Necessity is the mother of disruption: How Indonesia’s Fintech Startups can survive the do-or-die situation of COVID-19

by Anshul Saxena and Sheila Carina

Aug 27, 2020

5 min

This blog discusses the impact of COVID-19 on FinTechs in Indonesia. It also highlights the coping strategies of start-up FinTechs and provides recommendations for the stakeholders, government, and policymakers to help them survive and catalyze their growth.

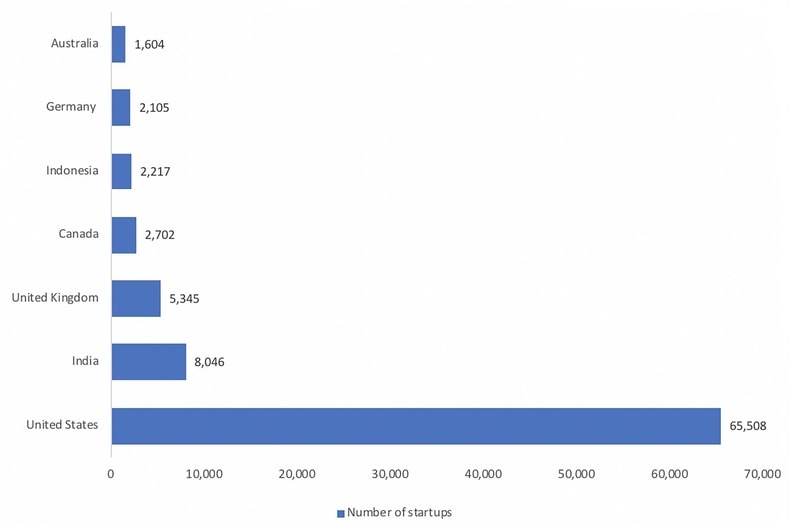

Indonesia is a silent giant in the startup ecosystem. As per the Startup Ranking site, with over 2,200 startups nationwide, Indonesia ranks among the top five countries in terms of the number of startups.

It is also the second-largest recipient of investments in Southeast Asia, which is an intensely competitive region.

Fintech is the biggest segment within Indonesia’s startup ecosystem. Fintechs in Indonesia have been hailed as the agents of change that can close the financial inclusion gap in the country and help conquer the digital divide. According to the World Bank’s Global Financial Inclusion index database, the country has made impressive strides toward financial inclusion. In 2018, approximately 50% of Indonesian adults owned bank accounts, up from 20% just four years earlier. At the same time, the country has made rapid strides to boost its digital economy, which is predicted to reach US $133 billion by 2025.

Super platform fintechs such as Gojek, Tokopedia and other large person-to-person lenders can take most of the credit for this success. They have promoted inclusion for underserved communities, such as small merchants and ride-hailing drivers. Together, these superplatforms and fintech startups have channeled loans worth approximately US $7 billion to date – with shorter turnaround times and lower overhead costs than banks.

However, with the onset of the COVID-19 pandemic, all the progress made by Indonesian startups is at risk of dissipating.

The impact of COVID-19 on fintechs in Indonesia

Our study on the impact of the pandemic on fintech in Indonesia revealed some alarming trends:

- Person-to-person fintech startups that target microenterprises and the low- and middle-income community have seen a 10-15% rise in non-performing loans.

- Platforms that cater to equity crowdfunding saw a 40-50% drop in the number of new investors, as investors have adopted a bearish attitude and want to conserve funds.

- Across the board, fintech startups have 5-6 months of runway for operations.

These trends are in sharp contrast to the experience of established fintechs – i.e.: those that have advanced beyond series-A funding. Here are some prominent examples:

- Less than 3% of borrowers at Koinworks have applied for payment relaxation to date.

- Investree continues its expansion with forays into other markets.

- On average, the volume of e-money transactions in Indonesia saw a 20% reduction by May 2020. Dana, however, reported a 15% increase in the volume of transactions.

- OVO reported an increase in volume of e-commerce, online education and cash top-up transactions.

- Established Insurtechs, such as Futuready and Simas Insurtech, reported no adverse impact of COVID-19 on their businesses in terms of revenues or sales. They are, in fact, optimistic about the growth of digital Insurtech.

