The Revolution MUST be Digitalized

by Graham Wright, Anup Singh and Abhishek Anand

Jun 7, 2022

5 min

It is clear that digital transformation is a journey, not a destination – so incremental progress is to be expected. Equity Bank, one of the leading microfinance providers in Kenya, developed a well-articulated approach and took over a decade to digitalize its operations. It started with the equivalent of a digital readiness assessment, on which it based its digital transformation strategy in 2010. MSC worked alongside Equity Bank, providing consulting services, for much of its digital transformation journey.

In “After the Fall (Part 2): The Revolution Might Not be Digitized,” Daniel Rozas, Sam Mendelson & Timothy Ogden eloquently argue that Covid-induced digitalization among MFIs is happening much more slowly than expected. “There remains a gap in the capabilities and resources of MFIs, along with a large segment of customers who are not yet ready to make the leap… Many futures are still possible.”

The authors reach this conclusion based on discussions with CEOs of leading MFIs across the globe under the remarkable Sentinel Project. But we at MSC believe it is important to amplify some of the points made in the blog, and repeat the plea for microfinance institutions (and those supporting them) to invest in digitalization and accelerate the pace at which they are digitizing their operations.

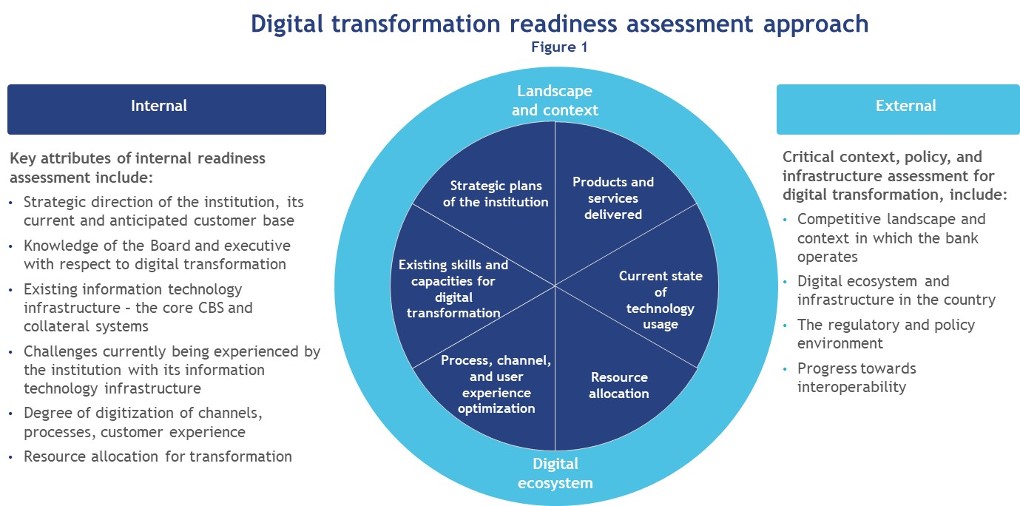

It is clear that digital transformation is a journey, not a destination – so incremental progress is to be expected. Equity Bank, one of the leading microfinance providers in Kenya, developed a well-articulated approach and took over a decade to digitalize its operations. It started with the equivalent of a digital readiness assessment (see figure 1 for MSC’s approach to this), on which it based its digital transformation strategy in 2010. MSC worked alongside Equity Bank, providing consulting services, for much of its digital transformation journey.

