The Digital Shift: Unlocking Opportunities for India’s Microentrepreneurs

by Naini Dahra and Priyam Mrig

Oct 4, 2024

4 min

The adoption of digital platforms has had a significant impact on India’s microenterprises, boosting income, enhancing financial management, and offering broader market access. However, challenges like higher costs and disparities in gender and rural-urban adoption persist. Addressing these barriers can create a more inclusive digital ecosystem for all entrepreneurs.

In our earlier blog, we looked at the digital revolution that has been brewing in India that continues to reshape the way microenterprises (MEs) function in today’s connected age. In this part, we dive deeper into the impact of digital platform adoption for MEs, variations within subtypes of MEs, and the way ahead for these small businesses.

The adoption of digital platforms has a nuanced but significant impact on MEs’ finances. Platformed MEs report a marginally higher income of INR 60,997 (USD 725) compared to INR 60,750 (USD 722) for unplatformed MEs. However, platformed MEs also face slightly higher expenses, with costs at INR 33,071 (USD 393) compared to INR 31,409 (USD 373) for their unplatformed counterparts. This increase is likely due to additional platform fees, logistics, marketing expenses, and increased inventory costs associated with digital platform use.

The impact of digital platform adoption also varies across different types of entrepreneurs. Male-owned MEs tend to incur higher business expenses, which could point to differences in the scale or type of businesses they operate. This suggests that platform adoption does not affect all MEs uniformly, as demographic factors like gender may play a role in shaping business outcomes. Despite higher expenses, frequent engagement with digital platforms tends to yield higher income, implying that MEs that invest more in the digital space can eventually realize greater financial gains. Thus, while digital platform use comes with added costs, the potential for long-term financial rewards remains strong for businesses that leverage these platforms effectively.

These observations underscore the importance of understanding the diverse ways digital platforms impact different groups of entrepreneurs. Gender-based differences in platform usage call for targeted interventions to ensure equitable access to the advantages of digital adoption. Furthermore, geographical differences emerge, as rural MEs tend to show better profit margins than urban businesses, while urban entrepreneurs express higher confidence in income stability. Together, these factors create a complex landscape of platform usage, requiring nuanced approaches to fully harness digital platforms’ potential for all entrepreneurs.

This financial impact extends beyond income and expenses, influencing how platformed and unplatformed MEs manage their financial operations. Our research shows that 79.7% of platformed and 81.2% of unplatformed MEs keep their personal and business finances separate. This demonstrates a fundamental level of financial discipline. However, the tools they use to track their operations vary significantly. Platformed MEs are more likely to use mobile money or bank statements and spreadsheets, while unplatformed MEs rely on memory and traditional bookkeeping methods. This suggests that digital platforms encourage the adoption of more modern, tech-driven management practices.

Interestingly, unplatformed MEs are more likely to reinvest their surplus funds into their business. This could indicate a difference in growth strategies or investment priorities between the two groups. Despite these differences, both platformed and unplatformed MEs embrace digital tools. A substantial 83.8% of unplatformed MEs use digital wallets for business transactions, which highlights the pervasive influence of digital financial services. As MEs adopt these new capabilities, they unlock opportunities to streamline operations, make data-informed decisions, and improve business outcomes. The digital transformation of ME business management is well underway, and many embrace these tools with the mindset that they will be well-positioned for success in the future.

Digital platforms contribute significantly to MEs’ resilience and growth potential. These platforms provide access to wider markets, streamline operations, and enhance financial flexibility, and, thus, empower MEs. Specifically, platformed MEs have access to a more diverse range of credit sources, which enhances their financial resilience. Our research shows that 39.5% of platformed MEs have borrowed money, with higher rates in urban areas. This diversification of credit options can help MEs weather economic storms and maintain financial stability.

Digital platforms are emerging as powerful tools to help MEs achieve several key business objectives:

- Expanded customer reach;

- Increased revenue streams;

- Improved operational efficiency;

- Enhanced access to financial resources, and;

- Greater business resilience.

However, it is not just about access to these resources but also how effectively MEs use them. The strategic use of digital platforms and the financial opportunities they provide can significantly impact an ME’s ability to grow, innovate, and withstand market fluctuations.

Platformed MEs are more likely to borrow for business than their unplatformed counterparts. This suggests that digital platforms encourage MEs to invest in their businesses, which lays the foundation for future growth. Platformed MEs are also more willing to switch lenders for better terms than unplatformed MEs. This flexibility allows MEs to adapt to changing economic conditions and benefit from more favorable financing options when they arise.

These platforms provide access to a broader range of financial tools and business investments to empower MEs to build stronger. In a rapidly changing economic landscape, digital platforms’ role in supporting MEs’ resilience and growth cannot be overstated. As more entrepreneurs embrace these tools, we can expect a new generation of MEs to be better equipped to navigate challenges and seize opportunities in the digital age.

