How do we envision digital payments beyond 2022?

by Manali Jain and Karishma Pradhan

Sep 27, 2022

6 min

This blog is the last of a three-part blog series. The blog highlights payment solutions that can lead to higher adoption and usage of digital payments in India by 2025 and drive financial inclusion by taking digital payments to the last mile.

Twenty-seven-year-old Vaishali runs a kirana (grocery store) in Uttar Pradesh. She started using QR-code-based payments and started accepting UPI. Vaishali also began to take customer orders through WhatsApp during COVID-19. Before the pandemic, she had limited exposure to digital payments and used to collect cash and deposit it weekly in her bank account. Despite her initial reluctance, Vaishali embraced both contactless payments options. “They are faster and easier. Initially, I thought contactless payments were just a way to please my customers. Now I know how much they help me.”

Vaishali now also uses an app to run her business, manage her books, and track all payments and orders at the store. As a mature user of digital payments, she now believes it has helped her increase efficiency and improve her business. Vaishali’s story reflects the financial livelihoods of many of the 60 million-plus micro-merchants in India. FinTechs and rising innovation in the payments sector now cater to merchants like her through business management and financial services apps. These organizations and products have transformed the payments experience for many such small merchants in the country.

Data from India’s central bank, RBI, suggests that digital payments grew at a CAGR of 38% in volume in the past five years (FY 2017-18 to FY 2021-22), which indicates the high pace of digital transformation in India. Several factors contributed to the rise in innovative solutions in the country, such as the proliferation of digital-savvy customers with high internet usage, rising smartphone penetration, and the arrival of an enabling regulatory environment. These have led to enhanced convenience and transaction experience for consumers and businesses.

However, persistent barriers in the digital payment infrastructure impede the uptake of digital payments. These include low smartphone ownership—especially among female customers, complex user interfaces, and low internet penetration in rural areas. People like Vaishali encounter challenges with only a handful of acceptance devices and inadequate cash-in-cash-out (CICO) networks, which further hinder the growth of digital payments. See our second blog for potential use cases in digitization and the untapped market for digital payments.

FinTechs have been approaching this market space with newer and creative models as they look into customer data, their behavior, and their perceptions. They have developed customized products for the mass market through machine learning, artificial intelligence, blockchain, and data analytics. These tools intend to provide a seamless experience to a large customer segment that has so far remained financially unserved or underserved.

As India becomes the fastest-growing FinTech market in the world, FinTechs and payment banks have continued to disrupt the space. Large players have emerged as key entrants, including WhatsApp, which provides payment options, and Amazon, which offers online payment and delivery options of goods and services in the neighborhood to support local store owners. Similarly, the launch of ONDC (Open Network for Digital Commerce) will digitize the e-commerce space and help small merchants expand their business further. ONDC is a community-led network that works to create an open, inclusive, and competitive marketplace.

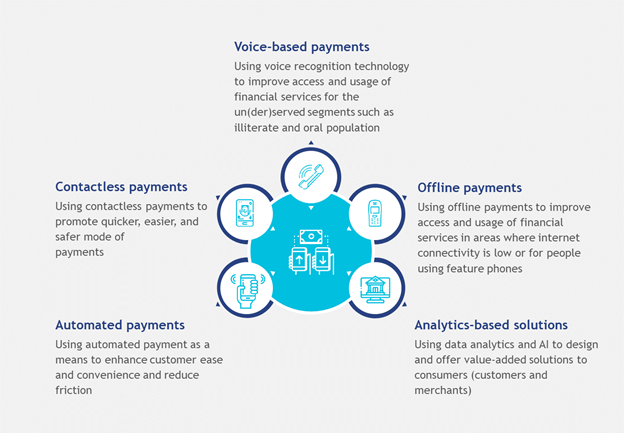

The demand for digital payments will continue to rise and accommodate newer players in the market. Meanwhile, several payment solutions are expected to lead the adoption and usage of digital payments. These include:

- Convenient, automated payments, which would allow customers to set up recurring payments for multiple bills, for investments, such as SIPs, and to automate other transactions. The industry currently has the capability and technology required to make frictionless payments seamless, with RBI considering the development of a sovereign digital currency in the country and mandating tokenization of cards—which currently apply only on credit cards.

- Speed and ease through contactless payments, which are envisioned to be a key solution for people to make payments by 2020, with systems like “pay-and-go” under NFC. Contactless payments constituted 15% of the overall digital payment solutions and are expected to expand with wider acceptance of NFC-based infrastructure and NPCI extending UPI’s reach in the future. The recent introduction of UPI123Pay for India’s 400+ million feature phone users, the launch of wearables for making payments, and the linkage of credit cards with UPI are expected to expand the use of contactless payments further.

- Voice-based technology and offline payments have the potential to reach the oral segments, as well as remote areas with low internet penetration, which can lead to last-mile penetration of payments. Merchants who cannot embrace technology will find voice-based solutions easier to use and can start accepting digital payments from their customers. The

- Increased transparency and personalization through analytics-based solutions, which will further enhance customer experience as users’ digital footprint deepens. Blockchain and AI/ML are expected to disrupt the payments space as they enter the markets. NPCI has already been gearing up to set up a blockchain platform, Vajra. Many FinTechs may also introduce solutions that would lead to customized products for the LMI segment based on their needs and data-driven information.

For merchants, these personalized solutions will provide additional value-added services, such as access to credit and sales dashboard analysis, leading to better business management and growth in the long run. Similarly, the launch of the Account Aggregator will expand data usage through a consent-based data sharing framework and improve access to financial services using analytics-based solutions.

The way ahead for financial service providers (FSPs) and regulators to encourage the sustained use of digital payments

FSPs need a better understanding of the needs, aspirations, perceptions, and behavior of customers. They need to know the barriers that hamper the customer journey of adoption. Several interventions can increase awareness and trust among people for digital payments and amplify usage among existing customers.

- Develop anchor use-cases for customer segments: Providers should create need-based anchor use-cases to enable the adoption of digital payments by various sub-segments of the population, such as women, farmers, merchants, and urban poor segments. Without anchor use-cases, payment solutions will unlikely find acceptability and uptake among customer and merchant segments like Vaishali in the long run.

- Conduct UI/UX testing of the product to ensure intuitive product design: Providers must create a positive experience for customers who have recently started experimenting with digital payments, to sustain their usage. Vaishali’s lack of intuitiveness and dependency on the regional language was a primary concern when she started using digital payments. Payment apps that offer regional languages can ensure a clear, engaging experience with digital payments for customers who struggle with English.

- Develop offline solutions to conduct transactions in regions plagued by low connectivity: Unstable internet connectivity in the hinterlands makes digital payments difficult for users who live there. This creates an urgent need for providers to develop offline payment solutions where transactions can either be processed without a data connection or processed later once a data connection is available. While the launch of UPI123Pay is a step in the right direction, the product must crucially offer a simplified user flow for the target customers to use it.

- Providers should deploy more PoS devices, such as smart PoS devices, BAP devices, and even Bharat QR codes, to improve the country’s acceptance infrastructure and build merchant capabilities. Devices like smart PoS can facilitate card payments and provide UPI transactions, pull-based transactions, and QR codes, among others, and use data analytics to offer payment-plus services, such as credit and insurance.

Despite the barriers, India’s evolving digital payments landscape suggests that the time is ripe for players in the ecosystem to work together and build secure and interoperable digital platforms ready for adoption by customers—especially ones from the LMI segments. FSPs should seize this opportunity and digitize the payments market, which will be worth USD 10 trillion by 2026.

Written by

by

by  Sep 27, 2022

Sep 27, 2022 6 min

6 min

Leave comments