What holds back microfinance institutions from adopting the DEPA framework?

by Sunil Bhat, Manali Jain and Vishes Jena

Jun 13, 2022

6 min

This blog discusses the Account Aggregator (AA) framework, a consent-based system under the IndiaStack that enables data sharing across financial institutions. Here we look at the framework from the perspective of financial inclusion and discuss how microfinance institutions, which cater largely to low and middle-income (LMI) customers, may struggle to adopt AA at this stage.

Electricity is one of humanity’s greatest inventions. It all started back in 1752 when Benjamin Franklin demonstrated that lightning was electrical with his famous kite experiment. Yet from the time the first American home got electricity in 1882 to when virtually all homes in America had connected to the grid in 1960, people could not fathom how electricity would revolutionize their lives in the 20th and 21st centuries. The Indian digital ecosystem stands at the brink of a similar— albeit faster—revolution.

In 2017, the Reserve Bank of India came up with the innovative idea of “non-banking financial company (NBFC)—account aggregators (AA)” that would aggregate the financial data of individuals. Much of this critical data lies in silos managed by different players across the industry. An AA provides information on various accounts held by a customer across multiple banking and financial entities. These AAs were conceptualized to consolidate, organize, and retrieve data on various types of financial engagements by a customer across different financial instruments like insurance, mutual funds, GST data, and bank account transactions.

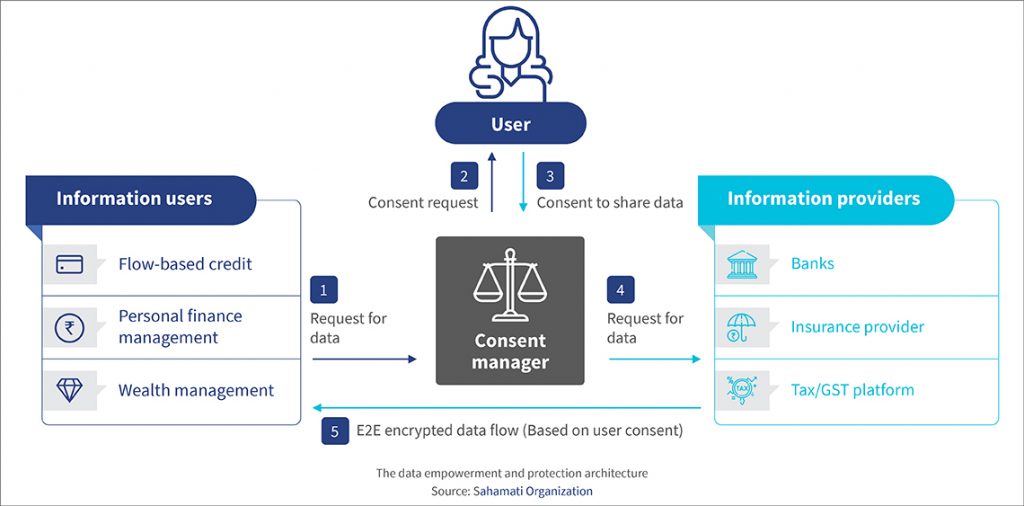

In 2020, the NITI Aayog released the Data Empowerment and Protection Architecture (DEPA) to empower every Indian with control over their financial data, democratize access to data, and enable the portability of trusted data between service providers. Simply put, the DEPA framework offers the user more control over how they share their data with regulated financial entities to access financial services, such as credit, insurance, and wealth management. DEPA also allows financial services providers to better understand the customer’s financial habits and offer them customized financial products.

The role of the consent manager or AA in the DEPA

Source: NITI Aayog

Two years ago, only a handful of large banks participated in this framework. Today, this ecosystem has more than 100 bank and NBFC participants. While the idea was seeded back in 2016, it was slow to gain traction. Yet once the AA framework formally went “live” in September 2021, it has been “full-steam-ahead.”

