Fate of MFIs post the COVID-19 lockdown – will they prove resilient again?

by Manoj Sharma and Akhilesh Singh

May 26, 2020

7 min

Read MSC’s take on the impact of the COVID-19 lockdowns on MFIs. Join our journey as we examine the surprising resilience of Indian MFIs. The blog compares past challenges like demonetization and traces how MFIs bounced back each time. The lockdown enforced to control the spread of coronavirus in 2020 has been the most severe crisis to hit the sector. Hopefully, MFIs will once again emerge resiliently.

How much time will it take to normalize MFI operations? The answer has INR 2,000 billion (~USD 26 billion) riding on it. We could compare the COVID-19 crisis with the Indian government’s banknote demonetization exercise of 2016 when currency notes of higher value ceased to be legal tender. Demonetization disrupted significant parts of the Indian economy for three months and the recovery process was protracted and difficult.

Demonetization had the most adverse impact on daily wage laborers and artisans, who were almost entirely without work for two months. The income of rickshaw, auto, and taxi drivers also declined significantly, as they depended on cash payments for their income. Sellers who offer essential products, such as grocery, dairy, and medicines continued to receive constant inflows, though sale volumes decreased. In contrast, the income of sellers of non-essential products, such as cosmetics and restaurants shrunk by more than half.

Amid the uncertainty, salaried employees decreased their consumption of discretionary items, while households focused on thrift and restricted their purchases to essential items. Yet in many ways, the impact of demonetization on the agricultural sector was lower, as seen now with the COVID-19 crisis. Most farmers were able to sell their produce at prevailing rates despite concerns that their income might diminish in the future as homegrown seeds were used for sowing instead of buying seeds from the market.

This pattern is similar in many respects to the way in the COVID-19 crisis has been affecting India’s economy – see MSC’s analyses on “Food security: How are agriculture and the corner shops faring amid India’s lockdown?” and “Micro and small enterprises: Will the pandemic put an end to their business?”. Yet there are important differences. Demonetization was a time-limited and relatively short-term event, whereas a great uncertainty surrounds how long, how hard, and how often the COVID-19 crisis lockdowns continue. This uncertainty makes predictions difficult, so we write this blog in the spirit of optimism that the crisis and lockdown will also be time-limited to around three months.

We have examined three aspects of MFIs to analyze the impact of COVID-19:

- Cash flow in the near to medium term;

- Sustainability;

- Staff psychology and management.

The cash flow for MFIs

The situation now

Repayments are the largest cash inflow for MFIs, followed by borrowings from financial institutions and fees from the off-book loan portfolio. The largest cash outflow is loan disbursement, followed by repayment to lenders and off-book portfolio, payment of salary and wages to employees, rent, utilities, and statutory dues, such as tax and contributions towards social security.

Loan repayments are a consistent and reliable source of cash inflow. In India, this has ground to a complete halt from 25th March 2020, because of a national lockdown. Lending institutions are also on a wait and watch mode – fresh loans are unlikely in the prevailing situation. On the other hand, MFIs still need to maintain scheduled cash outflows for salary and wages, payment of rent and utilities, payment of loan installments to lenders, and for payments toward off-book portfolio—particularly securitization and direct assignment. Though the Reserve bank of India (RBI), the country’s apex bank, has announced a moratorium on all term loans, banks were divided on whether NBFCs and NBFC-MFIs are eligible for a moratorium.

This seems to have been settled for now, with State Bank of India, the largest lender, agreeing to extend a moratorium. Hence, MFIs that struggled in the first month have received a breather. However, the struggle is unlikely to end, especially for small and mid-sized MFIs and the overall impact will vary. The smaller players face major challenges, while large MFIs, with well-capitalized books, may weather the storm marginally better.

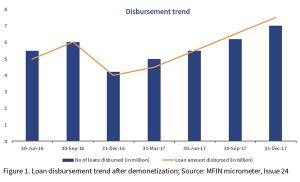

The probable situation when the lockdown is lifted

Over the years, MFIs have proven their resilience. During demonetization, repayment rates recovered from 50% to 80% within a month and settled at upward of 90% within three months. With this as a reference point, we can hope that repayment rates to MFIs will bounce back in the range of 90% within 3-4 months. This may rise further over a time horizon of, say, six months. Slowing down fresh loan disbursements will be an obvious strategy for MFIs, particularly in the first few months, which should allow them some space to manage cash flows.

Sustainability

Almost without exception, all MFIs revived after the three months of chaos following demonetization. MFI commentators think that it will take 12 to 18months for a full rebound, depending on the extent of the problems post the initial lockdown. Moves towards normalization will only be possible after the lockdown ends and field staff can move unhindered again. Yet given the nature of the virus, there is a real risk of second spikes and possibly repeated and localized lockdowns. These have the potential to disrupt the recovery further.

