Retail digital payments in India: A massive opportunity worth at least INR 45 billion (USD 608 million)

by Vishes Jena, Disha Bhavnani and Diya Chatterjee

Sep 26, 2022

7 min

This blog is the second in a three-part blog series. The blog highlights use cases where digitizing even a conservative 10% of the current cash-based transactions presents service providers with a supplemental opportunity worth more than INR 45 billion (~USD 608 million).

In recent years, India has experienced rapid growth in retail digital payments. In FY 2021-22, transactions conducted digitally increased from ~55.5 billion in the previous year to ~74.2 billion, aided by Unified Payments Interface (UPI) and the Aadhaar-enabled Payment System (AePS). The adoption of these products, coupled with people’s apprehensions about handling cash during the COVID-19 pandemic has pandemic has led to the inclusion of several first-time digital payment users. As the danger of the pandemic dwindled, these trends however showed no signs of stopping, resulting in an upward curve. However, several challenges hamper the user experience for digital payments.

Challenges related to the ecosystem

- Infrastructure challenges

The overall wireless teledensity[1] in India was reported at ~83.3% as of June, 2022. Yet it is much lower in rural India at only ~58.2%. Among barriers that prevent customers from adopting digital payments include low smartphone ownership and inadequate availability of the internet, with only 16% of rural and 45% of urban customers reportedly using the internet to transact digitally. The lack of appropriate infrastructure also means that the merchant ecosystem in many areas does not offer customers opportunities to pay digitally, which compels them to continue depending on cash.

- Product design challenges

Several digital payment solutions struggle at the product design stage to create intuitive and convenient modifications that are specific for user segments. The interfaces of payments services often have multiple steps for registration while only a handful of services are available in regional languages. Moreover, most products that use UPI solutions require certain prerequisites that prevent customers from adopting the product—both during onboarding and while navigating the product. These include a need for the customer to own a smartphone, email address, and active debit cards, among others. However, in 2022, NPCI launched UPI123Pay, allowing feature phone users to use the UPI platform. The launch of UPI123Pay points toward the further adoption of digital transactions in the countryside, where most citizens still do not own smartphones. UPI123Pay will make UPI accessible to a section of society so far excluded from the digital payment landscape—400 million[2] feature phone users. Last year, NPCI also initiated a new process to improve the onboarding mechanism to UPI. Based on this recent change, customers can be easily onboarded to UPI through an Aadhaar card and OTP instead of a debit card, which currently remains a prerequisite for making a UPI ID. This will greatly facilitate onboarding customers who lack a debit card, especially many PMJDY beneficiaries who have a bank account but have not been issued a debit card. Such developments will bring a transformative shift within this decade across the country’s digital payments ecosystem.

- Segment-related challenges

Payment products are characterized by their generic approach, which fails to serve the needs of all customer segments. The products tend to require customers to have some familiarity with digital payments. This causes exclusion among vulnerable customer groups, such as women and the rural population, who are often characterized by comparatively low literacy rates and lack of exposure to technology. Women in rural India are often secondary users of mobile phones, late adopters of technology and the internet, and excluded from having official government IDs, and therefore remain unfamiliar with digital payments.

There is still a long way to go, as service providers need to address the above gaps and improve the overall digital payment experience for all customers. In India, 80% of total consumer transactions still take place in cash, which highlights the tremendous opportunity for payment service providers to digitize transactions.

