How India is securing its G2P beneficiaries from COVID-19 – Lessons for other countries to create a G2P delivery platform

by Mitul Thapliyal and Venkat Goli

May 8, 2020

3 min

In the first blog from our new series on lessons from India for the world, we will look at the basic components of the digitized G2P ecosystem that enabled India to support beneficiaries even when the whole country was under lock down. We will follow this with detailed modules on each component.

As of May 1, about 159 countries have planned, introduced or adapted 752 social protection measures in response to COVID-19. 244 of such measures, representing one-third (32.4%) of total COVID-related social protection programs, are cash transfer programs. This includes both pre-existing and new programs.

India was among the first few countries to announce a social protection package of USD 24 billion at the federal level. State governments have announced, and are still announcing, additional measures. To our last count, this amount is around USD 14 billion. Of the USD 24 billion package, about USD 10 billion is for cash transfer and remaining is for in-kind support, primarily food grains. Under the cash transfer package, INR 500 (USD 7) will be transferred to the bank accounts of 200 million women every month for three months. 87 million farmers will get advance payment of INR 2000 (USD 28) under a pre-existing income support program called PM-Kisan. 30 million poor senior citizen, widows and disabled will get ex-gratia of INR 1000 (USD 14) under a pre-existing pension program called National Social Assistance Program (NSAP). 80 million poor women will get advance payment of about INR 784 (USD 11) to buy LPG for household cooking for the next three months[1]. In addition, 800 million beneficiaries will get three months of food grain free of cost through an extensive network of public distribution system that already delivers food grains to these beneficiaries every month at a highly subsidized cost.

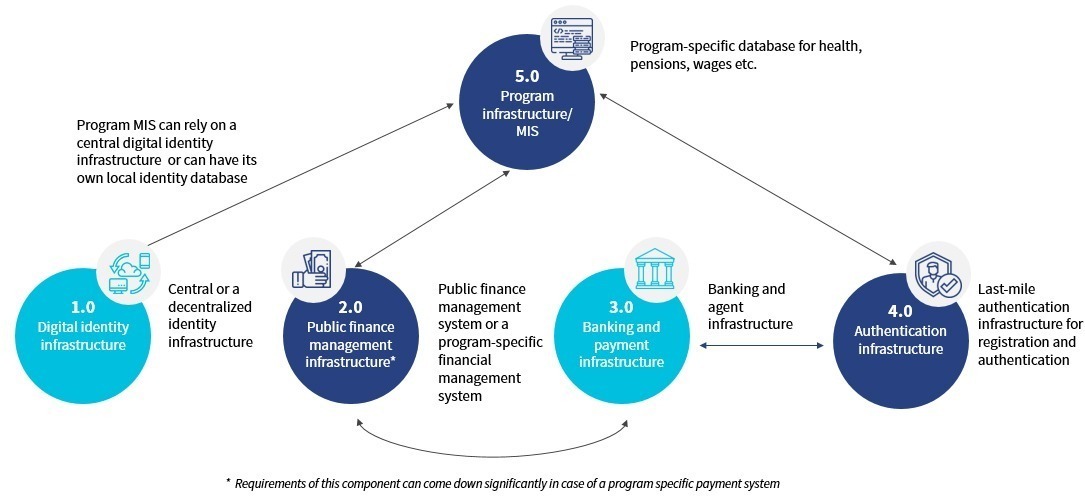

The value of Indian federal government’s social assistance package is almost half of the combined package of all middle income countries (MICs). But what is surprising is the speed at which the cash component of this package reached the beneficiaries. About 400 million G2P payment transactions were processed by the Indian federal government within of this announcement. Challenges such as payment transaction failure and onboarding new people, who are falling into poverty due to this pandemic, continue. But nonetheless this is a remarkable feat that many other countries, developing and developed, aspire to. Over the last few years there has been an increased interest among many countries to learn from India’s experience in digitizing its G2P program. The following figure illustrates various components of the ecosystem that must be considered.

