Postal banks: A stepping stone to the formal financial system?

by Disha Bhavnani, Manali Jain and Mitali

Sep 20, 2022

6 min

This blog is part 1 of a two-part series. The blog highlights the immense potential of postal banks to spearhead financial inclusion. It covers parameters that financial institutions, including postal banks, should address to serve low- and moderate-income customers effectively. We look closely at the challenges postal banks face across the globe and how they manage them. We highlight approaches and practices that can guide postal banks in their journey of innovation and mission to improve the lives of the unserved—especially in emerging and transitioning economies.

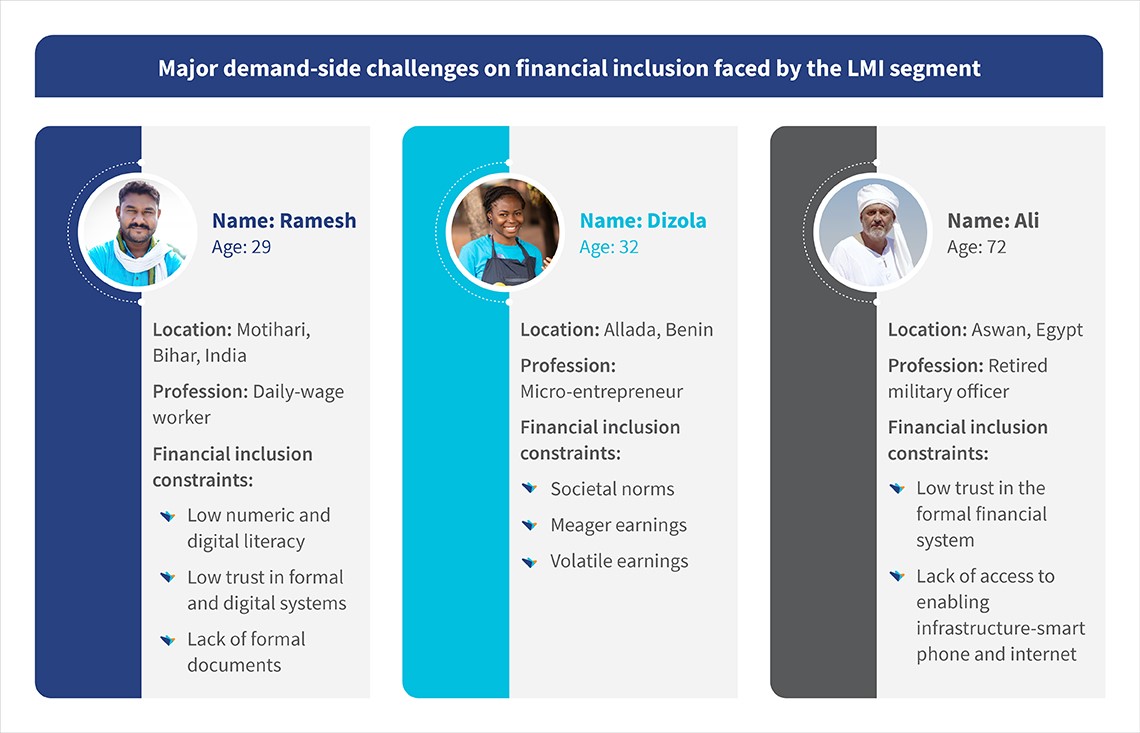

Ramesh, a daily-wage worker from Bihar, India, can send money easily to his family with the help of postal workers. Ali, a retired military officer from Aswan, Egypt, no longer has to queue outside any government offices to receive his social security payments. He can withdraw money easily from any Egypt Post ATM or POS-enabled post office with zero charges. Dizola, a micro-entrepreneur from Allada village, Benin, can conduct digital transactions through his postal account, even on his feature phone.

What common thread binds the lives of these people? The answer is the role the respective postal networks in their countries play to spearhead safe, affordable, and convenient customer transactions.

