Zambia’s comeback in digital financial services (DFS)

by Akhand Tiwari, Irene Wagaki and Nandini Harihareswara

Jan 27, 2016

4 min

This blog explores the factors that gave rise to the DFS sector in Zambia in 2009 after an unsuccessful launch to the world in 2002 through Celpay.

https://dev.microsave.net/helix-institute/

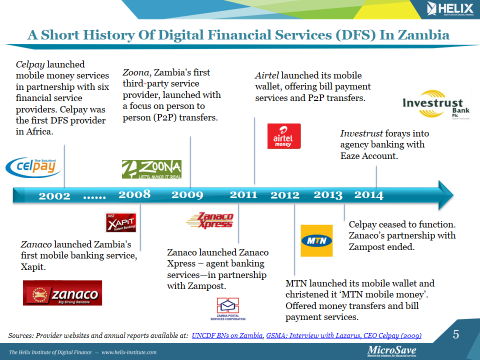

Zambia introduced Digital Financial Services (DFS) to the world with the launch of Celpay in 2002. Celpay’s offering to Zambians was somewhat similar to Safaricom’s ‘microfinance credit re-payment’ product, which was introduced in 2006 in Kenya. Whilst Safaricom’s M-PESA was able to spearhead the mobile money revolution by offering the value proposition ‘send money home,’ the Zambian market was not able to find this traction until 2009 when Zoona offered person to person transactions via the mobile platform (Figure 1)

Figure 1: A Timeline Of DFS In Zambia

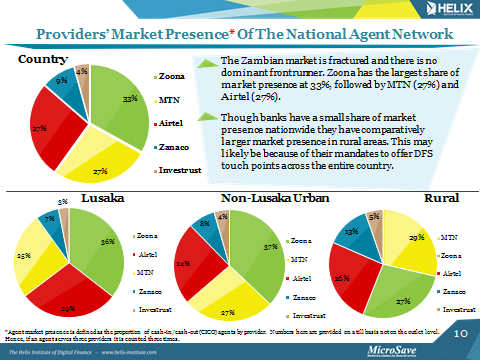

Fast forward six years: the Zambian DFS market is competitive; a diverse group of providers in the battleground claim approximately 4,500 agents across the country. The Helix Institute’s Agent Network Accelerator (ANA) Survey in Zambia, which was funded by the UNCDF MM4P Programme and conducted between July and August 2015, interviewed more than 1,200 agents and provides evidence to support the fact that providers face a great deal of competition. Research on the market presence of agents indicates that the market is fractured into segments represented by banks, third party providers and telecoms companies and that there is no dominant frontrunner.

In fact, Zambia is one of the most competitive landscapes among ANA research countries with five providers in the mix, following Pakistan which has six providers that have 5% or greater market presence. In contrast, Bangladesh had four when surveyed in 2014 and the East African markets had three or less, with Kenya witnessing an aggressive expansion from the banking sector in 2015.

Zoona has the largest share of market presence at 33% (Figure 2), followed by MTN (27%) and Airtel (27%). Thus far, we have seen that the most successful providers in the digital finance space are telecoms companies, who have large marketing budgets plus national networks of existing retailers and typically millions of customers they can tempt to register for digital finance. Nevertheless a third-party provider has gained a lot of traction in Zambia; followed by telecoms, and by banks vying for a piece of the pie.

Figure 2: Providers’ Market Presence in Terms of Agents

Agents’ Transactions are Comparable to East Africa

It’s impressive that Zambian agents conduct transactions comparable to leading and mature East African markets—Tanzania and Uganda—at a median of 28 daily transactions. It is noteworthy that most of the transactions are focused on payment services—cash in/cash out, money transfer, and bill payments.

Yet curiously, less than half of agents offer account opening services, which limits a provider’s ability to expand its customer base. Indeed, agents cited the lack of awareness of services among customers as one of the top barriers to doing more business. This barrier points to a need for aggressive marketing from the provider. In fact, one-third of agents say that their provider’s marketing is not effective in increasing customers’ awareness of DFS.

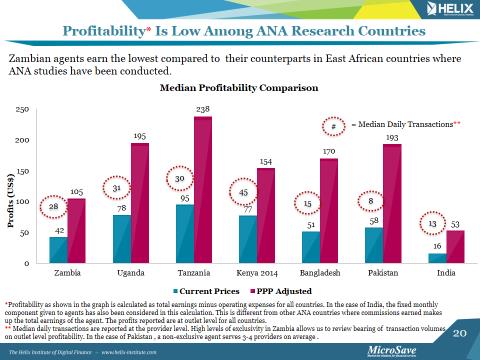

Profits Aren’t Aligned to Transaction Volumes

Whilst the number of transactions conducted is healthy, Zambian agents are not as profitable as their East African counterparts. In fact, profitability is among the lowest in ANA Research Countries (Figure 3). High agent profitability is often cited as one reason for the rapid growth of DFS in Tanzania. Agents in Zambia earn a median profit of USD$105 (PPP adjusted), compared with USD$195 in Uganda and USD$238 in Tanzania. It would be prudent for Zambian providers to understand the causes of low profitability among agents in order to avoid potential agent dormancy. The Helix research indicates that low earnings could be a result of the poor commission structures given to agents for low-value transactions.

Despite lower profits than East Africa, the current level of profitability is encouraging because:

- The market is nascent and the numbers of transactions are promising;

- Zambia is at a tipping point as only 14% of adults have/use mobile money, indicating a lot of room for growth;

- The competitive market may entice agents to work with multiple providers, thus increasing their potential revenue stream and profits.

Figure 3: Outlet Profitability among ANA Research Countries

The Future

The future could be very bright for DFS providers in Zambia. There are vast opportunities to expand financial access for Zambians, and the competitive landscape suggests a potential for the Zambian market to set new benchmarks in DFS globally. Financial services are ever more relevant to Zambians in the face of challenging financial circumstances. To set these new benchmarks, Zambian providers will need to revisit their strategies in order entice more Zambians to utilize DFS products, educate them on DFS services, and thus effectively breed the demand agents need to earn more profits.

Nandini is a Country Technical Specialist, responsible for the implementation of the United Nations Capital Development Fund Mobile Money for the Poor (MM4P) Digital Finance country strategy in Zambia. Partnering with Financial Sector Deepening Zambia (FSDZ), she is leading a team focused on increasing financial inclusion through digital finance. She is also assisting MM4P’s efforts in Malawi.

by

by  Jan 27, 2016

Jan 27, 2016 4 min

4 min

Leave comments