Unlocking access to formal credit for farmer producer companies (FPCs): Lessons from JEEViKA’s work in Bihar

by TVS Ravi Kumar, Rajnish Kumar, Pradeep Mishra and Jay Kishor Bharti

Apr 23, 2024

5 min

Access to credit for Farmer Producer Companies (FPCs) remains muted due to hesitancy by commercial banks to lend to them. Limited access to formal credit inhibits their potential growth. Despite the poor credit flow, the potential is huge. This demand-supply gap can be addressed by educating credit institutions about FPCs and working closely with them to address their concerns.

Credit is an important driver that fuels the growth of business enterprises. MSC’s diagnostic study of FPCs in Bihar also highlights access to capital as a vital factor that sustains FPCs. FPCs raise capital in two ways—equity raised through members and external debt. Smallholder farmers are the majority shareholders of FPCs, so their equity contribution is typically low. Moreover, poor capitalization of FPCs in India compels them to seek debt to fuel their expansion. However, FPCs struggle to access credit, which also hinders their growth. In Bihar, only 11% of FPCs applied for institutional credit from banks or non-banking financial companies (NBFCs), and only 9% received approval for their credit applications.

FPCs have huge potential despite the poor credit flow. The estimated size of this segment is around INR 6 billion (USD 72 million) and is projected to grow rapidly, given the thrust from the central government and many state governments. Various institutions, banks, and NBFCs provide credit to FPCs. However, FPCs receive most of the credit from three to four NBFCs only.

JEEViKA-promoted FPCs were also in a similar bind. They could not expand their business due to the lack of affordable working capital. The JEEViKA state team identified this challenge and undertook a focused effort with MSC’s technical support. This effort sought to address the lack of access to formal finance for operations. We undertook various activities over 12 months. This led to a substantial push on credit provision for FPCs, and eight JEEViKA-promoted FPCs raised INR 55.4 million (~USD 600,000) in debt from three commercial banks and two NBFCs. The loans included a mix of warehouse receipt finance, cash credit loans for working capital, and term loans to set up a processing unit.

This blog shares the lessons and approaches that JEEViKA took to overcome the barriers FPCs face when they access credit.

Why do commercial banks hesitate to lend to FPCs?

