Is there room for optimism in the Kenyan digital credit sector?

by Olivia Obiero and Wanjiku Kiarie

Sep 19, 2019

5 min

This blog sheds light on the current state of the digital credit sector in Kenya highlighting the growth that has been experienced over the last 3 years. In addition, it also brings to our attention the positive trend that has been observed in the performance of mobile loans.

Among borrowers in Kenya, 2.2 million individuals have non-performing loans for digital loans taken between 2016 and 2018. About half (49%) of the digital borrowers with non-performing loans have outstanding balances of less than USD 10 . This narrative of over-indebtedness has also been a mainstay in the media, with a number of news articles highlighting disturbing trends and statistics from the sector.

This begs the question: Can we attribute any positive outcomes to the evolution of digital credit products and the growth of the sector in the past seven years? In a recently published study on the digital credit market in Kenya, MSC analyzed supply-side data from 2016 to 2018. The study findings indicate some positive and encouraging signs for the sector. In this blog, we look at these signs in detail.

[1] MSC analysis of supply-side data from 2016 to 2018

What is the good news?

1. Digital credit has broadened access to credit, particularly for those previously left out

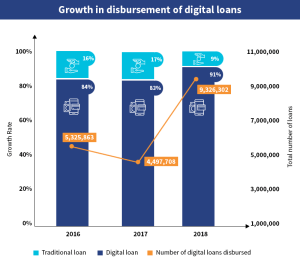

The digital credit sector has experienced significant growth. Our analysis shows that in the past three years, the number of digital loans disbursed has approximately doubled. In the same period, most of the loans (91%) were digital in nature. A key implication of this is also a broadening of financial inclusion in general. The latest FinAccess Household Survey is a testament to this, showing an increase in financial inclusion in the country from 75% in 2013 to 89% in 2019. This has largely received a boost from the ubiquitous nature of mobile financial services in the country.

2. The data reveals an improvement in loan quality

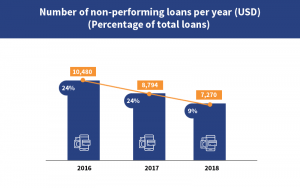

Almost a quarter of all digital loans issued in 2016 were non-performing. However, this figure had dropped to 9% for loans issued in 2018 by the end of that year , showing a 15% improvement in NPLs as a percentage of the total digital loans. In particular, MNO-facilitated lenders have managed to improve their loan quality compared to fintechs and banks. This is indeed remarkable.

