The need for innovative digital financial services to improve the lives of female micro- and small entrepreneurs operating in open-air and cross-border markets: A case from Kenya

by Mandira Sharma and Kim Kariuki

Aug 29, 2022

4 min

MSC conducted primary research in Kenya to understand the challenges of female traders in open-air and cross-border markets. The study identified limitations that prevent them from using digital financial services comprehensively. We sought to learn why these owners of micro and small enterprises shy from using credit, savings, insurance, and payments. Faith Njeri is one such woman.

Our new blog discusses the financial challenges countless women like her struggle with as they work on their dream of financial independence.

Faith in her dreams

Faith is a married woman with three children. She runs a microenterprise in an open-air market in rural Namanga, Kenya, and sells dairy products. Her business enables her to earn a living, averaging around USD 18 daily. Faith often faces liquidity crunches, especially during the lean season in January when earnings drop to less than USD 12 per day. This income is barely enough to feed her family and keep her business a float.

Faith’s story is not unique. Many like her in the developing world run successful micro businesses but remain invisible to formal financial institutions. It is almost as if the unbanked and the banked exist in separate universes, co-existing yet unable to meet for mutual benefits.

A key question emerges at this juncture. How can financial institutions offer innovative digital financial services (DFS) that meet Faith’s needs, increase her business’ resilience, and help her attain financial goals?

Women who work in open-air and cross-border markets present an untapped opportunity

The developing world has made great strides in increasing access to financial services in the past decade. For example, formal financial access increased to a healthy 83.7% in Kenya in 2021, as per FinAccess’ 2021 Household Survey. The gender gap also narrowed considerably to 4.2% in 2021 from 8.5% back in 2016 (Putting women at the center of inclusive finance, 2022)

In Kenya, the near-ubiquitous “access” to financial services results from the widespread use of mobile money. Digital payments enable pundits to tick the box and declare women “financially included.” However, under the hood, a significant gender gap persists in the “usage” of formal financial services.

Women like Faith contribute significantly to the Kenyan economy. Kenya has 1.17 million women-led micro and small enterprises (wMSEs) operating from open-air markets. Of these, only 50,000 are formal enterprises (MSC, 2011; KNBS, 2017). Moreover, Kenya has a large population of women who sell goods across borders (cross-border traders). MSC’s financial diaries research shows that wMSEs need a median of KES 30,000 (USD 270) to start a business.

Projection from MSC’s financial diaries research shows that if we assume all wMSEs are eligible for affordable credit when starting their businesses, it alone would translate to KES 38 billion (USD 316 million) in new loans for financial service providers. Clearly, female traders’ ongoing needs for working capital would further expand this colossal opportunity.

Yet, most financial service providers continue on a “one-size-fits-all” approach to low-income segments. Instead, they need to show sensitivity to the needs of women like Faith. Female entrepreneurs often juggle many family responsibilities while running their businesses, which compels them to prioritize convenience. Moreover, many lack proper documentation and collateral, which makes access to formal credit even more challenging. Most women find digital payments useful. Yet digital payments do little to enhance their businesses, build financial muscle, or diversify income streams. Therefore, women-led enterprises are more likely to fail due to reduced liquidity and excess reliance on informal credit. Female entrepreneurs frequently borrow from chamas (self-help groups) and informal moneylenders who charge exorbitant interests, which often prove costlier compared to formal sources.

Demand and supply-side challenges

Financial inclusion is a prerequisite for women’s economic empowerment, development outcomes, and poverty reduction. In its current format, digital payments alone do not work for Faith and others like her. WMSEs need access to other financial services like credit, savings, and insurance. The inability of financial service providers to extend a comprehensive suite of services pushes Faith and her peers toward informal channels. Chamas are particularly attractive because they offer “easy” access to credit. Banks, on the other hand, require documentation and collateral.

MSC conducted primary research in Kenya to understand the challenges encountered by women in open-air and cross-border trades. The study identified limitations that restrict comprehensive DFS usage by WMSEs—credit, savings, insurance, and payments.

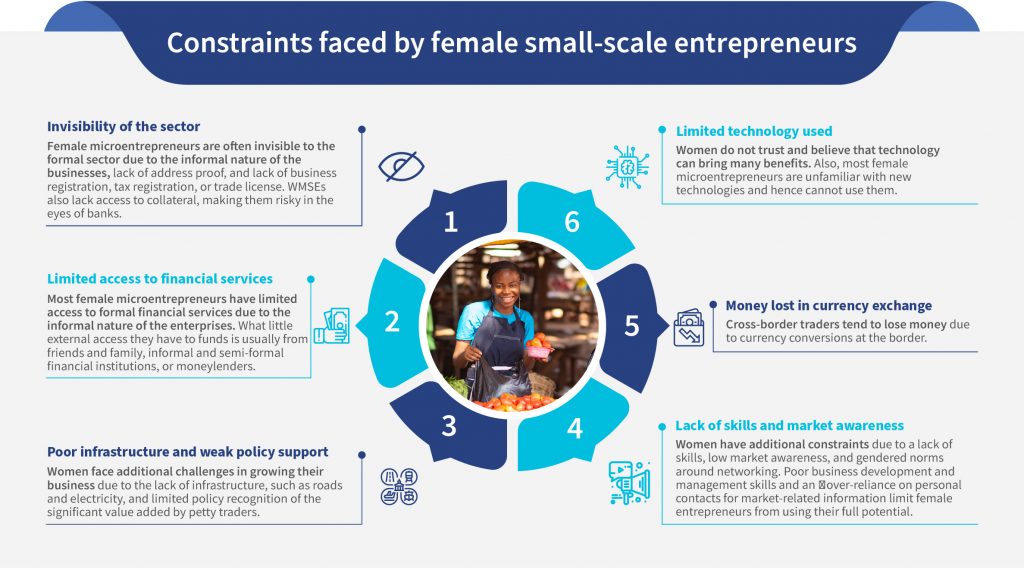

The graphic below shows the constraints women like Faith face while accessing digital financial services.

On the supply side, challenges preclude the delivery of affordable financial services to women, which include:

- Staff members of formal financial institutions have a limited understanding of the unique needs of female entrepreneurs and do not collect or analyze gender-disaggregated data. Thus, traditional banking methodologies and operations are not gender-sensitive and often lead to exclusion.

- Financial institutions require formal documentation, which most WMSEs lack. The informality of WMSE business structures presents a data-related challenge for most financial institutions.

- Most financial service providers have not evolved their lending methodologies to provide alternative ways of credit scoring.

- In stark contrast to the experience of microfinance institutions across the globe, most traditional financial institutions believe WMSEs present high credit risk (Are women better borrowers in microfinance? A global analysis, 2020). This is mainly due to their lack of collateral and the inability of financial service providers to develop innovative solutions to lend without depending on collateral.

- Financial institutions make no genuine attempt to tailor products and services to suit the needs of women like Faith. No single provider—formal or informal—meets more than one or two of her financial needs.

Currently, financial and non-financial services are insufficient to help WMSEs build and grow their business. Financial service providers need to provide customized and bundled products and services to meet the complex and diverse needs of women like Faith.

by

by  Aug 29, 2022

Aug 29, 2022 4 min

4 min

Leave comments