Worldwide, around 1.5 billion people access formal financial services through postal banks. Most belong to the low-and-moderate-income (LMI) segment. Postal banks have immense potential to push financial inclusion across the world. Since their conceptualization in 1861, postal banks have grown multifold in terms of their reach and financial offerings to bring last-mile customers into the fold of inclusion. Through their vast network of postal agents, postal banks are strategically well-placed to support universal financial inclusion, especially for the low- and moderate-income (LMI) segment. These postal agents mainly belong to the same communities as their customers and thus command high trust and approachability.

Research by the Universal Postal Union (UPU) highlights that postal banks worldwide have driven inclusive growth by providing financial services through 1.4 million postal agents and 2 million physical touchpoints. However, operational and regulatory limitations prevent postal banks from realizing their true potential to serve last-mile customers adequately.

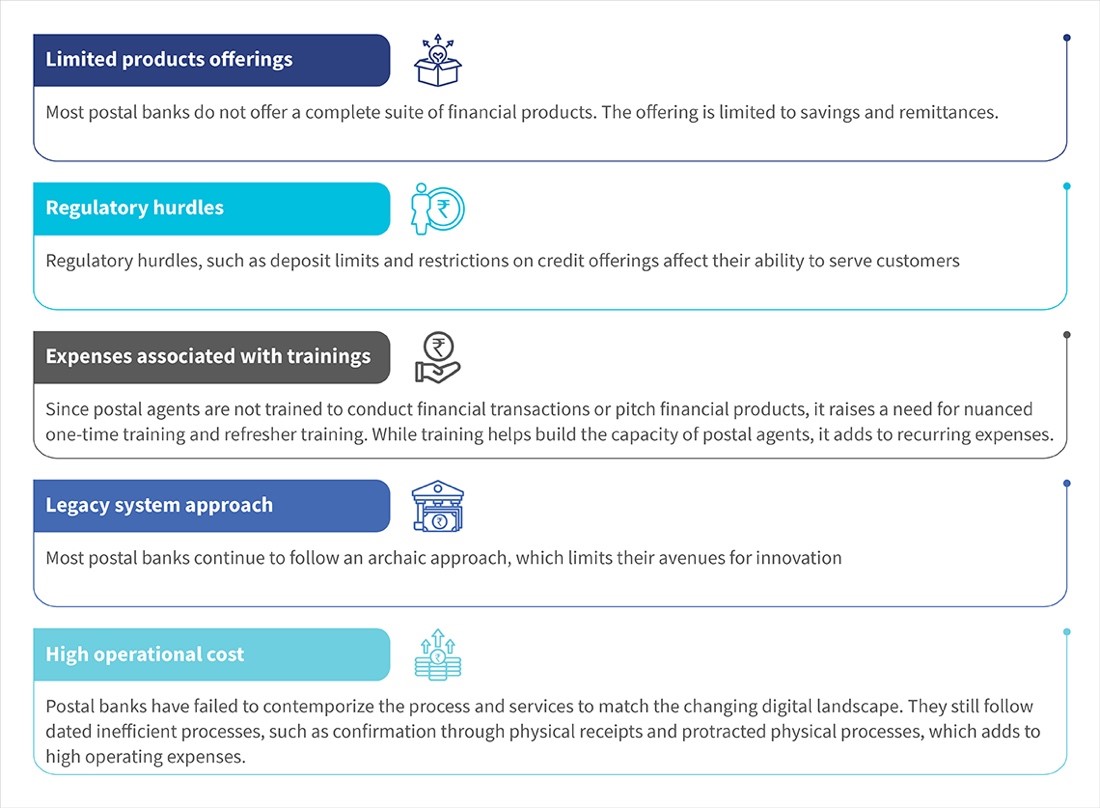

Predominant supply-side challenges faced by postal banks across the globe

Demand-side constraints including limited literacy, lack of formal documents, and lack of awareness about the formal financial channels, further exacerbate the situation. As a result, financial institutions, including postal banks, struggle to cater to LMI customers. Postal banks must now transform themselves to cater to their existing and potential customer segments against the backdrop of the changing financial service ecosystem and evolving needs of customers like Ramesh, Dizola, and Ali. The graphic below spells out some demand-side challenges:

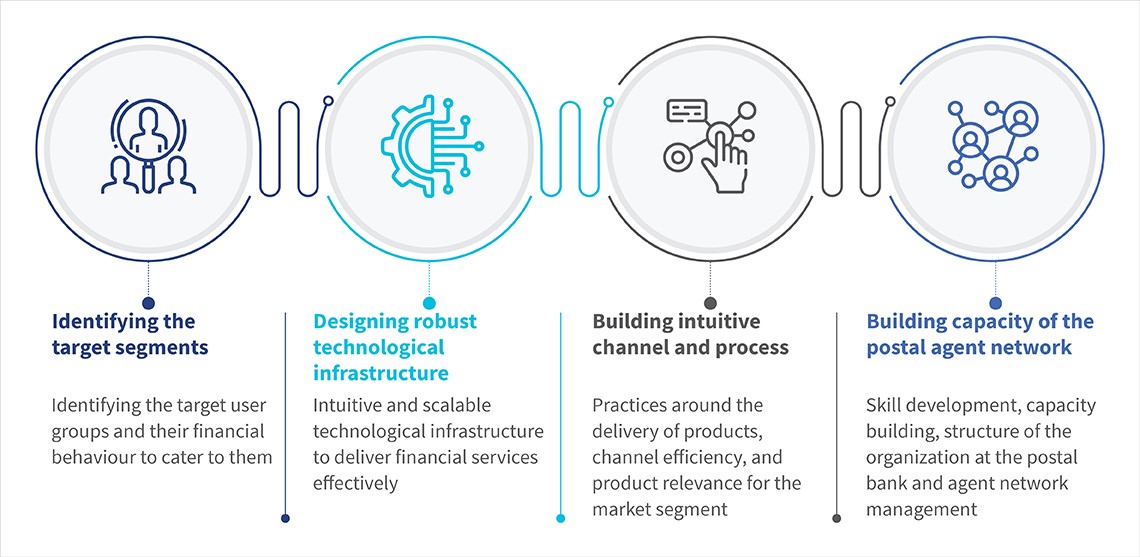

We have used the 2T2P: Target segment-Technology-People-Process approach to assess and suggest how postal banks can optimize their business operations, serve the target customer segments, and transform digitally to survive and thrive in the diverse ecosystem of financial services.

1. Target segments: Identify the right user base for the services

The customer comes first. Over the years, we have seen a major shift in customer behavior and expectations. This change has compelled financial institutions, including postal banks, to redefine their priorities to meet evolving customer needs. The postal banks must first understand the target segments to provide them value.

Profile customers: Capturing the customer lifecycle with data on financial behavior can help postal banks offer customized products, predict the need for different products, use their channels efficiently, and unlock new opportunities in the space.

Focus on advanced use cases: Emerging technologies can potentially offer advanced use cases for digital financial services. The emergence of big data has enabled different approaches to credit scoring, allowed providers to cross-sell and upsell products and services, and enabled the addition of new use cases. Postal banks are well-suited to use their existing database to provide financial services to underserved populations.

2. Technology: Achieving scale through intuitive tech infrastructure

Technological progress is transforming the financial services ecosystem globally, which can help postal banks build an efficient business model over time. Postal banks worldwide struggle with legacy systems and the inability to innovate fast. Postal digital transformation cannot take place by simply layering technology over legacy systems. It requires the creation of modular tech infrastructure and an easy-to-use interface that target segments will find intuitive and convenient. Once such upgrades are implemented, postal banks can scale and use data to advance their customers’ digital finance journey.

