The journey of mobile financial services at BURO Bangladesh: A lesson for the microfinance sector in Bangladesh

by Anant Tiwari, Ravi Kant, Shantam Mondal, Aneesh Gulati and Bijoy Bhowmick

Dec 7, 2021

6 min

The case study encapsulates the digital transformation journey of BURO Bangladesh as it tried to offer mobile financial services to its clients. The road was not easy, but the efforts have finally started to yield results to both the MFI and its customers.

The context of mobile financial services at BURO Bangladesh

About six years ago, BURO decided to offer mobile financial services (MFS) to its members, primarily women from the low- and moderate-income group spread across Bangladesh. The MFS option was BURO’s twin-pronged strategy to deal with rising cash-related fraud by staff while providing a convenient way for its customers to repay loans.

This case study charts BURO’s journey in MFS and highlights the critical benefits for the NGO and its customers. MSC supported BURO to undertake the digital journey under the Digital Microfinance project[1] commissioned by MetLife Foundation.

BURO’s MFS journey

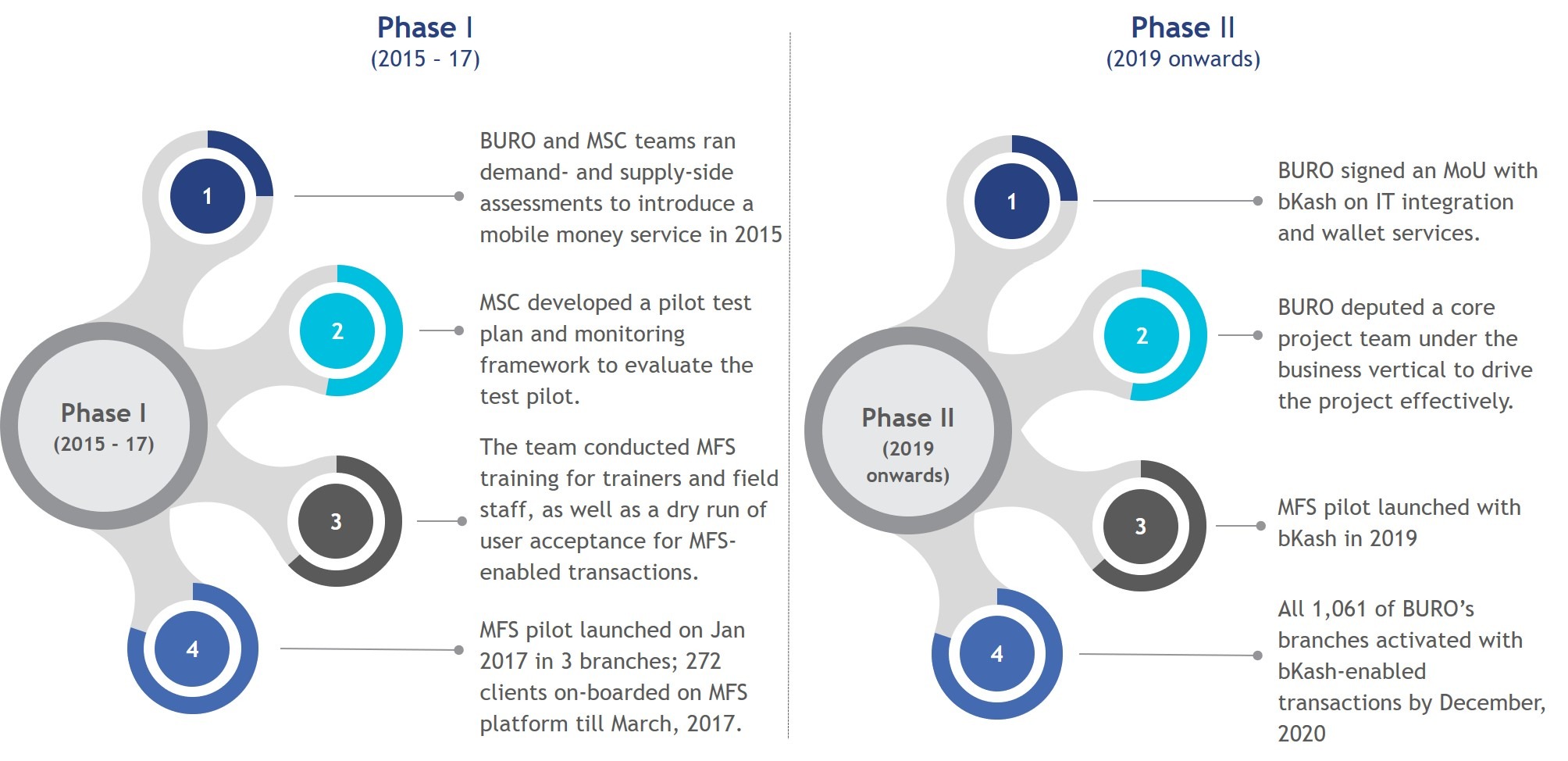

BURO started the MFS journey in 2015 in collaboration with an MFS provider. BURO developed its mobile financial services with an end-user-centered approach. To do this, BURO and MSC consulted prospective MFS users to understand their needs, attitudes, preferences, and behaviors. We then secured buy-ins at all levels through discussions with domain experts, senior management, and field staff.

