Fintechs for LMI segments – What’s the intricate puzzle?

by Mohit Saini and Tanvi Maniktala

by Mohit Saini and Tanvi Maniktala Aug 16, 2018

Aug 16, 2018 5 min

5 min

This blog covers the definition of the LMI segments, the fintech landscape in India, and the challenges that prevent various players like fintechs, incumbents, and investors from catering to these segments.

In 2017, J.P.Morgan commissioned MicroSave and IIM Ahmedabad’s Centre for Innovation Incubation and Entrepreneurship (CIIE) to undertake a study on the fintech landscape in India. This comprehensive study focused on the low- and middle-income (LMI) segments in the country. The research team consulted over 60 stakeholders spread across various industries, institutions, leadership levels, and geographies. The research sample had representation from fintechs, incumbents, investors, donors, industry bodies, experts, regulators, government and allied bodies, and incubator and accelerator managers.

We have captured the findings of the study in three blogs – this being the first in the series. This blog covers the definition of the LMI segments, the fintech landscape in India, and the challenges that prevent various players like fintechs, incumbents, and investors from catering to these segments. The second blog in the series highlights the potential opportunities present in the LMI market and how the current fintech ecosystem is approaching an inflexion point. The third blog highlights seven potential ways in which the fintechs can serve the LMI market and unleash its potential.