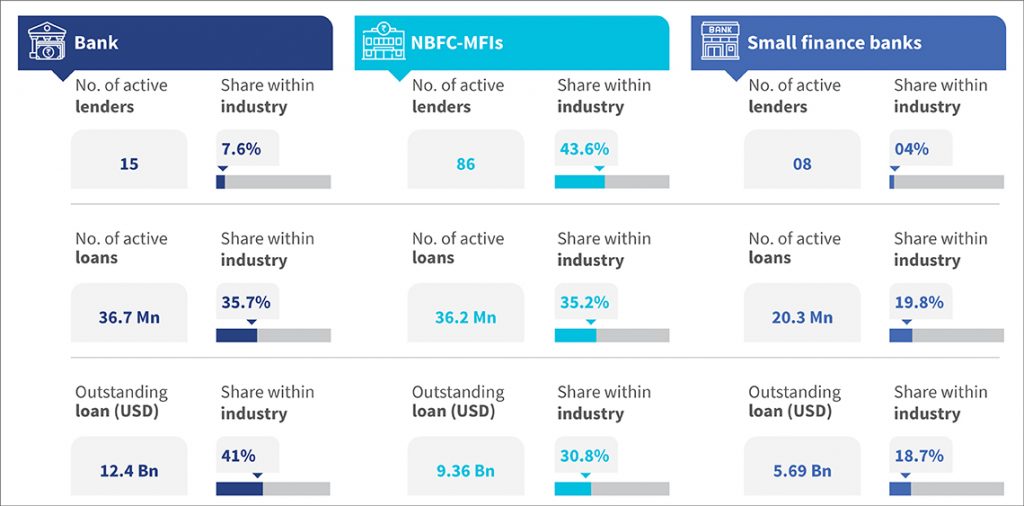

DEPA is expected to democratize data and improve individuals’ access to financial services. However, lending institutions like NBFC-microfinance institutions (MFIs) and some small finance banks with MFI-based models currently hesitate to join this framework for several reasons, mentioned later. These institutions play a critical role in driving financial inclusion and providing credit to 100+ million low- and middle-income (LMI) customers. India’s microfinance gross loan portfolio has grown at 18% CAGR in the past five years, up to June, 2021. Of the total Indian microfinance portfolio of USD 30.3 billion, NBFC-MFIs and SFBs hold a share of 49.5%, with their borrower outreach in very poor households being more than 11.6 million, as of June, 2021.

Microfinance lending portfolio as of June, 2021

Source: Reserve Bank of India

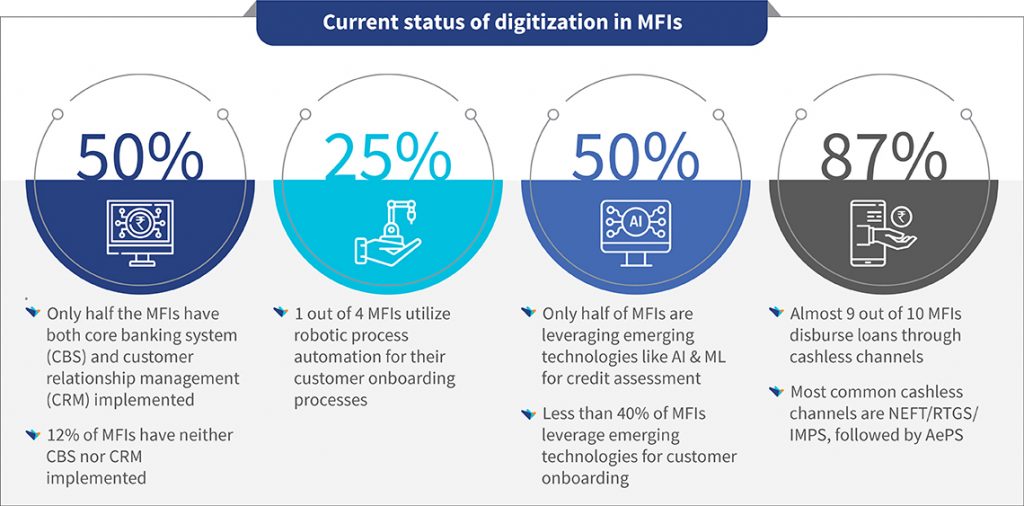

MFIs have a highly touch-based model, which results in a high cost of delivery and limited scalability. FinTechs that offer digital credit while promising efficiency, lower costs, and easier access have started to compete in this space. The emergence of new players poses the “need for digitization” of the microfinance-based model. As per a KPMG study, the figure below highlights the state of digitization of MFIs in India.