However, the pilot did not yield desired results due to several challenges. BURO discontinued the pilot in 2017 to resolve them. Eventually, BURO resumed the pilot with a new MFS partner, bKash, in 2019. The following graphic captures a snapshot of the journey that BURO undertook to introduce MFS.

[1] MetLife Foundation and MicroSave Consulting (MSC) conceptualized the project in 2015.

The outcome of the project

How do mobile financial services (MFS) benefit BURO and its customers?

- The convenience of anytime-anywhere payments for clients

MSC’s interviews revealed that BURO’s members liked to repay through MFS. They can transact any time and from any place without hampering their daily business activities. Specifically, female clients find MFS convenient. It lets them continue their transactions without stepping out and thus handle household affairs uninterrupted. Moreover, families that receive online remittances from abroad are happy with MFS as it rules out the need for physical cash. These advantages have led to the high voluntary uptake of MFS for BURO, despite the 1% associated fee it entails for customers.

- Savings in terms of time and cost for field staff have led to higher operational efficiency

MFS helped BURO’s field staff reduce their time spent on each group meeting by 25%. They now focus on their other responsibilities to improve branch operations and profitability by prioritizing the collection of overdue payments and expansion of business. Moreover, the automatic account posting[1] of MFS transactions has reduced the overall bookkeeping time at the branches by 11%. Further adoption of MFS by members will further improve BURO’s operational efficiency.