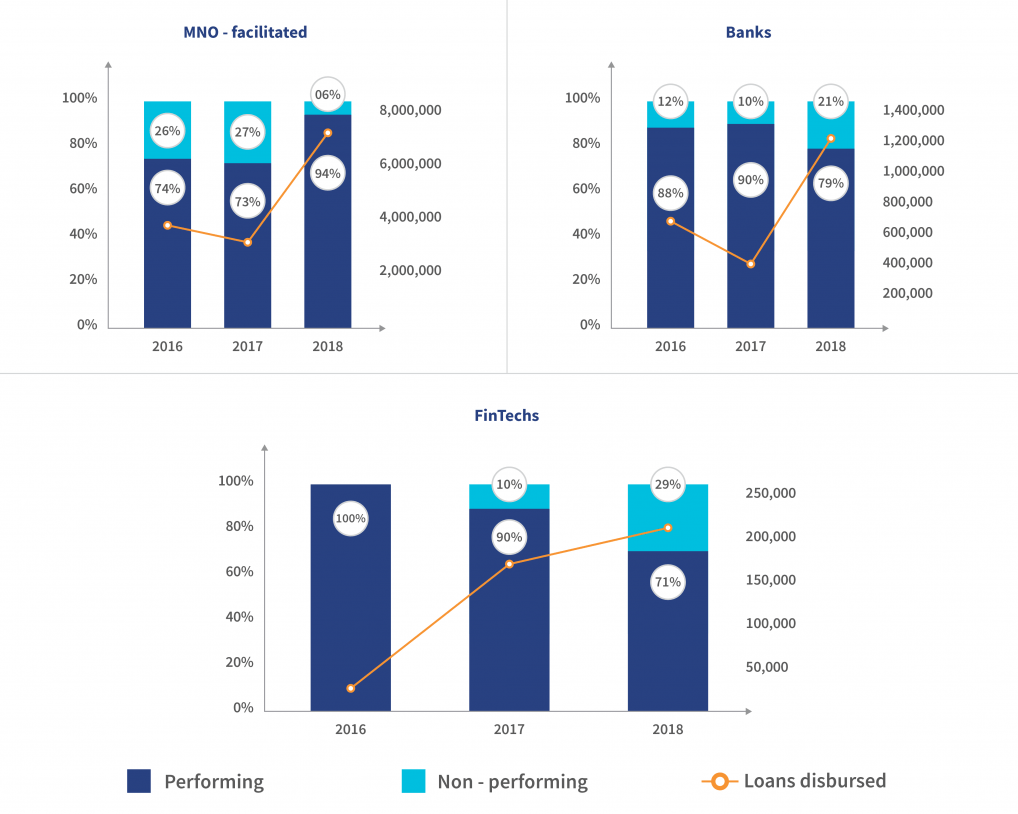

Loan disbursements and book quality per provider

[2] This figure reflects loan performance as captured by supply-side data as of end-2018. It rose to 11.75% as of August, 2019.

Further analysis of disbursement and loan quality

All suppliers have generally increased their loan volumes from 2016 to 2018. With an increase in portfolio, we can expect an increase in NPLs. However, the key MNO-linked suppliers have managed to increase both quantity and quality of loans, as seen from the data in 2018.

We think that this is largely due to a number of reasons. First, these suppliers enjoyed a first-mover advantage, which has provided them with robust customer data—both from mobile money historical payment transactions and from a longer digital credit history to underpin their credit assessment. In particular, Safaricom has data of millions of loyal customers who use their wide range of services. Second, this first-mover advantage has also allowed time for continuous improvement of their algorithms for credit assessment. Safaricom has since started selling the credit scorecard for its customers to other providers in the market. However, it still enjoys the prerogative of deciding which suppliers can access this data.

What could be leading to better loan repayment?

Increased awareness of the consequences of loan default

In our qualitative interviews with 50 digital borrowers, we found that they are increasingly aware of the impact of defaulting digital loans. They know that they risk being negatively listed in the credit bureaus, which would lower their credit score and limit them from accessing formal credit. Further, most clients are willing to repay the loans mainly because of their innate nature or due to their need to retain and increase their loan limits and maintain access to the loan.

Improvement in credit scoring

Our engagement with the lenders revealed that their loan assessment algorithm has been getting better over time. The accuracy of credit scoring continues to improve with usage. The lenders have adopted a test-and-learn approach where they use the initial stages of the product to learn the financial behaviors of their customers, which include saving, borrowing, repayment, and defaulting. The inputs improve the accuracy of predictive analytics through machine learning. For example, M-Shwari piloted their product for 18 months. This allowed sufficient time to collect data that would support in predicting the performance of future borrowers.

Now that players in the industry have gained experience and showed positive trends, what would we like to see in the future?

• Improvement of the products offered to ensure that they are customer-centric: Nearly all the products from lenders have similar features. Their tenure is mostly one month and the monthly interest rate is around 7.5%. On the contrary, the needs of customers are diverse and thus require differentiated products. A handful of lenders have been focusing on the underserved segments. FarmDrive is an example of a fintech that lends to small-scale farmers with products that are designed specifically for the market segment. In addition, products like AfriKash, which focuses on informal women traders, offers flexibility in repayment that rewards those that repay early.

• Regulation of the sector: The regulatory architecture that governs digital credit requires a coordinated effort to be reformed. Largely, we may consider the sector to be regulated. This is because MNO-facilitated lenders and banks, which enjoy the biggest market share, are fully governed. However, fintechs remain largely under-regulated. They have recently formed their own association with 11 members, dubbed the Digital Lenders Association of Kenya (DLAK). The DLAK aims to strengthen the sector with best practices and consumer protection. The introduction of data-protection draft bills for legislation in July 2018 and the reform of credit data reporting templates are steps in the right direction. However, much more can be done.

Our report based on our study of the digital credit landscape in Kenya (2019), discusses the changes in the digital credit landscape. It highlights the core challenges, emerging concerns and also goes further to formulate recommendations for both regulators and suppliers to make the delivery of digital credit more responsible and customer-centric. Read it here.

Leave comments

peter kaiga

20 Sep, 2019

Great Insights, Banks still King in Digital Lending, would be interesting to see if there is a significant change in 2019 data

peter kaiga

20 Sep, 2019

Great Insights, Banks still King in Digital Lending, would be interesting to see if there is a significant change in 2019 data

Written by

Olivia Obiero

Manager

by

by  Sep 19, 2019

Sep 19, 2019 5 min

5 min

Comments (2)