Would a Business Correspondent Network Manager’s (BCNM’s) strategy to customize incentive structure change the agent business?

by Disha Bhavnani and Manali Jain

Mar 1, 2022

5 min

This blog focuses on Eko – a leading FinTech platform providing tools, opportunities, and credit to ambitious individuals. Eko is a new-age banking correspondent network manager (BCNM) driving financial inclusion through its network of 200,000 agents. The blog looks at incentives for agents and Eko’s strategy to improve the incentive structure for its agents with support from MSC.

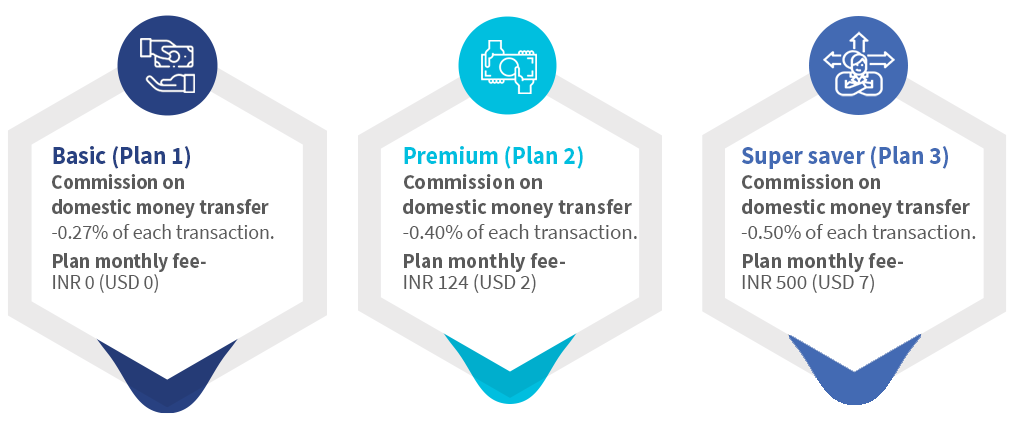

Eko India Financial Services is a new-age banking correspondent network manager (BCNM). It offered three progressive plans in its old incentive structure, shown in Figure 1, to more than 200,000 agents to take care of their business needs. The agents could choose the monthly plans which had different subscription charges based on their commission rates.

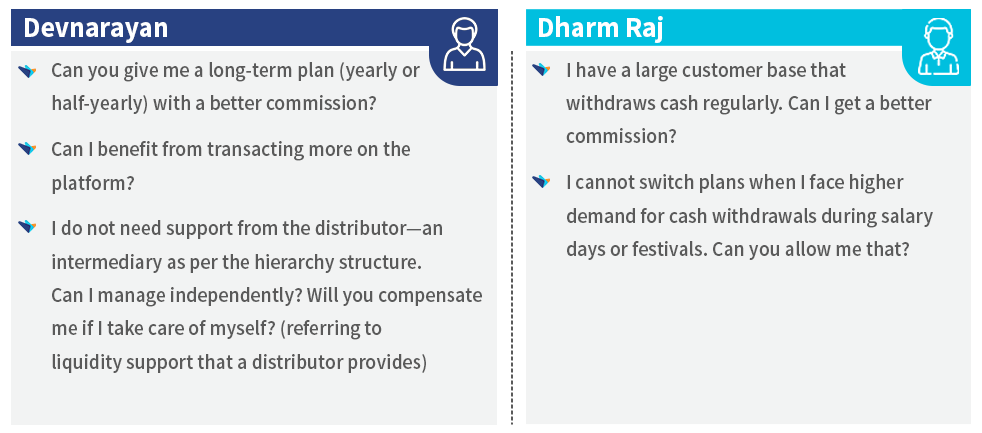

As Devnarayan’s outlet is close to an industrial area, his customer base primarily comprises migrant workers and truck drivers who send money to their families regularly using DMT services. Although his primary source of income comes from a cybercafe and cellphone selling shop, he is a well-performing BC agent on Eko’s platform. He conducts 80-100 transactions daily and earns between INR 30,000 to INR 40,000 (USD 400-500) per month by providing DMT services at his outlet.

Devnarayan has used Eko’s Supersaver plan till now. He paid INR 500 (USD 7) monthly and received a commission of 0.50% of the transaction value each time he transacted through the portal. While he was satisfied and earning well with his existing plan, he wanted more.

He conducts three to four transactions daily and earns between INR 1,000-2,000 (USD 12-20) in a month, using Eko’s Basic plan. Like Devnarayan, Dharm Raj’s primary source of income is a cybercafe.

Agents like Devnarayan and Dharm Raj face multiple challenges around the incentives received as an agent. They have varied key demands, listed in Figure 2.

