DEBIT: Unpacking women’s choice of financial channels

by Parul Tandon

by Parul Tandon Mar 20, 2023

Mar 20, 2023 3 min

3 min

MSC unpacked women’s choice of channels for financial transactions in India, Bangladesh, Kenya, and Indonesia. The result is a tool – the DEBIT framework. The four pillars of the framework are Diffidence, Education, Bias, Investment, and Trust. Read this blog to learn more about the framework and its application.

The pace of digitalization around the world accelerated significantly after COVID-19. Even those reluctant to try technology were compelled to use digital platforms for day-to-day transactions. People’s use of mobile phones to transfer money picked up across income strata.

After the pandemic, about 40% of adults in developing economies barring China, made their very first digital merchant payment using a card, phone, or the internet. Similarly, more than one-third of adults in developing economies had their initial experience of paying a utility bill directly from an account after the pandemic started.

Our research suggests that women, especially those from the low- and moderate-income segment, moved to use mobile phones for financial transactions. In the new normal, multiple channels have opened, allowing people to conduct financial transactions as they please.

At MSC, we sought to understand how low- and moderate-income women choose a channel for financial transactions. This led us to follow women’s customer journeys across various geographies and distill crucial factors that determine their choice of channel. We used MSC’s DEBIT framework, rooted in behavioral science, which uses a gender lens to decode this choice. Please see more of our flagship work in this area here.

At MSC, we sought to understand how low- and moderate-income women choose a channel for financial transactions. This led us to follow women’s customer journeys across various geographies and distill crucial factors that determine their choice of channel. We used MSC’s DEBIT framework, rooted in behavioral science, which uses a gender lens to decode this choice. Please see more of our flagship work in this area here.

The DEBIT framework provides evidence of, for instance, how women’s perception of a particular channel and the tendencies for loss aversion make them stick to tried and tested channels. It identifies factors that influence women’s choices and helps compute comparative scores for each channel of each individual. Comparing the DEBIT scores helps us identify actions that stakeholders, such as governments and financial service providers can undertake to help women access a broader range of channels.

