GoGullak- Making personal finance management easier

by Manali Jain and Shweta Menon

Jul 12, 2023

6 min

GoGullak aims to improve the relationship of money with individuals. Based on the concept of ‘Gullaks’ or containers, users can allocate money in different expense categories. This enables them to manage their finances with better control. Read on to learn how GoGullak uses this principle to automate the allocation of expenses and investments and provide personal financial advice using AI and ML.

This blog looks at a startup called GoGullak, part of the Financial Inclusion Lab accelerator program, which is supported by some of the largest philanthropic organizations across the world—Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network.

India is home to ~450 million blue-collar workers, most of whom earn a decent income but struggle to save adequately due to lack of appropriate tools. Piyush is one of them. He works in a factory in Delhi and earns INR 20,000-30,000 (USD 244-365) monthly, depending on the incentives he receives. He often struggles to manage his finances and resorts to personal loans for exigencies. Once he pays off his EMI and other necessary expenses, such as school fees and rent, he struggles to manage his remaining expenses.

Piyush knows that budgeting and tracking his expenses would help, but he finds it challenging to follow through every month. He tried a few ledger-keeping applications, but these did not suit his needs as they all worked after expenses had been incurred and did not help in decision-making when making payments. He continued to struggle to pay monthly EMI or save and invest to build an emergency fund.

Millions like Piyush face fail to manage their finances due to a lack of knowledge about financial planning and limited access to appropriate tools through which they can plan. This struck a chord with former engineers Avinash, Yashraj, and Yash —the co-founders of GoGullak.

Since their college days, the trio has been passionate about building a scalable product that could create real social impact. Initially, they worked on a financial education solution for investing in stock markets but quickly realized that financial management is a bigger cause of concern among India’s middle-income investors. Most users used several ledger-keeping apps to manage their finances but struggled to save enough money for investments. This led them to conceptualize GoGullak in February 2022, christening their venture based on the Hindi word for traditional earthenware coin boxes children use to save small change: “gullak.”

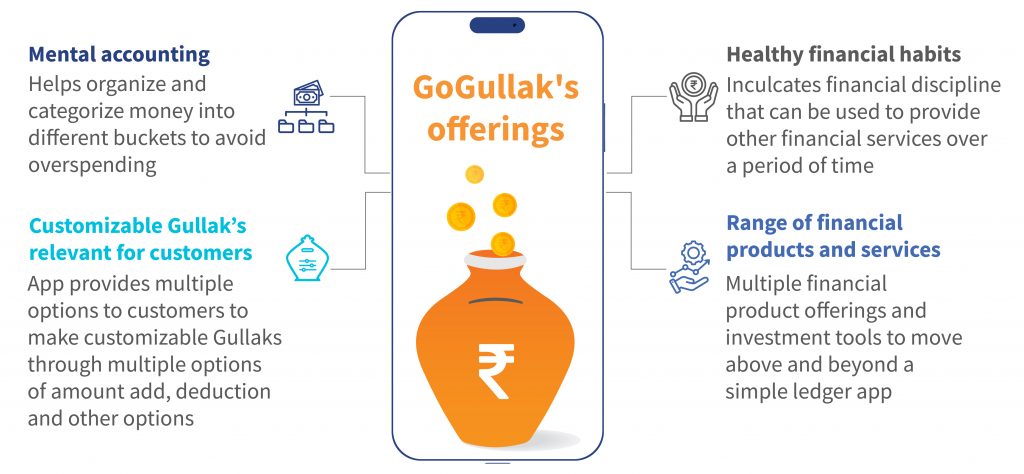

The GoGullak pitch: Building better financial habits through the concept of mental accounting

GoGullak is an aspiring neo-banking platform that helps users align their financial goals through real-time budgeting like an orchestrated finance platform that makes financial management as easy as arranging files on a computer. GoGullak uses the principles of mental accounting, popularized by behavioral scientist and Nobel laureate Richard Thaler as a way people organize and categorize money as per its intended purpose. This helps users better understand their spending habits and make more informed financial decisions. Users can park their money for specific purposes in separate micro-containers in their accounts, just like physical Gullaks.

