The evolution of payments in India—looking ahead

by Graham Wright, Akshat Pathak, Disha Bhavnani, Shweta Menon and Diya Chatterjee

Sep 29, 2022

5 min

The previous blog discussed the state of India’s digital payments ecosystem. This blog looks at where and how it may evolve further.

The previous blog discussed the state of India’s digital payments ecosystem. This blog looks at where and how it may evolve further.

NPCI

The National Payments Corporation of India (NPCI) is the backbone of the country’s retail payments and settlement systems. NPCI’s efforts to build an open source and safe digital ecosystem have transformed how digital payment solutions reach the masses. NPCI now boasts an extensive product suite comprising UPI, AePS, BAP, Bharat QR, BBPS, RuPay, CTS, NACH, IMPS, NEFT, and eRUPI. NPCI will continue to play a pivotal role in enabling India’s 1.2 billion mobile phone users to adopt and access digital payments.

These products are replete with innovation, promote inclusiveness, and create a seamless payments experience for individuals, businesses, and governments. NPCI’s role in pushing India toward a digital economy remains critical. NPCI should address the country’s growing needs through stronger partnerships, besides new relationships with FinTechs, payment service providers, regulators, banks, and other institutions. Concerted efforts are now required from service providers to augment digital payment solutions by developing tailored use cases for each customer segment in the country.

New Umbrella Entity (NUE)

The exponential increase in smartphone users, coupled with the widespread adoption of new-age digital payment solutions, such as UPI, has positioned India as one of the fastest-growing digital payment economies worldwide. The acceleration toward digital payments has come about quicker than planned during the pandemic. PWC and the Payments Council of India (PCI) expect India to contribute ~2.2% of the global digital payment market by 2023. By 2025, digital transactions in India are expected to rise to 167 billion in volume and INR 238 trillion (~USD 3.21 trillion) in value. It presents substantial business opportunities for existing and new players in the digital space.

The New Umbrella Entity (NUE) could bring about greater financial stability and efficiency in the backend system, which NPCI currently manages single-handedly. Key players and allies in the payments ecosystem, such as HDFC, Paytm, PayU, Visa, Punjab National Bank, Union Bank, Google, Amazon, Flipkart, and Tata, have applied to obtain the license for NUE. These entities should make the payments ecosystem more competitive, add to the existing product suites, and bring tailored use cases. These entities will also add to the overall innovation, insights around customer needs, and spending patterns, enabling them to align their offerings to increase the overall financial inclusion for several customer segments.

