Enhancing education finance: A perspective of the financial journey of low- to medium-cost private primary schools in kenya

by Olivia Obiero and Wanjiku Kiarie

Jun 19, 2018

5 min

MicroSave conducted a study to understand how low- to medium-cost schools meet their financing needs. In this blog post, we explore the estimated financing demand, financial journey, challenges, behaviour, current coping mechanisms, and recommendations for financial partners that wish to serve this niche segment in a profitable and sustainable manner.

The chatter and sounds of students playing in the school ground echoes in the distance. Peter, the school owner, looks at the children through his office window with pride. It seems like just the other day when he resigned from employment as a teacher to establish his own school. To finance the start-up, he used his savings to lease a piece of land and construct semi-permanent structures to serve as classrooms. Five years later, Achievers Academy in Githurai has grown from a student population of 20 to 250 with a stellar performance record.

The future seems bright and Peter has an ambitious vision for the growth of the school. The school management recently acquired a piece of land and has embarked on a project to build classrooms. Additionally, there are plans to acquire assets, such as two school buses and expansion to a new branch in Ruiru. These projects require external financing. Peter is multi-banked but needs a partner that would offer both financial and advisory solutions for his plans.

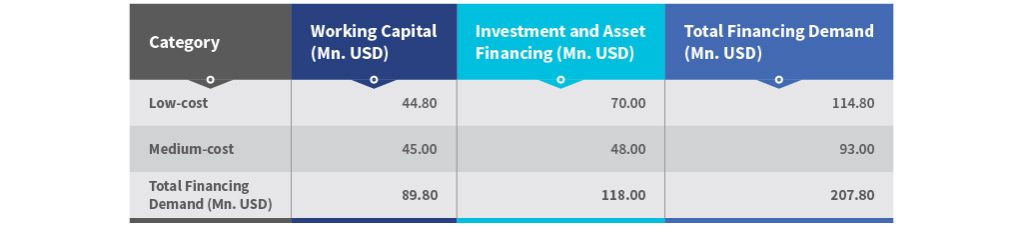

Based on our research, we found that low- and medium-cost primary schools require both working capital, investment, and asset finance. The major difference between the two categories is in the size of the finance needed. According to our analysis and estimation of available data, the current demand for finance for low- and medium-cost schools is approximately USD 207 million. This indicates an opportunity for financial service providers. The table below further illustrates the demand for low- and medium-cost schools:

Financial Journey of Low- to Medium-Cost Private Primary Schools

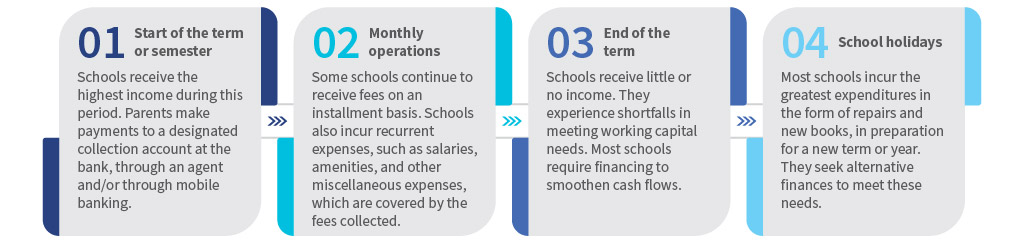

In Kenya, a school year has three terms or semesters. Each term comprises three to four months. Generally, schools manage finances on a term- or semester basis, as depicted below:

As seen in the graphic, as the term ends, low to medium-cost private primary schools struggle with working capital. In addition to term-related operations, these schools have annual plans to develop and expand the school. To finance such long-term projects, most school owners take out personal loans from formal financing sources. The size of these loans is limited by the borrower’s personal income flows and thus hinders the growth of the school.

Financial Challenges of Low- to Medium-cost Private Primary Schools

The financial challenges faced by low- and medium-cost private primary schools in their financial journey include:

- Limited capital for long-term investments: Low- to medium-cost private primary schools collect fees that they largely use to cover recurrent expenses. They, therefore, have limited capital for long-term investments, such as the acquisition of school assets and expansion of infrastructure.

- Inadequate access to formal finance: Formal financial institutions have stringent loan requirements, such as hard collateral and compulsory down-payments for asset financing. These requirements limit the ability of schools to access growth-related finance from formal financial institutions.

- Weak financial management skills: Most low- or medium-cost private school owners are former educationists. They have limited financial management and operational skills to drive their vision into action. This poses various challenges in planning and collection of school fee income and managing school fees’ arrears.