Opportunities to digitize payments and their market potential

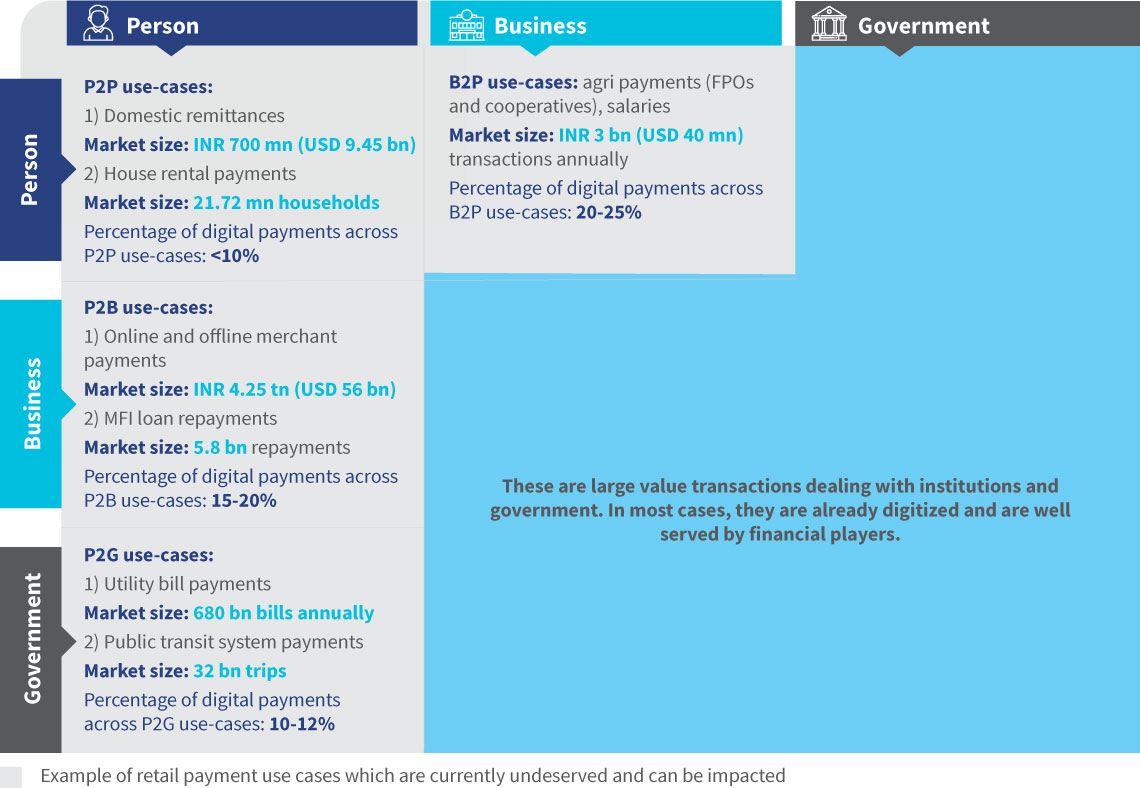

Figure 1: Opportunities to digitize critical payment use-cases in India

Based on the evolving customer behavior, we have used a 3X3 matrix[3] to analyze various transactions across several channels to assess their level of digitization. These channels include P2P, person-to-business (P2B), business-to-person (B2P), and person-to-government (P2G). This framework highlights the untapped market potential for each use case that offers service providers a chance to explore the ecosystem and make targeted interventions to boost the adoption of digital payments.

P2P use-cases (domestic remittances, rental housing payments):

Currently, P2P transactions comprise the most prevalent use-case in retail digital payments. These transactions range from splitting a dinner bill between friends, paying rent, monthly remittances, to paying for an auto-rickshaw ride. These transactions are being increasingly digitized through UPI or mobile wallets.

MSC estimates indicate that a market worth INR 900 billion (~USD 12.16 billion) can be potentially digitized by focusing solely on two promising use-cases that dominate the P2P channel—domestic remittances and house-rent:

- Migrant workers comprise the biggest share of remittance service users in India, accounting for domestic remittances worth INR 700 billion (~USD 9.45 billion). While 60% of such transactions happen through informal and often risky modes, it offers service providers a window to digitize remittance transactions worth more than INR 400 billion (~USD 5.4 billion).

- The booming rental housing market in the country tends to account for a large share of informal bill payments in India. Most house rental payments are paid in cash and some via bank transfers. The Economic Survey 2018-19 projects the urban population in India to rise to 600 million by 2031. Thus, a digital payment product that allows people to pay house rent offers a sizable opportunity for digitization.

