The last-mile reach: Postal banks across the globe that serve the rural and the remote

by Disha Bhavnani, Manali Jain and Mitali

Sep 20, 2022

6 min

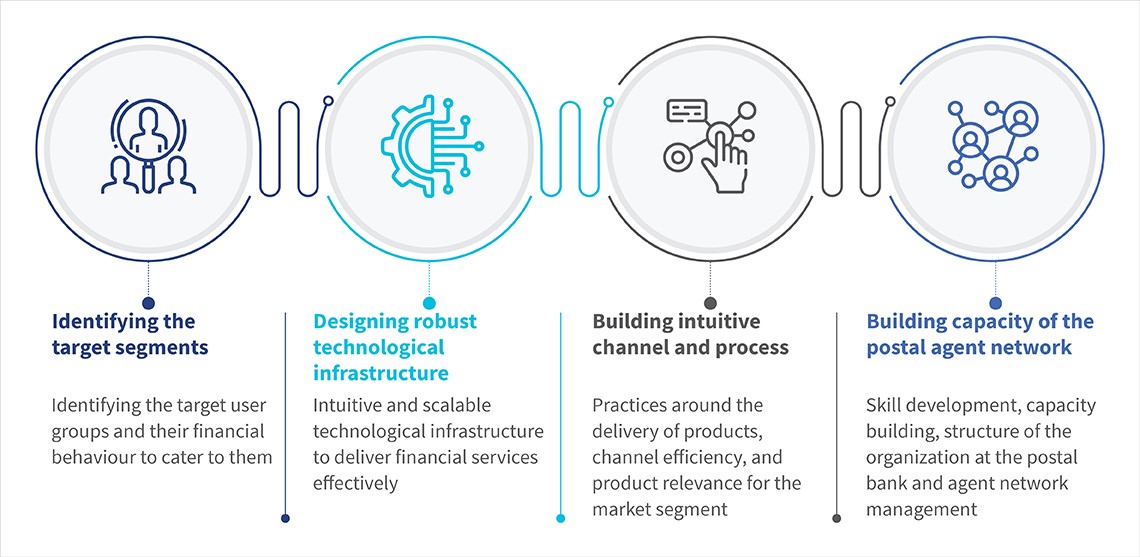

Postal banks have existed and played a key role for different customer segments in several countries. In this blog, the second of this series, we highlight the best practices postal banks across different countries have adopted and implemented to serve their customers under the 2T2P approach.

In our previous blog, we focused on the Target segment-Technology-People-Process (2T2P) approach that postal banks can use to enhance their offerings to low and moderate-income customers. With the changing financial inclusion landscape, it becomes essential for postal banks to meet the needs of their customers. Our framework highlights major areas a postal bank can focus on to keep up with the changing financial services landscape.

In the following section, we focus on some successful practices that postal banks have followed across different countries under the 2T2P approach and the impact of these developments on customers, such as Ramesh, Ali, Dizola, and others worldwide.

1. Target segments: Postal banks that cater to the changing needs of the customers

Customer segmentation and profiling focusing on different use cases can be critical for postal banks as they serve a large set of customers through their network. Customized products for different customer segments based on their financial behavior will be vital to improving customer experience.

Some postal banks, including Al-Barid Bank in Morocco and Tunisian Post in Tunisia, have been leading the way and targeting a specific set of customers through their network:

- Focus on low-and-moderate-income groups:

In some countries, post offices receive banking licenses to offer limited products and services. This allows them to compete with regular banks or supplement them for specific customer segments. In 2010, a subsidiary of Morocco’s post office received a limited banking license, and it floated Al-Barid Bank to serve low-income consumers. Since its inception, Al-Barid Bank has opened 400,000 to 500,000 bank accounts every year and improved access to banking for those in remote areas of the country. Similarly, Egypt Post has supported customers like Ali through their banking services.

- Improving customer stickiness to the platform:

The Tunisian postal bank, La Poste Tunisienne’s mobile banking services for virtual accounts increased retention among young customers, who usually switch to other banks once they start earning. Once La Poste Tunisienne extended mobile payment services to virtual accounts and started offering additional benefits, it became popular among young customers. Adem, an engineer from Ariana, opened his account at La Poste Tunisienne in 2019 and uses the platform digitally to make mobile payments due to the ease of performing transactions.

Tunisian Post has also been focusing on advanced use cases and is exploring this through big data and blockchain to expand the reach of digital financial services. Recently, it launched a new payment infrastructure with the Swiss tech platform, Monetas. The new digital payment infrastructure enables e-Dinar users to make instant, secure peer-to-peer mobile transfers, pay online and offline merchants, pay their utility bills, send remittances, and manage official government identification documents. Tunisian Post now seeks new use cases to expand digital financial services to its customers.

These postal banks are exploring newer use cases and keeping stickiness at the forefront for their loyal customer base. With this strategic focus, they have to potential to expand digital financial services to the unserved and underserved.

