Women’s entrepreneurship: What can be done to improve access to finance?

by Ariane Kouassi and Kate Okoué Assi

Mar 6, 2024

4 min

Africa has the highest rate of women’s entrepreneurship, at 24%, ahead of South-East Asia Pacific and Europe at 11% and 9%, respectively. Moreover, women’s entrepreneurship in Africa contributes to 7% to 9% of its GDP or some 150 to 200 billion dollars. However, women still face many barriers when they attempt to develop their businesses. Access to finance is one of the major issues. What are the possible solutions to this challenge? Read this blog to find out.

Africa has emerged as a melting pot for female entrepreneurship in light of the recent surge in attention to entrepreneurship. The continent has the highest rate of female entrepreneurship, at 24%, ahead of South-East Asia Pacific (11%) and Europe (9%). Moreover, female entrepreneurship in Africa contributes between 7% and 9% of its GDP, or some 150 to 200 billion dollars.

Yet, despite the dynamism that can be attributed to women’s entrepreneurship in context of these rather glowing figures, women face numerous barriers when they attempt to develop their businesses. Access to finance is one of the major issues. What are the possible solutions to this challenge?

Causes of the financing gap

Worldwide, women’s access to finance remains disproportionately low. The situation is far more alarming in Africa, which starts with unequal access to bank accounts.

In Sub-Saharan Africa, only 37% of women possess a bank account, compared to 48% of men, a gap that has been widening for several years. Women frequently have little capital to start their businesses and are less likely to benefit from private investment or venture capital. “I sell clothes to support my family. I wanted to increase my capital to develop my business. Yet the bank denied me a loan, because, according to them, I do not have strong collateral,” said Karidja Bakayoko, a clothing retailer in Daloa City, Côte d’Ivoire.

