AgTechs in India – Growing landscape and challenges

by Shweta Menon, Mohit Saini and Anil Gupta

Jul 15, 2020

4 min

This blog is the second in this series and covers the AgTech landscape in India, illustrates AgTech offerings across the agri value chain, and highlights the three key challenges that limit their growth.

The AgTech landscape in India is on a growth path

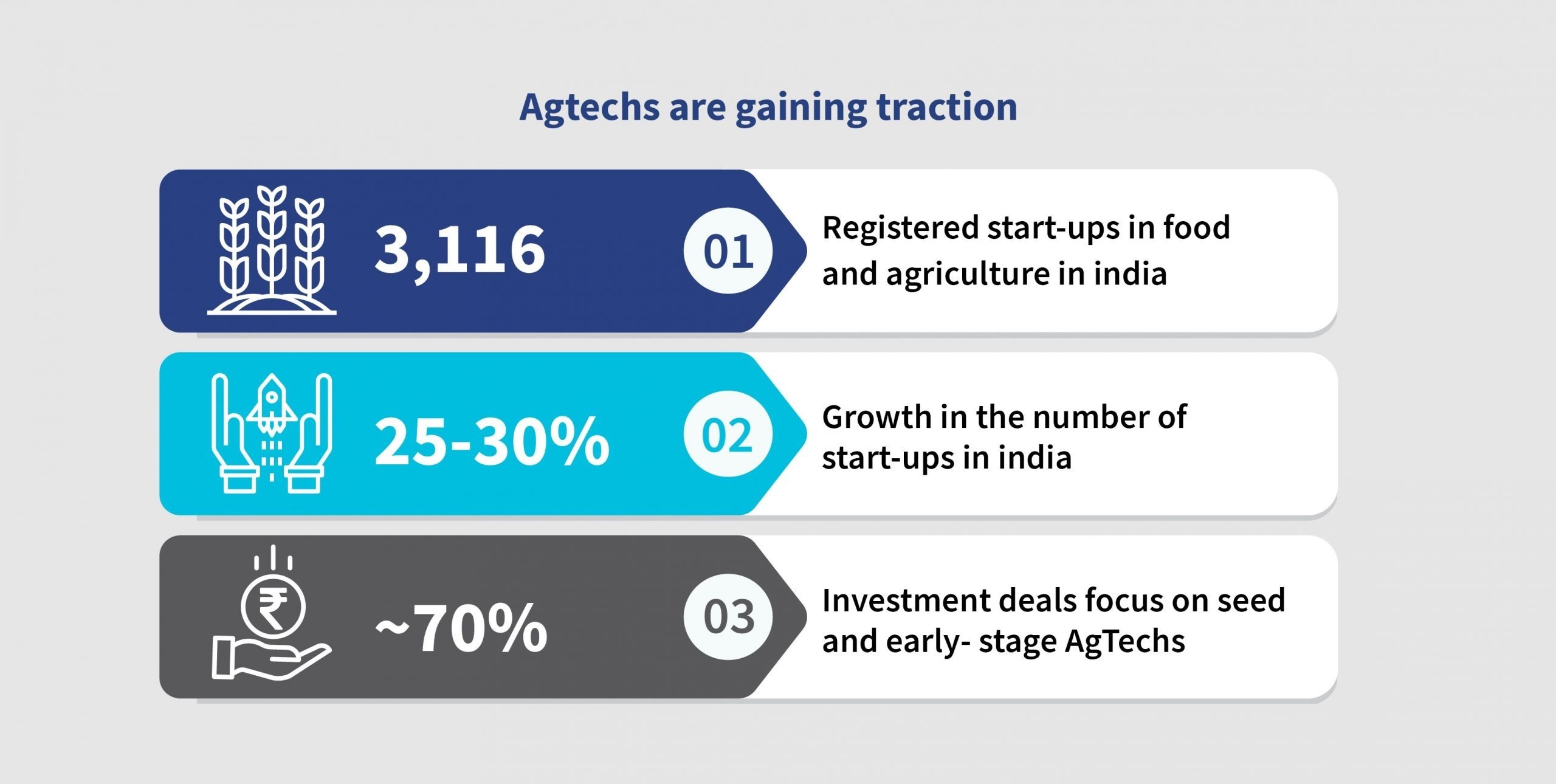

Over the past few years, the presence of AgTechs has increased. As per data from Startup India, the country has nearly 3,116 registered food and agriculture start-ups. This number has increased 25% to 30% annually. Most of these start-ups emerged over the past five years and at least 500 have crossed the Proof of Concept[1] (PoC) stage.