2. Technology: Unique scalable solutions using emerging tech

Postal digital transformation is difficult to achieve by simply layering technology over legacy systems. It requires building a modular tech infrastructure and an easy-to-use interface that target segments whom we met in the first blog – like Ramesh, Ali, and Dizola finds intuitive and convenient. Several postal banks have been implementing innovative solutions at the front end to provide a better user experience and at the back end to build scalable infrastructure.

- SmartCard solution introduced by NamPost Savings Bank in Namibia:

Namibia post offers banking services to its customers through its “SmartCard.” Whenever customers open their account with NamPost Savings Bank, the financial services arm of Namibia’s post, they get a smart card. The biometric card helps customers withdraw money in post offices and ATMs, transfer money to an account or another card, and pay in retail shops across countries via Point of Sale devices.

- Partnership with mobile operator networks (MNOs) to improve technological capabilities:

Tunisia Post partnered with three major MNOs in the country, Tunisie Telecom, Ooredoo, and Orange, to offer mobile postal financial services. This allowed customers to transact conveniently from anywhere in the country. The partnership had a significant impact on improving financial inclusion among last-mile customers.

- Partnership to digitize traditional financial products:

Benin Post partnered with the FinTech e-Savings club to digitize and formalize rotating savings and credit associations (ROSCAs). The postal agents collected monthly savings from customers at the convenience of their doorsteps. Further, they were also responsible for sending timely reminders to reduce the delinquency rate among customers. Once the amount collected is deposited in the post office, the customers receive a confirmation message.

The digital revolution has allowed these postal banks to use emerging technology, build innovative solutions, and provide different financial products through FinTech partners. The introduction of customized financial services through the network of postal banks can potentially disrupt and scale them—and extend their reach to the last mile.

3. Process: Building efficient processes and operational models to deliver relevant products to specific segments

Service providers can offer several services at low cost through digital and non-digital channels, thanks to the expanding internet and smartphone user base across the markets. Postal banks can build “phygital” models and processes, that combine technology with human assistance, to deliver efficiently to their target segments.

- An agile approach to adopt innovations in the market and serve customers adequately:

Elta Hellenic Post, commonly known as ELTA, is Greece’s national postal service. Doorstep delivery of social security payments through bank checks was one of ELTA’s essential tasks, besides other postal services. However, when a law was introduced to outlaw the physical delivery of G2P payments during the COVID pandemic, ELTA was quick enough to respond to this change. ELTA introduced giro accounts to serve beneficiaries. Beneficiaries approach the postal delivery staff to open giro accounts to access their social security payments at home. This helped ELTA retain its customer base and adopt a robust system to deliver no-contact payments.

- Co-branding approach and effective processes to deliver financial products:

In the UK, many private-sector banks have partnered with postal banks to offer co-branded basic financial products, such as customer savings accounts and current accounts for merchants. The partnership also enables banking agents to use post offices as a physical touchpoint to help customers conduct transactions, such as deposits and withdrawals. Several banks in high-income countries show similar trends to maintain their presence in rural areas. In Spain, Slovenia, and the Czech Republic, post office employees execute customer transactions on behalf of several private sector banks. In effect, these post offices act as agents for banks.

4. People: Capacity-building of the agent network and staff within the organization

Traditionally, the role of a postal agent is limited to mail delivery services, and they are not well acquainted with digital interfaces. The transition from being a mail carrier to financial inclusion enabler requires training. Further, postal banks also need strategic leadership at the top to drive innovation in service and processes to maintain a sustainable business model over time.

- Training and capacity building through creative tutorials:

India Post Payments Bank introduced creative video modules for its network of 189,000 agents. These modules are constantly updated and available in regional languages across India for postal bank agents to understand the content without any challenges. This includes engaging comic strips that have generated higher awareness among agents of IPPB to serve customers effectively.

- Leadership from both banking and startup experience can help drive innovation and growth:

Some post offices focus on building a solid leadership team to drive innovation. The leadership of Anas Alami, former Director General of Poste Maroc, laid the foundation of financial inclusion for the Morocco Postal Bank. The in-house experts’ knowledge base helped the bank minimize expenditure on hiring external consultants. Further, the experience of the senior management team comprising different age groups and diverse backgrounds helped Morocco Postal Bank to make well-informed strategic decisions.

The future is now, and postal banks can use their competitive advantage to make the most of the opportunity

Several postal banks, such as those in Japan, India, and Morocco, have adapted to their country’s cultural nuances, customer needs, and technological developments. Most importantly, they use the postal networks’ widespread presence to provide financial services, specifically in pockets that lack traditional banking outlets for customers, such as Dizola and Ramesh.

Postal banking played a crucial role in increasing financial inclusion globally and was a game changer during COVID-19 for beneficiaries like Ali receiving social security payments. They enabled multiple use cases across P2P and G2P payments during those difficult times. Thus, if postal banks can build their model around local requirements, they are here to stay, sustain, and thrive.

by

by  Sep 20, 2022

Sep 20, 2022 6 min

6 min

Leave comments