MIS Program Infrastructure

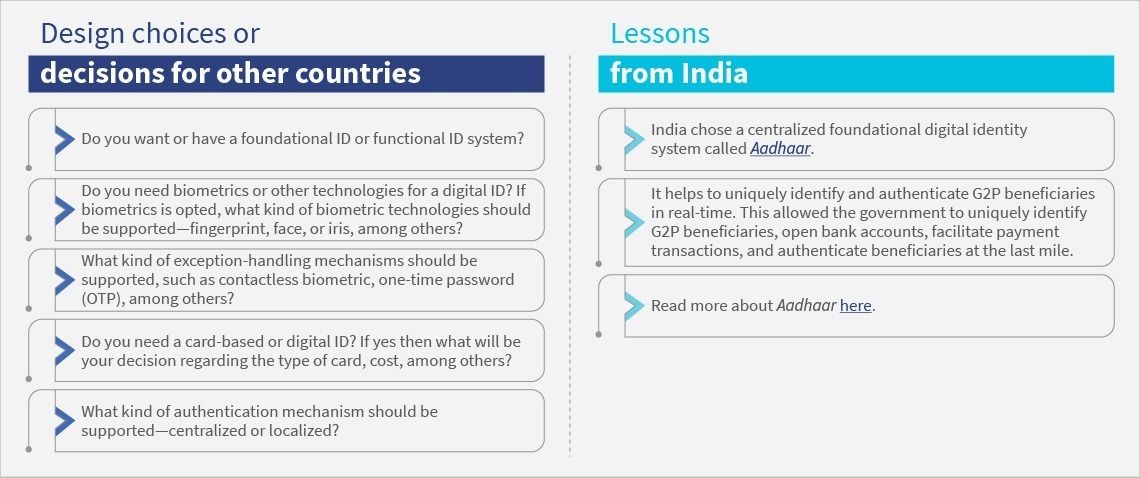

1.Digital identity and authentication infrastructure

A digital identity system can help to uniquely identify and enrol people into a G2P program. Countries have choices depending on whether they already have an existing digital identity database, are creating a new one, or can repurpose an existing database for this purpose.

A digital identity system can also serve as an authentication system that can reduce the cost of last mile authentication infrastructure and overall transaction cost.

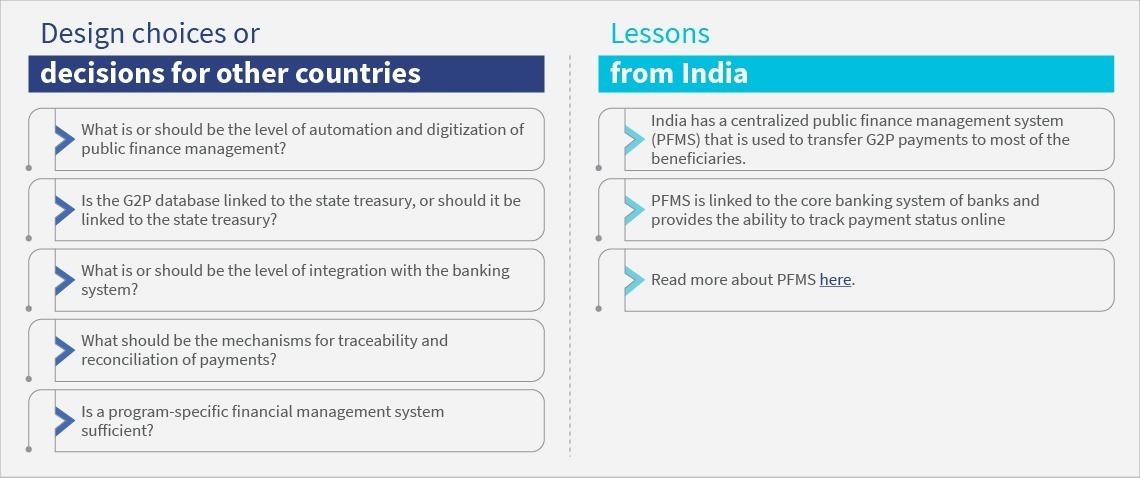

2.Public finance management infrastructure

A digital public finance management system can increase the observability, efficiency and targeting of G2P payments by several fold. However, it is difficult to create and manage. Volume and value of G2P payments will also play and important role in deciding whether one should have a centralized system to manage G2P payment or a program specific financial management system is sufficient.