Build an intuitive frontend interface for customers: A user-centric platform is essential to facilitate usage and enhance customer experience. Since LMI customer segments have limited digital literacy, postal banks must build intuitive and easy-to-use solutions in regional languages with voice-assisted modes. These users have not experienced financial services on smartphones. The frontend customer interface must therefore be intuitive, with ample handholding to boost customer confidence and trust in digital transactions.

Develop a scalable infrastructure at the backend: Postal banks must use technology to implement new services and diversify into new business models to scale their services. Their core architecture must include digital innovation, e-commerce, data collection, API development, and digital identity. This inclusion will enable postal banks to propose new services, increase efficiency using technology, drive innovation and agility, and improve resilience and scalability.

Ecosystem enablement—API-driven open architecture approach: Postal banks can build strategic partnerships with emerging FinTechs and other institutions to provide products on demand through open APIs. This will help customers access multiple solutions through postal banks. It becomes a win-win solution for FinTechs and postal banks, which they can use to build competitive advantages and drive financial inclusion.

3. Process: Building efficient processes and operational models to deliver relevant products to specific segments

Customers prefer a bank that understands their needs, offers suitable products, maintains transparency, offers simple and streamlined processes, and is approachable. With an expanding internet and smartphone user base across markets, postal banks can offer many services at low costs efficiently through digital and non-digital channels. However, postal banks need to combine an all-digital experience with a human touch to cater to people at the bottom of the pyramid.

Build a “phygital” operational model and processes to deliver relevant products and services to the last mile: Most postal banks have a significant physical presence that they can use to serve customers better. Depending on the existing bank structure, postal banks can gradually move to a digital-led operational model where their postal agents serve customers using digital devices. Many postal banks can take a phase-wise approach to roll out the services and move gradually from an assisted model to a self-service mode. This way, they can still keep features like doorstep delivery that add to the convenience of the customer segment, and take digital financial services to vulnerable segments, such as pensioners and rural women.

Use the trust in the post’s brand and network to add new financial and non-financial services: Most customers trust their postal banks. Postal banks can use this implicit trust to add new value-added services based on the lifestyle needs of customers, who otherwise largely remain unserved and underserved by incumbents in the ecosystem. They also offer a really important opportunity for G2P (government-to-people) payments, as postal banks typically have significant outreach into the vulnerable and remote communities targeted by G2P programs.

4. People: Developing capacities of the agent network and staff within the organization

Postal banks reach and serve customers at scale through their vast distribution network. Evolving customer expectations and technology make it essential for postal banks to recognize the emerging needs of their customers and build a skilled workforce that caters to their specific target segments. A major struggle for postal banks is achieving a sustainable business model while developing their network capacity.

Build capacities and skill sets of postal agents to deliver digital financial services: Traditionally, the role of a postal agent is limited to mail delivery services, and they are not accustomed to using digital devices for operations. Transitioning from a mail carrier to a financial inclusion enabler requires nuanced training. If postal agents wish to develop their skills, they must receive training at regular intervals with hands-on experience. They can then serve customers better.

Acquire strategic leadership and enhance the existing team’s skills with a focus on innovation with better product design and delivery: Postal banks need leadership teams that understand tech-based solutions of FinTechs and know about the operations of traditional banks. A combination of the two will help them select the right partners to drive innovation in postal banking and expand their business. They can then sustain their digital finance ambitions with a clear vision, strategy, and roadmap in-house.

Conclusion:

Research suggests that households and businesses with access to formal financial services can respond better to financial shocks. Postal banks, alongside other financial institutions, continue to make efforts to reach the 24% of people worldwide who still lack a bank account. The assisted banking approach, and technology-based solutions offered by postal banks, coupled with their vast network, show a high potential to serve millions of underserved customers like Ramesh, Ali, and Dizola.

The following blog in this series captures lessons from postal banks spread across our 2T2P model, which highlights how some postal banks can serve the excluded.

by

by  Sep 20, 2022

Sep 20, 2022 6 min

6 min

Leave comments