Where are the women in the digital credit bandwagon? Lessons from Kenya

by Rahul Chatterjee, Karthick Morchan and Anup Singh

Sep 23, 2019

5 min

This blog sheds light on how women are placed in the digital credit bandwagon in Kenya . Along with highlighting three key insights, the blog also establishes the business case for focusing on women as an important customer segment.

Seven years since the launch of digital credit in Kenya, women are still disproportionately under-represented among borrowers. Yet they offer immense potential—for providers with the right focus. Just as in many developing markets, the economic participation of women in Kenya is largely concentrated in the informal sector, where women participate in small businesses, farm on small landholdings, and work as laborers, among other professions. The digital avatar of credit is particularly well suited for this segment, as it can address some of the biggest challenges that women entrepreneurs face.

Access to credit is an important tool since economically empowered women are better equipped to achieve their goals. They are able to provide for their families, contribute to society, and advance their own rights. The instant, uncollateralized, and relatively hassle-free nature of availing digital credit makes it an effective tool for women to manage or smooth over emergencies related to income. It has the potential to play a direct role to advance Women’s Economic Empowerment (WEE) and further the Sustainable Development Goal 5 (SDG 5) of gender equality.

We are excited by the significant opportunity that digital credit offers in the current age, which is characterized by a rapid increase in access to mobile phones. At present, Kenyan women comprise just 37% of the digital credit user base, which amounts to a gender gap of 26%1. The participation of women in the digital credit market is even lower when we consider loan volumes—women borrow only 31% of the total value of digital credit loans1. This presents a significant opportunity for players in the digital credit ecosystem to expand their customer base. Yet gender inclusivity is one area that needs more work.

MSC’s recent study2 on “How to make digital credit truly responsible and transformative” highlights three key insights to make digital credit in Kenya more gender-inclusive.

1. Evidence suggests that women are more reliable and loyal borrowers and hence form a strong business case for providers to employ a gender lens.

Our research reveals two interesting behavioural traits of women borrowers:

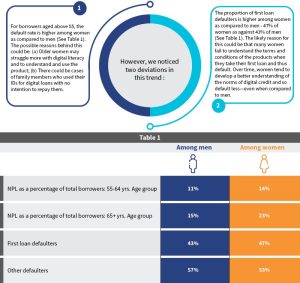

Figure 1

a) On average, women are less likely to be negatively listed as compared to men (See Figure 1). Women are more anxious about defaults and their consequences. They are also generally more risk-averse in nature. These reasons probably drive them to be extra cautious to repay on time.

b) They are more loyal to a specific brand and prefer to stick to one provider instead of experimenting with different ones3.

Men are more experimental and tend to use a number of digital credit providers while women stick to preferred providers. This indicates a need to tap into this tendency to be loyal to ensure a prolonged business relationship. Among those with multiple digital loans, 41% of women borrowers stick to the same provider, as compared to 26% of men.

The unmet market potential of women, their lower rates of default, and greater loyalty establish a strong business case for providers to onboard more female customers. Variation in reasons for taking digital loans among women indicates the heterogeneity in the segment. Providers have an important opportunity to recognize this heterogeneity of women as a segment and build a strategy focused on them. This strategy may include the design of segment-specific products and intuitive women-friendly digital interfaces along with gender-centric communication, among others. Providers that already operate on a large scale have a great opportunity to offer differentiated services for women.

Niche players who are committed to this goal also deserve greater support from the investors and regulators.

2. The organization of cost-effective digital communication campaigns with a human face is the key to attract more women customers

The study on “Digital Credit in Kenya: Evidence from demand-side surveys” indicates that women are 35% more likely to cite fear as a reason to not borrow compared to men. Periodic digital communication campaigns enable women to become better informed and may help overcome this fear. On-the-ground communication campaigns through influencers and opinion leaders are important to develop a loyal base of women customers who prefer, choose, and use digital credit.

Women are generally more cautious to adopt technology. Social proof is a key determinant of how low-income women adopt and use digital credit. Hence, incentives that align with peer recommendations can be an effective way for providers to reward women who help enroll other women.

3. A robust grievance resolution system with a human touch will help providers serve their women clients better

The current grievance resolution mechanisms (GRM) rely largely on the use of SMS, call-centers, and emails. These mechanisms are “low-touch4” in nature and mostly unused by the customers. Our research indicates the need for various levels of “touch” depending on the customer segment. Women customers who fear digital loans and are extra cautious prefer high-touch communication channels, particularly when they try out a new product or seek to resolve their grievances. Adding a proactive human face to the GRM to provide quick, hands-on solutions for issues faced by customers is essential to gain their trust and serve them better.

Studies have established the importance of digital credit to help households meet their expenses. However, due to negative shocks, the difference in its impact based on gender is not clearly established. While we lack hard data, the presence of anecdotal evidence is sufficient to get us started on further exploration and research. The business case is evident and providers should not hesitate, as the early movers will likely reap significant benefits.

Our report based on our study of the digital credit landscape in Kenya (2019), discusses the changes in the digital credit landscape. It highlights the core challenges, emerging concerns and also goes further to formulate recommendations for both regulators and suppliers to make the delivery of digital credit more responsible and customer-centric. Read it here.

[1] MSC analytics

[2] Supported by SPTF and Accion Smart Campaign

*Estimated based on population, target age group, mobile phone availability, number of digital loans per year and an average value of each loan

[3] MSC demand-side research and analytics

[4] Lower level of human involvement in the GRM process from the provider’s side

by

by  Sep 23, 2019

Sep 23, 2019 5 min

5 min

Leave comments