We assessed the efficiency of using iris-based authentication for conducting BAP transactions for agents (merchants) and customers compared to fingerprint-based authentication. We suggested recommendations to improve the overall experience for the agent and customer.

Idea Money

Idea Money intended to understand the risks inherent in its current account opening process that led to delays in opening accounts for customers. Idea Money engaged MSC to provide technical assistance to develop the as-is process for account opening, identify the process risks and implications of these identified risks on the channel, and provide recommendations for the upgraded platform.

mPESA

A diagnostic study with IPPB agents revealed that 39% of agents struggled to operate a micro ATM. Only less than 50% of agents knew of the financial products offered by IPPB. Agents have limited capability to engage with customers. Specifically, postal agents with no training or experience in consumer sales find it challenging to “sell” products. Secondly, a lack of hands-on training hindered usage for those agents who were not digitally savvy. MSC designed comprehensive digital training content for IPPB agents, conducted a training-of-trainers to build self-sustainability, and helped IPPB set up training systems.

Catalysing Business Transformation: A study on Mobile Financial Services for MSEs in Bangladesh: Prospects and Challenges

We supported the Bangladesh Bank and Business For the Poor in Bangladesh (BFP-B) in this Nathan Associates-funded study to understand the prospect of using MFS for the benefit of micro-and small-enterprises (MSEs), including the banking and MFS agents. The broad objective of the study was to understand the use of MFS by MSEs, identify key challenges that limit the uptake of MFS by MSEs, and explore opportunities to address the needs of the MSEs by MFS providers.

Agency banking in Bangladesh: learning for other commercial banks

In 2018, BRAC Bank decided to offer banking services to the unbanked population and its branch customers in rural and semi-urban areas across Bangladesh. Offering services through agent banking channels was BRAC’s twin-pronged strategy to improve its customer services for SME loan customers. Agent banking allows BRAC Bank to offer customers a convenient alternative for loan disbursement and repayment while reducing dependency on other banks.

This case study charts the agent banking journey of BRAC Bank. It highlights the unique steps in the journey that ultimately helped to ensure channel sustainability. MSC supported BRAC in undertaking the journey under the agent banking project.

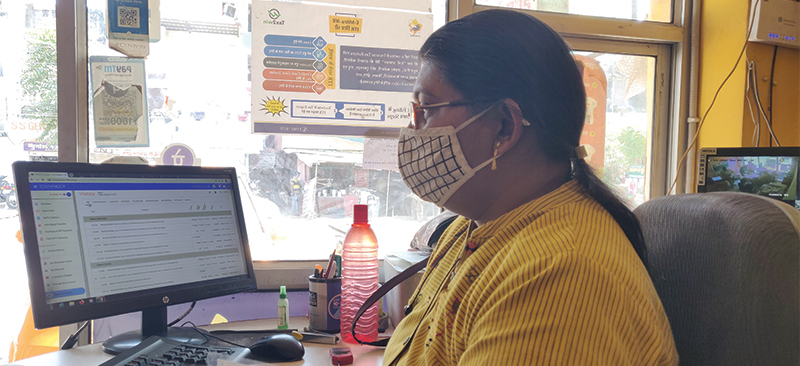

SBI: Enhancing the value proposition of SBI’s CSP network

Several customers of SBI prefer to transact at branches compared to their agent outlets. This is mainly due to the lack of trust in agents and the agent network of SBI. SBI intends to increase the trust of the customers in their agent channel and intends to increase the footfall of the customers at their agent outlets thereby reducing the congestion in their branches. MSC conducted a diagnostic exercise to understand the agent-level issues.