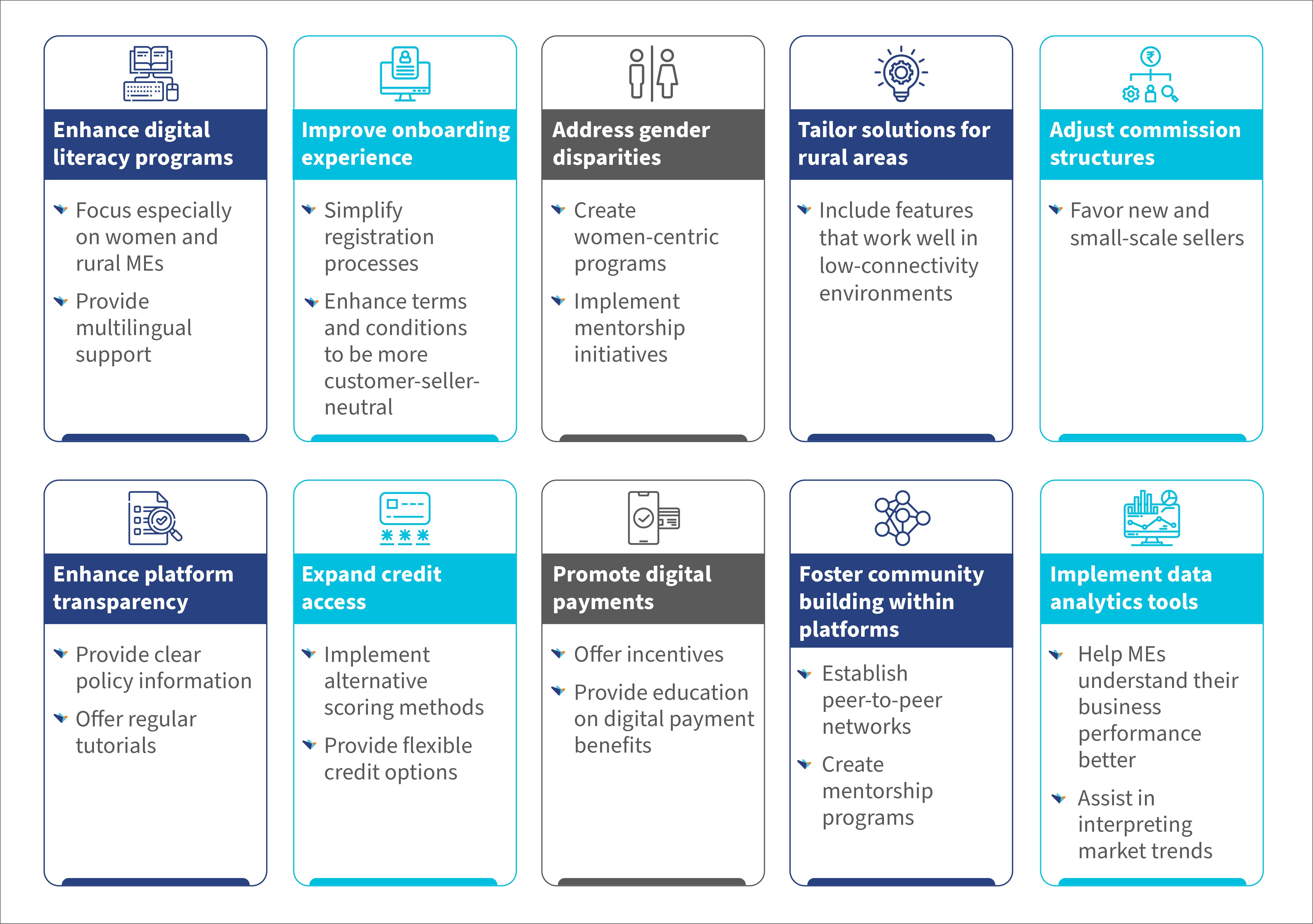

We propose several recommendations to empower microenterprises (MEs) further and increase the positive impact of digital platforms:

Digital platforms are indeed revolutionizing small businesses in India. They offer unprecedented opportunities for growth, resilience, and financial inclusion. However, the journey is far from complete. Significant disparities persist, particularly in terms of gender and rural-urban divides. Digital platforms’ potential to transform microentrepreneurs’ lives is immense. However, all stakeholders, including platform providers, policymakers, financial institutions, and support organizations, must make concerted efforts to realize this potential.

We can address the challenges and implement targeted support mechanisms to create a more inclusive digital ecosystem that empowers all microentrepreneurs, regardless of their location, gender, or digital proficiency. Microentrepreneurs can use digital platforms’ true potential if stakeholders employ mechanisms for MEs’ growth as the digital ecosystem grows.

*We have assumed a conversion rate of USD 1 = INR 84.08, as of October 2024

Written by

Naini Dahra

Assistant Manager

by

by  Oct 4, 2024

Oct 4, 2024 4 min

4 min

Leave comments