Survey findings from the KPMG study

Source: KPMG

Many MFIs in India are swiftly adopting different types of technologies. These include cashless disbursements, credit underwriting using alternate data points, psychometric evaluations, and geo-tagging of customers, among others. DEPA will likely boost this tech adoption by the sheer amount of data it would provide for customer analysis. In the process, it will strengthen MFIs’ decision-making abilities.

However, these institutions may need more time to benefit from this framework.

Operational factors

Legacy system

All MFIs follow the group-based lending model to assess their clients’ creditworthiness. About 85% of their assets are group loans. This system focuses on the customer’s repayment history in previous loan cycles and their engagement tenure. It does not depend on data points as much, since MFIs do not do a cash flow analysis to assess creditworthiness. Most MFIs optimize operational costs through regimental process engineering. Hence, many MFIs would also see that bringing in more data from external sources is unnecessary.

Mono-product institutions

Microfinance works mainly on a single product—the group loan—which has not changed much for many years unlike other products for the non-LMI segment. The only changes in the interest rate and loan size are primarily due to the RBI’s regulatory guidelines. Unlike other financial services providers (FSPs), MFIs do not use data to customize or change their product offerings. Consequently, they do not offer a case here for DEPA.

Status quo and looking for a proof of concept

The existing system has been working well for years. So no MFI wants to tinker with it. Also, small MFIs wait for large MFIs or other players like banks to show the way.

All MFIs are not regulated uniformly

Not all MFIs in India are regulated by the Reserve Bank of India (the central bank). Many small MFIs are classified as societies under the Societies Registration Act, as trusts under the Indian Trusts Act, and as not-for-profit companies under Section 25 of the Companies Act. Due to their size and regulation, these small MFIs are not keen on any innovation that puts their operations at any risk (even perceived). These non-profit MFIs are content with the status quo since they face more organizational resistance to adopting the AA framework.

Technological factors

Limited tech ability

Smaller MFIs have limited skills around technology, such as using cloud services and application programming interfaces (APIs), due to costs involved or staff capacity. This limits their inclination and indeed their capability to adopt the DEPA framework as a financial information user (FIU) or financial information provider (FIP) and develop modules with relevant customer data. Handholding remains limited, which makes such initiatives a daunting task.

Business-level factors

High costs of implementation and limited resources to employ

Implementing the AA framework, including the AA’s fees and the API charges for fetching customer data, is expensive and consequently increases the cost of lending. MFIs would be cautious in tightly contested markets and conduct a cost-benefit analysis before signing up for the new system. Some players also feel that the costs are too steep at the moment. Perhaps MFIs are waiting for costs to reduce as the DEPA system matures.

End-customer-level factors

Customer segments with limited phone ownership and low or no digital footprint

The use of the DEPA platform depends on smartphones. The AA framework requires customers to download the AA’s app on their smartphone and provide consent to share their data. The GSMA Mobile Gender Gap report 2021 shows that just 67% of women in India own a mobile phone, while only 25% own a smartphone. The NFHS survey for 2019-21 indicates just 54% of women own a mobile phone. Even though smartphone ownership is increasing, low smartphone penetration hurts DEPA’s adoption. Hence, MFIs may struggle to access meaningful data, except perhaps for their smartphone-using clientele.

Limited financial literacy

The digital and financial literacy of LMI users is limited. They struggle to navigate the app, add bank data, understand the requirement for consent, and provide consent to sharing the required data points. Most LMI customers need help with these activities.

Poor agent network and cash-based business

Most group loan customers are engaged in businesses that accept and pay in cash. Hence, they would need a vibrant agent network to digitize this cash. Currently, finding liquid agents in rural areas continues to be a challenge.

The combination of the factors above limits the adoption of this consent framework by MFIs. Could MFIs be supported in getting on board the DEPA and benefit from India Stack’s consent layer? Can FinTech firms play a role? Read our next blog that discusses how FinTechs as technical service providers (TSPs) can help such institutions adopt the AA framework.

by

by  Jun 13, 2022

Jun 13, 2022 6 min

6 min

Leave comments