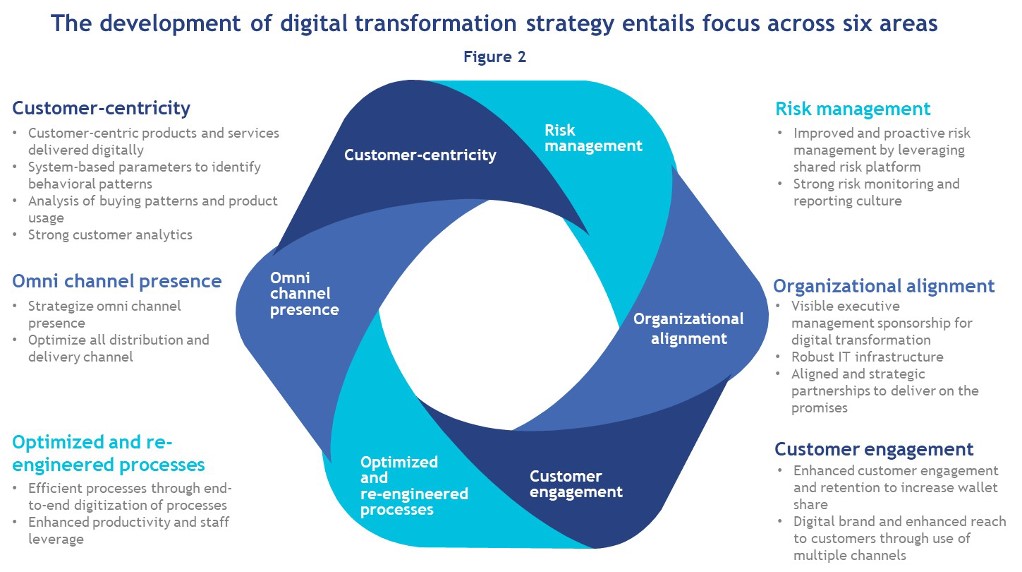

Equity Bank’s strategy comprised a wide range of strategic and operational variables. With M-PESA playing an increasing role in the market, many of these were context-specific, but digital transformation typically encompasses six key focus areas (see figure 2).