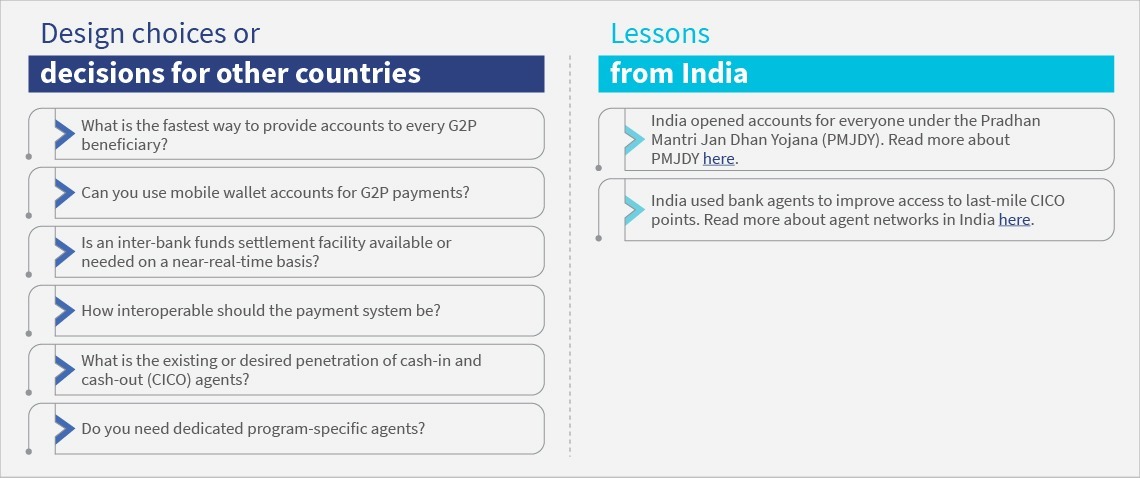

3.Banking and payment infrastructure

Penetration of banking and payment infrastructure is key to facilitate G2P payments. There are three key elements to this – access to bank/mobile wallet account to g2P beneficiaries, integration of backend payment system and last mile access points for transactions.

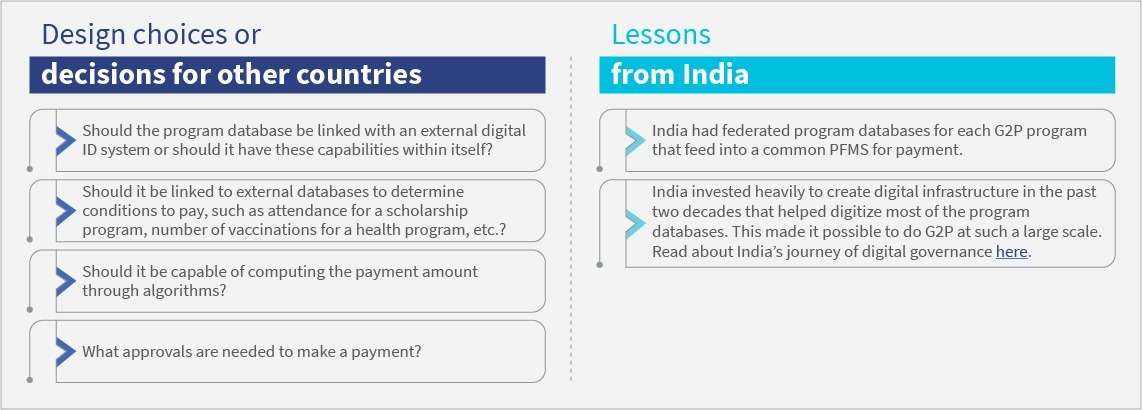

4.Program infrastructure/MIS

A digital program database is an important requirement for running a G2P program. The level of automation of this database can vary and determines the efficiency of the system. Designers of program database have many design choices depending on the requirement and budget.

Every country’s journey to create a digital system that brings in efficiency, accuracy and speed to G2P payments will be unique depending on its current situation, aspiration, budgets, legal and regulatory requirements and many other conditions. India offers valuable lessons for other countries to learn and adapt these learnings to create its own roadmap.

Written by

Mitul Thapliyal

Partner

by

by  May 8, 2020

May 8, 2020 3 min

3 min

Leave comments