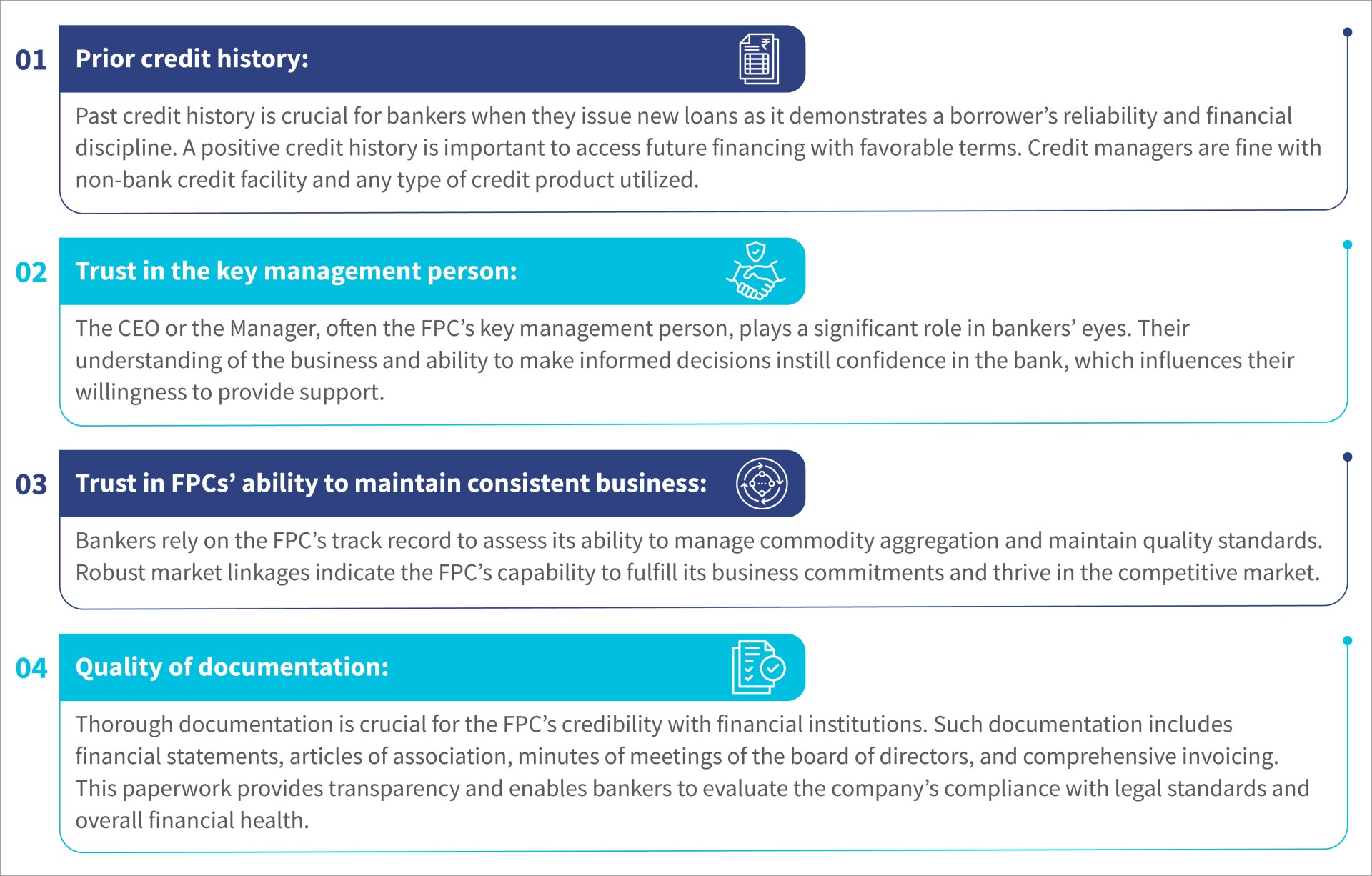

Banks typically assess creditworthiness based on factors, such as business plans, audited financial statements, and mobilized share capital. As a result, FPCs focus much of their technical advice and capacity-building initiatives on these aspects to get credit from banks. However, our experience shows that these factors are critical but not sufficient on their own. One of the reason is a majority of the FPCs formed in India are in their nascent stage and as a result the financial statements look weak. Local branch managers and regional credit appraisal teams are accountable for loan sanctions and repayments and often make the banks’ credit decisions. FPCs must ensure they are comfortable signing the loan agreement. Following are some additional factors that affect banks’ credit decisions:

What approaches did JEEViKA-promoted FPCs take to access commercial finance?

With the above insights, the JEEViKA team took the following strategies to ease barriers and enable the FPCs to access commercial bank credit:

1. Used warehouse receipt financing as an entry point: Financing against stored produce represents the most practical means for an FPC to obtain institutional credit. FPCs typically lack assets to offer as collateral as most are new and small, have limited business transactions, and lack credit history. Additionally, their board of directors and promoters often have limited net worth.

Our experience indicates that warehouse receipt financing (WRF) and invoice discounting are effective products that can help FPCs establish credit relations with formal institutions. Warehouse receipt financing is provided against produce stored in accredited warehouses, which makes it particularly beneficial for FPCs that need temporary storage.

Three JEEViKA-promoted FPCs initiated formal mainstream finance through loans against warehouse receipts worth INR 10 million (~USD 125,000) , INR 15 million (~USD 188,000), and INR 10 million (~USD 125,000) to store 2,193 MT of maize, 250 MT of lentils, and 500 MT of maize and wheat, respectively. After they sold their produce, they repaid the loan amount in full and repeated this cycle in the following season. This process helped the FPCs show the reliability of their business operations and establish creditworthiness. After two cycels of WRF, all three of them eventually got access to cash credit facilitity of commercial banks to finance their working capital needs.