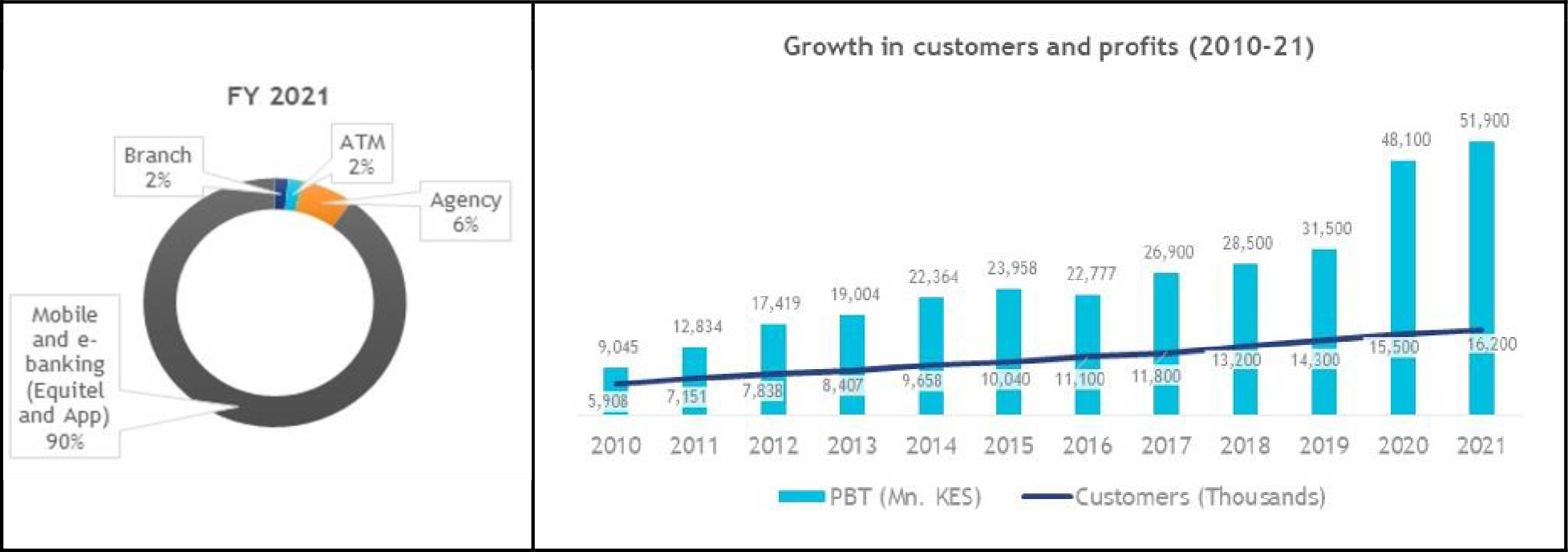

While the digital transformation of Equity Bank was time-consuming and resource-intensive, the results have been spectacular (See graph 1). The vast majority of transactions are conducted outside the bank’s branches, which has allowed it to redeploy tellers and branch staff members to play the role of advisors and wealth managers. Ninety percent of transactions are self-initiated by customers on mobile or e-banking channels. The resultant cost savings, and thus profitability, have been enormous – far eclipsing the very significant investments made in the digital transformation of the bank.

Equity Bank: Growth in customers, profits, and digital transactions

Graph 1

See this short video for more details on Equity Bank’s digital transformation and its remarkable impact.

So while MFIs and the investors behind these often very profitable organizations might claim that they do not have the resources to invest in digitalization, this seems to be a very short-term perspective. This might reflect short-term key performance indicators, but often in our experience, it also reflects a lack of vision and/or a fear of change.

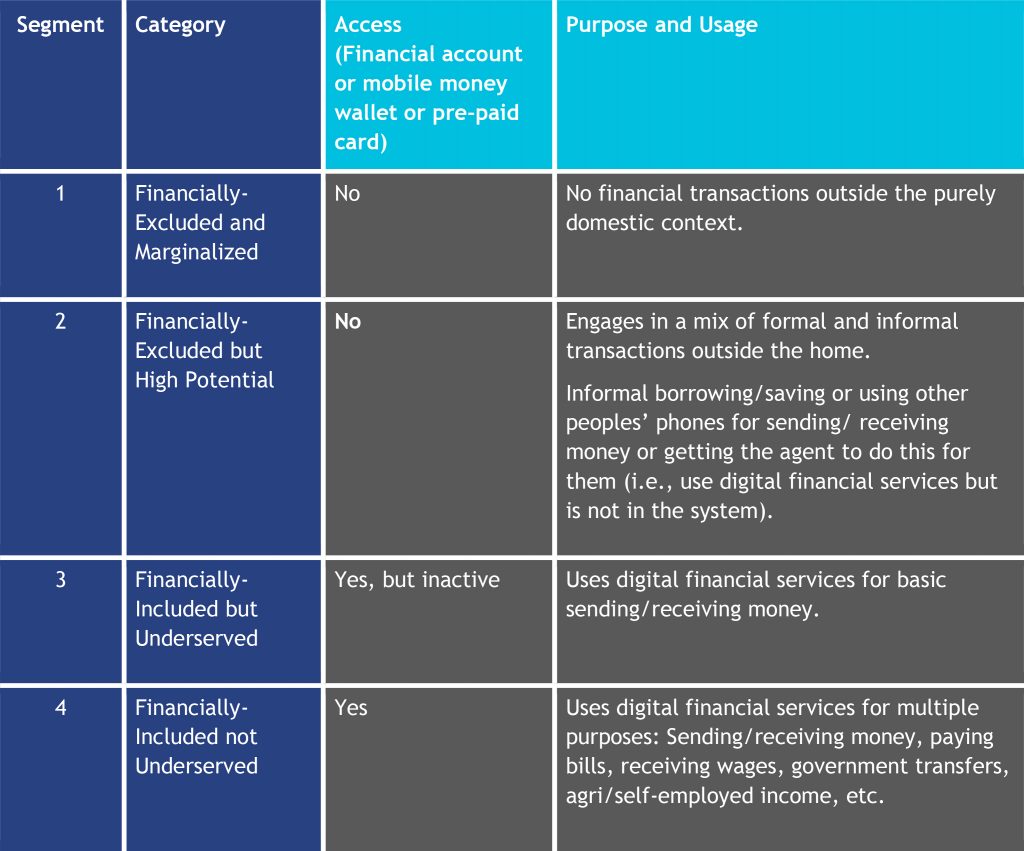

But the pace of change is also slowed by the reality that few countries in Africa, or indeed in Asia, have the level of digital capability that we see in Kenya. Ogden et al.’s concern that many customers are unwilling to “take the leap” into a digital world is well-grounded. Mathematica has developed an elegantly simple approach to segmentation:

