In collaboration with L-IFT, MSC has been running the Corner Shop Diaries Project, which involves research using the Financial Diaries methodology. Based on an analysis of six months of global diaries data through a gender lens, this slide deck explains significant differences between men-run and women-run enterprises. It further discusses the role of social norms and what is needed to reimagine how we examine women-run businesses.

Why should salaries be monthly when expenses are daily? Welcome, FlexiSalary!

This blog is about a startup under the Financial Inclusion Lab accelerator program, which is supported by some of the largest philanthropic organizations across the world – Bill and Melinda Gates Foundation, J.P. Morgan, Michael and Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

Startups are rarely known to follow conventional wisdom. They believe in turning any traditional business model on its head. Shantanu Singh and Eral Ravi also did something similar when they decided to transform their childhood friendship into an entrepreneurial partnership. Both come with 18+ years of consulting and practice experience human resources and have a strong understanding of the market forces in this domain. The third co-founder, Aashutosh Chaudhary joined them as a developer when they were building their first startup, Unnati Online—a recruitment technology company—and ultimately rose to become a co-founder and CTO at Flexi Salary.

When it all began

The genesis of Flexi Salary is rooted in Unnati Online. Shantanu and Ravi launched 30 “Rozgar Kendras” during their stint at Unnati – a tech-enabled employment exchange for hiring informal sector and entry-level workers – in Gurgaon. Nearly 20,000 blue-collar workers registered at these Rozgar Kendras within two to three months. This stint gave the founders a chance to observe a large number of workers closely and interact with them. They noticed that nearly all workers were visibly strapped for cash and relied extensively on social borrowing, especially after the 15th of the month.

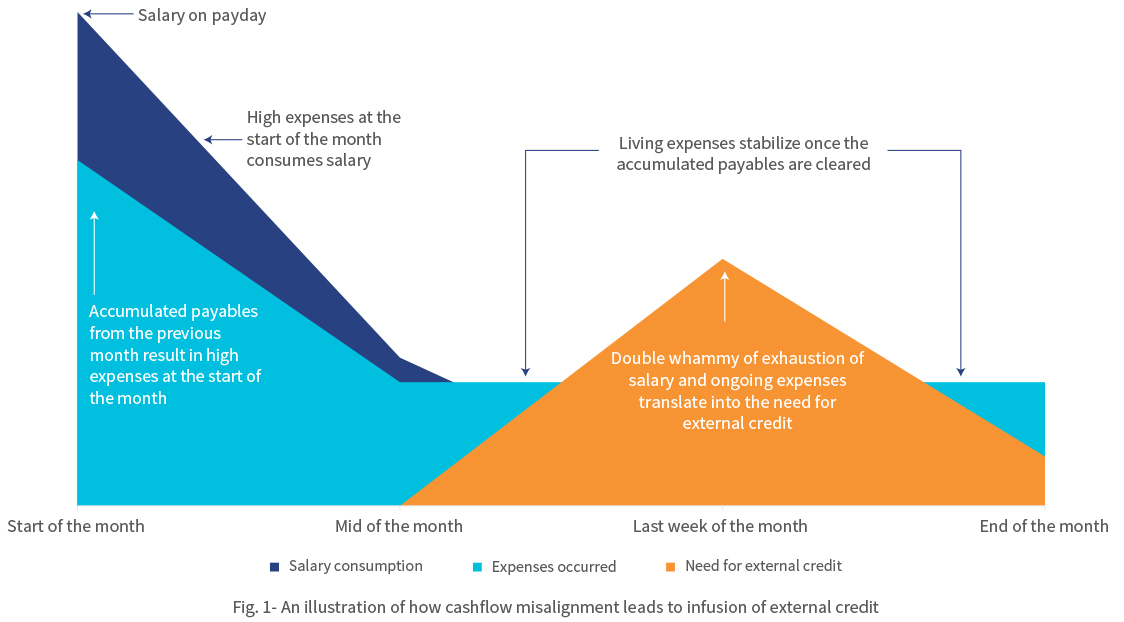

Although “living paycheck-to-paycheck” and “waiting for salary day” have become an accepted way of life for millions of Indians, the founders recognized that these are symptoms of a deep-routed misalignment in cash flow. They believed that FinTechs that provide credit access acted as temporary pain-relievers, as they merely addressed a symptom (an immediate cash crunch) rather than solving the underlying problem (cashflow misalignment). The following graphic illustrates how cash misalignment comes into being.

