Volatility and resilience: Lessons from the corner shop diaries research in Nigeria

by Rahul Chatterjee, Anne Marie van Swinderen and Mhlalisi Ncube

by Rahul Chatterjee, Anne Marie van Swinderen and Mhlalisi Ncube Feb 26, 2021

Feb 26, 2021 6 min

6 min

This blog provides three key insights into the financial lives of small corner shop owners in Nigeria. It also offers a glimpse into the strategies they adopted to survive the COVID-19 pandemic.

Adaeze Degreat, a middle-aged mother of two, works in a local teaching hospital in Southern Nigeria and runs a supermarket that sells groceries and daily provisions. A steady income from her salary and a variable income from her shop keeps Adaeze’s household finances mostly manageable. That is, until COVID-19 hit Nigeria. The disease was first reported in the country on 27th February, 2020. By April, several states in the country were under a complete lockdown, barring essential service providers, such as medical facilities and grocery shops.

The virus struck communities and upended people’s lives in an unprecedented way, affecting their economy in particular. Different states implemented lockdowns during March-June, 2020. The baseline data of the National Longitudinal Phone Survey, which was collected in April-May, 2020, indicates that 35-59% of the households that needed staple food could not purchase it, 26% of the households could not access medical treatment, and the income of 79% households decreased.

As highlighted in this report by FATE Foundation, the pandemic had a severe impact on MSMEs. 94% of MSMEs reported being negatively impacted by the pandemic—particularly in the areas of cash flow (72%), sales (68%), and revenue (59%). However, corner shops, which are small neighborhood shops that sell daily need items were allowed to operate during the lockdowns and they served as the sole lifeline for local people.

L-IFT had been running a Financial Diaries research exercise in Nigeria since 2019. In that sample, we identified five corner shops and later included a sixth shop in April, 2020 for the global Corner Shop Diaries research. All these corner shops are located in the Edo State in Southern Nigeria. By the end of March, Edo State had started lockdown measures by limiting public gatherings to 20 people. By mid-April, a full lockdown was in effect, backed by containment strategies, such as closures of all interstate borders.

Using the daily financial transaction data from the diaries, our blog provides key insights about the financial life of corner shops and the impact of COVID-19 on them.

- The COVID-19 pandemic had a severe impact on the income of corner shops, which was already volatile

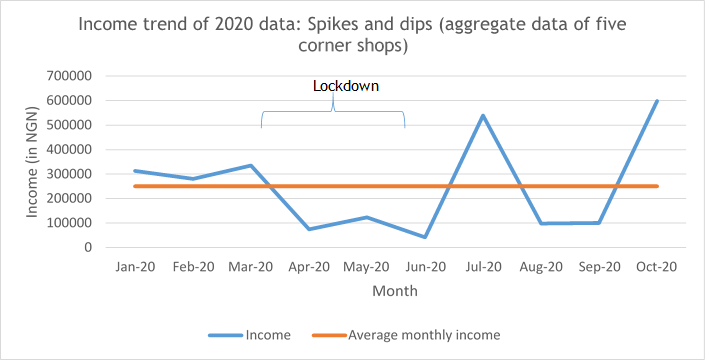

The five corner shops in our pre-COVID sample vary in terms of the businesses they operate but all display similar volatility in income. Three corner shops sell groceries and daily provisions, one is a crayfish business, and one is a digital services shop. Examining the trends in the income of these shops in 2020 (Graph 1) highlights the volatility.

For five out of the 10 months, the combined monthly income for the five corner shops was more than 25% below their overall average monthly income—we can call these dips. The monthly income for three months was 25% more than the average monthly income—we can call these spikes.

We also see how external factors, as well as business-specific nuances, can affect income. The crayfish business, which started in January, 2020 has been very profitable and has seen big cash flows in regular intervals. The spike in July is mostly due to one such big cash flow. The second spike in October a result of panic buying by people as they feared a shortage of items caused by the END SARS people’s protest.

Graph 1

Graph 1

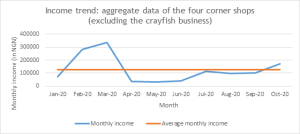

If we zoom in on the data from March to June in the early months of the pandemic, the impact of the lockdowns is prominent. As we can see in Graph 1, during the lockdowns, that is, April-June 2020, the income of the corner shops was at its lowest point. The crayfish business, which performed well during some stages of the lockdown, created the combined income spike in July 2020. Graph 2 highlights that the other businesses did not reach their pre-COVID level yet and even the panic buying during the END SARS protests in October did little to help them.