Globally, India ranks second, based on the number of AgTechs, behind only the US. A 2018 PwC report estimated the overall target market for AgTechs in India to be more than USD 350 billion yet the combined revenue of all food and agri start-ups in India is less than 100 million USD, indicating a huge opportunity for AgTechs to disrupt the market.

Investors are also increasingly interested in AgTechs in India. The sector currently has more than 90 active institutional investors and 250 angel investors. This interest has translated into higher investment sizes—the sector has seen investments worth about USD 500 million since 2014, with more than 50% of this amount invested in 2019. AgTech in India received a major boost early last year with Tiger Global investing USD 89.5 million in NinjaCart. Furthermore, the sector has received renewed attention as a result of COVID-19 as AgTechs supply essential products and services. The pandemic has presented an opportunity for growth for many AgTechs and has demonstrated their resilience and relevance.

Our analysis further suggests that seed and early-stage funding comprises nearly 70% of AgTech investment deals whereas the remaining 30% represent investments in series A stock and beyond. With an agrarian economy and the world’s second-most populous country, funding has facilitated AgTech innovations and improved the productivity of farms and farmers.

AgTechs offer diverse solutions across the agri value chain

Innovative AgTechs in India offer solutions to problems permeating the entire agri value chain, both upstream (close to farmers) and downstream (close to consumers). For the purpose of MSC’s study, AgTechs in India were classified into six broad categories, as discussed below, based on the solutions offered. Farmers require financial services for various purposes across each of these six categories:

- AgTechs in farm management and data analytics facilitate data collection and decision-making using drones, sensors, Internet of Things (IoT) technology, and data analytics. These AgTechs use this data to build models around price forecasting and the management and monitoring of crops, among other areas.

- Agri-input marketplaces provide farmers and merchants a platform where they can purchase agriculture inputs and facilitate last-mile delivery.

- Agri–output marketplaces are business models that aggregate demand in the supply chain. They typically source produce from farmers or farmer producer organizations (FPOs) and sell to Kirana stores, supermarkets, and hypermarkets, among others.

- Agri financing companies offer applications and platforms that connect farmers digitally. They offer digital payment solutions, lending services, and insurance services. Most FinTechs in India have built interesting models around farmer onboarding and credit scoring using alternate data, such as farmer behavior. Agri-FinTechs have huge potential to meet the unmet credit needs for farmers with their innovative models.

- Livestock management AgTechs digitize supply chains for allied activities such as cattle, poultry, and fisheries to introduce efficiency and reduce costs.

- Mechanization or novel farming systems are a category of AgTechs that include 1) companies offering farming-as-a-service, in other words, they rent services and machinery to reduce capital expenditures thereby increasing efficiency and affordability, and 2) companies that offer alternate farming techniques such as aeroponics[2], hydroponics, and aquaponics.