Table 1: Segmentation approach by Mathematica

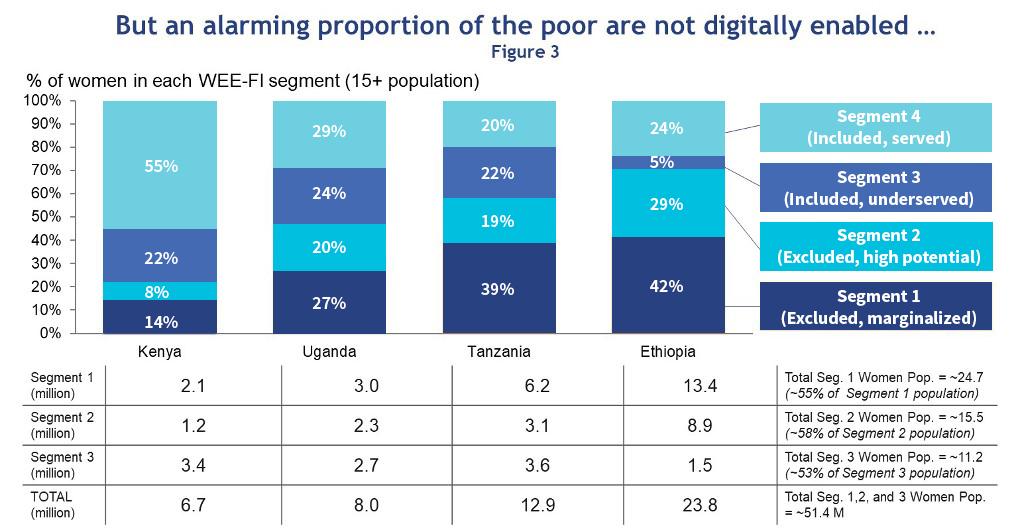

Applying this to four countries in East Africa, based on the Findex 2017 data, we can see that the levels of inclusion and usage are alarming – particularly amongst women (see figure 3). Segments 1 and 2 deserve special attention as they are likely to lack the digital capability to engage with digital financial (or indeed any other) services.

“Surely the Findex 2017 data is old and presents an outdated and thus paints a pessimistic picture?” we hear you say. You may be right. Findex 2021 will tell. But, our discussions with industry experts in Uganda and Tanzania suggest that taxation on mobile money transactions and the debilitating impact of COVID-19 on household income, are leaving increasing numbers of women stranded in segments 1 and 2 … on the wrong side of the digital divide.

Addressing the digital divide will require a greater emphasis on assisted transactions (typically agent-assisted), not self-initiated transactions. By way of example, in Kenya, even after a decade of M-PESA, about half of users (66% of women and 34% of men) still sought agent assistance with transactions. Agents are uniquely well-positioned to deliver money management tools and services tailored to the oral and poor segments – thus enabling MFIs to deepen their service to these groups. This can be done through smartphones or (better still) tablets at agent outlets running apps that provide intuitive user interfaces and reflect the mental models people use to manage their money.

However, to achieve this, MFIs will need to develop products that respond to the needs, aspirations, perceptions, and behavior of their target market and then market them through agents and other opinion influencers and social marketing channels. The poor have more resources and more propensity to save than expected. For example, after about five years, the 450 million PMJDY accounts opened for the unbanked masses of (primarily) rural India. Despite around 50% dormancy, these accounts now have an average balance of INR 3,623 (USD 48). And these relatively stable balances are growing over time. Furthermore, poor people also seem willing to adopt market-priced life and accident insurance policies, when these are adequately marketed. And, of course, the demand for credit can be taken as a given … the question will be how to modify existing products to tailor them to the rural poor.

