets are thoughtfully designed to target specific groups, such as FPGs, fish vendors, and community members. These materials provide essential information and practical guidance, which include recipes for fish powder and paste preparation. The dissemination of these IEC materials further amplifies the ease with which fish-based nutrition can be incorporated into children’s diets. This contributes to the broader goal—to address Bihar’s persistent nutritional challenges.

Additionally, information, education, and communication (IEC) materials are crucial to our strategy. Various posters, banners, and pamphlets are thoughtfully designed to target specific groups, such as FPGs, fish vendors, and community members. These materials provide essential information and practical guidance, which include recipes for fish powder and paste preparation. The dissemination of these IEC materials further amplifies the ease with which fish-based nutrition can be incorporated into children’s diets. This contributes to the broader goal—to address Bihar’s persistent nutritional challenges.

Way forward

Our program envisions a deeper geographic expansion, which extends into districts, such as Nalanda and Madhubani. It targets areas with a greater density of ponds and elevated malnutrition prevalence. The extension of our successful fisheries activities will deepen our impact and empower communities with sustainable livelihood opportunities and access to nutritious fish. Simultaneously, community engagement programs will be pivotal in addressing cultural barriers, dispel myths, and promote the nutritional benefits of fish consumption. This targeted awareness campaign seeks to instigate a positive shift in community attitudes toward fish as a valuable dietary component.

Our focus remains on the expansion of the Matasya Sakhi program to scale up our impact. It would create a larger cadre equipped with the knowledge to support WFPGs on the supply and demand sides. The use of technology will be crucial to integrate digital solutions, such as mobile applications or SMS-based platforms. It would provide real-time information and support to FPGs and community members. This digitally adept approach ensures a continuous learning environment and enhances our ability to disseminate nutritional knowledge effectively.

Furthermore, our strategy aligns with broader agricultural, food security, and social safety net programs. We intend to create collaborations that amplify our efforts’ impact through the integration of our initiatives into these existing frameworks. Collaboration with policymakers will advocate for supportive policies within the fisheries sector and strive to integrate nutrition-focused strategies into broader agricultural and economic development policies. This inclusive approach fosters an environment conducive to sustained positive change. It addresses malnutrition comprehensively and creates a lasting impact on the well-being of Bihar’s communities.

Understanding Users’ Experience with Digital Lending Applications (DLAs) in India

The Fintech Association for Consumer Empowerment (FACE) and MicroSave Consulting (MSC) have published a survey titled “Understanding Users’ Experience with Digital Lending Applications (DLAs) in India,” which analyzes user knowledge and behavior regarding DLAs and digital loans. The findings reveal that while 70% of users felt confident verifying loan apps, many lacked awareness of how to identify illegal lending apps. More than half of the users were uninformed about proper verification methods, making them susceptible to fraud. Most users focused on partnerships with NBFCs/Banks, reviews, and ratings, often overlooking downloads and data-sharing metrics. Even highly confident customers demonstrated limited understanding of their digital loans, such as the Key Fact Statement and Grievance Redressal mechanism. Social media advertising strongly influences digital loan purchases, with friends and family playing a significant role in decision-making. Female users showed better awareness of loan products compared to male users. Digital lending applications positively impacted 76% of users, whereas 11% reported negative experiences. Finally, individuals who did not use loan apps, mostly in rural areas, mentioned reasons such as no loan requirement, access to alternative credit sources, or unfamiliarity with loan apps.