|

Understanding the LMI segments

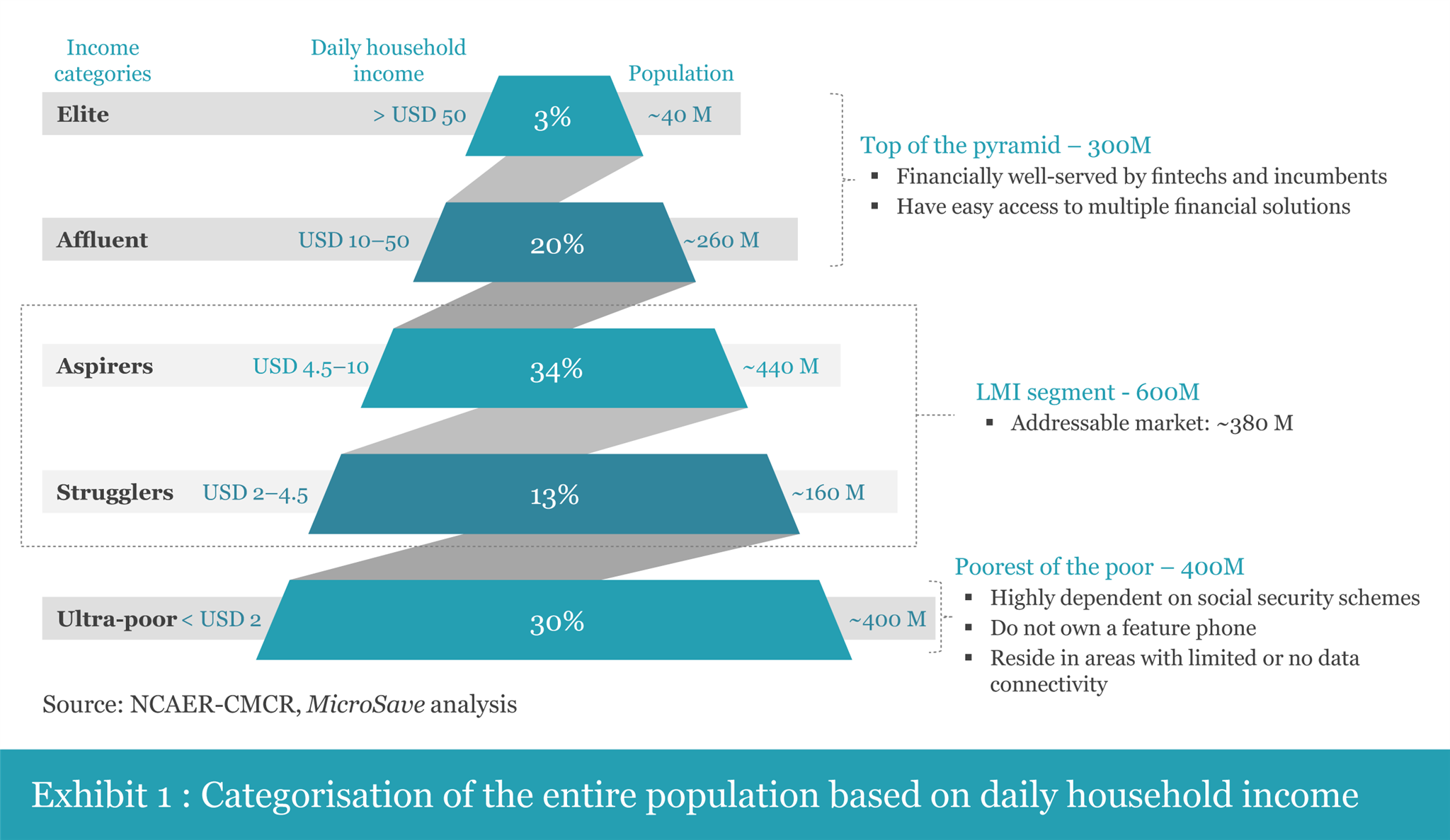

For the research, we have categorised the LMI segments based on daily household income. A snapshot of the entire population including the LMI segments is as follows:

The current trend and focus of incumbents and fintechs suggest that the top of the pyramid is financially well-served. However, the bottom-most segment, that is, the ultra-poor, is currently not ready to use and adopt most of the fintech solutions. The middle section of the pyramid, which comprises aspirers and strugglers, is classified as the LMI segments. Our analysis suggests that it is this middle section of the pyramid that offers an expansive new market for fintechs. The skewed focus of fintechs on the elite and affluent segments leaves an addressable market of ~320 million (84%) LMI customers untapped.

The fintech landscape in India

Over the past few years, there has been a growing influence of fintechs in India. The fintech landscape has seen rapid growth in terms of numbers and reach, as well as investments in fintechs. According to a 2017 PwC report, there are more than 1,500 fintechs in India. Two-thirds of them started in the last two years. An earlier KPMG report from 2016 estimated that the transaction value for fintechs in India would increase from USD 33 billion in 2016 to cross USD 73 billion by 2020.

As expected, the fintech sector continues to witness acquisitions for a variety of reasons. This has mostly to do with a tendency within the fintech sector to deriving synergy and consolidation. Our analysis of data from Tracxn suggests that between 2011 and 2017, there have been 27 notable acquisitions in the fintech sector in India. Some of these include FreeCharge by Axis bank, PhonePe by Flipkart, and Citrus by PayU.

From the data, it appears that the fintech sector is growing. However, it is restricted to certain geographies and service lines. Moreover, only a few large, established players are able to emerge and receive major investments in India.