- Better staff monitoring and elimination of cash-related fraud

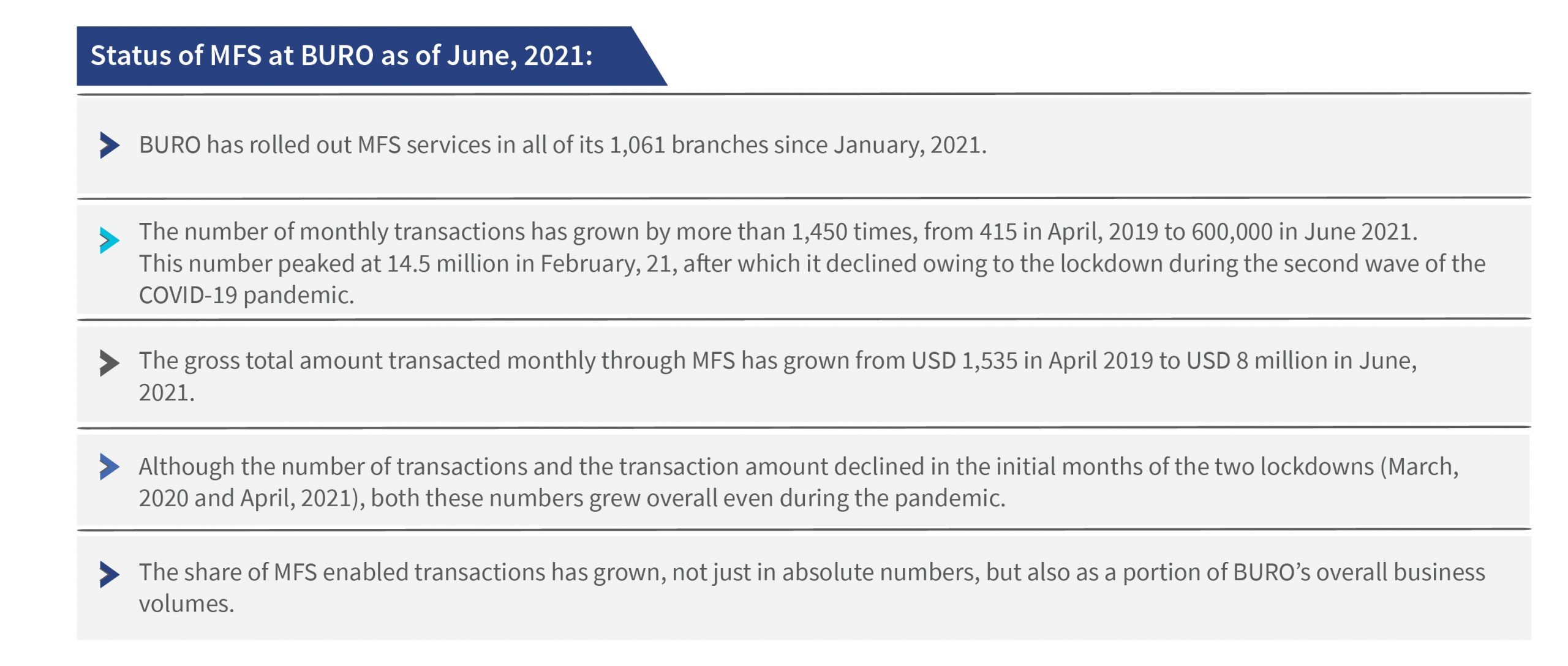

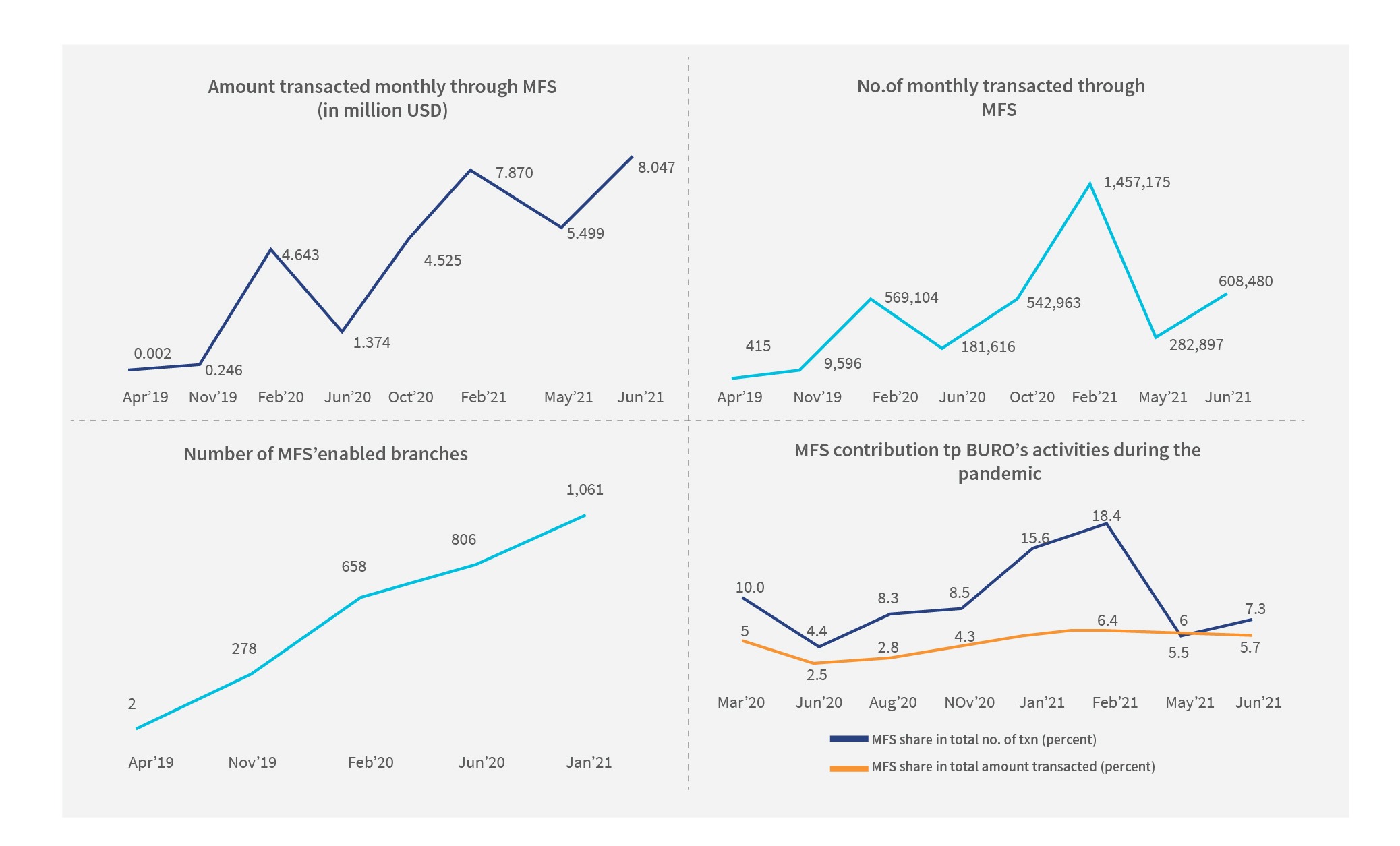

MFS has helped BURO eliminate cash-based transactions, as field staff do not need to handle any cash for MFS customers. As of June 2021, 7.3%of all transactions by BURO members occur through the MFS channel. MFS has sharply reduced cash-related misappropriation by field staff while improving staff monitoring through near-real-time digital updates on-field activities to portfolio managers. Cases of misappropriation-based staff terminations at BURO reduced by 15% compared to the pre-MFS period.

