The status of agents in Kenya: Proliferation, dominance, evolution & impact

by Evelyne Matibe and Mike McCaffrey

Jun 20, 2014

5 min

This blog delves deep to focus on four key themes that emerged from the Agent Network Accelerator Survey: Kenya Country Report 2013, namely, the proliferation of agents in the country, the effect of Safaricom’s dominance, how the network of agents is evolving, and the indicators for the impact it is having on financial inclusion.

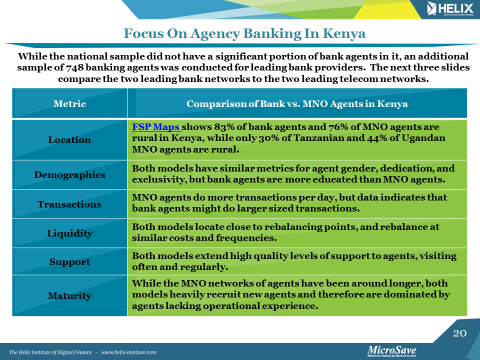

The Helix Institute of Digital Finance released its third Agent Network Accelerator (ANA) country report on 19th June 2014, in a launch event conducted in partnership with FSDK and InterMedia. The research presented was based on a nationally representative sample of 2,113 interviews with agents that were conducted across Kenya in September/October 2013, as well as 748 additional interviews with banking agents. The presentation noted that agents in Kenya were very busy, conducting a median of 46 transactions per day for each provider, which is 48% more than the 31 transactions per day found in Tanzania. The presentation went further to focus on four key themes that emerged from the Agent Network Accelerator Survey: Kenya Country Report 2013, namely, the proliferation of agents in the country, the effect of Safaricom’s dominance, how the network of agents is evolving, and the indicators for the impact it is having on financial inclusion.

Proliferation

Over seven years ago Safaricom launched M-PESA in Kenya. The assumption among many is that agents in Kenya have been in operation for a number of years as well. However, the ANA research finds that 59% of agents have been in operation for a year or less. While it is clear that a large portion of this is explained by aggressive growth from the provider, the survey also found that only 58% of agents thought they would continue to be an agent in a year’s time. This indicates that there might also be a lot of turnover of agents in the network. Further, the vast number of agents is putting pressure on each of them individually, with agents ranking competition between themselves as the greatest barrier for them doing more business.

Dominance

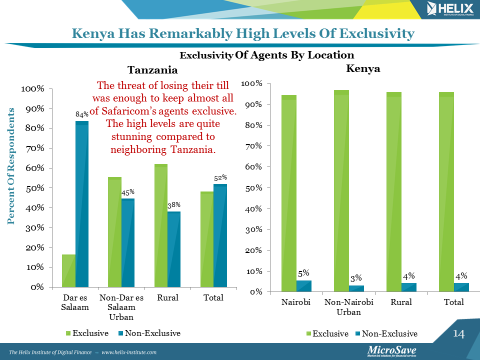

Agents were selected randomly for the survey, and 90% of the ones engaged were serving M-PESA. Across East Africa, each country has a leading provider, with MTN controlling 63% of agents in neighbouring Uganda, and Vodacom having 55% in Tanzania, but the high level of the dominance found in Kenya is unprecedented. This dominance has some interesting implications like the degree to which the country’s agent network is shared. Exclusive agents only serve one provider, and providers like to keep it that way so their competitors cannot leverage on their networks, but they need a lot of market power to enforce this aspiration. The dominance of Safaricom has allowed it to keep the most exclusive agent network in the region, with 96% of agents serving only one provider vs. 48% in Tanzania. This seems to greatly impact profits for the agent since they can only earn revenue from one provider rather than multiple, and explains much of why agents in Tanzania make a median of $US 95 per month vs. only $US 70 in Kenya. Therefore Kenyan agents do more transactions per provider but make less money overall by serving fewer providers per agent.

Evolution

The agent network in Kenya, not only continues to proliferate rapidly but is also evolving the types of agents it has. About three years ago, banking agents were introduced to the market, and more recently mobile money merchants began operations (see the blog on merchants in Kenya here). Banking agents are now becoming an important part of the digital financial ecosystem in Kenya and display some interesting traits. A lot of the banking teams building these networks used to work in mobile money, and seem to have designed certain facets of them similarly. For example, both mobile money and agency banking networks display similar levels of dedication, exclusivity, rural/urban locational splits, liquidity management techniques, and support systems. However, the differences may be even more intriguing, as we see bank agents being more educated, and willing to do much larger transactions for clients than mobile money clients. Bank agents are also displaying some growing pains, taking a long time to register new customers, and still having 50% of their agents doing 30 transactions per day or less. Banks will have to focus on these issues as they continue to expand their networks across Kenya. However, the outlook is positive given some of the mature metrics of agent support and management they are already displaying.

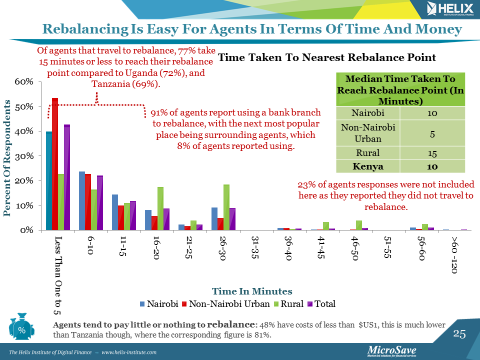

The presentation examined impact from multiple angles including, the geographical expansion of the access to financial services. The access frontier is being expanded with at least 55,000 agents across the country, which is much higher than the approximately one thousand bank branches in Kenya. However, it seems like they might be constrained geographically. Of the 77% of agents that report travelling to rebalance their float levels, 77% of them say it takes them 15 minutes or less to reach their rebalance point. With 91% of them reporting using a bank to rebalance, this seems like the majority of Kenyan agents are concentrated around the financial infrastructure that we are trying to extend outwards. Further work is planned to look at the correlations to population densities, and try to determine the degree to which this is problematic.

Agents feel like the market is saturated, with some reporting opening side business to supplement revenue, and only 58% of them saying they think they will still be an agent in a year. It seems likely that the number of agents on the market will contract. Safaricom’s M-PESA continues to dominate the market, and while the regulatory wind seems to be pushing towards non-exclusive agents, the high-quality support they are providing to their agents’ means it will continue to be hard to wrestle market share from them. The addition of banking agents to the market is welcome, and they may be finding a different market need than mobile money such as showing the ability to conduct bigger transactions for customers. Finally, the agents are extending financial inclusion, but evidence indicates they many may be tethered to the existing financial infrastructure for rebalancing, and therefore further expansion into rural and remote areas may require superior liquidity management techniques. Overall, it is a very positive picture, from the frontier market in digital finance.

To read our ‘Agent Network Accelerator Survey – Kenya Country Report 2013‘ in full click here

To read our ‘Agent Network Accelerator Survey – Tanzania Country Report 2013‘ in full click here

To read our ‘Agent Network Accelerator Survey – Uganda Country Report 2013′ in full click here

by

by  Jun 20, 2014

Jun 20, 2014 5 min

5 min

Leave comments