Lessons from Frontier Markets: Surpassing gender norms to build a tech-driven and self-starter marketplace model to onboard the next half-million rural women

by Disha Bhavnani, Manali Jain and Amrit Mohan

Jun 15, 2022

6 min

This blog highlights the journey of Frontier Markets, a startup that uses its social-assisted rural e-commerce marketplace, digital infrastructure, services, and solutions to empower rural women from the SHGs and help them augment their family incomes. It focuses on lessons from Frontier Markets’ growth for other village entrepreneurship platforms that intend to scale operations.

This blog looks at Frontier Markets, part of the Financial Inclusion Lab accelerator program, which receives support from some of the largest philanthropic organizations worldwide—Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

A journey well begun

In 2011, Frontier Markets started with a simple idea—to serve the last mile market using tech-based solutions and make life easier for rural households. Its mission led the startup to build a phygital platform to provide retail and financial solutions for the last mile.

Frontier Markets has had an impactful journey since it started. Our previous blog tracked how it adopted a robust strategy to onboard rural women and train them as Sahelis—digitally skilled local and rural women entrepreneurs.

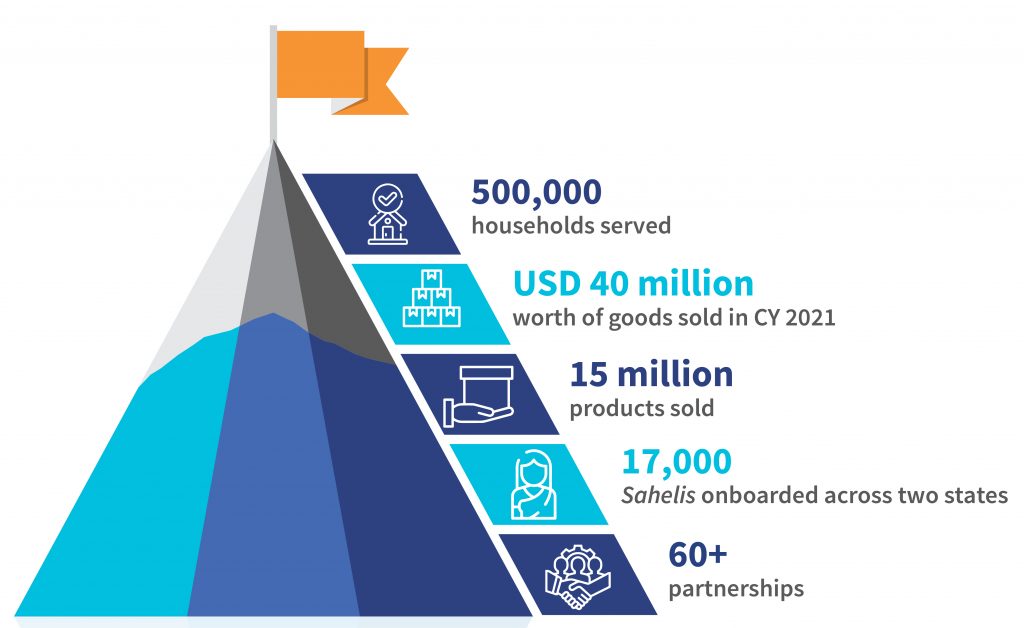

Figure 1: Progress of Frontier Markets since its inception in 2011

The path to scale-up

Indian rural market’s potential is 10 times that of all the Indian unicorns combined. Since 2017, rural India’s internet user base has risen sharply by 197%, from 113 million at the beginning of FY 2016-17 to 336 million by Q2 FY 2021-22. The total number of rural smartphone users increased from 50 million to 109 million between 2017 and 2021. The increasing technology awareness and product affordability in rural India have fuelled the growth of the assisted e-commerce market.

Rural women can catalyze this market by helping rural households source required products and run their enterprises from their home locations. In the past few years, many players have entered the ecosystem to support the rural e-commerce market’s growth in different parts of the value chain. Some players help build women’s capabilities in manufacturing products, digital and financial literacy, and provide market linkages, such as Meesho, GlowRoad, and Sheroes.

