This blog is a part of a COVID-19 research study conducted under the Financial Inclusion Lab accelerator program. The lab receives support from some of the largest philanthropic organizations across the world, including the Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

The Indian FinTech market grew by 20% between 2017 to 2021, and is currently valued at USD 50-60 billion (INR 3.7-4.4 trillion). FinTechs have played a pivotal role in transforming the Indian economy in the past decade. Their digital and tech-based solutions have overhauled the financial services industry and driven financial inclusion. The onset of COVID-19 in 2020 affected the growth of these FinTechs—some of them thrived, while others struggled. Many FinTechs found it challenging to interact with prospective users, investors, or active customers in the field due to lockdowns and social distancing mandates. Despite these obstacles, the valuation of FinTechs in India could rise to USD 150 billion (INR 11.1 trillion) by 2025 with appropriate investments, regulatory policies, and customer usage.

COVID-19 and its impact on the Indian FinTech ecosystem

The pandemic has been a double-edged sword for the Indian FinTech ecosystem. While substantial investments nourished some FinTech businesses, others struggled to stay afloat with limited resources at hand. The following infographic depicts the major areas of impact for FinTechs, as detailed in our recent report.

Figure 1: Major areas of impact on FinTechs

A surge in savings boosted the growth of wealth-management FinTechs

Uncertainties during the pandemic affected the financial stability of low- and middle-income (LMI) Indians—the unemployment rate shot up as work became irregular and salaries insecure. The lack of a safety net pushed the LMI segment further to the brink. As interest in deposit products increased, the younger generation looked for new avenues to park their savings with a focus on flexibility and minimal procedures. The increase in awareness around savings enabled saving- and investment-based FinTechs to realize higher revenues. Buoyed by the change in customer behavior, funding in this sector of FinTechs saw an upward trend.

Liquidity crunch for credit FinTechs

Amid multiple lockdowns and economic instability, the incomes of retail customers and small businesses dropped, which made it challenging for these borrowers to repay loans. The moratorium announced by the Reserve Bank of India and an increase in delinquencies lowered the revenues of credit FinTechs, and some of them had to shut shop. This also affected investor sentiment—they became more cautious and focused on larger FinTechs with sustainable and proven business models.

Expansion of InsurTechs due to the jump in demand

The demand for insurance solutions leaped as customers sought more insurance cover, yet preferred entirely digital policies to reduce the risk of infection. InsurTechs launched products customized to COVID-19 to capitalize on this massive demand for pandemic-related health covers. They deployed data and analytics to craft customer-friendly, bite-sized solutions that became popular in 2021. Funding deals from investors also increased due to this pandemic-led growth in insurance penetration.

Multifold growth for digital payment FinTechs

The growth of digital payments accelerated in 2020 and 2021, as more people switched to contactless modes of transactions. UPI-based transactions shot up by 71% year-on-year in December, 2020, with the three largest players—PhonePe, Google Pay, and Paytm—commanding more than 90% of the market share. This growth of payment FinTechs symbolizes the new normal in India, where digital transactions have been replacing cash-based payments rapidly. As several mature payment FinTechs attracted strategic investments, their focus remained on enhancing the product experience with digital transformation.

How FinTechs coped with the challenge of COVID-19

Most FinTechs across various sub-sectors used the crisis to re-think and re-emerge with better business strategies. While the business model and customer segment influenced their recovery strategies significantly, we noticed five consistent strategies that FinTechs used to survive and sustain in the new normal – see Figure 2.

Figure 2: Coping strategies of FinTechs

FinTechs have made enhanced their digital engagement. For example, many FinTechs now use remote communication tools to interact with stakeholders, such as employees and investors, and WhatsApp or SMS-based messaging for customers. Though customer lifecycles are largely digital, most platforms look to digitize them further. As our study observed, customers now prefer using digital channels to interact with platforms due to the convenience and promptness of these solutions. FinTechs have adapted to this change by replacing field-based customer touchpoints with virtual support assistants on their platforms, to enhance customer experience and streamline their operations.

With the shift in customer behavior, FinTechs have also diversified their product range to attract new customer segments. Platforms have begun to offer products that are customizable at the user’s end for wider outreach and made their platforms more inclusive. Some InsurTechs now offer “bite-sized” insurance products at USD 5.4 (INR 396) per year. Similarly, credit FinTechs pushed the idea of “buy now pay later” for digital transactions.

While designing new products, FinTechs have been using data to deliver customer solutions more efficiently. They use multiple data points and intricate algorithms to determine the financial behavior of their customers. Some credit FinTechs even use psychometric analysis to identify repayment behaviors of prospective borrowers.

