Piloting smart payments for Odisha’s special schools

by Diganta Nayak, Ritika Singh and Vikram Sharma

Apr 15, 2024

6 min

This blog explores the transformative potential of digital innovations to improve the efficiency of public expenditure in particular and strengthen public finance management (PFM) systems in general. In early 2021, MSC worked with the Government of Odisha under its digital PFM project on public finance reforms in the grant-in-aid (GiA) program for special schools that impart education to children with disabilities.

The blog outlines the challenges in the program’s process, payment, and workflow. MSC proposed and designed a smart payments system (SPS) that is pivotal to revolutionize PFM based on a diagnostic study. It would promote fiscal prudence and overall accountability in the system.

Transforming PFM through digital innovation

The government’s commitment to social schemes, particularly in education, is crucial for boosting citizens’ productivity and economic well-being. For instance, in India the year 2023-24 saw the sector receive its largest budget allocation of USD 15.5 billion (INR 1.20 lakh crore). Special grants for schools, linked to specific outcomes, exemplify this commitment. However, merely promising these grants is not enough to achieve the desired outcomes; effective fund flow and program management are essential. Digital solutions have emerged as a critical tool to enhance accountability and transparency. They can help modernize public finance and strengthen overall governance to safeguard the interests of taxpayers and beneficiaries alike. This blog, in our digital smart payments series, highlights technology’s reassuring effect to strengthen public finance management (PFM) systems in general and improve public expenditure’s efficiency in particular.

MSC seeks to solve challenges in the PFM landscape through the design of specific digital tools based on PFM principles of observability, single source of truth for data, digitization of inputs at source, and demonopolization of access to services. Once deployed, these tools will enable rule-based processing of payments and the “just-in-time” (JiT) release of funds. Thus, it would enable frictionless payment processing and real-time use of funds for any government program.

Case of fund management for special schools: The diagnosis

In early 2021, MSC worked with the Government of Odisha’s (SSEPDD) on public finance reforms under its digital PFM project. The department executes a grant-in-aid (GiA) program for schools that impart education to children with special needs. Under this program, SSEPDD provides funds to the schools under three major heads: (a) maintenance for residential and non-residential students; (b) salaries for teaching and non-teaching staff; and (c) other grants, which it receives in two tranches over a financial year. Under its GiA program, SSEPDD supports 6,815 students across 104 schools in Odisha with a total budgetary outlay of USD 5.9 million (INR 49 crore).

MSC assessed the program across special schools in four cities: Bhubaneswar, Bayalish Mouza, Nimapada, and Sunakhala. The diagnostic assessments covered the fund flow system, program processes, existing IT systems, and payment processing lifecycle. Some major challenges identified during the assessment are as follows:

- Friction in fund flows: The program faced issues related to delays in payments to vendors and teaching staff. As a result, the funds often remained unspent in the special schools’ bank accounts. Further, the Integrated Financial Management System (IFMS) could not track the expenditures incurred, and SSEPDD had limited visibility into the use of school funds. This was because the funds under GiA were disbursed from the state treasury to bank accounts of special schools that lie outside the government ecosystem.

- Poor visibility of staff attendance: The program lacked the provision to capture attendance on a single window portal (SWP) due to which schools had to manually record attendance data. This led to delays in the submission of staff absentee statement into the state’s human resource management system (HRMS).

- Poor vendor management: The lack of a vendor management module in the SWP led to manual systems to receive and approve invoices, record, and report expenditures, which led to delays in vendor payment processing.

- Administrative burden on officials: The program had a low monitoring capability across the payment lifecycle. It also had to release funds manually through biannual tranches. This made it difficult to trace the fund usage and increased the administrative burden on the District Social Security Officer (DSSO) and other officials.

- Lack of database integration: A lack of integration between different systems, such as HRMS and SWP, resulted in slow verification of important information.