Three key factors limit the growth of AgTechs in India

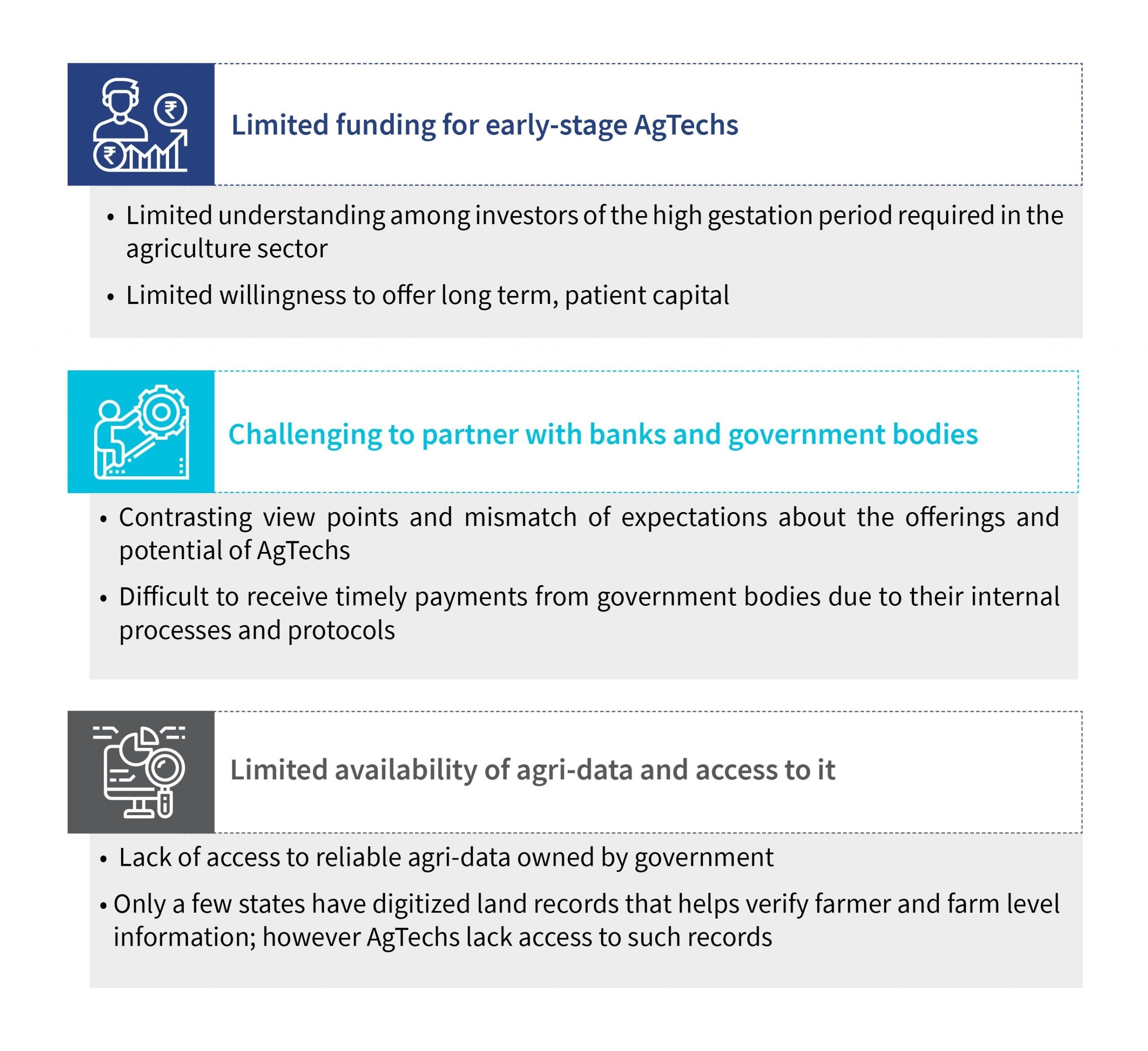

Despite their immense potential, AgTechs in India are limited by challenges around funding, strategic partnerships, and data. The following graphic looks at these challenges in detail:

AgTechs continue to innovate with the goal of improving farmers’ lives. Yet, the complexity of the agriculture sector makes it difficult for AgTechs to remedy these challenges independently. The answer, in part, lies in collaboration. Some AgTechs have realized this and are actively scouting for ways to collaborate with financial institutions and government bodies. In the third and final blog of this series, we highlight ways AgTechs can successfully work with financial institutions and overcome collaboration challenges, as well as discuss ideas behind the development of innovative solutions to finance the farmers.

About the blog series

This is the second blog in a three-blog series for a study entitled the “Role of tech-enabled formal financing in agriculture in India” conducted by MSC (MicroSave Consulting) and ThinkAg, with support from Rabo Foundation. Read the first blog of this series here.

[1] Proof of Concepts are used for testing the feasibility of a design idea or concept for application to real-world challenges and problem statements.

[2] Aquaponics is an indoor gardening practice whereby plants are grown and nourished by suspending their roots in the air and spraying them regularly with nutrients and water solution. Hydroponics is the science of growing plants without using soil, while feeding them with mineral nutrients dissolved in water. Aeroponics is the field of agriculture that uses technology for data collection, analytics and automation in farming activities.

by

by  Jul 15, 2020

Jul 15, 2020 4 min

4 min

Leave comments