A major problem that users like Piyush face is the inability to control their spending when all of their money looks the same in a single digital account, even though each rupee may have a different purpose.

To solve this problem, GoGullak allows users to save money for different categories, such as rent, bike expenses, subscriptions, food, and EMIs on the app. Unlike a typical savings account in a bank, GoGullak helps users to create labeled micro-containers, with each gullak acting as a sub-account on top of a single bank account. This allows users to budget their monthly expenses for each category on the app. The users pay through the gullaks created for each category on the app instead of conducting a post-facto analysis of the expenses incurred in the month. Users can club similar spending categories or earnings and manage them individually through these gullaks.

GoGullak offers complete customization of each gullak to each individual’s needs and offers them the flexibility to budget, track, and pay conveniently through a single platform.

An ecosystem approach to build the business model

The founders understood that if they could create value for users when they sought to plan, store their money, and pay through GoGullak, they could uncover an opportunity to monetize the platform. They could provide users with suitable products, such as mutual funds, insurance, white and electronic goods with save now, buy later (SNBL- where customers can save in installments to buy products in future) while offering them good consumer brand deals. In the process, the founders want to create an ecosystem where consumer brands and financial institutions can use transaction data to offer GoGullak customers tailored offerings.

GoGullak’s ecosystem will help users plan, save, invest, and purchase transparently while promoting good financial behavior. “I am focused on building long-term sustainability for the user and GoGullak. Anything bad for users in the short term, even if it is good for GoGullak’s revenue, is not sustainable. GoGullak’s analytics will nudge users to adopt sustainable financial practices and spending through the platform for the long-term,” notes Yash, GoGullak’s co-founder.

GoGullak’s vision is to ensure that users enjoy financial freedom and bring financial discipline back into their lives. This vision resonated with leading financial institutions in the country and has encouraged them to tie up with GoGullak to offer its solution to their customers. GoGullak is currently a part of the Fincluvation program with the India Post Payments Bank (IPPB). Under this IPPB willl leverage GoGullak’s solution for its customers.

Challenges for GoGullak

Automated personal finance management lies at the core of GoGullak’s value proposition. While this is valuable and holds appeal across different customer segments, GoGullak’s product roadmap and promotion will have to ensure that the initial hook of financial management translates into adopting other products like investment, insurance, financial analytics, and SNBL, as these are key revenue sources. In this process, another challenge for GoGullak is to make an intuitive user interface so that users can navigate through various products and features with the least possible friction. Besides these, system integration with banks and other financial institutions to provide a smoother user experience has been a constant challenge for the team.

Support from FI Lab

Under the FI Lab program, MSC helped GoGullak identify its target segments, understand their behavior, and help the founders identify gaps in the app’s UI/UX journey. The research with salaried classes and micro-entrepreneurs revealed pain points in managing their personal finances. It helped identify the key focus areas for GoGullak to build loyalty and retention. The insights helped the startup refocus and target its efforts towards a particular range of income and occupation segments. GoGullak’s proposition resonated the most with these segments and helps them address their pain points efficiently.

The MSC team also helped GoGullak build a B2C and B2B2C GTM strategy and created an implementation roadmap post its launch.

Building financial discipline and a digital future

GoGullak plans to boost its customer reach and performance. As it grows, it will focus on big data and artificial intelligence to build services that will make personal finance management easier for its users. With the vision to make GoGullak universally accessible and helpful, it expects to create an impact on the low- and middle-income segments. In addition, the team is working on creating a voice-based chatbot in the native languages of India to improve the usability of its app for even low-tech savvy persons. “Ultimately, we want to give everyone their financial assistant, which will act as their second brain for personal finance,” says Avinash, the co-founder of GoGullak.

The co-founders believe that by making financial planning and management more accessible and useful to everyone, they can empower people to take control of their financial future and achieve their financial goals.

This blog post is part of a series that covers promising FinTechs that have been making a difference in underserved communities. These startups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative and is co-powered by MSC. #TechForAll, #BuildingForBharat

Written by

by

by  Jul 12, 2023

Jul 12, 2023 6 min

6 min

Leave comments