Thus, a growing BCNM like Eko must set the prices that provide value to their last-mile agents for higher usage and motivation.

Reinventing the existing incentive strategy: Addressing the challenges faced by agents

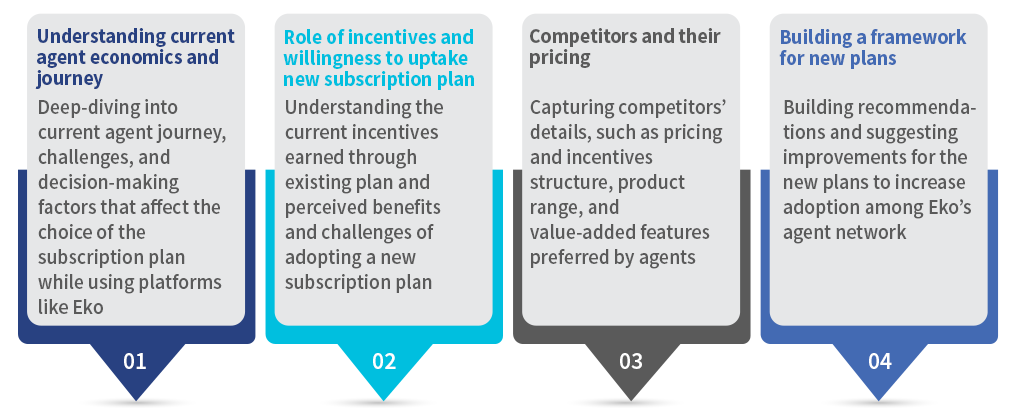

Eko cannot follow a cookie-cutter approach to address its agents’ varied needs and requirements. Thus, it decided to remodel its existing subscription plans to meet the needs of different agents. Eko designed a new set of plans based on the information and data in its extensive “agent transaction data bank” to address its agents’ needs. MSC (MicroSave Consulting) conducted an assessment to understand the agents’ perceptions around these new plans. The assessment focused on:

After completing the assessment, MSC recommended the “Good-Better-Best (GBB) framework” for improvements to the subscription plans, which would address the challenges faced by agents like Devnarayan and Dharm. The GBB framework helps Eko design a strategy that:

- Provides variable incentives for agents who have different turnovers, use specific services, or value features like longevity, subscription price, and commission value of the plans differently;

- Introduces plans with minimal entry barriers for all the existing and new price-sensitive agents who adopt Eko; and

- Enhances the suite of value-added features for high-potential agents.

GBB facilitated a subscription model that works as a tool to build solid relationships between Eko and its agents. Moreover, the model provides a seamless and sustained brand experience.

A sneak peek at the GBB framework for Eko

GBB takes a holistic approach to a solution to cater to differentiated needs and the value of differently-priced subscription plans for agents.

What implementing GBB means for the agents and Eko

Based on this recommended approach, Eko tweaked its plans to improve the overall incentives it provides agents to suit agent-specific needs better. The new plans have changed how an agent chooses a subscription plan.

- Now, Devnarayan can choose plans with extended validity. He chooses a 365-day plan and does not bother with monthly payments.

- Dharm Raj earns a higher income on cash withdrawals through AePS in his village. His overall earnings have also increased. He can now switch plans on specific days when customers receive subsidies. His outlet sees a high volume of transactions.

Other Eko agents can offer additional services through Eko and thus met a broader range of customer needs and serve more customers. Furthermore, the new scheme provides multiple options to rebalance, and even add e-value through UPI, which reduces their dependence on distributors. The option without distributors now offers a higher commission to agents like Devnarayan.

These changes supported different agents by offering more flexibility, convenience, and higher revenue due to increased incentives across multiple products and services. Since the launch of the scheme in July 2021, more than 68% of agents have taken up the new plans. Eko has increased revenue and provided new sources of earnings to its extensive agent network through the platform.

What the new pricing strategy means for Eko’s future

The changes Eko introduced have supported the increase in agent incentives. But will the new scheme prevent agents like Devnarayan or Dharm Raj from moving to competitors offering them other unique benefits? We cannot say for sure.

With an increasing number of BCNMs in an ecosystem that provides agents with higher increasing incentives, competing providers will find it challenging to maintain agent stickiness. Similarly, these will not be the last set of plans Eko launches to support its agent network. Every time the agent incentives and plans are redesigned or changed, the Good-Better-Best framework and its principles can guide Eko.

Increased competition will influence the BCNM ecosystem through new product features, convenience, and commissions. We expect things to heat up—for the better—as we move forward with new emerging business models, rapid technological innovations, state initiatives, and more players entering the market.

Written by

by

by  Mar 1, 2022

Mar 1, 2022 5 min

5 min

Leave comments