Finlok: Save together digitally

by Shweta Menon, Prabir Barooah, Anil Gupta and Anshul Saxena

Jul 8, 2019

4 min

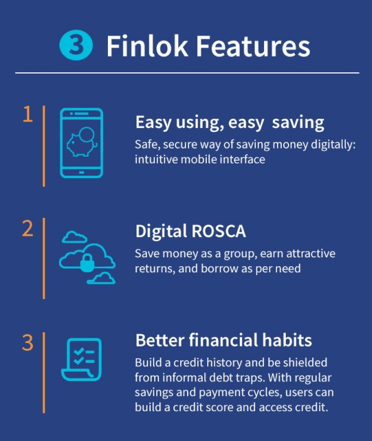

Finlok is a financial platform that helps people save money and avail hassle-free credit through a group savings-based financial model. This blog explores how the platform will help the low- and middle-income segments gain greater control over their finances.

This blog post is part of a series that covers promising fintechs making a difference to underserved communities and supported by the Financial Inclusion Lab accelerator program, co-powered by MSC. The Lab is a part of CIIE’s Bharat Inclusion Initiative.

|

|

A majority of low-and-middle income (LMI) customer segments typically earn approximately INR 8,000 (USD 115)-25,000 (USD 360)/- month, and rely on informal or semi-formal sources for urgent money needs. These sources include money lenders and cash-based local rotating savings and credit associations (ROSCAs) such as bhisi or chitti. Lack of sufficient documentation such as address proofs or credit history obstructs their access to formal credit.

In fact, the Global Findex Data 2017 stated that only 27% of adults saved formally in one year at a bank or a financial institution. There is a massive gap between people seeking avenues to save money and access credit.

Enter Finlok – an app that digitalizes the proven financial model of people saving and borrowing money, together in a peer-to- peer setting of banking and lending.

One Eureka moment, no looking back

Co-founders Atish and Tanuj bring together rich experience in building and servicing financial products – especially

The idea of Finlok was conceived when the team noted that a segment of the population was not utilizing their bank accounts. Despite massive campaigning for the Pradhan Mantri Jan-Dhan Yojana (PMJDY) scheme, many account holders have zero balances. On the other hand, ROSCAs were flourishing. These cash-based saving models were making people create a corpus beyond formal banks. For the co-founders, this gap became an opportunity.

With Finlok, they digitalized the savings group model with dual benefits – people could continue with their current models and yet, have a formal financial profile. This digitalization has a potential to help Finlok’s users access financial services like credit, insurance, and investments from formal institutions, with fewer impediments. “Other favored avenues of saving money, such as self-help groups, MFIs, banks or co-operative societies lack tech-based interfaces or are unable to match LMI people’s credit requirements. We aim to address both these limitations with one solution – the digitalization of saving models”: says Atish.

The pitch: The digital avatar of informal saving modes

The Finlok app is designed to be simple and easy to use. If a user like Rohan explores the app, he can see how, by saving small amounts of funds every month, he can save a lump sum amount of money which can be used in times of emergencies. Finlok also helps him create a digital footprint which can help him build a credit history.

The evolution: A challenge to identify the audience and convince them

Centre for Innovation Incubation and Entrepreneurship (CIIE), along with MicroSave Consulting (MSC), conducted boot camps, diagnostic sessions, and clinics to chalk-out an impactful strategy for Finlok to help achieve their targets.

Zeroing in on the right set of customer segments is an uphill climb. The early adopter segment possesses bank accounts but cannot access formal credit. They are familiar with digital payment modes and have used bhisi or chitti. But identifying such segments is a daunting task due to the geographical expanse and the high costs involved in reaching them.

MSC assisted Finlok by conducting a market scoping study to get feedback from current customers, and to identify potential customer segments. MSC helped Finlok to narrow down on relevant customer segments such as women entrepreneurs, government school teachers, sales staff, security guards, and BPO employees in Pune and Hyderabad.

The other challenge is product adoption. At the local level, a bhisi or chitti is widely used by low-income groups. However, making them switch to digital savings groups poses a big challenge. Product adoption by the target segment revolves around three core aspects:

- Convincing potential users to join the digital savings groups

- Improving usability of the app even for the not-so-tech-savvy users

- Maintaining trust in the product and its offerings

The future is digital

Finlok plans to focus on boosting their acquisitions and activations in the near term. It aspires to emphasize on referral marketing, digital marketing and other below-the-line (BTL) marketing with target groups, as identified during the acceleration. Finlok has also been in talks with some leading organizations for strategic partnerships. Further, it intends to continually improve the app with bidding options to users in a group, customer engagement and action tracking, and bundling insurance to improve the group savings proposition.

While Finlok improves their product offerings, their focus is on empowering LMI population to build a financial profile. It gives their users, like Rohan, greater control over their finances and impacts their lives positively. With this vision, Finlok is paving the path for other fintechs looking to provide solutions for low-income segments.

Follow #TechForAll and #BuildingForBharat to stay updated on fintech start-ups driven to bridge the social, financial and economic inclusion gap.

by

by  Jul 8, 2019

Jul 8, 2019 4 min

4 min Rohan, 21, works as a sales staff at a mall in Pune and makes INR 15,000 / month (USD 220). After remitting money to his parents in Bihar, and paying off expenses, Rohan can hardly save. For any emergency, he will have to borrow funds from friends or even moneylenders who may charge exorbitant interest rates. Since Rohan does not possess adequate documents, approaching a bank for his credit needs is out of question. Can Rohan come out of the vicious cycle?

Rohan, 21, works as a sales staff at a mall in Pune and makes INR 15,000 / month (USD 220). After remitting money to his parents in Bihar, and paying off expenses, Rohan can hardly save. For any emergency, he will have to borrow funds from friends or even moneylenders who may charge exorbitant interest rates. Since Rohan does not possess adequate documents, approaching a bank for his credit needs is out of question. Can Rohan come out of the vicious cycle?

Leave comments