Dedicated efforts along with the ability to adapt and innovate in these difficult times have positioned FinTechs well to tackle new challenges.

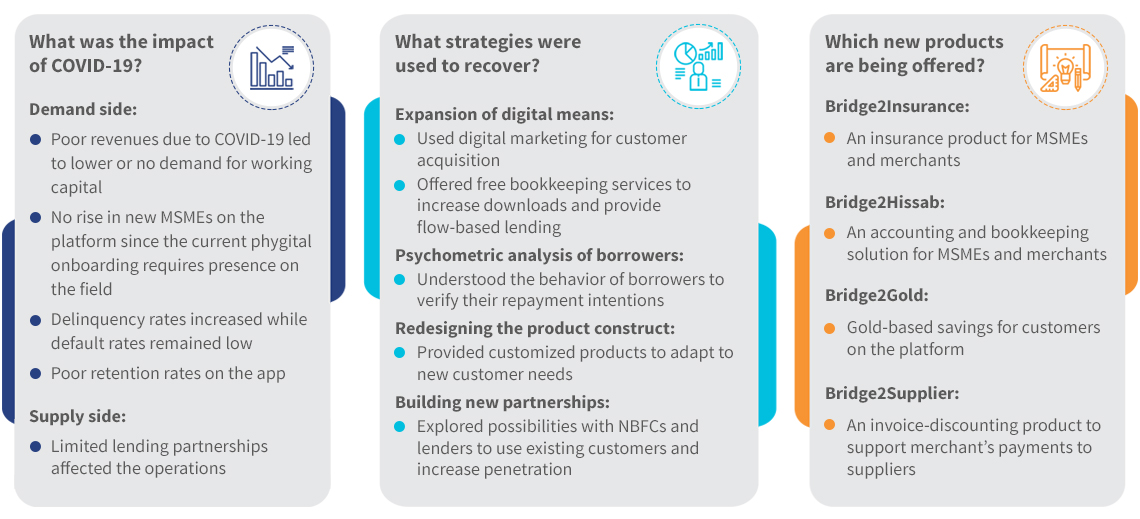

Figure 3: A snapshot of Bridge2Capital, a FinTech case study in our report

Supporting FinTechs for a brighter future

FinTechs have come a long way since the pandemic struck, but they still need the support of stakeholders in the ecosystem to continue to grow. Even as existing FinTechs struggled to adapt to the new normal, new ones were set up to address the needs of various customer segments. Though such FinTechs are well-oriented to serve customers through their digital platforms, they struggle with market knowledge, logistics support, and funding. These FinTechs, in particular, need support from regulators, accelerators, and investors to help them reach customers and deliver services. Here are a few recommendations for stakeholders to support the growth of FinTechs, as detailed in our report.

Ease regulations and compliances: As per our study, FinTechs struggle with regulatory requirements and processes. This is mostly due to a lack of clarity in the public domain on how government regulations affect organizations, and how they can furnish the required information to regulators. In the age of digital solutions, FinTechs still need paper-heavy processes to start their businesses and face procedural hindrances. We still see the prevalence of archaic systems such as sending cancelled cheques to regulators at the time of registering a business, as well as long wait times on hearing back from authorities.

Improve the dissemination of information on policies: Most start-ups lack clarity on how to apply for stimulus packages from the government. Policymakers should clearly communicate the procedure and eligibility requirements for availing micro, small, and medium enterprise (MSME) stimulus packages on official websites and social media channels. This will clear up existing confusion and reduce the time for FinTechs to receive grants and stimulus packages.

Prime and accelerate FinTechs for the future: FinTechs need guidance on marketing, customer and business strategies, and business management planning. Most first-time FinTech founders are young and need support to scale up operations. COVID-19 has aggravated this existing challenge. Accelerators should help create a comprehensive understanding of current market trends and changes in the ecosystem to support start-ups.

Though 2020 presented many challenges for FinTechs, it also taught them valuable lessons. Most FinTechs struggled to adapt, and not all of them survived. The newfound stability of organizations that managed to find their feet will last well into the subsequent waves of the pandemic. Their understanding of the new market climate will help them engage new customer segments and address gaps across the market. 2021 has already started to witness increased interest from national and international investors, which is a positive sign for the FinTech ecosystem. The period between the first and second waves of the pandemic has helped FinTechs observe market and customer trends, and prepare their business plans accordingly.

As 2021 progresses, we expect new products that address the needs of consumers to enter the market. Addressing the unique needs of niche segments as well as increasing convenience, FinTechs are revolutionizing the way Indians access financial services and driving financial inclusion. Though the pandemic disrupted some of their plans, these disruptors are here to stay and grow. As FinTechs recover from the impact of the second wave, we look forward to positive changes in the coming months.