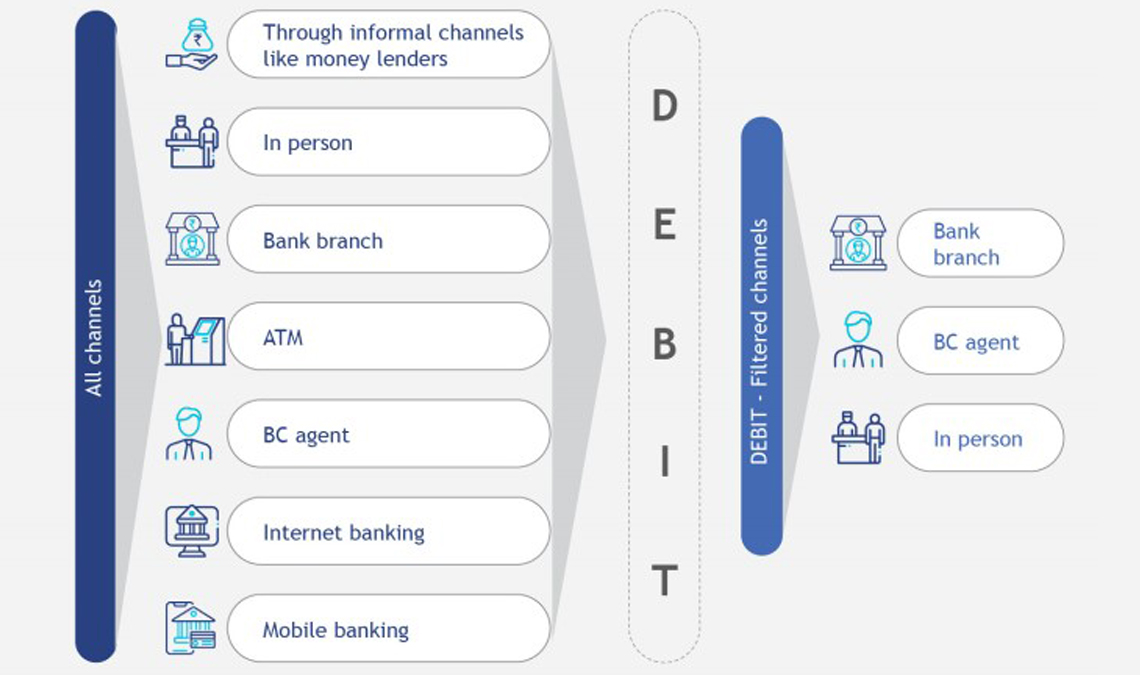

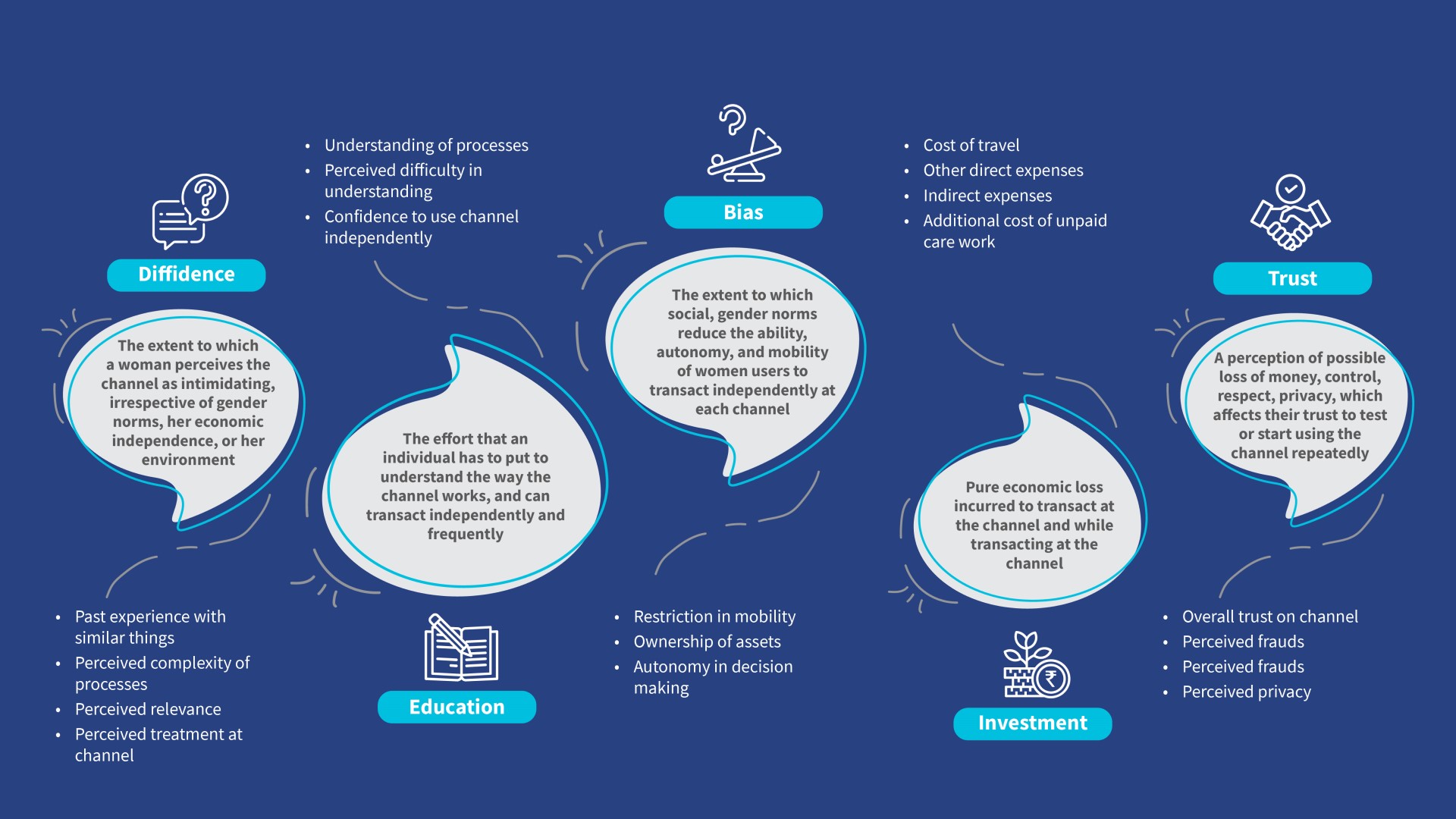

The DEBIT framework can be unpacked as:

Diffidence: the extent to which a woman feels hesitant to use the channel based on her perception of its relevance, complexity, and her treatment at the channel

Education: the cognitive burden of new learning on how to transact at a new channel

Bias: the extent to which social and gender norms reduce female users’ ability, autonomy, and mobility to transact independently at each channel

Investment: the economic cost incurred in reaching the channel and transacting, including the opportunity cost of her time

Trust: the function of perceived fear of transacting at the channel; a perception

of possible loss of money, control, respect, and privacy, which affects their trust to test or use the channel repeatedly

These drivers of debit are complex and interrelated.

DEBIT stands literally and metaphorically for everything people perceive to lose when they choose a channel. The choice is primarily based on loss aversion. DEBIT computes the perceived loss and shows that the user will choose the channel with the least cost.

The process to compute the DEBIT value for a channel:

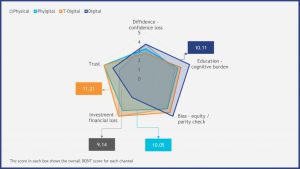

- We compute the rating or value of each DEBIT factor for a channel by taking the average rating of multiple indicators representing the factor, on a Likert scale of 1 to 5, with 5 being the maximum.

- The channel’s polygon is drawn using the individual rating computed for each DEBIT factor.

The overall area of the polygon for a channel represents that channel’s perceived loss (DEBIT value).

The customer considers the channels with the lowest perceived loss the most rational choice and adopts it.

Here is an example from our DEBIT Kenya research for a proxy M-PESA user. The graph captures higher scores for M-PESA, which means that the perceived loss of using M-PESA is higher among these women. They are yet to transition to M-PESA due to a lack of personal ID.

Here is an example from our DEBIT Kenya research for a proxy M-PESA user. The graph captures higher scores for M-PESA, which means that the perceived loss of using M-PESA is higher among these women. They are yet to transition to M-PESA due to a lack of personal ID.

We developed DEBIT values for women across India and Kenya for channels, such as bank branches, ATMs, mobile banking, women collectives (SHG, ROSCA, ASCA, SACC), and cash. DEBIT helps us understand that women choose the channel to transact based on several factors beyond just the economic cost involved. Women in low-income communities make complex choices beyond what “seems rational” to everyone. These choices reflect their complicated daily lives as they deal with work and bear the disproportionate burden of care while managing their financial lives.

Read MSC’s reports from India and Kenya for the whole story.

Written by

Leave comments