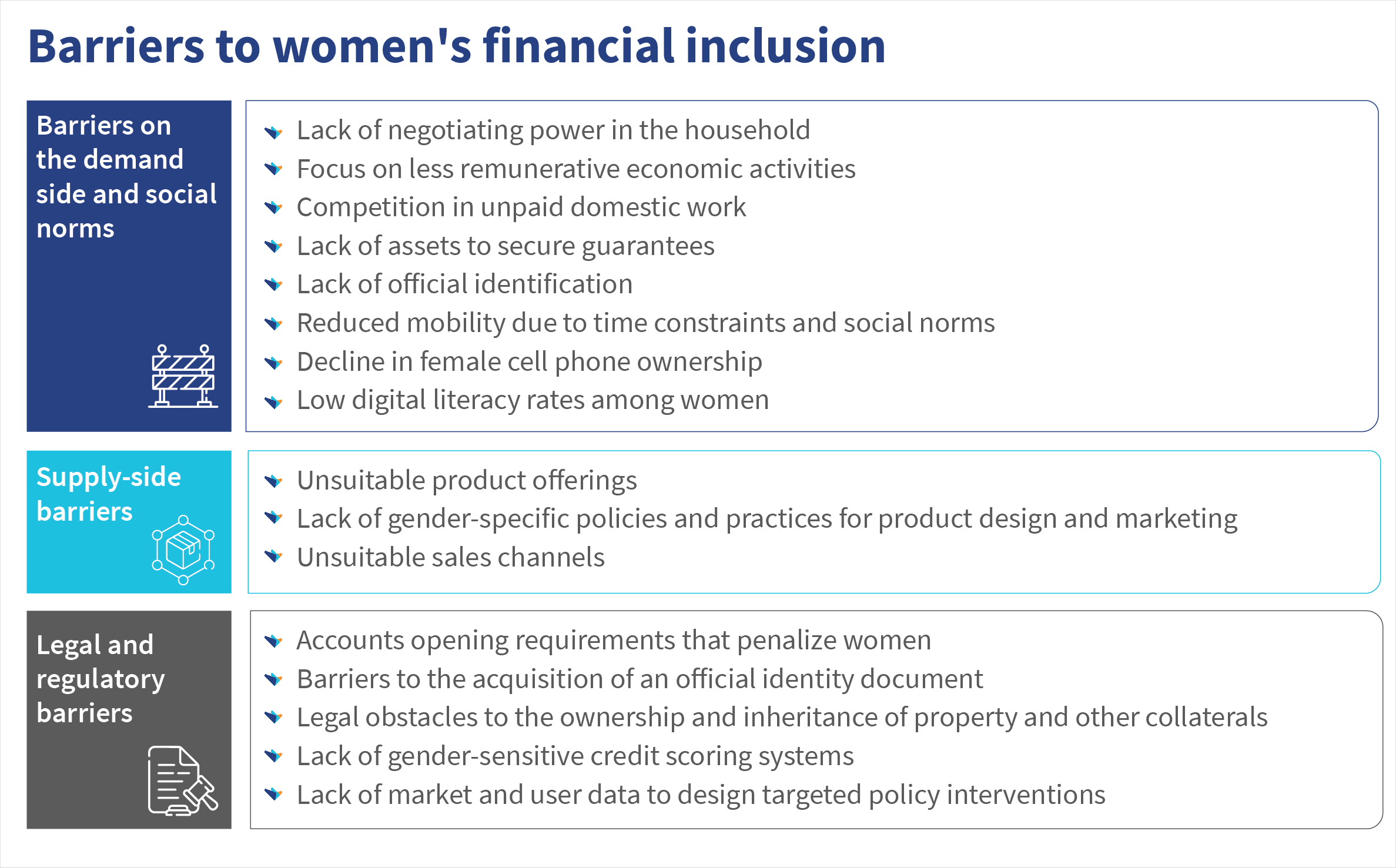

Banks require collaterals that women cannot often provide. Men usually own valuable assets, such as land titles or vehicles, which they can provide as collateral to support some women. Notably, 45% of women in low-income countries have no official identity documents, compared to 30% of men. In addition, women are usually risk-averse, with little financial culture and a fear of failure, which often prevents them from requesting loans. They also have to contend with a lack of family support and a lack of training to develop the skills needed to run a business effectively. Other barriers include personal constraints, such as family projects, spouses’ professional projects, and family responsibilities, alongside women’s poor integration into business networks, and the lack of suitable financial products. In addition, banks’ lack of understanding of women-owned businesses and women’s lack of financial education are barriers to financial inclusion, as shown in the table below.

However, when financing and markets are available, women can contribute significantly to their families’ well-being. They can then mobilize savings to prioritize their children’s education. They also contribute to their country’s economic development by setting up businesses that create jobs and wealth.

Initiatives to boost access to finance for women entrepreneurs

Concrete actions are needed to promote women’s access to finance. Governments should introduce financial inclusion policies and regulations that favor women. To this end, several initiatives have already been developed across Africa, such as the Affirmative Finance Action for Women in Africa (AFAWA) program.AFAWA is an African Development Bank (AfDB) initiative that seeks to bridge the estimated USD 42 billion financing gap that affects women in Africa. The initiative is in early discussions with financial institutions in West Africa. AFAWAis also a USD 12.5 million anchor investor in Alitheia IDF Managers (AIM), the first private equity fund of its kind, led by experienced women fund managers that invests in high-growth SMEs owned and run by women in Africa. In 2018, AFAWA provided technical assistance to several banks. AFAWA trained 1,000 women entrepreneurs across the African continent in business model development and financial planning in collaboration with the Entreprenarium Foundation. The aim is to give them the resources they need to access financing easily.

Investment funds dedicated to women akin to Janngo, a venture capital fund run by women that invests 50% of its revenues in start-ups founded, co-founded or benefiting women, should increase even more. In Côte d’Ivoire, the government set up a fund in 2017 to promote SMEs and women’s entrepreneurship with a budget of 5 billion XAF. This fund seeks to facilitate access to bank credit for women entrepreneurs, including startups, across all business sectors. The initiative will provide a tangible boost to financing for women and help advance financial inclusion.

Financial institutions should not stay aloof from these initiatives. They could consider creating women-friendly banking procedures, such as waivers on minimum balances, reductions in collateral requirements, and inclusion of other forms of collateral that are more accessible to women. In addition, financial institutions would benefit if they develop products and services dedicated entirely to women that take their needs into account. They should consider important aspects, such as product simplicity or reliability, when they design these products and services, which are likely to guarantee their frequent use.

We must, however, note that the design of financial services should be accompanied by financial education programs that will enable women entrepreneurs to develop suitable financial skills and behaviors. In short, the goal is to improve women’s understanding of financial services while raising their awareness of the risks involved so that they can make autonomous and responsible financial decisions. It is with this in mind that the Digital Finance Hub has been created to offer everyone the tools they need to develop their business.

Worryingly, a customer base in excess of 1 billion women remain disconnected from financial services and predominantly underserved. To change this situation, FSPs must study women’s customer journeys and use this knowledge to design tailored financial product offerings. The dual benefit will be to transform women’s lives and offer commercial value to financial institutions. Financial institutions would be able to create new products and reach out to women, who are usually not funded. With a tailored offering, the financial institutions can grow their clientele—and their income.

by

by  Mar 6, 2024

Mar 6, 2024 4 min

4 min

Leave comments