SureClaim: Assurance of insurance claims

by Mohit Saini, Anil Gupta and Anshul Saxena

Jul 11, 2019

4 min

Sureclaim came into being to bridge the persistent gaps between the insurance premiums that insurance firms collect and the claims they reimburse. The company works to ensure that customers from the low- and middle-income segments are able to get the maximum out of their insurance policies.

This blog post is part of a series that covers promising fintechs making a difference to underserved communities and supported by the Financial Inclusion Lab accelerator program. MSC is a partner to the FI Lab, which is a part of CIIE’s Bharat Inclusion Initiative.

| There is a huge gap between the premium collected and claims reimbursed in India. Indians are likely to spend an estimated INR 300,000 crore (USD 42 billion) in 2021 towards treatment expenditures, with the low and middle income (LMI) segments incurring a significant part of the expenses. How can these customers leverage their insurance policies to the maximum? |

There is a pressing need to orient many, like 32 million Employee State Insurance (ESI) beneficiaries, and assist them in filing and claiming the entitled reimbursement claims.

A few years ago, Anuj Jindal faced serious challenges while filing insurance claims for a family member. The troubled times made him wonder how other customers might be coping with similar issues. The numbers backed his doubts: as per FY 2016-17 data, under the ESI Scheme, the central government collected a premium of INR 14,000 crore (USD 2 billion) and paid around INR 6,000 crore (USD 857 million) to its beneficiaries. This gap between insurance premium collected and paid is a whopping 57%.

At the country level, insurance can help maintain healthy financial lives during adverse times, especially in the LMI segment. But the low penetration of insurance and the complex reimbursement process acts against the philosophy of hedging unknown risks. Together, these form an important barrier to onboard new customers.

Today millions of people in the LMI segment, including those under the ESI Scheme, need support in filing their reimbursement claims. SureClaim is here to fill the gap.

The pitch: Offering right insurance benefits to the right people

During a year-long in-depth field research, the team helped hundreds of patients in filing their claims. In doing so, the team realized that most people were willing to pay a fee, as the SureClaim service saved them precious time and effort. More importantly, the team minimized customers’ expenditure towards items that their insurance schemes covered – which customers were neither aware of nor apprised of by the insurance companies. As a result, the customers expressed a sense of gratitude towards the SureClaim team for their support.

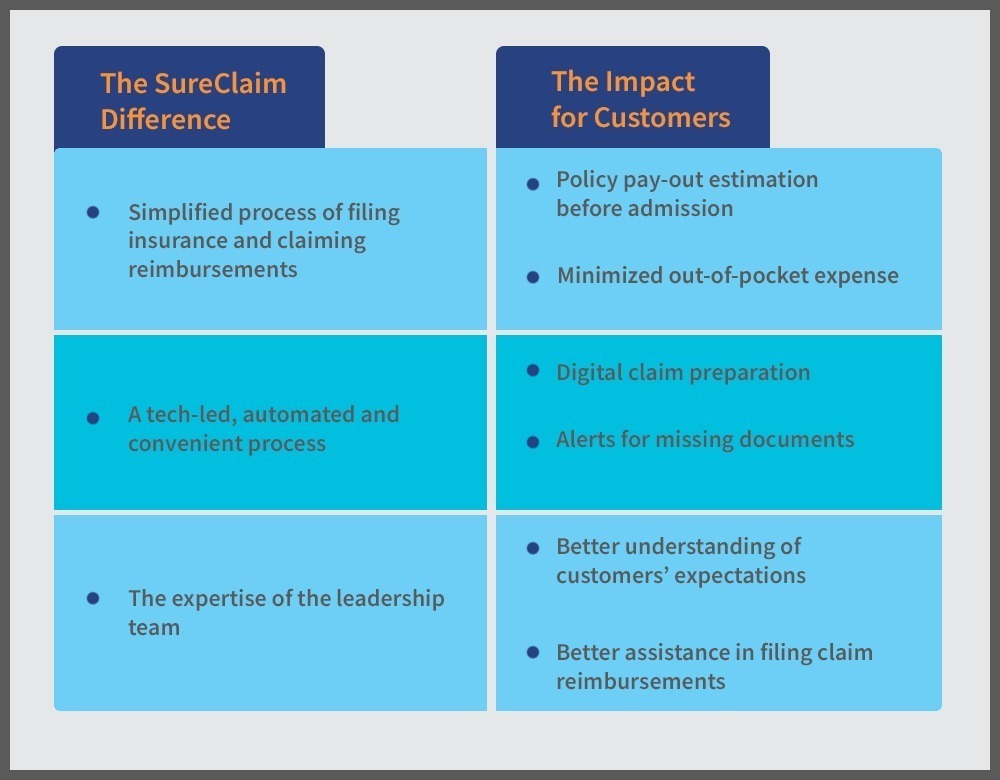

These research findings set the stage for SureClaim. The team validated that it was solving a crucial problem by helping people claim all that they were entitled to as per their respective insurance policies. So, SureClaim aligned its staff and core processes to optimize insurance-related benefits for its customers – a unique service not offered by many market players. The team also understood exactly what the customers expected from insurance claims. It further helped SureClaim to better assist its customers in filing claim reimbursements. Today, SureClaim takes pride in understanding claims better than most other market players.

The evolution: Overcoming roadblocks in the claim reimbursement proces

The Centre for Innovation Incubation and Entrepreneurship (CIIE) and MicroSave Consulting (MSC) organized boot camps, diagnostic sessions, and clinics to advise the SureClaim team to refine its strategies and address its challenges. The team also received intensive guidance from sector experts.

For SureClaim, streamlining its processes and scaling-up was key. Under the technical assistance (TA) component of the FI lab, MSC supported SureClaim to look at their current business as well as exploring a new segment of ESI benefits.

- MSC provided insights to SureClaim to identify the different areas of intervention during orientation and claim reimbursements. SureClaim understood that they had to build a robust partner ecosystem to fill the gaps, and design a scalable technological solution for their product.

- On ESI front, MSC helped the team to understand the current processes followed by employers to orient employees on the benefits of ESI, thus refining their product. SureClaim team also found that employees lacked knowledge about ESI benefits and the claims-filing processes for medical reimbursements. This led the team to realize that employers required support to address their pain points – highlighting the need to build a customer service desk to reach a wider audience.

Together, this helped SureClaim to enhance their business offerings and craft better communication strategies for their audience.

The future of insurance. Claimed.

SureClaim aspires to add more capabilities to its online claims platform. These capabilities will enable users to search for their policy benefits using simple, everyday terms. They will also be able to predict all their expenses specific to a treatment which would be covered by their policy. SureClaim also seeks partnerships with service providers and insurance intermediaries who wish to deliver better claim reimbursement experience to their customers.

By covering gaps in the processes, SureClaim ensures that due claims are reimbursed in time with minimal troubles.

Follow #TechForAll and #BuildingForBharat to stay updated on fintech start-ups driven to bridge the social, financial and economic inclusion gap.

by

by  Jul 11, 2019

Jul 11, 2019 4 min

4 min

Leave comments