Face-to-face network specialists: Helping institutions better bring digital finance to the unreached Part 2

by Chris Wolff, Prabir Barooah and Graham Wright

by Chris Wolff, Prabir Barooah and Graham Wright Feb 12, 2019

Feb 12, 2019 9 min

9 min

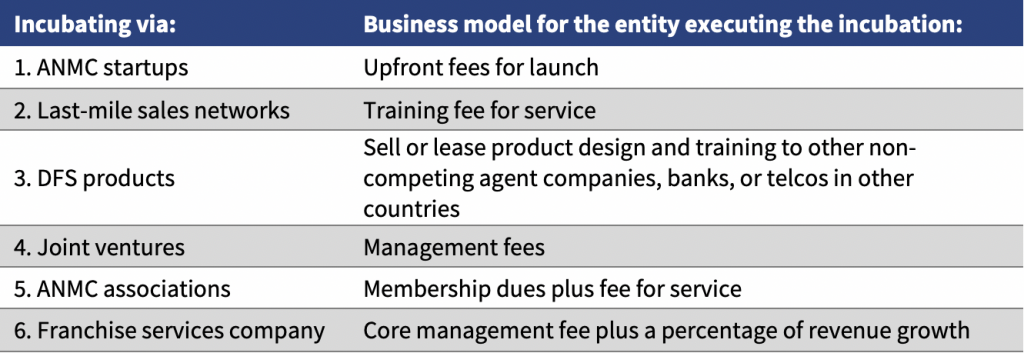

In this blog, we provide a high-level outline of six options to support the impact of Agent Network Management Companies (ANMCs).

Six ideas to shape the future

In our previous blog, we outlined the potentially catalytic role that Agent Network Management Companies (AMNCs) could play in extending the reach and quality of services for the mass market. In this blog, we provide a high-level outline of six options to support the impact of ANMCs.

- Incubate ANMCs by catalyzing startups or bolstering smaller players:

Help startups launch to introduce AMNCs in new markets that have mobile money but where telcos or banks need an outsourced way to scale for network effects. While outside support would bear upfront costs and be time-limited to get the startup up and running, local business owners would maintain the responsibility for ongoing network operating expenses. The incubating functions could include:

- Recruiting long-game, socially-minded owners;

- Attracting or brokering seed capital or managing a seed fund that invests in scaling networks;

- Initial training of staff and assisting with surge capacity to onboard large numbers of new agents.

Why? Fragmented agents and their ANMCs lack power compared with telcos and banks and have been a missing or under-represented actor in the push for universal DFS. Telcos and banks with competing revenue lines often treat agents as costs to be minimized. This results in a neglect of agents and underinvestment in networks and thus less reliable services and slower proliferation of DFS.

Support for ANMCs with better customer education and promotion in new markets could lead to faster adoption of mobile money and a healthier ecosystem to deliver and use DFS. Tracking and demonstrating metrics of how the value-addition from and trust in agents improves the bottom line could flip the paradigm from a cost center to revenue driver and differentiator. This flip is essential to stimulate investment in innovative DFS products that agents may sell or facilitate, rather than just waiting for smartphone-only apps in the hopes of bypassing agents.

- Incubate last-mile sales networks to augment their offerings as providers of a range of digital services:

Help any base-of-the-pyramid sales network to introduce or diversify products with mobile money or DFS. This would be like equipping the sales agents or outlets of FMCG companies, or merchant networks like M-Kopo, or itinerant sales agents like Living Goods to offer airtime scratch cards, cash-in-cash-out (CICO) services, or eventually DFS products. The same could be attempted when the super-platforms develop fulfillment distributors to bring e-commerce. For this path ANMC functions would include:

- Training sales forces on product details, processes, and pitch to convert any frontline salesperson into a DFS provider;

- Training-Of-Trainer (ToT) for normal refresher training courses on products.

Why? Leveraging existing face-to-face networks can spur efficient growth of outreach as well as diversify revenue streams either to decrease agent churn or improve the liquidity for CICO service agents, or both. Some countries might only be able to achieve network effects by building mobile money or DFS on existing distribution systems.

