Formal financial services, informal workers: How can financial services work for the gig economy?

by Peter Charagu and Edward Obiko

May 20, 2020

5 min

The informal sector offers abundant opportunities for the youth in Kenya to generate income, though it has its challenges like poor and irregular pay and a host of other challenges. Read more on what can be done for the gig platform economy to offer better working conditions for the informal workers.

It is a new week and month. Miriam rises in the morning, prints 20 copies of her résumé, and ventures into the city of Nairobi. She plans to drop her resume at different companies within the Central Business District in the hope of getting a job. It has been nine months now since she graduated with a diploma in electrical engineering from a local technical college. Yet she has not been able to get formal employment.

The scarcity of formal job opportunities is increasingly becoming a cause of frustration for young people in Kenya, much like Miriam. The COVID-19 pandemic has exacerbated the situation even further. Unable to secure formal employment, Miriam had been using her skills to provide electrical repair services to people in her locality and, in turn, making some money to get her going. Given the essential nature of her work, Miriam is still able to receive calls to fix domestic electrical faults. The income from these odd jobs would be decent—if they were more regular and better paid. She wants to be her own boss, but the jobs she gets from friends and previous customers are not enough.

According to the United Nations, the rate of unemployment[1] in Kenya is at 11.5%. This is significantly higher than its neighbors Tanzania and Uganda, which have unemployment rates of 2.2% and 2.1% respectively. It is important that we solve issues of unemployment, which fall under Sustainable Development Goals 1, to end poverty, and 8 to promote economic growth. Abundant opportunities for income generation for the youth in Kenya lie in the informal sector. The Kenya National Bureau of Statistics estimates that in 2018, 83% of the employed in Kenya were in the informal sector. This number has been consistent and growing for the past five years, demonstrating the critical role the informal sector plays in the economy.

The informal sector has several characteristic features. These include small-scale activities, low entry and exit barriers, skills gained mostly from vocational schools, less capital investment, limited or no job security, and self-employment. The proliferation of digital financial services has also enabled remote working and payment, where possible. However, the informal sector faces several challenges:

- Poor and irregular pay: Informal jobs are not consistent. The remuneration is usually low as informal jobs are often considered of less value.

- Lack of awareness and minimal protection of workers by labor laws: Workers are exposed to mistreatment, wrongful dismissal, and poor working conditions, among others.

- Lack of access to necessary financial services, such as insurance, credit, and pension: Informal workers lack transaction history and job security, which impedes their ability to access credit and insurance.

- Lack of employment history: Save for personal referrals, informal workers are rarely able to demonstrate their track record to get jobs.

- Loss of potential government revenue: Most informal workers do not contribute to income tax.

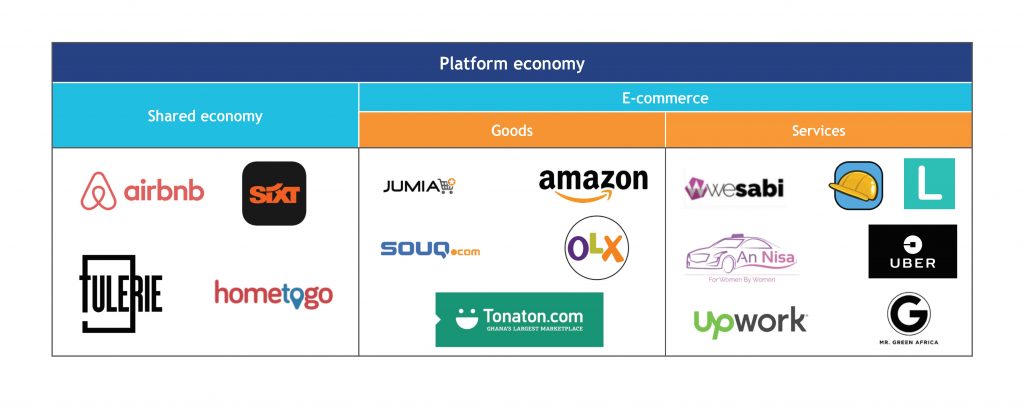

So how does the informal sector become more conducive for the worker? How do we solve issues of informal employment, such as poor pay, inconsistent jobs, and lack of access to financial service? The platform economy is one solution that helps informal workers to benefit from the advantages of the formal economy. Through these digital platforms, the records of workers are well captured and retrievable. Sometimes referred to as the gig economy, these digital platforms are marketplaces where independent workers meet customers to offer one-off, short-term services like transport, plumbing, electrical installation or repair, research, and web development, among others.

Below are current examples across the globe:

Description of Lynk

Formalizing aspects of the informal sector

Gig platforms guarantee the informal worker that they will have continuous work. Customers trust the platforms to provide safe and vetted expertise on the platforms. Informal workers now access more opportunities every day and have a stable income. Miriam is now part of a gig platform and offers multiple electrical installation and repair services through the platform. She benefits through a mix of on-the-platform and off-the-platform jobs. She continues to serve people from her locality alongside new consumers through the platform based on their location.

With the increasing number of COVID-19 infected cases and government-imposed lockdown and social distancing measures, some app-based services have flourished. Glovo, a delivery firm, was reported as among the most downloaded apps for the month of March 2020, in Kenya.

The COVID-19 pandemic has however, had a drastic impact on traditional physically accessed informal jobs. The manicure artist, for instance, who waited for customers passing by her shop, now does not have any more business as the customers are all at home, keeping safe from the spread of the virus. The carpenter, who relied on customers passing by the road to see and buy great furniture, is not able to sell his goods as the customer is at home. Once the artisan is able to display their goods on an online platform, the customer will access these good seamlessly. The customer still needs furniture and good nails, but they need it in the safety of their homes.

Gig platforms collect large amounts of data. This data includes information, such as the number of engagements, the payment amounts, the variety of services provided, and customer testimonials. Such data may be useful in enabling informal workers to access a range of financial services, such as credit, pension, and insurance. Some jurisdictions require gig platforms to provide insurance policies such as Work Injury Benefits Act (WIBA), especially when contracting blue-collar workers who face risks involving accidents at work.

MSC recently engaged local insurance companies to develop microinsurance products for gig-workers. The platform is piloting the use of transaction and job data to provide adequate cover to gig workers through dynamic and on-demand policies. Such insurance products are beneficial to both the gig-workers and the gig platforms. However, developing such insurance products requires re-thinking insurance models to make them more customer-centric as well as cater to the digitally-transforming informal sector. Gig platforms must also explore the role of incentives, such as financial education to help gig workers improve their livelihood through digitally-issued financial services like insurance.

Miriam started getting work through Lynk to offer electrical repair services. “I am now earning better than my peers who joined a formal job, thanks to the platform”, Miriam beamed. She is her own boss and is optimistic about her future now.

In the next blog, we explore in more depth how to develop insurance and other financial services for gig workers.

[1]Unemployment is defined by the International Labour Organization (ILO) as “not in paid employment or self-employment, but is available for work and has taken steps to seek employment or self-employment”.

by

by  May 20, 2020

May 20, 2020 5 min

5 min

Leave comments