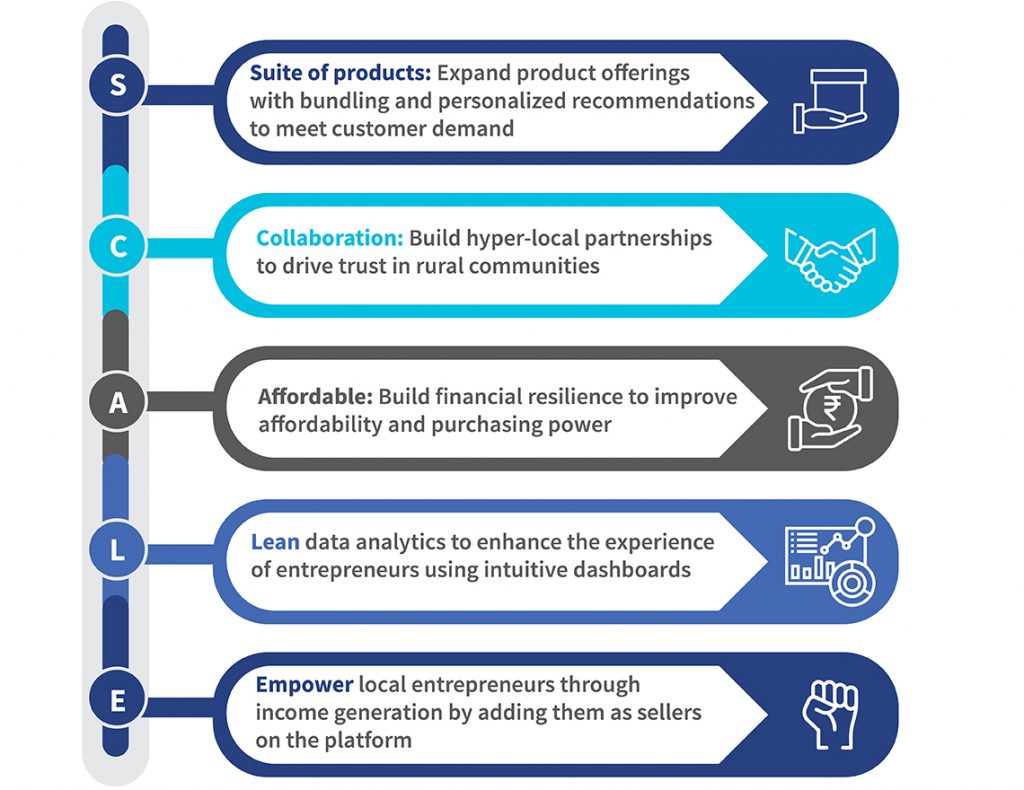

Frontier Markets remains one of the major players in India’s village-level entrepreneurship (VLE) space. Other players with VLE models have the potential to scale, contribute to India’s rural e-commerce ecosystem, and empower rural women to make economic decisions and grow as entrepreneurs. The upcoming VLE models in India can take a MSC recommended five-step SCALE approach to achieve this growth.

Figure 2: SCALE approach for VLE models to expand their entrepreneur base

The SCALE approach can work as a playbook for the village entrepreneurship model in India. It can help village-level entrepreneurs tap opportunities and uncover business propositions. Upcoming players can use Frontier Markets’ lessons and the SCALE approach to expand in new geographies, gain market share for distribution channels across different states in India, and build a sustainable model as they onboard rural women entrepreneurs.

1. Suite of products to meet different customer needs:

The customer demand varies in two ways:

(i) When the customer orders products for a large family or a family function, and they prefer ordering higher quantities currently limited on existing platforms; or

(ii) When the customer orders a specific set of products altogether. If items are not in stock due to their limited availability, the customers have to then purchase those items from the physical marketplace.

The inability to order high quantities or lack of products leads to dropouts along the order process for customers.

VLE players can build a customer profile using data that includes family size, product category preferences, order frequency, and more when customers place their first order. Based on a few consecutive orders, the players can then revise the permitted quantity the customer can order. Over a longer duration, they can start suggesting and offering product bundles to the customers to reduce dropouts of loyal customers, increase the entrepreneurs’ income, and elevate the platform to become a customer’s preferred choice, thereby increasing customer retention.

