Opportunities in digital financial services related to jobs in Sub-Saharan Africa

by Elizabeth Berthe

by Elizabeth Berthe Dec 6, 2018

Dec 6, 2018 5 min

5 min

With over 10 to 12 million young people entering the job market yearly on the African continent, the private sector, despite its dynamism, cannot create enough jobs to absorb them. The global jobs crisis has exacerbated the vulnerability of young people in terms of (i) higher unemployment; (ii) lower quality jobs for those who find […]

With over 10 to 12 million young people entering the job market yearly on the African continent, the private sector, despite its dynamism, cannot create enough jobs to absorb them. The global jobs crisis has exacerbated the vulnerability of young people in terms of (i) higher unemployment; (ii) lower quality jobs for those who find work; (iii) greater labour market inequalities among different groups of young people; (iv) longer and more insecure school-to-work transitions; and (v) increased detachment from the labour market.

As mobile phone prices continue to decline and ownership grows, and as fintechs develop new services, the commercial landscape is changing and opens up opportunities to access and leverage data in new ways. The Digital Financial Services (DFS) sector has the potential to improve youth livelihoods but, in its current state, this potential is limited in scale and sustainability.

Findings from McKinsey projects suggest that widespread use of digital finance could boost annual GDP of all emerging economies by $3.7 trillion by 2025, a 6 percent increase versus a business-as-usual scenario and Dalberg notes that the digital economy can help in reaching the ambitious goal whereby the global economy needs to create five million jobs each month to absorb the one billion people that will enter the job market over the next decade.

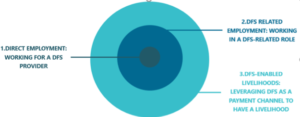

Commissioned by the Mastercard Foundation, over the last six months, MicroSave conducted research in Ghana, Kenya, Senegal and Uganda to understand job opportunities in the DFS space. We found the area of opportunity for the most job creation is related to DFS-enabled livelihoods whereby DFS serve as a channel to create a livelihood.

1. Direct Employment: DFS providers hire on an as needed basis and do not willingly target youth as this is a business decision and not a corporate social responsibility decision. Jobs are generally filled with recent university graduates, but opportunities are limited.

2. Indirect Employment: DFS related roles, such as an agent owner or commission based sales agents, are generally out of reach of youth due to high startup costs and ongoing working capital needs. These are often filled with recent graduates who cannot find jobs that match their skills and take these jobs hopefully as a springboard to something else. Handlers or tellers, who work under agents, often work without contracts with limited sustainable livelihood and decent working conditions.

3. DFS-Enabled Livelihoods: DFS can be a tool that enhances access to new markets, business information, and financial products leveraging the DFS ecosystem. It helps create and accelerate the growth and sustainability of people’s livelihoods. The ‘trickle down’ impact on people’s livelihoods is highly dependent on the growth, innovation, and success of the DFS ecosystem.

A study by KPMG on Safaricom noted that 682,000 direct and indirect jobs were created in Kenya based on the products and services offered by the telecom operator. For everyone to benefit from DFS, including the trickle-down benefits for the entire population, DFS providers need to be fit for purpose and produce quality products and services to meet the needs of customers and small business owners. In 2016, P2P represented 69% of the value of mobile money transactions, with 31% coming from more advanced use cases such as savings, credit, and insurance. Despite seeing gains of around 11% in the use of products that might drive greater ecosystem development, it is nevertheless a slower gain than many anticipated over a 5-year window.

During our research, and based on extensive experience of the industry, it is clear that many DFS products and delivery systems are not customer-centric, do not meet customer needs and sometimes focus on relatively small parts of the population. Additionally, our recent research commissioned by the Mastercard Foundation in Côte d’Ivoire on DFS products based on needs and merchant payments showcased how DFS products available on the market today do not meet the needs of individuals who continue to use informal services and small businesses. Business owners have a mobile phone and access to internet, but only a minority uses their phones as a business tool, suggesting that providers have not thought yet of offering a corporate value proposition to businesses.

The GSMA’s State of the Industry Report for 2017 highlights that 49.1% of the African continent has a mobile account. This massive pool of customers offers many opportunities for job creation and the development of products and services catering to the needs of local markets. How can we improve digital and entrepreneurship skills to ensure youth have the tools and skills to lead, have access to jobs or become self-employed?

According to the AfDB’s African Economic Outlook (AEO) report, 22% of Africa’s working-age population are starting new businesses, which is the highest rate of any region in the world. The AEO recommends policies supporting the businesses for entrepreneurs by improving skills, grouping business clusters and improving access to funds (see graphic).

Across all markets, employers from our research noted a mismatch between the skills acquired and those required by the labor market. Investment is needed in education to ensure youth are prepared with the right skillsets – including being digitally literate. The amount invested in providing human development services for young people, particularly their education and skills, will help to determine whether Africa can harness the demographic dividend rather than risk a demographic time bomb. Policies that bridge employment and education systems need to be the new norm to address the gaps in job readiness and job skills and be approached holistically. Furthermore, we see opportunities to work with the private sector and governments to develop demand driven curriculums and develop outlets for innovation by youth.

Across all markets, employers from our research noted a mismatch between the skills acquired and those required by the labor market. Investment is needed in education to ensure youth are prepared with the right skillsets – including being digitally literate. The amount invested in providing human development services for young people, particularly their education and skills, will help to determine whether Africa can harness the demographic dividend rather than risk a demographic time bomb. Policies that bridge employment and education systems need to be the new norm to address the gaps in job readiness and job skills and be approached holistically. Furthermore, we see opportunities to work with the private sector and governments to develop demand driven curriculums and develop outlets for innovation by youth.

Our research indicated that most youth aspire to work for large corporates which are socially perceived as a stable source of livelihoods and signaling entry into adulthood. Many young people aspire to work in ‘white collar’ roles for large corporate brands because they are prestigious and have good reputations. They have, however, limited insights about DFS and self-employment opportunities in the sector. Many young people take DFS-related jobs as a stepping stone to another job or as part of mix livelihoods strategies.

Digital ecosystems and entrepreneurship are essential for growth and job creation. There needs to be a focus on building soft and hard skills, improving youth awareness on information on jobs and earnings, and preparing youth to develop foundational skills for future jobs to ensure entrepreneurship in DFS leads to additional job creation. Through the creation of an enabling environment for self-employment and small businesses as well as revisiting TVET programs to ensure that they are linked to the private sector and their needs African youth will be better prepared for the digital age and be able to create jobs from themselves and others.

Written by

Leave comments