- Incubate DFS products by incorporating R&D specialists within the daily operations of an owned network:

Help develop and test more diversely supportive DFS products by running an R&D arm embedded within the operations of an ANMC to learn and experiment continuously with real-time data on product usage. Product development specialists, researchers, and other institutions seeking pro-poor DFS diversification could recognize and leverage the differences in the capabilities and sophistication of agent networks in different geographies in order to cross-fertilize ideas and capabilities from leading markets into those that lag. The embedding of R&D could be structured as a sponsored collaboration, outsourcing or subcontract, or a joint venture.

Why? With access to real-time data to iterate prototypes, pro-poor practitioners can focus on designing demand-side, client-centric products without the same telco or bank supply-side constraints that lead to “orphan products” from providers. Without creating their own operational footprint, embedded R&D or consulting providers also benefit from building their knowledge base from gleaning frontline experience or wisdom.

- Incubate joint ventures through brokers that form and run shared agent networks:

Help create joint ventures to run shared agent networks (or “Android of agents” as proposed in Helix’s Agent Network Accelerator’s closeout). With an ANMC in place to manage agent operations on behalf of multiple clients, a brokering entity could perform functions that include:

- Recruiting partners according to carefully defined standards;

- Broker coopetition partnerships and facilitate negotiations that are fair to the whole group;

- Navigate the product mix and equal training and promotions;

- Form the legal entity and house a dedicated Director within an external Agent Network Incubator.

Why? These attempts could appear more attractive while initiating rural expansion where a sole provider might avoid trying to build their own network alone. Some markets ripe for shared networks (like Uganda) would benefit from socially-minded hubs to initiate coalition building and to protect the trust of more vulnerable partners from being torn apart by predatory negotiations from the most powerful partner. In contrast, the markets that lack the critical mass for network effects, or without a widespread agent network, could ramp up mobile money adoption by one convener—building out shared agents from the start. For example, see Nigeria’s Shared Agent Network Expansion Facility (SANEF). Joint ventures will be more effective than bilateral partnerships for all players to maintain ownership and continue to feel control and in effect protect their respective brands while ensuring the balance between parties continues to work for all as the market evolves.

Without an initiating business actor in the ecosystem who may spur action that instills a “fear of missing out”, it can take a long time for incumbent providers to overcome their hindrances simultaneously. Markets can take a long time to mature to coopetition, as is seen in the limited or tardy sharing of ATM networks or telecom masts.

- Incubate ANMC associations to tackle shared problems and proliferate the increased value-add brought by their industry:

Help convene regional or global associations of ANMCs to tackle shared issues and demonstrate their unique value-add collectively. Introductory steps could begin with informal workshops in key markets and then assembling an industry conference (per region). The functions could include:

- Research;

- Advocacy;

- Shared best practices;

- Professionalization and delivery of staff training courses over e-learning platforms;

- Coalition building or partnership brokering.

Why? Currently, each ANMC is learning on its own and alone holds little influence or power to demonstrate the revenue-generating value addition of investments made in the technology or human capital of agent networks. Staff churn remains a pernicious problem that would benefit from industry-wide talent development. Similar to telco and bank associations, ANMCs could also serve as the focal point of the industry for the social good achieved or a structured channel to direct socially supportive resources.

- Incubate a franchise services company that spreads expertise and investments for ANMC owners to not have to each learn best practices alone:

Help to eventually create a franchise services company—perhaps spun out by the Association. Once enough ANMCs have grown strong enough globally, they could professionalize in the same ways as other labor-intensive hotel or restaurant chains, and distinguish the owner from the specialist operator. They could provide functions that are typical of franchises:

- Systems—standard procedures, manuals, and software or apps;

- Shared backend services, such as liquidity management or cloud systems;

- Training courses;

- Brand, with standards enforcement;

- Combined marketing;

- Business consultation.

Why? Beyond all the value that these functions are better provided more centrally, franchising ownership structure is an efficient way to scale a large footprint that nurtures successful business. It differentiates operating expenses from the upfront ownership investment provided by the franchisees.

Each of these six incubation paths originates from ideas already at work in other industries of the global marketplace and so has a corresponding business model. Therefore, any social or philanthropic infusion involves a way to propel each method sustainably.