The figure above represents the cash-flow pattern of a salaried employee from the low- and middle-income (LMI) segment across a month. Expenses peak at the beginning of the month due to recurrent liabilities, such as outstanding bills, rent charges, and so on. Often these overdue bills are pushed to the next payday, which can be any of the first seven days of the next month. Once the employee clears the post-dated bills at the beginning of the month, the expenses decrease but not significantly since the living expenses remain consistent. The steady decline in funds as the month progresses creates a need for external credit. The cycle repeats when the next payday arrives and the bills for the previous month are overdue. This leads to a dreadful phenomenon of living paycheck to paycheck.

Flexi Salary understood that the “monthly salary” system, that is, the mindset of “wait till month end to get paid” generates a cash flow mismatch that causes financial distress for LMI households in India every month. The disruptive question was in front of them—“When expenses are daily, why not income?”

The founders envisioned a new salary system to solve this problem, which would give workers instant access to the money as and when they earned it. The founders understood that this mismatch was an overwhelming problem faced by millions of Indians and therefore was an opportunity to build a company to cater to this large market demand. And so, Flexi Salary was born.

No more monthly salaries

Flexi Salary is a new “instant salary” system in which employees are paid immediately for every workday. Every workday, the day’s salary is loaded into each employee’s salary wallet. As employees work through the month, their earned salary accumulates in their salary wallet. Instead of waiting until the month’s end, employees can withdraw their earnings from their wallets any time they need money. This is done by real-time on-tap liquidity provided by Flexi Salary and their partner NBFCs, which offers timely access to salary for employees. The employees can thereafter repay the withdrawn amount when they get paid the full salary by their employers at the end of the month.

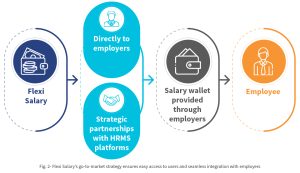

Unlike other FinTechs in this space, Flexi Salary not a loan app. It is not an app that users can use to take credit in a piecemeal manner to meet their liquidity needs. Instead, it provides the customers with continuous access to funds that they have already earned. Flexi Salary stays true to its mission by offering its product to employees through their employers alone. The startup partners with companies that enable the Flexi Salary system for their employees. Once an employer introduces the wallet in the workplace and the employees choose this option, they do not have to wait for the payday or seek additional approval from their employer to withdraw their daily salaries—Flexi Salary’s app handles these aspects.

Flexi Salary has partnered with lenders that provide liquidity flexibly to the users at any time of the month. When the user receives their wages at the end of the month, they can repay the availed amount to Flexi Salary. Neither the employer nor the payroll teams need to get involved. The payroll team and their usual operations can continue as per the established monthly cycle, while Flexi Salary’s wallet powers each employee with the convenience of flexible salary.

Besides being a workplace perk, the facility to avail salary flexibly ensures that the employees are well-funded, which minimizes the chances of having to look elsewhere to make ends meet, thereby falling into a potential debt trap. Flexi Salary has also partnered with leading human resource management system (HRMS) players in the industry, including Quess Corp, Adetto HR, and Hono HR. Powered by such partnerships, a company that uses any of these HRMS solutions can implement Flexi Salary easily within their workplace in a plug-and-play mode.

Battles to win:

The founders believe in validating the product—and what better way to do this than by engaging HR leaders and other decision-makers in trials before rolling it out to the employees. While Flexi Salary has had significant early traction in its journey, generating trials for such leaders has been an uphill task. Moreover, the uncertainty in the business environment posed by COVID-19 has prolonged some of the business discussions indefinitely.

Adhering to the same spirit with which they set out to solve the problem of cash flow misalignment, Flexi Salary took these roadblocks head-on with grit and commitment. The team has used the personal networks of founders and connections from investors. One of the advantages of Flexi Salary has been Shantanu’s alumni network at Xavier Labor Relations Institute- XLRI, which has one of the best human resources MBA programs in the country. The team has accessed the alumni network to tap into HR leadership in various firms in India. Not letting the crisis go to waste, Flexi Salary has been focusing on improving its product through continuous product development and pilots. These refinements will ensure that the product is scalable. As soon as the second wave recedes, the team can hit the ground running to realize their dream of enabling flexible salaries for everyone in India.

