Food security: How are agriculture and the corner shops faring amid India’s lockdown?

by Akhilesh Singh and Manoj Sharma

Apr 16, 2020

5 min

What is the impact of COVID-19 on agriculture and microenterprises? As transport and flow of cash and goods remain restricted, how will farmers and owners of small shops cope with the crisis? These are some questions we explore in detail as we devise suggestions for policymakers and players in the ecosystem.

In the wake of the COVID-19 pandemic, the global economy will be impacted by USD 1 to 4 trillion, depending on the agency you want to believe. What underlies the statistics? What is the impact on agriculture and microenterprises?

Preliminary qualitative research on the impact of India’s lockdown provides important indicators on what is to come. For most people in India, lockdown means home confinement. Exceptions include government officials and a few services deemed “essential”. All public transport—road, rail, and air remains suspended, while private transport is heavily regulated.

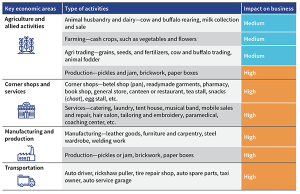

In this article, we have grouped microenterprises into four major categories.

- Agriculture and allied activities

- Corner shops and services

- Manufacturing and production

- Transport

At a high level, this is where they are, and the position will change—you bet!)

Impat of COVID-19 on business

Read on for a more nuanced and detailed understanding of agriculture and allied sectors and the corner stores and services sector.

We have split agriculture and allied sectors into three subsectors:

- Animal husbandry and dairy: Farmers in this sector rear cows and buffalos to collect and sell milk. They form a significant part of the portfolio of microfinance institutions (MFIs) and banks, and have both an urban and rural presence. These farmers rarely sell milk directly to consumers. An intermediary or milk collection agents collect the milk on behalf of large dairies, such as Parag or Amul. In the case of intermediaries, they sell milk in the market and retain a margin. The farmers are paid less, but the payment is regular.

As of now, even though the consumption of milk has reduced (remember, the sweet shops and restaurants are largely closed!), the intermediary has been buying all the milk, selling a part of it and converting the rest into ghee (clarified butter). However, since the clarified butter cannot be sold at the pace at which it is being produced, the intermediary will not be able to pay the farmers for long— their cash flows are being affected. Hence, the dairy farmers will see a greater impact in the days to come—only so much milk can be converted into ghee and milk powder!

Indian poor farmer

Implication: As a first step, the government should prevail on large dairies, especially those in the cooperative sector to continue buying milk from the market, convert it into ghee or milk powder and keep paying the farmers. The rural economy will be severely impacted otherwise.

- Crop farmers: Most farmers in India or around 70% own less than one hectare of land, which is below the subsistence level. Such farmers depend on MFIs for credit— this also includes landless farmers who rent land every season and cultivate. As of now, vegetable farmers are not impacted, and indeed are seeing an upside as prices of some vegetables, such as potatoes, have risen amid fear of scarcity. Farmers who cultivate staples are still on the edge—they are either harvesting their crops or have harvested their crops and are waiting to sell the produce.

Somewhat apprehensive, they are still hopeful that the administration will arrange to sell their produce in the market and they will realize a good price. In contrast, farmers engaged in flower cultivation are badly impacted. The demand for flowers has plummeted as temples and places of worship have shut down alongside flower retailers.

Implication: Mandis, which are wholesale grain, fruit, and vegetable markets, have to remain functional and farmers have to be provided transport for their produce. Farmers, especially those with mature crops should be allowed to harvest and get their grains to the market. The availability of farm labor is an issue, but the farmers will likely sweat it out in the field, with their family, to harvest standing crops. If the state can facilitate the journey from the farm to the market, we might see the current rural stress reduce somewhat. Otherwise, not only will the farmer be unable to repay debts, the next crop cycle will be impacted. Also, food grain prices will increase if the produce does not make its way to the markets.

- Agri trading: This includes trading of grains, animals—cow and buffalos, seeds, fertilizers, and fodder shops. Seeds, fertilizer and fodder shops see moderate to low impact. In any case, it is early days for the demand for seeds and fertilizers. However, trade in animals has been affected seriously because the movement of goods is restricted.

Implication: The government will need to allow movement of agri essentials—seeds and fertilizer to keep the supply chains moving—both to provide inputs to farmers and to maintain food supplies. Although state governments have been vigilant in this aspect, the economic equation of demand and supply remains at play, and food grain prices have started to increase. In an atmosphere of hoarding induced by fear, it will be a herculean task to maintain normal food prices. Let us hope a good harvest can control price escalation.

- Corner shops: Petty businesses, largely street shops and vendors play a critical role in the local economy. Except for those selling essential goods such as groceries, vegetables, and medicines, all other businesses are severely impacted as they are under forced lockdown. Those in the grocery business may be making a little extra money—or at least someone in the value chain is pocketing the extra cash that consumers are being made to shell out as prices begin to increase. On the brighter side, this segment of corner shops will be the first to bounce back once the lockdown ends. Though revenues may remain muted for some time, cash flows will resume as recovery gains ground and cash begins circulating in the economy.

Implication: Replenishing supplies at corner stores will call for more working capital. Will banks and MFIs have the liquidity to meet this need? A lot will depend on the relief package from the Government of India and the Reserve Bank of India. As of now, a three-month moratorium, which does not apply to NBFCs—the mainstay for these corner shops—is grossly inadequate. In case the informal economy is to survive, RBI will have to announce a six-month moratorium and include NBFCs and NBFC-MFIs as beneficiaries of the repayment holiday. How else will money flow into the informal economy?

Corner shop in India

- Services: All activities under the services category are severely impacted. Either the demand for services has reduced or access remains an issue, or a combination of both continues to plague services. However, here again, recovery will be quick once the lockdown ends. MFIs and banks have moderate exposure to this segment and its loan requirements are not significant. In most cases, the person or entrepreneur is selling their skills.

Implication: These businesses may or may not need additional working capital. In case a loan is outstanding, stagger the repayments and increase the repayment period. The trickle of customers into these service outlets will build up gradually. Revenues will remain muted for some time to come. Spread the tenure of loans and—pray!

Indian village women smiling

Leave comments

Prakash Chandra Panda

09 May, 2020

The article has been well presented and contains a wholistic picture of impact of covid 19 on rural economy. A list of remedial measures like; Subsidizing credit and input supply Strengthening supply chain of vegetables and food grains and enhancing storage and transportation More government expenditure on cold chain and supply chain. Devising new mechanisms like door step delivery and home delivery of vegetables by mobile vans.Mobile marketing facilities etc can help.

Written by

by

by  Apr 16, 2020

Apr 16, 2020 5 min

5 min

Comments (1)