- Staying resilient during crises

Bangladesh grappled with the twin crises of Cyclone Amphan and COVID–19 in 2020. With an intervention like MFS, BURO gained a competitive edge. It could now collect loan installments from its clients digitally without relying on physical interactions. The share of MFS in BURO’s total monthly collection amount grew during the pandemic, and reached 5.7% in June 2021.

- Enhanced brand image for BURO

The benefits of MFS for clients and field staff have helped BURO improve its overall brand image. The number of field staff leaving the organization has reduced by 22% after it rolled out MFS.

What did BURO do to overcome the challenges faced during the pilot, and achieve its goals?

BURO faced many operational and technological bottlenecks during the initial phase of its MFS pilot (2015-2017). Lessons from this phase helped BURO plug the identified gaps and prepare itself better for phase II of the pilot:

- Staff deployment: BURO deployed contractual staff in the field during the first phase of the pilot, but their performance and level of effort were unsatisfactory. In response, BURO created a dedicated MFS team of regular employees and achieved the desired results.

- Staff training: The first phase of BURO’s pilot suffered due to the limited understanding of field staff regarding MFS processes. BURO realized this, and trained more than 9600 field team members on MFS technology for the second phase of the pilot.

- Client training: During the pilot review of Phase 1, BURO identified an awareness gap regarding MFS among both staff and clients. BURO has since mandated training on MFS for all its field staff and new employees. This trained field force educates the clients on the benefits and processes of MFS.

- Branch automation: BURO faced multiple technological glitches during the first phase of its MFS pilot. It upgraded its MIS system[2] to creating a robust technical backend. BURO migrated all the branches in a phased manner to the new online mode by June 2020. The branches now have integrated inventory, fixed asset management systems, and regular branch operation on the new online platform.

- Inadequate agent presence: BURO had partnered with an MFS service provider for the initial MFS pilot. It had a limited field presence in BURO’s operating geographies. The leading MFS provider, bKash, had a much more pervasive and accessible agent network in the territories, thus making cash in/cash out much more convenient for BURO members.

- Partnership with bKash: In 2019, BURO collaborated with bKash for mobile-enabled deposit and collection services for loan installments. A well-planned integration exercise ensured a smooth handshake between the systems of both organizations.

What made mobile financial services work in BURO?

BURO had been working to achieve its goal of digital transformation since 2015. Although it faced multiple challenges in the initial phase of the MFS pilot, the team at BURO did not waver from its mission and addressed the challenges actively. In 2019, BURO set up a dedicated MFS core team within its business vertical. This team plugged operational gaps identified in the initial phase and accelerated the rollout of MFS across the organization. Another significant step was when BURO upgraded its core IT system, which enabled the introduction of the MFS. BURO’s organizational commitment and its senior management’s foresight paved the way for the MFS pilot’s success.

The way forward

We suggest two measures to strengthen the MFS initiative among microfinance institutions in Bangladesh:

- Develop a policy framework for MFIs to offer MFS services: Since BURO’s MFS pilot has shown encouraging results, it could become a case study for the regulatory authorities in Bangladesh to develop a policy framework for MFIs. The framework would encourage MFIs to build technical capacity, and roll out MFS services for their members. The initiative will help improve MFS adoption across microfinance customers in Bangladesh.

- Reduce transaction fees for microfinance customers: MSC’s primary research reveals that microfinance members perceive the 1% transaction fee as an increased interest rate. The price impedes the widespread adoption of MFS significantly. Stakeholders, especially the regulators, as well as MFS providers and microfinance institutions, can discuss ways to reduce the fee for microfinance members. Large-scale adoption of MFS among members would greatly support Bangladesh’s digital economy in the medium and long term.

[1] Before BURO introduced MFS, the Branch Accountant would manually check the deposited amount with the collection sheet and post it in the books; MFS technology has automated this process through digital transactions.

[2] Earlier, BURO used to work on a paper based standalone MIS system. It has now deployed the gBanker database solution in all its branches.

by

by  Dec 7, 2021

Dec 7, 2021 6 min

6 min

Leave comments