Graph 2

- Depending on additional income sources, rationalizing expenses, and withdrawing savings were key survival strategies for corner shops during the pandemic

The COVID-19 pandemic emphasized the importance of multiple sources of income for a household. We saw that our respondents either picked up additional sources of income or started to depend more on their secondary sources of income. One of the respondents, who holds a salaried job, happened to have started the lucrative crayfish business just before the pandemic in January, 2020. She is the highest earner in terms of overall income among the corner shop diarists.

The respondent started this business after realizing her fixed employment was no longer enough to survive. This proved lucky for her. During the lockdown, which limited operating times at her workplace, shifts were implemented. Meanwhile, her salary began to diminish. She also offered crayfish deliveries during the lockdown, since she owns a car. Through this venture, she could reach more customers quickly and provide a convenient solution for them, who stayed at home to avoid COVID-19. The income from this crayfish business helped her to manage her finances at the peak of the pandemic.

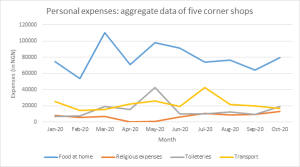

Graph 3

The expenses of the corner shop owners (Graph 3) helps us understand some of the coping strategies they adopted and how their expenses changed during the pandemic. We can see an increase in expenses on food in March, which can be attributed to pre-lockdown panic buying of essentials. We then see a drop in April, when the lockdown was in full swing, and then a rise in May as lockdowns eased up. This gradually came back to the pre-COVID levels by September-October.

Understandably, we see a drop in religious expenses in April – May. This was the time during or just after the lockdowns and mosques and churches were closed. Although the lockdown eased slightly from May, the post-lockdown era came with its own new set of regulations with bans on religious and social gatherings still in place. However, around October, religious expenses seemed to have exceeded pre-COVID-19 levels.

Owing to the lockdowns, when nobody was permitted to travel, transport costs dipped during March. The month of May saw the gradual easing of lockdown restrictions, which allowed people to move and work again. Hence, we see a sharp increase in transport costs followed by a gradual stabilization and then further increases with further easing of the lockdown.

The cost of toiletries rose just after the lockdown (see the spike in May) as personal hygiene measures were a priority for most. Since toiletries, such as soaps and sanitizer were important for COVID-19 prevention and care, some shops bought and hoarded them in anticipation of their demand. However, during the June to August period, we see toiletry expenses dropping as a result of lower demand and an expectation for them to return to pre-COVID-19 levels.

The pandemic also forced the diarists to withdraw significantly from their savings. Data from the five corner shops—excluding the one that joined in April, 2020— indicates that the total savings withdrawn by respondents increased significantly between April-October, 2020 compared to August 2019-February 2020. The respondents reported that they withdrew NGN 354,000 or USD 928 in April-October, which is 66% more than their withdrawals in August 2019-February 2020. The crayfish business and a supermarket contributed the most in this owing to the increase in demand and the subsequent need to restock.

- The savings patterns of corner shop owners correlate with their income

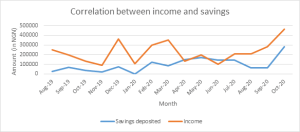

Graph 4

Graph 4

We observed that income and savings are correlated (correlation coefficient=0.5). Graph 4, makes it evident that the pattern of people making savings deposits mostly mirrors their income patterns. The only exception is in March, 2020, the month when lockdown started. This dip in March is likely due to the limited amounts that could be saved during the start of the lockdowns as businesses and their individual households needed more funds to stock up adequately for the COVID-19 period. During this time of uncertainty, people may have also preferred to keep their money in cash, ready for use, instead of saving the money.

Closing remarks

The findings highlight the reality of income volatility and celebrate the resilience of micro-businesses and LMI segments. Many observers expect the business of corner shops to remain unharmed as they were allowed to operate during lockdowns. Yet this is clearly not the case. They faced significant drops in income and have only gradually started to recover. We also see how multiple sources of income are extremely helpful during times like the pandemic. Adaze, who we met at the beginning of this blog, received substantially less income from her salaried job and her business also suffered due to reduced customer footfall. However, she and her business, along with many others like her in Nigeria survived in the long run and have been gradually recovering from the shock. And we can credit a nuanced research approach like the Diaries method to have uncovered a better understanding of the path toward recovery.

Leave comments