Re-thinking MFI Operations using Mobile Technology

by Jitendra Balani and TVS Ravi Kumar

Nov 24, 2015

4 min

The authors describe why evidently, time is ripe for micro-finance Institutions in Indonesia to leverage technology and take their operations to the next level.

In Indonesia, microfinance is offered by a variety of institutions, namely credit and savings cooperatives, BPRs/rural banks, venture capital firms, rural branches of commercial banks and informal village banking institutions. Despite this, only 36% of the total population above 15 years of age has access to formal financial services. This indicates that there is a huge untapped market wherein MFIs could reach out to those financially excluded from formal financial services. MFIs could do so more efficiently using the technology and, particularly, digital financial services. And this could be instrumental in increasing financial inclusion.

The microfinance sector in Indonesia continues to lag behind countries like India, Kenya and the Philippines in leveraging technology to optimise operations. The back office core banking solution or the information system used by MFIs to manage and track client-level transactions and financial accounting are often working fine, but the front end typically remains paper-based. MicroSave, which has worked with more than 30 of the leading MFIs in Indonesia, has found that very few of these MFIs used front-end technology, with the exception to update their regular repayment transactions.

Front-end technology includes the use of a hand-held device/mobile/tablet to digitise the information flow and update the records directly into the core banking solution. These devices are loaded with CRM (Customer Relationship Management) solutions — a system for managing a company’s interactions with current and future customers. It often involves using technology to organise, automate, and synchronise sales, marketing, customer service and technical support. MFIs have used CRM solutions to manage the entire customer life cycle right from acquisition to post disbursement servicing, all on a single platform. Most of the CRM solutions available in the market are built on an android operating system and are more user-friendly and intuitive for field staff such as loan officers and branch managers.

The figure below shows a few common functionalities which a financial CRM can offer to an MFI. (This is not an exhaustive list of functionalities and there could be many more such as analytics, etc., which can be offered by a financial CRM):

Financial CRM for MFIs

Lead Generation

|

Lending Platform

|

Loan Utilisation Check and Monitoring

|

Loan Repayment

|

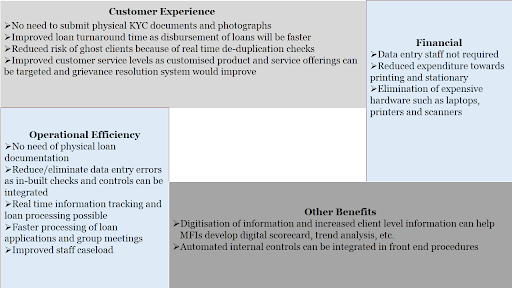

MFIs can garner the following advantages by using mobile technology:

*Above figure has been adapted from MicroSave’s DFS for MFIs Toolkit and Accion’s Case Study on Digital Field Applications

The adjacent figure shows an example of how a front-end procedure of client sourcing/loan origination will look like after adapting to mobile technology.

The benefits listed above and with the ease of processing as shown in the adjacent figure clearly demonstrate that by using mobile technology, MFIs would not only be able to streamline their operations and reduce redundant manual work flows but would also be able to increase the access to and quality of financial services.

In India, most of the medium-sized and big financial institutions have already started rolling out such technology.As highlighted in a case study on digital field applications published by Accion, Ujjivan, one of the largest MFIs, has been able to improve its staff caseload efficiency by 34% after adapting to front-end technology. Similarly, in Kenya, Musoni was able to reduce loan processing time from 72 hours to just 6 hours.

For more details, we encourage you to watch a video of Musoni. Musoni has embraced technology in every aspect of its operations. The MFI uses M-PESA to transfer cash into the mobile wallets of customers.

While the benefits are quite evident, MFIs must carefully consider the following issues before venturing into a new technology-enabled provision of financial services:

- The strategic objective of using the new technology should be clear to the management as well as all the staff of an MFI

- The MFI’s existing core banking system must enable integration with the CRM module – particularly where the CRM module is supplied by a new vendor

- The market environment and infrastructure (including mobile penetration and connectivity, field staff literacy levels, etc.) play a critical role in choosing the front-end technology and the user interface

- The reliability of the CRM technology to not only handle the current scale of transactions but also an expected growth in the medium term

Evidently, time is ripe for MFIs in Indonesia to leverage technology and take their operations to the next level. MicroSave, with the support of MetLife Foundation, conducted a training in Indonesia on the use of DFS. The training covered a breadth of issues that will help interested MFIs to craft robust strategies in enhancing their financial services. We are keenly looking forward to working with several of them to implement these initiatives.

Written by

by

by  Nov 24, 2015

Nov 24, 2015 4 min

4 min

Leave comments