In our previous note “Food security:How-are-agriculture-and-corner-shops-faring-amid-India’s-lockdown”, we analyzed the impact of the lockdown on different economic activities of microfinance clients. Once the pandemic subsides, microfinance clients will largely be able to bounce back. This, coupled with RBI’s booster packages, will play a critical role in reviving economic activities.

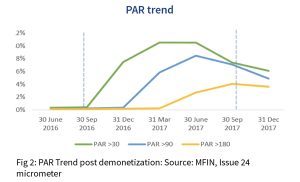

Portfolio at risk (PAR) will shoot up initially. It will gradually decline over 2-3 quarters once full-fledged operations resume. During demonetization, it took two quarters for PAR (>90 days) to start its downward journey. Fig.2 presents the PAR trends during and after demonetization.

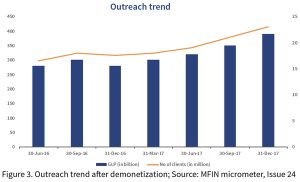

Under the present lockdown, the intensity of the problem may be in line with the challenges that demonetization had presented in 2016. Post demonetization, MFIs had to write-off5%-10% of the book. However, the increased demand for credit had compensated for losses (see Fig. 3). Post demonetization, the demand for credit shot up as customers needed the liquidity to re-establish their business.

We may expect a similar outcome this time around. Of course, clients will need additional time to repay their current loans. The moratorium may have to be extended and installments staggered. However, most of the credit outstanding will flow back. MFIs in India have some experience of dealing with stresses in customer liquidity, which should come in handy in managing the current situation.

Staff psychology and its management

Operations staff, particularly branch managers and field staff, will play a pivotal role in managing the field once the lockdown lifts. The post-lockdown period will present additional challenges. The fear of infection from the coronavirus will play on the minds of field staff. MFIs will have to address this psychological fear upfront and offer a safety net in the form of insurance cover or support, or both, in the event of hospitalization. Plenty of rumors will fly around, both at the level of clients and among field staff. MFIs must over-communicate – or rumors will fill the void. Three areas where MFIs will have to focus on include:

- Movement in the operational area

This may be the biggest challenge for staff when they will begin moving in their respective operational areas. In India, the government has divided districts into green, orange, and red zones based on the prevalence of COVID cases. Movement will continue to be restricted in red zones. Moreover, the situation is dynamic and a green area can slip into orange or red. We are not yet out of the woods.

- Dealing with customers

MFI staff will have to deal with customers who have now been traumatized by the loss of income. A few may have faced medical emergencies during this period. Understanding customer psychology and dealing with them appropriately will be key. Here, the senior staff will have to handhold field staff and keep channels of communication open. Branch staff will be able to draw from the experience of senior staff at the head office and zonal or regional offices. Feedback or information from the field should be turned into advisories quickly for wider dissemination across the organization.

Furthermore, MFI staff have a critical role to play as communicators on hygiene and role models for their clients. A pandemic of misinformation has already permeated the villages—MFI staff are uniquely positioned as respected opinion leaders to counter these dangerous and damaging rumors, half-truths, and lies. Both clients and staff are at significant risk of infection as they collect and count cash—indeed group meetings could become the dreaded “super-spreader” vectors for the virus.

Therefore, MFI staff need to model and demonstrate best practices in to protect themselves and educate their clients. To help with these issues, MSC has developed two comic books to inform and educate both clients and staff – MFI client awareness and MFI employee training. These are free to download and available in English, Hindi, and Bengali at the time of writing.

Besides, as the pandemic runs its course, the government will want and need to communicate additional information to help the country recover and return, cautiously, to a new normal. MFI staff can and should play a critical role in these communication efforts.

- Dealing with external entities

MFIs deal with poor and vulnerable clients. Political leaders at the lower levels find MFI clients to be easy pickings as they try to create a following in local communities—particularly with promises of loan waivers. Over the years, MFIs have learned to deal with this problem better but it is unlikely to go away completely. The lockdown and the consequent economic stress will make clients vulnerable to overtures from such external interest groups. MFI associations will have to play a critical role in dealing with such challenges.

Indian MFIs have weathered many challenges in the past. The Andhra Pradesh microfinance crisis of 2010 and the demonetization in 2016 disrupted operations. However, in both cases, MFIs bounced back and emerged stronger. The lockdown enforced to control the spread of coronavirus in 2020has been the most severe crisis to hit the sector. Hopefully, with some deft financial and people management, MFIs will once again emerge resilient and ready to provide valuable credit services to their millions of clients across the cities, villages, and far-flung frontiers of the country.

Written by

by

by  May 26, 2020

May 26, 2020 7 min

7 min

Leave comments