- In general, established players have benefited as first-movers through wider and deeper market exposure, operational stability and strong funding support. These players have encouraged the use of sophisticated technologies, such as AI and Big Data analytics, to overcome the impact of the pandemic.

The coping strategies of startup fintechs

Most startup fintechs we interviewed had to implement coping mechanisms to survive and extend their runways. For instance:

- An early-stage startup in the field of over-the-counter digital payments laid off 30% of employees.

- An early-stage Insurtech renegotiated office rents and introduced pay cuts for staff to save money for a planned product launch later this year.

- To mitigate increased non-performing loans, some early-stage credit startups have stopped extending new loans. They are instead focused on collections and are implementing a door-to-door collection protocol.

Tweaking or pivoting business models is another survival strategy. For example:

- E-wallet providers are collaborating with remittance and e-commerce players to explore new use-cases.

- Before COVID-19, equity crowdfunding platforms were doing their own due diligence on small and medium-sized enterprises. However, they are now allowing users to decide which of these enterprises should go for initial public offerings on their platforms. Effectively, the due diligence process has been outsourced.

- Insurtechs are innovating and now offer microinsurance packages. Demand for higher ticket-size policies is waning.

Recommendations for fintech stakeholders

An old saying says that “Necessity is the mother of invention.” But in today’s world, necessity has become the mother of disruption – and stakeholders must support young businesses in that process. Ignoring startup fintechs in Indonesia would undermine their potential to solve existing problems through scalable solutions. This would be a big mistake, given that startups are poised to change the business landscape in the country. We recommend the following measures for fintech in the startup ecosystem, which can fast-track Indonesia’s economic recovery from the pandemic:

- Fintech startups should build strong use-cases and work with established players. Mergers amongst startup fintech that provide complementary solutions or support can also be a way forward. Eventually, the market needs to see a strong value proposition.

- It is time to focus on profitability rather than scalability. This approach will build business resilience and attract investors, even during these bearish times.

Recommendations for government and policymakers

The government can and should be the main catalyst for the survival and growth of fintech startups. But to date, the government of Indonesia has no specific regulations or measures to support fintechs, big or small. Instead, it is offering a general package of assistance for small and medium-sized enterprises, and fintechs are expected to accommodate themselves to it. This package does not really address the needs of tech-enabled startups.

A tailored and sustained push from the government for fintech startups could include:

- The allocation of emergency funds and well-structured guarantee programs to help startup fintechs extend their runways. The support would also catalyze positive investor sentiments for the entire fintech sector.

- The replication of initiatives implemented by the government of Singapore. Singapore has provided free API access and a “Digital Acceleration Grant” to fintech startups with less than 200 employees. The objective of the grant is to help these startups adopt a suite of digital tools to upgrade their enterprises while ensuring business continuity.

- Efforts to enhance the resilience of the fintech sector and support rapid scale-up. In particular, it would be helpful to pass a personal data protection bill and to increase access to the national ID database to enable electronic know-your-customer processes that can streamline customer onboarding for fintechs. Both of these regulatory actions would bolster customer confidence in the fintech industry, and lower customer acquisition costs through digitalization.

- The government of Indonesia could also invite fintech startups to support the distribution of government-to-person programs, such as People’s Business Loans, Ultra Micro Loans, or the Non-Cash Social Assistance Program. Using digital channels such as e-wallets and direct bank-to-bank money transfers to distribute these payments would reduce the costs associated with physical distribution channels, and also enable the contactless delivery of money. It could also promote the use of digital payment systems instead of cash.

Even though the current situation facing Indonesia’s startup ecosystem looks bleak, pushing the potential of fintech as a complement to traditional banking is our best hope for recovering its momentum. Fintechs are more agile and adaptive than traditional banks which still rely on legacy technology of its core systems. Hence, FinTechs will adopt automation and digitalization of banking processes in a much more agile manner and provide relevant use cases for banks to leverage this strength. Dedicated support from the government and more enabling regulations for these businesses can give a boost to the economy, and retain Indonesia’s position as a top destination for startups in the ASEAN region.

The blog was also published on Next Billion on 27th August 2020

Written by

by

by  Aug 27, 2020

Aug 27, 2020 5 min

5 min

Leave comments