From diagnosis to action

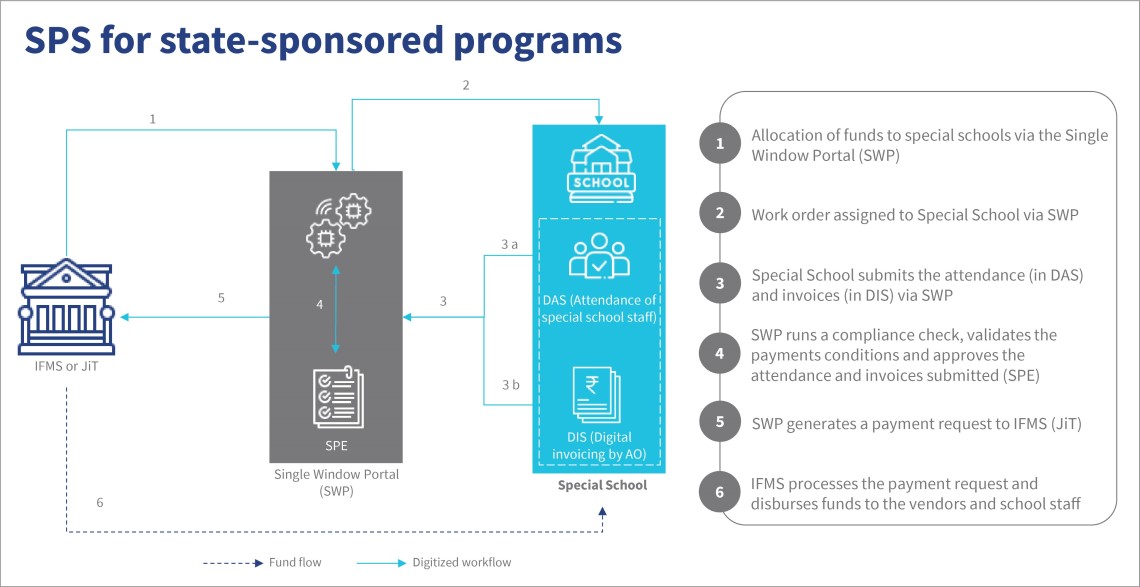

A solution was needed to enhance the functionality of SWP to support attendance tracking and vendor invoices. It was also necessary to streamline the fund flow from the treasury to schools and improve the monitoring capabilities of SSEPD. A smart payments system (SPS) provided such a fix. This new system would serve as an interface between the SWP and IFMS, which is Odisha’s IT-based financial management, budgeting, and accounting system. The SPS would consist of three components:

- Digital data capture system (DDCS): This system will create a digital layer on top of SWP and will have two sub-components:

- Digital attendance system (DAS) – to record the attendance of full-time staff serving as an input to calculate the monthly salary expenditures

- Digital invoicing system (DIS) – to generate digital invoices for non-salary expenditures, such as fees for part-time teaching staff, medical expenditures, and vendor payments for uniforms, groceries, fuel, and incidentals.

- Just-in-time (JiT) funding system: The JiT funding system will enable pull-based fund disbursement directly from the treasury into the school vendor’s bank accounts. It will assign virtual spending limits (similar to a credit card instead of actual fund transfer) as ‘authority-to-pay’ to schools, allowing them to pull funds in real-time as needed. The Finance Department has already built the JIT systemand integrated it with the IFMS. This system can allocate funds to respective DSSOs, who will then distribute it to the schools under their administration. It will also validate payment requests based on predefined conditions to disburse funds.

- Smart payments engine (SPE): It is a rule-based system that will integrate SWP and JiT systems. It will validate all payment conditions based on predefined rules as per the program guidelines to generate payment requests, send them to the IFMS, and disburse funds to the vendors and school staff.

MSC designed an SPS, that would enable the digital submission of monthly attendance records, generate vendor invoices, and expedite payment requests based on pre-approved rules and conditions. This way, it strengthens the current system SWP and IFMS. Refer to figure 1 below for an overview of the SPS.

Figure 1: Overview of the proposed smart payments system

At the process level, the solutions included digitization of all relevant documents, automation of procurement processes, digitization of inputs at source, and changes in the program workflows. Critical design elements that were considered while reengineering the process are as follows:

- Creation of a single source of data for the program: This sought to establish a single source of accurate information for all aspects of the program. It included special school details, staff assignments, vendor contracts, DSSO details, fund allocations, and payment records.

- Automatic payment processing: This was meant to ensure prompt and efficient fund disbursement to beneficiaries as per predefined processing rules. For instance, attendance details and staff absentee statements would be automatically submitted on each month’s last working day to facilitate salary payments. This will eliminate the time delays and reduce the administrative burdens on the school staff and SSEPD officials.

- Facilitation of machine-to-machine data exchange: This was intended to facilitate smooth data access across systems via defined protocols and integrated APIs. This step allows systems, such as the school’s SWP and the state’s HRMS and IFMS, to communicate effectively. It would enhance fund flow monitoring.

- Digital processing of program workflows: This sought to achieve digitization at the source. Function-specific IT solutions were developed, which included mobile apps for staff attendance, vendor onboarding, and digital invoice submission.

While JiT is already built and integrated with the IFMS, the progress on SWP enhancements is underway. MSC has proposed, developed, and deployed a robust SPS under MUKTA, Odisha’s urban wage employment program, in collaboration with partner organizations. We developed the SPS based on the lessons from the case of fund management for special schools. MSC has been working closely with the Government of Odisha’s Housing & Urban Development Department (H&UDD) and other stakeholders to implement a pilot on SPS in Odisha’s urban local bodies (ULBs). The initial results from the pilot have been promising – there is a complete elimination of float, with a 57% reduction in payment delays to beneficiaries, and a considerable reduction in the administrative burden on officials (reducing days taken for approval from 16 to 5 days, and eventually to 3 days.

A revolution in the PFM landscape through smart payments innovation

The smart payments solution streamlines payment processing, ensures fiscal prudence, and saves significant time and cost for the government once deployed, as highlighted by the results of the pilot. The SPS would facilitates observability, reduces administrative burden, and, most importantly, reduces friction in government fund transfers.

The smart solution could work in tandem with the government’s unique disability ID project to effectively manage programs for persons with disabilities based on the principle of a “single source of truth.” Over the medium term, we expect smart payments to become the cornerstone of the highly accountable and streamlined public fund management system.

by

by  Apr 15, 2024

Apr 15, 2024 6 min

6 min

Leave comments