Support from the FI Lab

Through CIIE.CO and MSC, the Lab has been helping their business in two phases, besides making the right connections.

In the first phase, the Lab helped Flexi Salary to identify the appropriate product positioning of its app, based on ground-level research with white-collar as well as blue and grey collar employees to identify their problems and needs. Using a human-centered design framework on the salary wallet model and expense allowance model, MSC helped Flexi Salary to strike a balance with blue-collar as well as entry-level white-collar workers.

In the ongoing second phase of the TA, the Lab has been helping Flexi Salary in its scale-up by identifying companies that can act as aggregation points through strategic partnerships. Identification of such strategic partnerships can unlock access to many employers and thus, employees. We have also supported Flexi Salary in developing its business development strategy and implementation of the same to ensure that the team can scale up faster.

Collectively, the advisory support of the Lab will ensure that Flexi Salary finds the right product-market fit at an early stage in its journey. Once this is achieved, Flexi Salary would scale up efficiently through bootstrapping and minimal external funding.

Way forward:

The founders want to establish the concept of flexible salaries across industries. In the short term, the founders hope to popularize Flexi Salary as the “employee-friendly” way of paying salaries to employees. They hope to partner with companies in a diverse range of industries to enable Flexi Salary for their employees making the product industry-agnostic. Over the next five years, they hope to replace the concept of “monthly salary” with flexible salary and establish it as the preferred salary payment system across India Inc.

This blog post is part of a series that covers promising FinTechs that are making a difference to underserved communities. These start-ups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative and is co-powered by MSC. #TechForAll, #BuildingForBharat

Kosh: A community-based credit platform that offers financial security to blue-collar workers

This blog talks about Kosh, a start-up that is part of the Financial Inclusion Lab. The Lab is an accelerator program supported by some of the largest philanthropic organizations across the world, such as the Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

Suresh, aged 40, works at a manufacturing firm in Haryana. He needed some money urgently to pay his daughter’s school fees. However, he did not want to fall prey to the usurious rates local money lenders charge. Suresh was also not comfortable asking his family members for money. He came to know about Kosh from a colleague and decided to approach the platform for a loan. Suresh was delighted with the quick processing and disbursement of the loan. Today, he is an active borrower at Kosh. With a good repayment history and the leads he has generated for Kosh, Suresh has now graduated to the role of a group leader.

India is home to more than 120 million blue-collar workers like Suresh. Most of these workers struggle with a lack of financial awareness and have limited access to affordable financial solutions. Financial institutions are reluctant to serve these customers due to the high cost of acquisition (CAC) and a high operational cost. This gap between financial institutions and customers, albeit in a group setting, offers an opportunity for start-ups like Kosh.

The light-bulb moment

Founded in 2018, Kosh is a digital lending platform that provides community-based credit through its mobile application, primarily to blue-collar workers who reside in tier-2 and tier-3 cities.

Co-founders Aayush and Sahil know each other since high school and used to work together at a global investment banking firm before founding Kosh. During their time together, they spoke to multiple gig-economy workers, such as drivers, food delivery personnel, and factory workers. These interactions helped them realize the struggle blue-collar workers face to access affordable credit. These workers also find it difficult to manage their finances efficiently. The occasional chat soon turned into full-fledged interactions with blue-collar workers to gather a detailed understanding of the challenges they face to access formal financial services.

Sahil and Aayush discovered their mutual passion for solving issues related to financial access and usage for the low- and middle-income (LMI) segment. Soon after, moved by the plight of many like Suresh, Sahil and Aayush decided to set up Kosh. Their idea was to offer the LMI segment a platform to gain awareness of financial programs and to access formal financial services at affordable rates.

What makes Kosh unique?

Kosh is one of the few players in the digital lending space that gives importance to social capital in communities to which their customers belong. Despite having a fully digital model, Kosh is passionate about understanding the community. Kosh capitalizes on the belief that such customer segments use their close social circles for liquidity farming to help each other financially, and exchange credible financial information and advice.