Payments channels

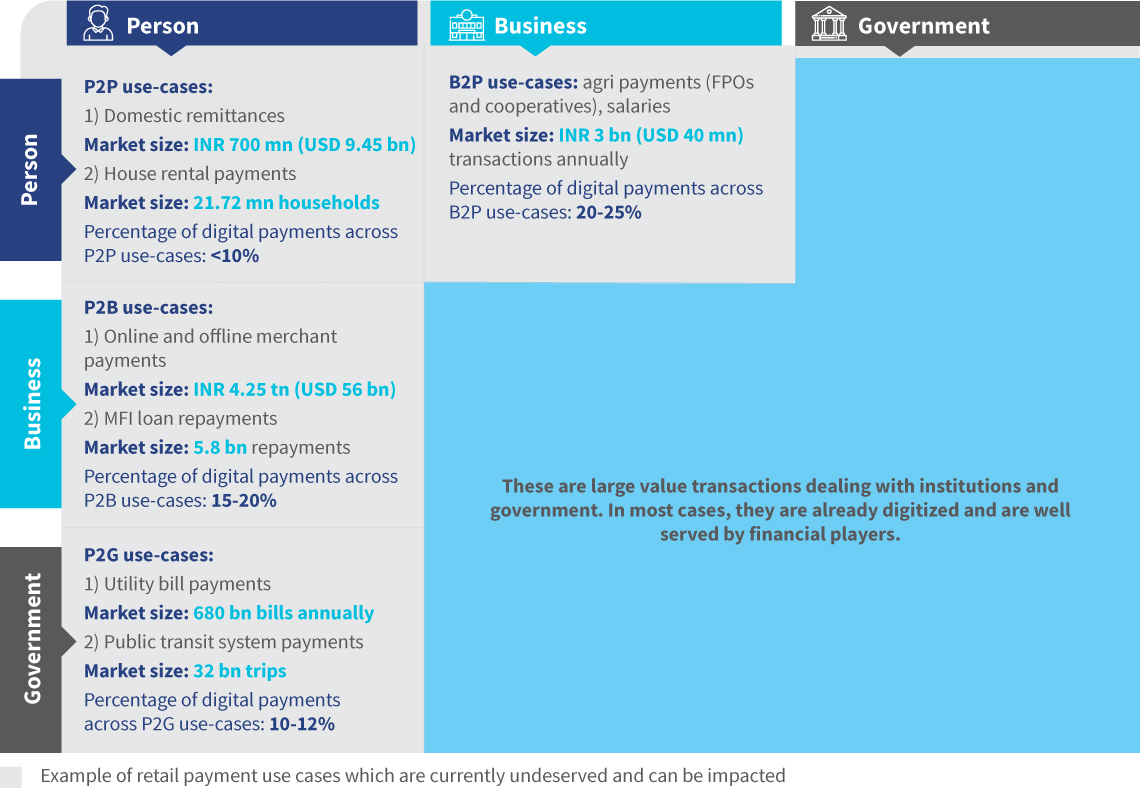

Four payments channels have tremendous potential to be digitized—P2B, P2G, P2P, and B2P. Targeted interventions through digital payment solutions across these channels will help address the specific financial needs of the unserved and underserved LMI customer segments. Promising examples include digitalizing domestic remittances, house rental payments, cash on delivery (CoD) payments in e-commerce, offline merchant payments, repayment of microfinance loans, recurring payments in agriculture and allied value chains, utility bill payments, and transactions in the public transit system.

The performance of these payment channels shows potential for growth:

- Migrant workers comprise the largest user segment of remittance services in India. About 120 million migrant workers from rural areas account for 80% of the country’s domestic remittances valued at ~INR 700 billion (~USD 9.45 billion). Presently, around 60% of domestic remittance transactions occur through non-traditional channels, such as friends, family, and agents for remittances. This untapped market offers an opportunity to digitize remittance transactions worth more than INR 400 billion (~USD 5.4 billion).

- India has 63 million micro-merchants in the country who facilitate P2B transactions. Many live in rural areas. While financial service providers have acquired around 10 million merchants, most are more prominent merchants from urban areas. Approximately 90% of micro-merchants currently transact exclusively in cash. The dependence on cash creates a massive potential to digitize cash-based transactions worth INR 4,200 billion (~USD 56 billion), as per MSC’s analysis based on IBEF estimates.

- India’s e-commerce sector is currently worth INR 2,600 billion (~USD 35.1 billion), a value that is forecasted to grow at a CAGR of 27%. Presently, around 17% of India’s total e-commerce transactions occur through cash-on-delivery (COD) payments. Converting even a conservative 10% of these cash transactions to digital presents an opportunity for digitizing transactions worth ~INR 45 billion (~USD 0.61 billion).

- India has 202 microfinance institutions (MFIs) with a branch network of 19,073 and 152,000 employees, per the Bharat Microfinance Report 2020. These MFIs have more than 59 million clients, primarily women, and an outstanding loan portfolio of ~INR 2,600 billion (~USD 34.6 billion). MSC’s analysis suggests that more than 95% of these loan repayments happen in cash through MFI field agents, highlighting the potential to digitize 5.8 billion transactions annually. Digitizing these MFI transactions can serve as anchor use-cases for women borrowers and increase the uptake and usage of digital payments across women in India.

- Salaries comprise the most significant use-case of payments made through the B2P channel but most of these payments are already digitized.

- Individual contract payments or payments for agriculture input and allied sectors constitute the next big use case under the B2P channel. MSC’s analysis suggests that transactions worth INR 880 million (~USD 40 million) flow through this channel annually, of which only 20% have been digitized thus far. This gap highlights the massive opportunity to digitize B2P payments.

- MSC’s analysis highlights that the P2G channel sees transactions worth ~INR 36,000 billion (~USD 486 billion). These include payments for government services, donations, bills, and taxes. However, more than 80% of these transactions occur in cash due to the consumers’ limited awareness and capability regarding digital payments and the institutions’ complex legacy systems.

Iris authentication payments

Currently, one in every three AePS transactions fails, with around 17% due to biometric mismatch using fingerprint authentication mode. The high failure rates in AePS transactions through fingerprint-based authentication have created a need for alternate authentication modes. Iris-based authentication provides a better alternative to fingerprint authentication. The iris-based mode is safe and secure—since the iris is difficult to forge, hygienic—as it is a contactless solution, and convenient—since it involves fewer scanning attempts than fingerprints. It is also far more accurate, with a false rejection rate (FRR) of 0.1-0.2% compared to 2-3% for fingerprint authentication.

Around 200,000 iris devices have already been installed across India to manage beneficiary authentication for various government schemes—public distribution systems, pension distribution, and mid-day meals. Currently, five banks—ICICI Bank, Andhra Bank, Fino Payments Bank, Central Bank of India, and RBL Bank are adopting iris-based authentication for AePS transactions. The average cost of an iris device is around INR 3,500 (~USD 47) compared to ~INR 2,000 (~USD 27) for a fingerprint device. Despite the comparatively higher device cost, iris devices have seen good adoption as 9% of Indians use them compared to the global average of 3%.

Way forward

The country’s payments ecosystem has many opportunities to grow and improve. NPCI has made moves to seize many of these opportunities. Meanwhile, the NUEs will encourage and enable innovation and diversification, which should further expand the frontier for digital payments.

That said, concerns about approaches to include those without access to smartphones persist. Regulators can address these concerns by enabling improved and intuitive USSD-based interfaces or agent-assisted transactions. This work will assume increased importance as user competition rises over time.

Written by

Graham Wright

Group Managing Director

Akshat Pathak

Specialist

Disha Bhavnani

Senior Manager

Shweta Menon

Manager

by

by  Sep 29, 2022

Sep 29, 2022 5 min

5 min

Leave comments