Wonderlend Hubs (WLH): Alternate route to credit history

by Disha Bhavnani, Anil Gupta and Anshul Saxena

Jul 17, 2019

4 min

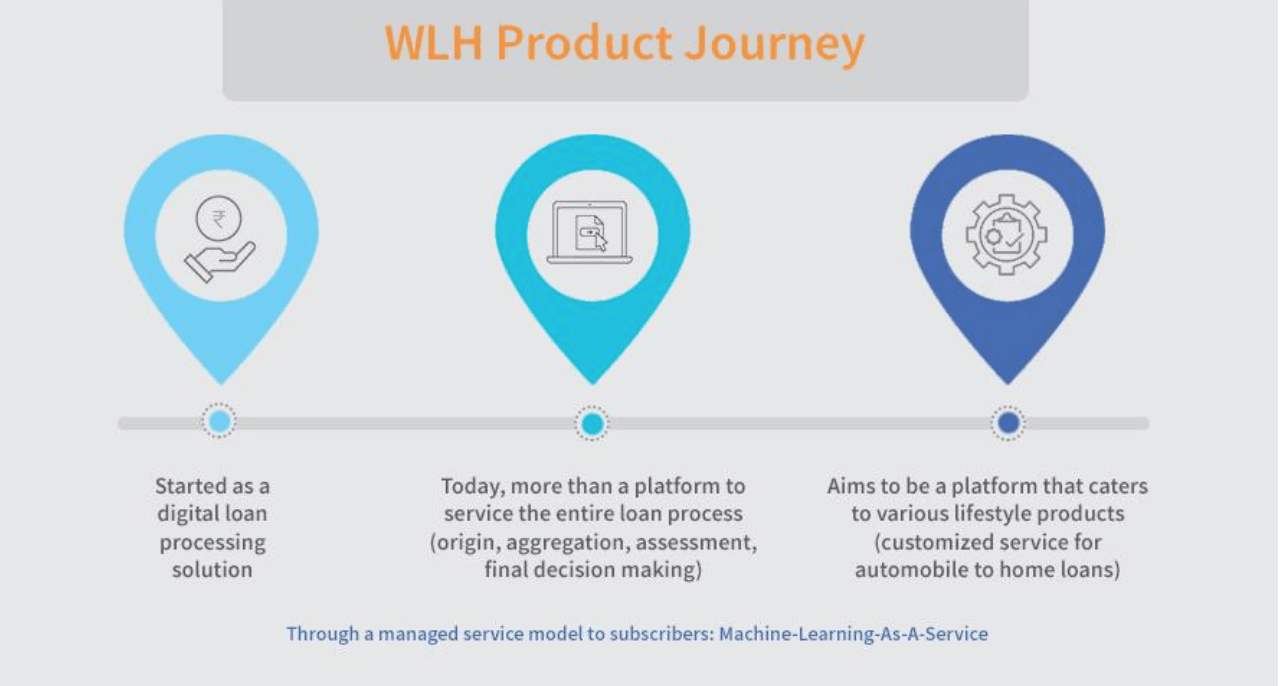

Read to see the journey of WonderLend Hubs, a company that provides Machine Learning-as-a-Service (MLaaS), as it implements this fascinating service to become the credit gateway for India’s low-to middle-income segments.

This blog post is part of a series that covers promising fintechs making a difference to underserved communities and supported by the Financial Inclusion Lab accelerator program. MSC is a partner to the FI Lab, which is a part of CIIE’s Bharat Inclusion Initiative.

|

Sujit, 25, runs a kirana (grocery) shop at Maharajganj. He inherited the shop from his great grandfather over seven years back, but without legal papers. With expansion on his mind, he seeks capital to purchase products in demand, renovate the shop etc. But lack of credit history and legal ownership documents make Sujit a least preferred customer at banks. Can new-age technology help Sujit? |

Small business owners like Sujit need a platform to build their credit history using alternative sources of data – such as cash flow and transactions – and finally enable them to take loans easily and on time.