Kosh uses this social capital to verify the background of potential customers before it processes and disburses loans. Trusted colleagues or influencers in the community act as guarantors on the platform and Kosh onboards them as group leaders. These leaders are tasked to create a group of two or three members to avail credit from the platform. All members, including the group leader, need to repay each loan installment on time.

Kosh also offers financial incentives to group leaders to onboard others in their network. This places the onus on the group leaders to introduce more users to the platform. This joint liability model based on social capital helps Kosh provide credit, especially to vulnerable segments. Access to credit also opens opportunities for these customer segments to access a bouquet of other formal financial services, which enables Kosh to make a meaningful impact in their overall financial lives.

The joint liability model also offers several other advantages to Kosh, a few of which are as follows:

- Lower cost of acquisition: The onus to form a group is on the group leader, which reduces the customer acquisition cost for Kosh.

- Fewer defaults: The group creates social pressure on the members to maintain discipline and repay the installments on time.

- Opportunity to offer a suite of financial products: Kosh can use the data collected during the lending process to further design financial services customized to these segments.

Kosh follows a simple digital onboarding process to acquire customers. Moreover, the app provides a group chat facility for its customers to discuss their queries and concerns with each other and the Kosh team. Kosh also offers complete parallel support through WhatsApp and over calls to help customers complete their registration process and get their other queries addressed. The frequent interaction, both among the members and the team, helps build mutual trust.

Roadblocks in its journey

Despite a good start to its journey, Kosh faced a few roadblocks. The first major barrier came after the decision of the Reserve Bank of India to offer a moratorium to borrowers from March, 2020 as a relief measure during COVID-19. Many customers believed that their loans were waived. This behavior affected the collection rates of Kosh. However, the start-up adopted a proactive approach and actively engaged and informed these customers about the importance of timely repayment, which helped them pull through.

The second major roadblock is around the adoption of products and scale-up. Currently, Kosh depends on its contacts or existing networks to onboard group leaders. So far, the startup has only worked with blue-collar segments and most of its business development is through existing networks. This limits growth and creates barriers to scale-up. Kosh continues to actively explore new avenues to boost its business, even as it keeps existing customer segments engaged.

Support from the FI lab

As part of the Lab’s accelerator program, MSC supported Kosh with a set of technical assistance (TA) activities, as described below:

- MSC derived additional insights from the feedback of existing and potential customers of Kosh. This helped the start-up understand the perception of customers about availing group loans through a digital platform. Equipped with better knowledge of its current and target segment, Kosh designed a more customer-friendly application process based on the UI/UX insights.

- In a quest to scale up, Kosh wished to explore partnerships with financial service providers, such as NGOs, MFIs, and other non-lending FinTechs. These organizations would be best suited for collaboration as their efforts also focus on serving LMI segments through relevant products and services. Such collaborative efforts would help Kosh grow its business further. Based on its offerings and requirements of potential partners, MSC helped Kosh identify a few such partners.

As a part of its short-term vision, Kosh plans to scale up and boost customer acquisition aggressively. Kosh is aware of the need to optimize its loan repayment management system to scale up. It also needs to strengthen the group incentive structure to minimize defaults. As a part of the FI Lab, MSC continues to work closely with Kosh to strengthen its business model and devise appropriate strategies to improve business operations.

Plans for the future

Along with higher customer acquisition, Kosh aspires to transform into a financial services platform that offers a host of community-based services, such as credit, savings, employment opportunities, and others to blue-collar workers in tier-2 and tier-3 cities. Kosh intends to use technology extensively to create a network of employees across different industries and regularly engage them on the platform to collect data. This data will help Kosh design and offer customized services to its customers in the future.

Further, Kosh plans to develop its next-generation group savings product by understanding the savings behavior of self-help groups (SHGs) and members of cooperatives. This will help Kosh digitize community savings on its platform, like a digital rotating savings and credit association (ROSCA). To achieve this goal, Kosh plans to partner with a few MFIs, SHGs, and other FinTech players to further strengthen its business and expand its reach.

Despite a brief setback due to the pandemic, Kosh managed to get back on track toward its goal of alleviating the financial struggles of customers like Suresh. Kosh intends to become a leading digital-first financial services platform that offers greater control to customers over their finances, thereby creating a positive impact in their lives.