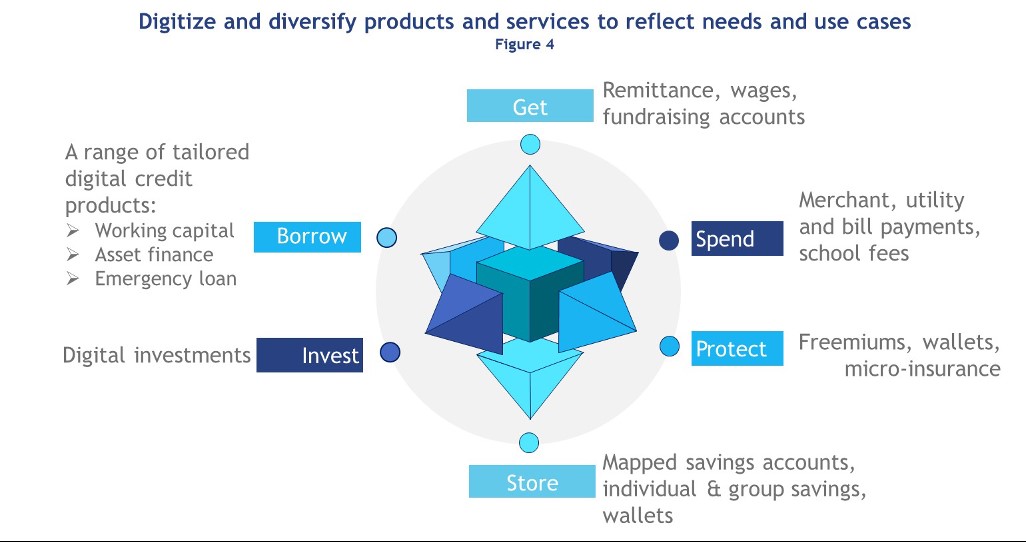

Digital transformation provides unique and compelling opportunities to build and deliver tailored products for the different market segments served by MFIs (see figure 4). Many of these will require strategic relationships with other financial service providers endowed with the relevant licenses, but doing so will allow MFIs to offer a comprehensive suite of products to enable their clients to manage their household and business finances much better.

The business imperative to undertake the digital transformation journey is compelling. McKinsey estimates that the digital transformation of financial institutions could add 45% to their annual net revenues: 15% from enhanced product uptake and 30% from reduced operational costs. And MFIs have an excellent opportunity to build on the relationships that they have with their current clients to offer an assisted, “phygital” hybrid experience combining physical and digital to meet their needs.

Failure to do so comes with many attendant risks. As Wright noted in The digital transformation: Four opportunities and three threats for traditional financial institutions: “There is a clear and present threat of a yawning digital divide—and with it the demise of many MFIs unwilling, or unable, to transform to operate in the digital world. FinTechs are building their customer base in urban and peri-urban areas with connectivity, smartphones, and the ability to buy data packages. They are serving the high-value customers. Thus, MFIs will be left trying to serve rural communities with poor connectivity, no smartphones, and not enough money for data packages – the low-value customers.”

This means that MFIs would no longer be able to cross-subsidize services to their rural, lower-value customers with the profits from urban, higher-value customers. And most fintechs would not be able to reach rural customers without access to 3G data services and smartphones—even if they were interested in doing so.

If MFIs fail to digitalize, it could mean the end of financial services for the rural poor, because the business case is so challenging, particularly compared to the diverse, low-cost opportunities to serve the higher-value, connected urban market. In short, this could end years of progress towards financial and social inclusion.

The Financial Access first published this article on 2nd June, 2022.

by

by  Jun 7, 2022

Jun 7, 2022 5 min

5 min

Leave comments