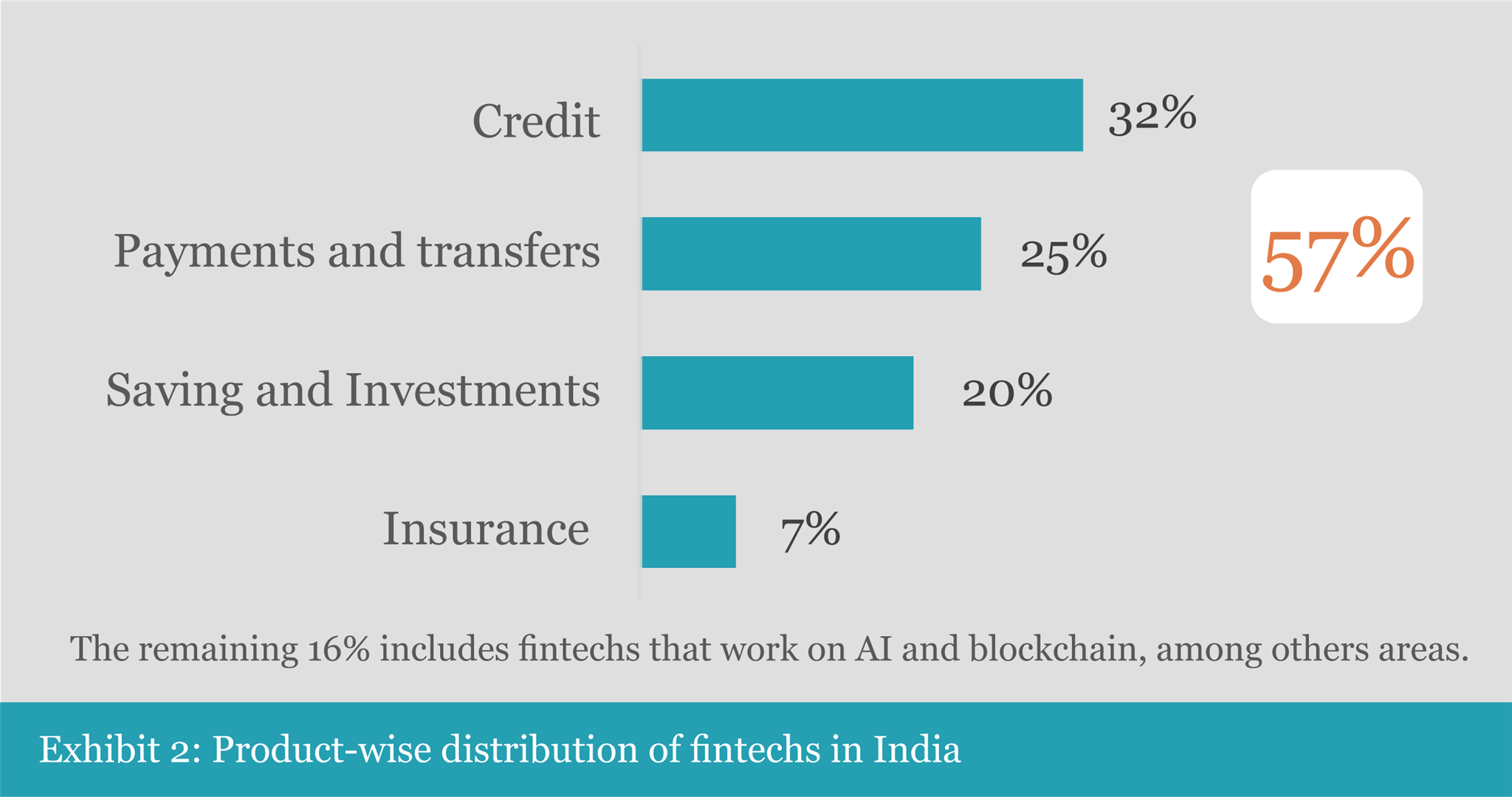

As per the data from Tracxn, 82% of fintechs are located in the three metro cities, that is, Delhi-NCR, Mumbai, and Bangalore. Moreover, a significant proportion (57%) of fintechs offer either payments and transfers or personal/business credit products. This leaves behind savings & investments, and insurance products. The analysis also suggests that since 2011, 87% of the total investment in the fintech space has gone into fintechs that deal with payments & transfers, and credit products. Moreover, the investment pattern is highly skewed towards select fintechs. For instance, 75% of the total investments since 2011 have been made in only 10 fintechs. Of these, Paytm alone cornered 47% of the total investment. Moreover, most of the fintechs receive large investments at an expansion stage, that is, at the Series D, E, or F stages.