This blog post is part of a series that covers promising FinTechs that make a difference to underserved communities. These start-ups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative and is co-powered by MSC. #TechForAll, #BuildingForBharat

Role of FinTechs in transforming the future of work

Digital transformation continues to revolutionize the future of work, especially after the COVID-19 pandemic hastened its pace. However, financial constraints still hinder the growth of the LMI workforce. This video highlights how start-ups under the FI lab have been trying to solve these challenges through human-centric solutions for an inclusive future.

Entitled: A synonym for empowerment of blue-collar workers through customized financial services

This blog talks about a start-up called Entitled, part of the Financial Inclusion Lab accelerator program, which is supported by some of the largest philanthropic organizations across the world – Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation and Omidyar Network.

In India, more than 170 million people are classified as blue-collar workers. Most are semi-educated migrants from rural areas, who often lack formal financial history. Most blue-collar jobs do not provide any form of social protection, unlike white-collar jobs in the country.

A combination of a lack of financial literacy, low income, and lack of financial data has rendered this segment extremely vulnerable. The recent migrant worker crisis in India, brought about by COVID-19 further amplified this vulnerability. Traditional financial products that are designed for the top-of-the-pyramid customers often fail to meet the needs of this segment, leading to their exclusion.

Sana Qureshi is a 23-year-old woman who works at a healthcare platform in Mumbai. She faced the pain of such exclusion when she could not source a loan for her sick father’s medical treatment. Information asymmetry and fear of getting scammed worsened her conundrum as she searched desperately for options. This is when Sana came to know about Entitled—something that she recalls, “gave her hope”.

The fintech was founded by Anshul Khurana, Krishna Yadav, and Arpan Jain in 2019. It uses technology to provide access to a range of financial products, such as health insurance, emergency credit, and savings solutions for blue-collar workers, such as Sana.

It takes three to tango

Two of the founders, Anshul and Krishna, met at an organization that works with a large number of blue-collar employees. Here, they saw that blue-collar workers struggled with exclusion from formal financial services. These workers frequently needed loans and salary advances. They lacked knowledge about Employee State Insurance (ESIC), provident fund (PF), and other statutory deductions as well as workplace benefits. Moreover, the workers spent close to a tenth of their income each month on unnecessary expenses like bank withdrawal charges and late payment fees.

Two of the founders, Anshul and Krishna, met at an organization that works with a large number of blue-collar employees. Here, they saw that blue-collar workers struggled with exclusion from formal financial services. These workers frequently needed loans and salary advances. They lacked knowledge about Employee State Insurance (ESIC), provident fund (PF), and other statutory deductions as well as workplace benefits. Moreover, the workers spent close to a tenth of their income each month on unnecessary expenses like bank withdrawal charges and late payment fees.

This spurred the idea of a platform to engage employees through financial products.

Solving problems for employees: What Entitled does

The two co-founders had another profound learning. They realized that they should focus on two interconnected aspects to solve these problems for the workers. The first is to educate them about financial management. The second is to counsel them to bring about effective lifestyle changes through a mindful selection of financial solutions suited to their context and needs. So, they started looking for a “partner-in-crime” who could help them add this dimension of education and counseling for their targeted customer segment.

Fortunately, they soon crossed paths with Arpan who shared the vision to support blue-collar workers. The trio was completed and their brainchild was formally given a name, Entitled. Combining their expertise, they began to engage employers in Mumbai to gather employee details. Gradually, Entitled began to offer financial wellbeing products to empower workers while bringing cohesion and clarity in their financial lives.

Entitled: A full-service financial wellness platform for blue-collar employees

Entitled helps blue-collar workers to access a range of financial services and rewards through its financial wellness platform.

How does Entitled do this? It links up with employers to offer services on the platform as employment benefits to these workers. The product suite includes:

- Financial counseling;

- Access to emergency funds;

- Insurance;

- Long-term saving instruments; and

- Rewards programs for employees based on their use of financial products.

The platform uses the employment information of the workers to build profiles and map the appropriate services to the employees.