P2B use-cases (e-commerce, micro merchant transactions, MFI loan repayments):

The P2B payments segment has been growing at a rate of 118% in the past five years and is set to grow up to USD 1.1 trillion by 2025. This could be achieved by improving the penetration of both offline and e-commerce merchants and increasing the propensity for cashless payments.

Today, many stakeholders, ranging from a street vendor to a supermarket, display a QR code at their sales counter. These trends can be replicated across other P2B use-cases. We highlight a few examples of online and offline merchant payments that offer a huge potential for financial service providers to digitize payments:

- 17% of e-commerce transactions in India are still conducted using cash-on-delivery. This creates the opportunity to digitize transactions worth INR 494.2 billion (~USD 6.2 billion). While a few service providers already use digital modes to accept payments at the customers’ doorstep, such solutions have limited popularity in capturing the cash-on-delivery market and gaining the customer’s trust to transact digitally. Digitizing even a small share of these transactions presents a huge opportunity to drive digital payments.

- Of the 63 million micro-merchants in the country, more than 90% deal exclusively in cash. Service providers have acquired around 10 million merchants, most of whom are in urban areas and do not fall into the category of micro-merchants. This has resulted in mainly rural merchants being left out of the reach of digital financial services, which presents a massive potential to digitize cash-based transactions worth INR 4.2 trillion (~USD 56 billion).

- Microfinance institutions (MFIs) in India account for over 34 million clients with an outstanding loan portfolio of INR 965.6 billion (~USD 13 billion). More than 95% of these loan repayments are made in cash. This highlights a potential to digitize around 5.9 billion transactions annually, which can become anchor use-cases for female borrowers and further drive digital payments for women in India.

B2P use-cases (payments for agriculture and allied sector inputs):

The agriculture and allied sectors in India offer the second-largest use-case under B2P after salary disbursements. According to MSC’s estimates, these sectors account for more than INR 3 billion (~USD 40 million) worth of transactions, only 20% of which has been digitized so far. With such a vast volume of financial transactions taking place, digitizing even a small share of the agri and allied sector can increase the digital transaction volume significantly.

P2G use-cases (bill payments, ticketed transportation):

The P2G channel consists of payments against government services, bills, and taxes, among others. As per MSC analysis, such payments add up to INR 36 trillion (~USD 486 billion) transactions, of which more than 80% are currently conducted in cash. While the government has been making several efforts to create simpler and more convenient platforms to collect payments, these are yet to gain popularity with the masses. The two most significant use-cases in this category are utility bill payments and transport payments:

- As per MSC’s estimates, recurring utilities make up 72 billion bills in India, out of which 70% are paid in cash. Owing to the COVID-19 pandemic and resultant lockdowns, Bharat Bill Payment System (BBPS) could consolidate most of India’s recurring bill payments industry under one payment system. However, several barriers such as lingering preference for cash, limited awareness of BBPS, and the perception of BBPS as a costly solution, hinder the potential of BBPS for massive adoption.

- Indians make 88 million trips each day via public transport, while also using other means including auto-rickshaws and cycle-rickshaws, among other modes. Though the numbers might be skewed owing to travel restrictions brought about by COVID-19, it still holds a significant opportunity for stakeholders to digitize millions of ticketed transactions.

Way forward

We estimate, digitizing even a conservative 10% of the cash transactions above presents service providers with a massive opportunity worth more than INR 45 billion (~USD 608 million). Currently, digital payments are characterized by a one-size-fits-all approach, which needs to change. Our next blog in this series emphasizes solutions that can not only resolve some of these challenges but will also drive the next phase of digital payments.

[1] Number of telephone connections for every hundred individuals in a specified geography

[2] Times of India. “Explained: What is 123PAY and how you can use it to make UPI payments without internet connection.” timesofindia.indiatimes.com. March 9, 2022, Accessed June 22, 2022. https://timesofindia.indiatimes.com/gadgets-news/explained-what-is-123pay-and-how-you-can-use-it-to-make-upi-payments-without-internet-connection/articleshow/90090779.cms.

[3] Based on the Better Than Cash Alliance (BTCA) payments grid

by

by  Sep 26, 2022

Sep 26, 2022 7 min

7 min

Leave comments