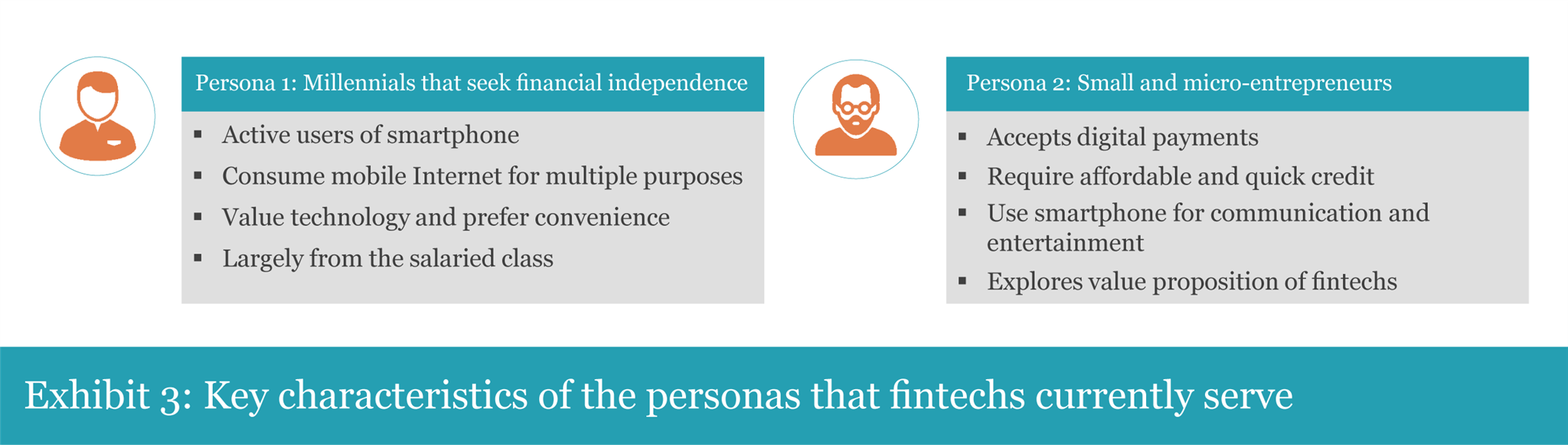

Our research suggests that most fintechs serve only the affluent, tech-literate customers in tier-1 geographies. These fintechs typically serve two types of non-LMI personas – millennials and micro-entrepreneurs. These personas have the following characteristics