Figure 1: User engagement of Entitlement

Sana Qureshi, 23, who is employed at a healthcare platform in Mumbai was introduced to the Entitled team by her employer and became an early adopter of the platform. Entitled not only provided her access to credit but also handheld her through the onboarding process and helped her to learn and leverage other features of the platform.

How does Entitled ensure the efficacy of its platform?

While providing financial wellness products, Entitled also captures the impact they have on their users. Entitled maps impact against specific metrics and tracks them continually. For instance, these metrics:

- Gauge the convenience and simplicity of formal products for workers who access them for the first time;

- Map product usage patterns against employee awareness and knowledge to design similar products for other segments; and

- Benchmark each of the platform’s products and services against the market rates at which these can be accessed through formal banking institutions be it lending or savings products, as applicable.

Such impact assessment helps Entitled in multiple ways.

- Enable increased awareness or understanding of formal financial products

- Create and deepen financial history for its users

- Catalyze their users’ access to financial institutions in the future.

Impact assessment helps Entitled ensure the financial wellbeing of users like Sana Qureshi, who we met earlier in our blog even during the pandemic. The Entitled team provided her guidance and timely nudges to meet every repayment in full and on schedule. This improved her credit score, which will enable her to avail cheaper and easier loans in the future. Sana is one among many others whom Entitled have helped in their nascent journey—a fact that is not lost on happy employers.

Trials along the way

While some employers are yet to recognize the importance of offering financial health initiatives and providing workplace benefits to their workers. Others simply fail to prioritize the financial health of employees. This leads to delayed interventions and denies employees critical financial aid and advice.

The first significant challenge for Entitled is user capability. The employee’s lack of awareness about technology and financial products requires significant handholding. Owing to the COVID-19 pandemic, user engagement has deteriorated.

Secondly, regulations, such as the moratorium announced by RBI in March 2020, have diminished investor willingness to lend—which in turn has impeded customer traction for Entitled. Nevertheless, the resolve of the founding team is strong and the team has invented ways to overcome the hurdles. The team has quickly adapted and shipped new product designs to ease the onboarding flow in a self-service delivery model.

Support from the FI Lab:

Entitled has been part of the Financial Inclusion Lab accelerator program, which receives support from some of the largest philanthropic organizations in the world—Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

The Lab has offered a cohesive and holistic support package to Entitled, ranging from mentor hours and grant capital to field studies led by financial inclusion experts in the areas of consumer and market insights. This has helped Entitled to gain a deeper understanding of its customers and build resilient, impactful solutions for them.

Vision for the future

While the pandemic has had an impact on Entitled, the company was able to refine its strategy to move forward and engage with more users on the platform. Based

on its knowledge of users’ behavior and familiarity with WhatsApp, Entitled has designed a customized WhatsApp bot for digital on-boarding. Such an approach tackles the first set of challenges that new users face while onboarding in the absence of over-the-counter interactions.

Figure 3: Entitled’s WhatsApp onboarding flow

Entitled has taken an efficient path to move forward by remaining lean and agile with minimal operational staff and by prioritizing product development for features based on customers’ needs. It continues to move toward improved digital features on the platform through a mobile application. The mobile app will make interactions easier, more efficient, and explanatory for users while adding a positive dimension to the financial lives of their customers once on-boarded.

This blog post is part of a series that covers promising FinTechs that are making a difference to underserved communities. These start-ups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative and is co-powered by MSC. #TechForAll, #BuildingForBharat

The many aspects of financial inclusion

Latest Episodes

MicroSave Consulting (MSC) is a boutique consulting firm that has, for 25 years, pushed the world towards meaningful financial, social, and economic inclusion. These podcast series are hosted by MSC for dedicated founders, start-ups, investors, and other stakeholders in the startup ecosystem. Through this bouquet of curated conversations around developments in the financial inclusion space, we offer insights and lessons based on our research and expertise.

In this podcast, Pauline Katunyo, a Housing Finance Expert at MSC, and Doreen Njau of MSC discuss Kenya’s affordable housing crisis. This crisis has led to a deficit of more than 2 million units and primarily impacted the LMI households. They explore key barriers, such as high construction costs and limited financing options, and highlight innovative solutions, such as rent-to-own programs, incremental housing loans, and the role of microfinance institutions.