Will QRIS help deliver the promises of digitization to small and micro-merchants in Indonesia?

by Sneha Sampath, Ira Aprilianti and Raunak Kapoor

Jul 26, 2022

4 min

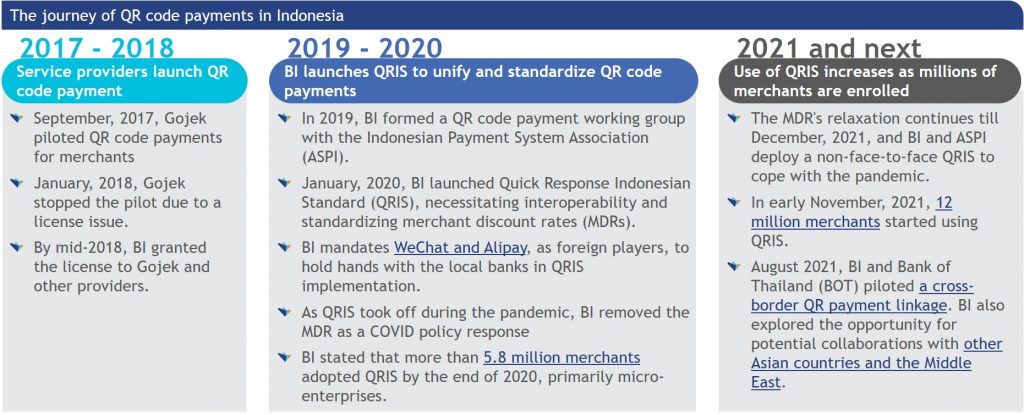

Quick Response Code Indonesian Standard (QRIS) is the first experience using a digital financial service (DFS) for many micro-merchants in Indonesia. The blog explores what other DFS and nonfinancial services would benefit these merchants just beginning their digitization journey.

Putri is one of the 15 million micro-entrepreneurs in Indonesia who now has affordable access to digital payments. For many micro-merchants like Putri, who earn less than IDR 300,000,000 each year, using QRIS is their first experience using digital financial services. Earlier, offering digital payment options to customers was expensive and time-consuming for micro-merchants. Merchants had to buy expensive point-of-sale (PoS) devices, which took more than two weeks. Now, service providers can onboard merchants and provide them with the option to use QRIS on their merchant applications faster and at nearly no cost.

In a country where ~88% of the MSMEs still prefer cash as the primary mode of payment, the growth of QRIS has been impressive. In 2021, Indonesia recorded around 12 million QRIS transactions worth IDR 27.7 million (USD 1,840), showing a growth of 237% from the previous year. However, despite such growth, some challenges restrict the uptake and usage of QRIS.

We highlighted these challenges in our earlier blog, and validated them using insights from our most recent study to assess the implementation and usage of QRIS among micro and small merchants. The only other major challenge quoted by some merchants in using QRIS as a payment method was the limit on the transferable amount and wallet balance. However, as of 1 March, 2022, the regulation has changed, and Bank Indonesia increased the limit from IDR 5 million (USD 330) to IDR 10 million (USD 660), and then further to IDR 20 million (USD 1,320). This new limit is a reasonable amount, even for some of the larger merchants.

The evolution of QRIS and where it should head

While QRIS has evolved majorly, the focus now must shift to optimizing the usage of the platform and provide value-added services to the merchants.

As QRIS has forged a path into digitalization for many merchants, service providers and the government can use it to deliver better services and relevant support. Service providers have a unique opportunity to onboard merchants and help them gradually enhance the digitalization and resilience of their businesses. Merchants who start their digital financial journey with QRIS are ideal for upselling and cross-selling other products offered by the service providers.

Using QRIS and digital transactions to access more products

Service providers now have a record of digital transactions conducted by merchants. Based on these transactions and other socioeconomic details, providers can use alternative credit rating mechanisms to offer credit to merchants who previously lacked the required information to avail of credit traditionally. Uni offers pay later credit cards to the masses in India, specifically targeting applicants without a credit history. Uni determines the creditworthiness of applicants based on alternate credit rating techniques and its proprietary underwriting tech.

Building merchant resilience through other business development applications

Besides offering products based on QRIS and digital transaction history, service providers have the opportunity to upsell other useful products. Business management tools can help merchants keep track of their business based on transaction trends. Providers can offer such tools as an additional feature or an upgrade to the merchants. Basic analytics can be used for stock management by determining trends in sales to help growing businesses make more informed decisions. GoBiz is a super app that provides several business management tools and integrates payment and credit options for merchants.

Supporting business growth with other relevant financial products and services

Providers can tailor other products like savings and investments to merchant requirements based on their business stage and growth prospects. GoPay, a mobile wallet, has an option for its users to save with Bank Jago and invest through the app. Products developed specifically for merchants could build their business resilience and create a strong relationship with service providers who can benefit from these opportunities to cross-sell.

Onward and upward

For MSMEs to reap the benefits of being truly digitally included, stakeholders need to take collaborative action. Complete digital inclusion of MSMEs in the digital ecosystem will ensure benefits for MSMEs and profits to service providers. Regulatory oversight is required to keep fraud and data privacy issues in check so that new digital merchants are included responsibly.

Like many other micro-merchants, Putri would benefit from a small short-term loan to buy her raw materials or equipment. Micro-merchants like her would also appreciate a savings product that offers easy liquidity to tide over the weeks sales are low. Technologies like QRIS offer a great start to build merchant capabilities and support them in their digital journey. Using QRIS will develop the right skills and confidence among merchants and access to useful digital products and services will help them thrive in the digital era.

by

by  Jul 26, 2022

Jul 26, 2022 4 min

4 min

Leave comments