Challenges in catering to the LMI segments

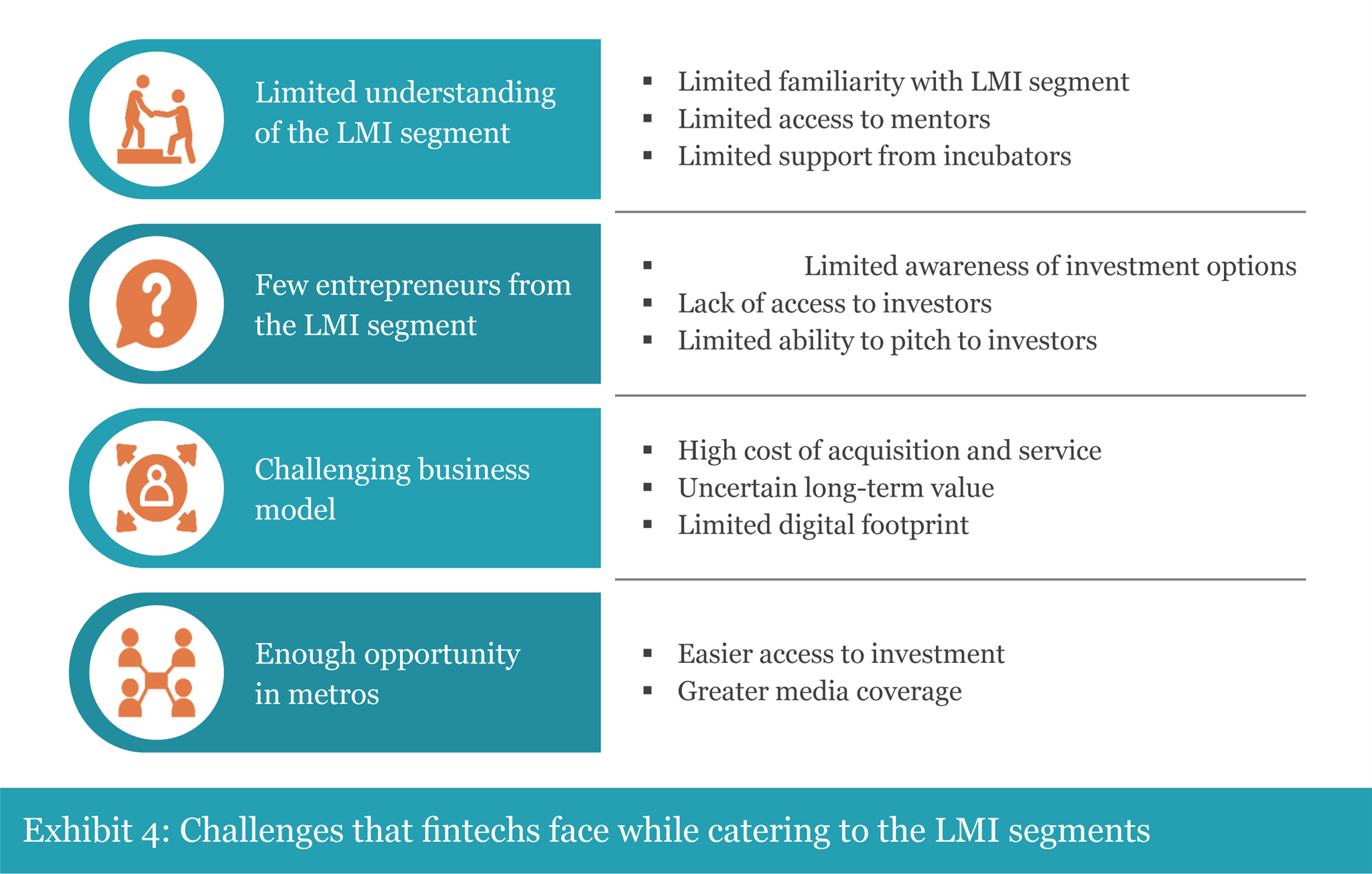

While our research indicates that there is a huge opportunity in the LMI market, the current fintechs have not been able to yet tap this effectively. This is due to multiple challenges that they face in their understanding of the pulse of the LMI segments. Some of these challenges are:

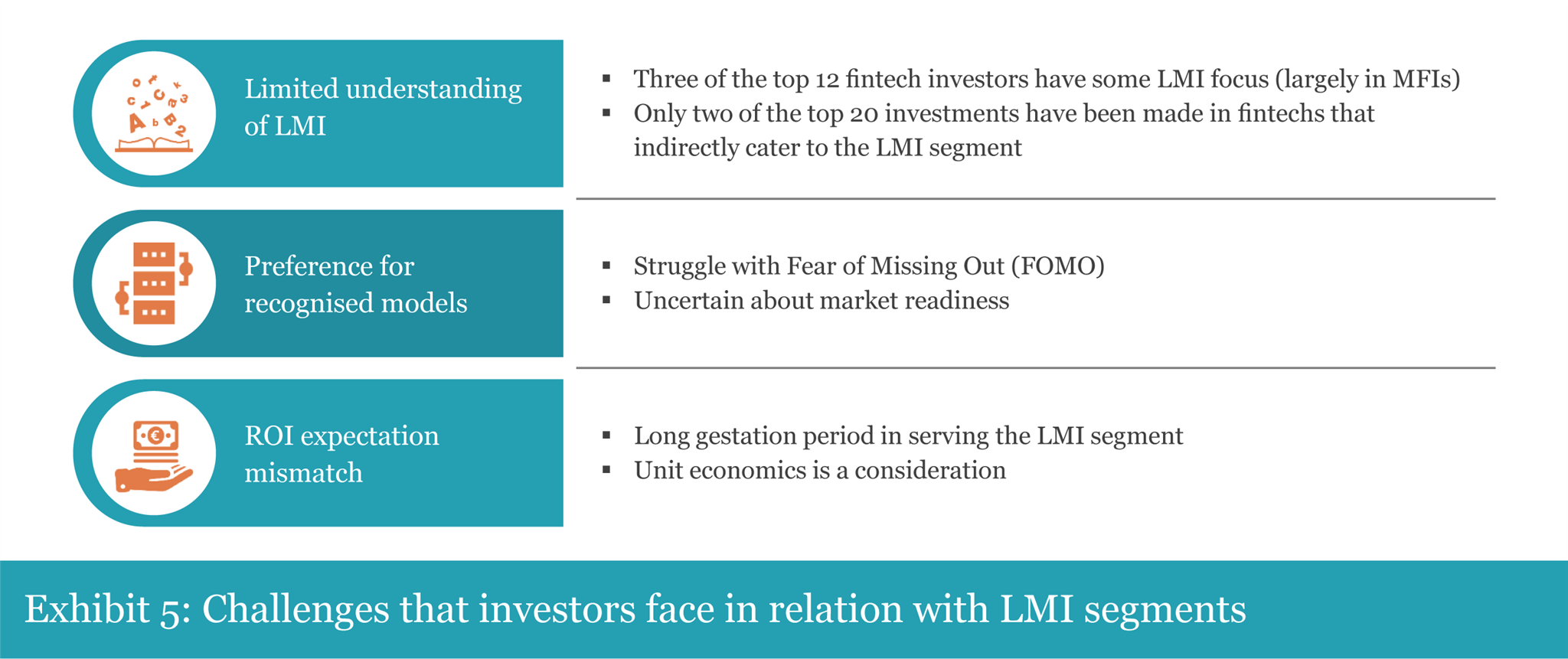

In general, investors understand the value that fintechs create and assess the viability of their business models.However, when it comes to the LMI market, investors have their own apprehensions due to a host of factors.

Most investors continue to look at the per-unit economics for investment and remain sceptical if this would work in the LMI market. Their go/no-go calls for investment decisions are generally driven by metrics of the long-term value (LTV) of a potential customer against the cost of acquisition (CoA). A thumb rule that is used is LTV/CoA > 2.

Although there are various challenges that fintechs and investors face in serving the LMI segments, there are players like microfinance institutions (MFIs) and public sector banks (PSBs) that cater to these unserved and underserved segments. Like other players, in a few years, some fintechs might be willing to look beyond the opportunities in the non-LMI segments and make a dent in the LMI market. This, however, is likely to happen only if fintechs and investors recognise that there is sufficient opportunity in the LMI space and are willing to increase their risk appetite and invest for a long gestation period. This is the subject matter of the next blog where we highlight key insights drawn from the positive experiences of players that operate in the LMI market.

i Fintech is a hybrid of financial services and technology. Fintech refers to technologically driven innovations that support or disrupt the existing financial system to improve the delivery of existing financial services and offer new financial products and services to consumers in an economically viable manner. Fintechs are technology-focused or technology-led start-ups that use or provide modern, innovative technologies.

ii There are 600 million people in the LMI segments in India. As per the 2011 census, 62.5% of the population falls under the working age group, that is, 15–59 years. As a result, there is an addressable market of ~380 million in the LMI market. Assuming that fintechs in India serve ~200 million customers of whom 70% (140 million) belong to non-LMI segments while 30% (60 million) belong to LMI segments, there are ~320 million untapped customers in the LMI market.

Written by

Mohit Saini

Senior Analyst

Leave comments