Micro and Small Enterprises (MSEs) play a vital role in the Indian economy. According to a recent Confederation of Indian Industries (CII) survey, MSEs provided 13.5 to 14.9 million new jobs in the past four years – mostly to unskilled and semi-skilled people from semi-urban and rural areas. This segment is identified by irregular income, lack of credit history in formal financial institutions and lack of physical collaterals – impediments to accessing credit from formal institutions.

Wonderlend Hubs (WLH) utilizes everyday digital footprints and cash flows of an MSE owner to create a credit record. It tracks the repayment capability, business solvency, and credit needs of MSE owners, making them a credit worthy customer in the formal credit market, and facilitating hassle-free and quick credit.

Treading new roads

The WLH team, Ram Ramdas, Founder, Rajesh Iyer, Chief Business Officer and Anusha Jathanna, Co-founder and Head – Platform & Products goes back to Herald Logic, an earlier venture they started together. At that time, they garnered knowledge about big data, machine learning, and human innovation, and observed that credit flow was significantly hampered for a large segment of India due to lack of credit history. This gap steered the idea of WLH – a unique solution that makes finance accessible to “the next 500 million” of India from the MSE and other underserved individual segment.

Ram Ramdas, Founder Rajesh Iyer, Chief Business Officer

The pitch: Building credit history one day at a time

Today, banks find it challenging to assess potential loan customers based on non-standard data without a credit history. Collecting and analyzing relevant data-sets for a small loan ticket size for MSEs is not cost-efficient either. Underwriting and operations are not feasible, making formal credit unviable for MSEs. WLH aims to bridge the credit gap for the under-served segments across the urban, semi-urban, and rural areas of the country. WLH also intends to customize the credit product based on business needs and aspirations.

WLH product range

The evolution: Reaching out to the right target segment

Along with MicroSave Consulting (MSC), the Centre for Innovation Incubation and Entrepreneurship (CIIE) conducted boot camps, diagnostic sessions, and clinics to help the WLH team to tide-over their business, product, and technology bottlenecks and craft sound business strategies.

While WLH wanted to disrupt the credit market for the unserved and under-served segments, identifying the exact target segment was a challenge. The team needed to understand the MSE segment better, their diverse day-to-day business practices, how they sought credit and how the local financial ecosystem influenced their behavior.

These sessions, coupled with MSC’s research, helped WLH gain a better insight into the current business and credit practices, and the demand for credit among MSEs. The team could also assess a merchant’s familiarity with digital financial services, and identify enablers to promote uptake of digital products. Based on the study, WLH gauged their position in the market and how they could design a customized product to maximize business.

A future for Bharat

WLH is a business-to-business-to-consumer (B2B2C) platform aiming to provide fully configurable and scalable managed services to help the new age lenders, aggregators, independent originators, and other fintechs. It will help these institutions to identify customers who can take small ticket size loans and offer tailored credit products to them. The solutions will be available in the form of “The Bharat Credit Stack” – easy to access, easy on the wallet, and bundled API usage plans that target highly customized credit sanctioning.

WLH aspires to be a preferred “credit gateway of Bharat”, where it can use alternate sources of data to generate a credit history for people like Sujit. This will make him a creditworthy customer in the formal credit market.

Along with strategic product partners – “How India Lives” and “121 Mapping” – WLH has also developed Socio-Economic Profiler (SEP), an industry-first, alternate public data-based system. WLH leverages a bevy of conventional and new-age macro-economic data sources backed by machine learning and advanced analytics to build SEP. The SEP will provide indices and scores at pincode levels to predict delinquency. WLH has already done a successful proof of concept (POC) on the SEP and it is in the final stages of client data validation, slated for a market release shortly.

By developing India’s first alternate data credit bureau by 2020, WLH intends to process approximately 20% of the retail and small business loan volumes in India by 2025.

Follow #TechForAll and #BuildingForBharat to stay updated on fintech start-ups driven to bridge the social, financial and economic inclusion gap.

by

by  Jul 17, 2019

Jul 17, 2019 4 min

4 min

Leave comments