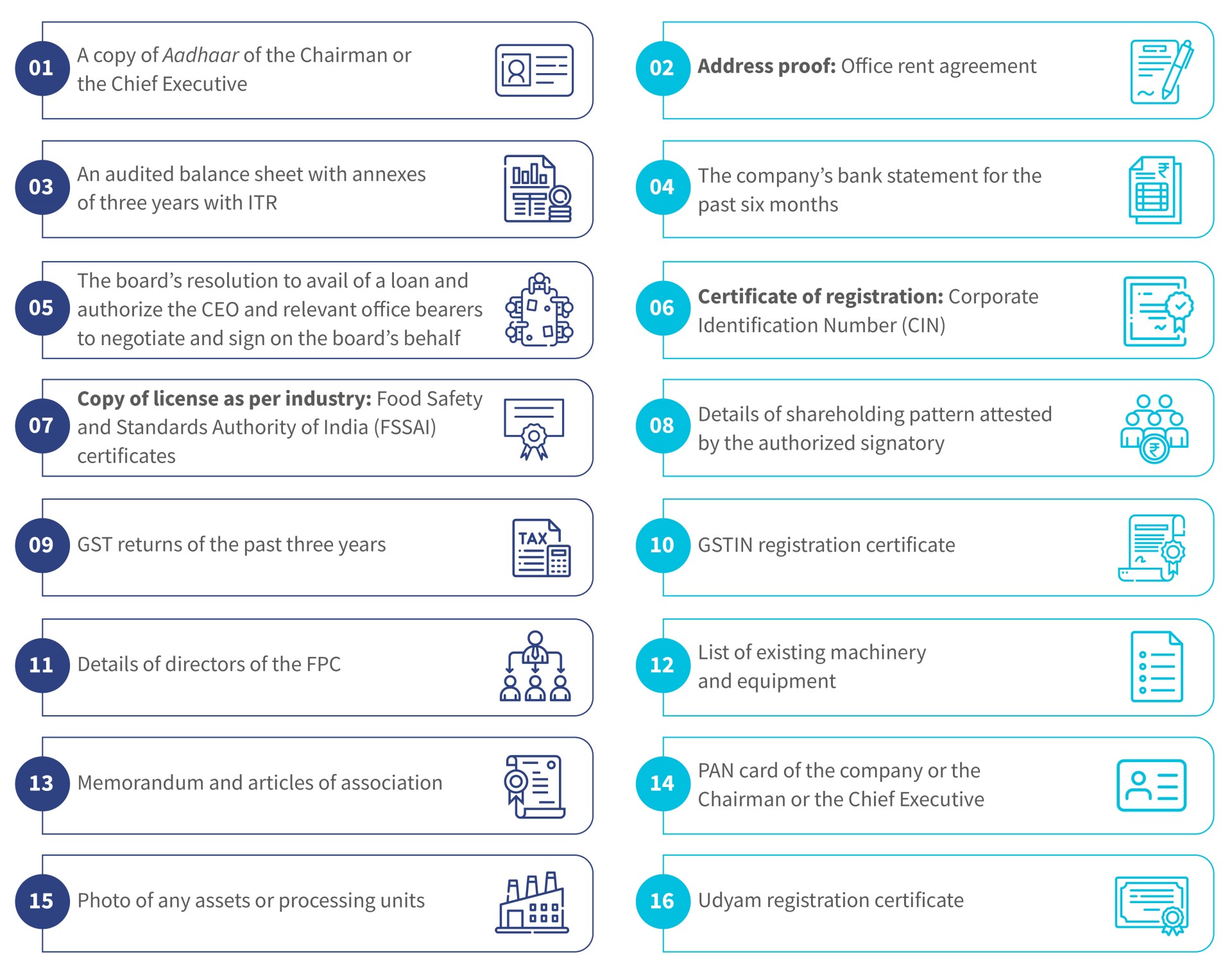

2. Kept documents ready: JEEViKA identified the documents needed for working capital and term loans and ensured that the FPCs kept these updated. Any additional requests for documentation were tracked centrally, and FPCs ensured to respond on time. Timely response to queries also adds to the FPC’s professionalism and builds the confidence of the bank credit staff. Table 1 shows that the bank asked for around 16 documents for a working capital loan.

Table 1: List of documents required by a commercial bank for a cash credit loan to an FPC

3. Engaged with bankers to educate them on the business status: Under the guidance of the state office, JEEViKA-promoted FPCs actively engaged with their bankers and provided detailed insights into their business, which included sales turnover, margins, market partnerships, and growth potential. CEOs received soft skills training to enhance their confidence and communication abilities. This proactive approach built trust and showcased the CEOs’ competency to bank branches and credit managers. Additionally, JEEViKA discovered that local branch managers were unfamiliar with lending rules for FPCs. This feedback prompted JEEViKA to relay the information to commercial banks’ regional offices to ensure the dissemination of suitable lending guidelines to branch teams.

4. Used central programs, such as PMFME and AIF, for term loans: Central programs, such as the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) and the Agriculture Infrastructure Fund (AIF), can help FPCs secure term loans. Under pressure to show progress in these government-backed initiatives, banks are more inclined to extend credit to entities that align with the programs’ objectives. FPCs can proactively ensure that their business models and documentation meet the eligibility criteria to tap into these programs effectively. Two JEEViKA promoted FPCs secured term loans of a combined USD 175,000 for setting up of a wheat flour and mustard oil processing units under the PMFME scheme by developing robust business plans. Their applications for subsidy were approved by the Department of Industries, Government of Bihar and this in turn convinced the banks to process their term loan applications.

Access to credit is a critical missing piece for FPCs to scale up their services. Operational, financial, and business sustainability are critical to ensure bank linkage for early-stage FPCs. However, FPCs can also adopt softer approaches to overcome the barriers to access to formal finance. These approaches include the demonstration of the key management person’s competency and business competency, the development of credit relationships with non-banks, sound partnerships for market linkages, and the use of government programs.

Written by

TVS Ravi Kumar

Associate Partner

Rajnish Kumar

Senior Manager

Pradeep Mishra

Programme Director, JSPVAT

by

by  Apr 23, 2024

Apr 23, 2024 5 min

5 min

Leave comments