2. Collaboration: Build hyper-local partnerships

Trust is the glue that holds rural communities together. Anyone outside these close-knit communities struggles to expand in the rural markets and introduce new employment opportunities for women. Raising awareness through training and workshops is crucial but not enough to onboard new women entrepreneurs.

Engaging with community leaders and influencers through partnerships with local bodies and organizations is crucial to getting a foot through the door. These community members can build confidence and influence the households’ decision-making. For instance, Frontier Markets engages with State Rural Livelihood Missions (SRLMs) and government departments to build trust and get women on board.

Other VLE players can further enhance this by including cooperative societies, networks of BC Sakhis, microfinance institutions, local schools, and college teachers as they expand into local markets. Identifying and collaborating with these local networks is vital as any VLE player scales up its operations to new geographies.

3. Affordable: Build financial resilience to improve customers’ purchasing power

Low and unstable income patterns and lack of savings are critical barriers for customers to order products and pay the full amount on delivery in rural markets. Semi-durable and durable products remain a significant expenditure for rural households.

VLE players can collaborate with other FinTechs, offering goal-based savings to enable their customers to build a corpus for purchasing high-value products. Introducing goal-based saving products for the customers’ short-, mid-, and long-term goals can make many aspirational household purchases affordable.

Customers can also get buy-now-pay-later (BNPL) offers based on their existing purchases and credit history. Consumption has been rising countrywide alongside high smartphone and internet penetration in rural India. Meanwhile, the BNPL market will grow at 66% CAGR over the next five years. At this juncture, VLE players can serve their customers and the network of women entrepreneurs through partnerships.

4. Lean data analytics to enhance the experience of women entrepreneurs with intuitive dashboards:

The women entrepreneurs receive commissions in their bank accounts as they receive their orders. VLE players should build intuitive dashboards with details of earnings over months, sales, and performance across different product categories to inform them of their income.

Using BI dashboards with key metrics can help improve performance, provide a customized experience, and help the entrepreneurs observe trends across different parameters. Such dashboards can reduce information gaps in receiving monthly commission details, improve decision-making, reduce dependence on the VLE platform field staff for commission details, and improve performance over time.

5. Empower local entrepreneurs by providing market linkages:

Many women in rural areas of India are skilled at handicrafts, making local food items, or other saleable products. Yet most women have no or limited understanding of market access to sell their products.

Entrepreneurs on VLE platforms like Frontier Markets’ Sahelis are well trusted and belong to these women’s local communities. These platforms can onboard these micro-entrepreneurs and provide them with market linkages, allowing customers to buy the products from a shared marketplace with doorstep delivery.

Onboarding micro-entrepreneurs will build a localized e-commerce platform and a high-trust community comprising these women and their customer base. These women play a crucial role in pitching or selling their products and taking ownership of any issue during order delivery, building an enabling ecosystem at the micro-level in their community.

So far, Frontier Markets has impacted the lives of its Sahelis in ways they could never imagine. Its VLE-model has the power and potential to scale the number of such empowered women across rural communities in the country.

Figure 3: Anecdotal evidence from the Sahelis of Frontier Markets

Frontier Markets has established its foothold in Rajasthan, India. It can use lessons learned in Rajasthan to scale up its operations in the upcoming markets of Uttar Pradesh and others states. The startup can follow the same approach and customize it to the nuances of the local women’s community.

The FI Lab (CIIE.CO and MSC) supported Frontier Markets as one of the startups selected for its accelerator program. The Lab helped Frontier Markets build a comprehensive communication strategy playbook that focuses on the lessons learned and outlines a clear pathway to expand effectively over time as it explores new markets in India.

The SCALE approach can help expand Frontier Markets’ operations in new markets and support other VLE platforms to solve gaps for customers and entrepreneurs by empowering them and building their self-confidence and capabilities.

This blog post is part of a series covering promising FinTechs making a difference in underserved communities. These startups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative, co-powered by MSC. #TechForAll #BuildingForBharat

by

by  Jun 15, 2022

Jun 15, 2022 6 min

6 min

Leave comments