Social sector practitioners or donors want agent networks—whether owned by the telco, bank or independently as ANMCs—to run in a manner that delivers real value to the base of the pyramid (BoP). This will require patient capital, client-centric strategies, innovative HCD-based products, and a combination with complementary services to develop more comprehensive solutions that meet the daily needs of the BoP. Investing in ANMC approaches could help convince many providers to adapt their business strategies, or as a coopetition actor, to raise the bar on how to serve the needs of BoP through profitable business practices. None of these ANMC approaches are incompatible with also pursuing telco, bank, super platform or FinTech strategies. They could actually be flip sides of the same coin as the Catalyst Fund discovered a key success factor of inclusive FinTechs involved deploying a mix of “tech + touch for new interactions to reach & and keep customers“. Rather than every Fintech having to create their own field force, might FinTechs (or any specialized e-marketplace or tech platform company needing to deploy gig “digital translators” to help customers transition into the digital economy) stay lean by relying on a developed industry of ANMCs as face-to-face specialists?

Accion Venture Lab’s report “The Tech Touch Balance” advises “design an intuitive customer journey that maintains established relationships, trust, and cost-effective, scalable operations, yet still balances digital and human engagement”. As has been done with many call centers, insurance brokers, or BPOs (Business Process Outsourcing), in what ways could FinTechs outsource the handling of different stages of their customers’ journey where customers prefer human touch? Customers have demonstrated a preference for human touch when learning more about a product and its benefits, enrolling, and trying to resolve complaints. ANMCs could offer another “leg of the stool” that focuses on optimizing the various human touch prerequisites for digital finance usage still seen even by the research in digitally prolific markets of Kenya (see Pesatransact’s range of services through app + agents on page 14) or India. This special attention could prove a necessary tool in the efforts to close the gender gap in DFS.

Nonetheless, an ANMC-based strategy does face limitations. Some are as following:

- Outside India, there are not that many large ANMCs to support.

- Operations of a large human network are inherently difficult given the requirements to manage recruitment, onboarding, training, and churn.

- Margins are very thin, requiring efficient operations and making investment opportunities less attractive.

- Investors entering this market must have long-term horizons and patient capital.

- Many telcos at the moment prefer to control agent management in-house.

- Much larger telcos and banks would maintain much stronger negotiating positions.

Some fundamental questions remain:

- Are there willing business partners, and is there market demand for such ANMC services?

- Would a mix of philanthropic funding and patient capital investors commit to a long-term vision of next-generation DFS agents amidst the inevitable learning curve and setbacks?

- How can the unit economics work out to manage to break even and business sustainability for these pro-poor ANMCs?

While benefiting from what a developed industry of ANMCs could provide different institutions, here are some practical steps each could take to complement their own work.

- Philanthropic funders can add the above paths to social impact by deploying the same technical assistance, challenge funds, and grants to ANMCs that they use to incentivize banks and telcos to tackle financial inclusion.

- Telcos can start by hiring ANMCs for their rural expansion strategies to penetrate harder to reach areas. As that alternative of outsourcing proves to not threaten their control, they could increase their reliance on ANMCs in established markets as a way of offloading cumbersome system hassles or lack of internal capacity. Then telcos could turn to ANMCs to better segment and support agents and promote and deliver more complex products and value-added services (VAS) to customers.

- Banks and MFIs can outsource or subcontract the basic CICO service component of agency banking and then expand their reach through ANMCs that develop sales agents to promote and cross-sell digital financial products and services on their behalf.

- FinTechs can develop and iterate their technology in conjunction with ANMCs to deliver the customer-preferred “touch” portion of the experience rather than each building their own human channel to market.

- NGOs are experienced in mobilizing volunteers to reach masses, especially where it is harder for markets to reach. So they can look for ways to partner with ANMCs to deliver complementary value, such as health insurance via community health workers or agriculture finance via extension workers or partnering co-ops. Moreover, they can help with pro-poor product development or integration of DFS with NGO social services to meet practical needs.

- Social enterprises while targeting BoP markets can consider diversifying their “basket” offering with digital financial products to diversify revenue streams for their sales force.

To fulfill the promise of diversified DFS meeting tailored needs, everyone in the ecosystem would benefit from a reliable industry of expert ANMCs that focus on maximizing value through face-to-face networks.

Written by

Chris Wolff

Warning: Undefined array key "title" in /var/www/html/wp-content/themes/microsave/single.php on line 486

Warning: Trying to access array offset on value of type null in /var/www/html/wp-content/themes/microsave/single.php on line 486

Prabir Barooah

Specialist/Consultant

Leave comments