- Weak relationship with financial institutions: Most schools have transactional relationships with financial institutions, which reduce the benefits they may derive from these relationships.

- Weak loan structuring by financial institutions: Most formal financial institutions structure loan repayments on a monthly basis. However, schools receive their incomes on a termly or semester basis. This mismatch in the schools’ cash-flows and repayment schedules leads to difficulties for the schools in serving loan facilities.

Financial Behaviours of Low- to Medium-cost Private Primary Schools

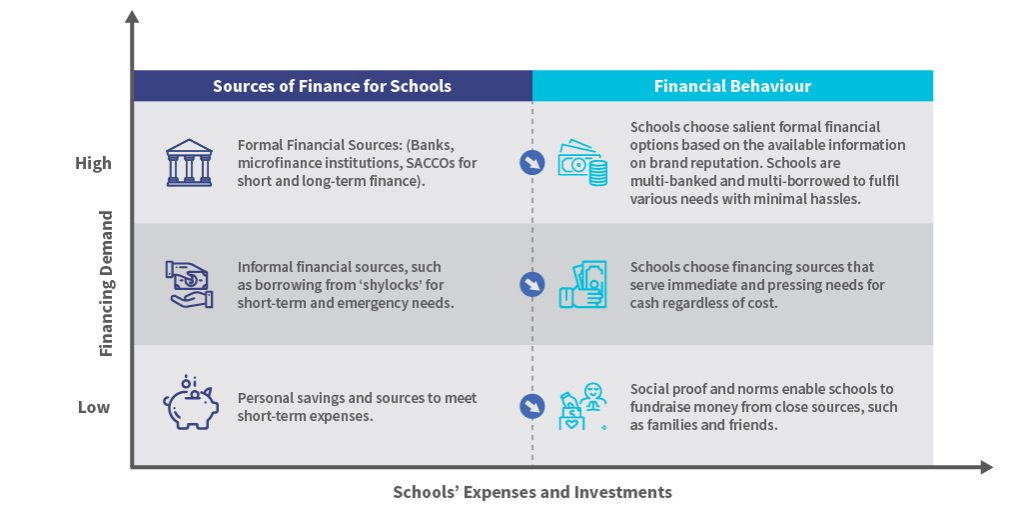

The challenges experienced on the financial journey influences the financing behaviour of these schools. In the adjoining illustration, we depict the financial demand in relation to expenses and investment, and the behaviours that affect the financing choices of the school. As the schools’ demand for financing increases, they seek and use financing from formal financial institutions. However, only a limited number of schools are able to access appropriate financing from these institutions.

As seen in the graph, schools use a combination of both formal and informal financing to fulfil their varying operational and financial needs. The demand for finance to sustain the operations and investment purposes of the schools is high and presents an opportunity for financial institutions to enter the space. However, it is critical that financial institutions understand the financial needs and behaviours of schools to adequately serve them. How can a financial institution profitably partner with low- and medium-cost primary private school owners? We list below the minimum considerations for financial institutions that are interested to serve and meet the financial needs of schools in a sustainable and profitable manner.

a) Dedicated Relationship Management

Low- and medium-cost private primary schools value a long-term relationship with formal financial institutions. This means financial institutions that target such schools may consider building this through relationship managers who are experts in school management. In this way, school owners and management can benefit from both financial and non-financial services.

b) Education Sector-centric Products with Digital Aspects

Financial institutions can develop or refine their existing products to incorporate the needs, activities, and financial behaviour of schools. For example, they can design a loan product that would account for the school fees payment schedules and period of the term or semester. Additionally, products (including collection accounts, payment platforms etc. – see below) may be accessible through various channels, such as agency banking, online banking, and mobile banking.

c) Marketing and Branding

Financial institutions that seek to finance the education segment should invest in marketing and branding to ensure that their potential customers can reach them better. These institutions can do it by reviewing existing marketing approaches to ensure consistent messaging on education finance. A financial institution may proactively engage in activities, such as advertising school education finance products, participating in private school association meetings, conducting school visits, and sponsoring school events.

d) Wallet-share Maximisation

Financial institutions can consider providing a full suite of services to meet the needs of schools. These services may include school fees collection accounts, payments and transfers, short-term and long-term credit, regular and goal-based savings, insurance, budgeting, and financial management to benefit from financing this segment.

In conclusion, low- and medium-cost private schools in Kenya present a niche segment for formal financial institutions. However, these schools face exclusion challenges due to lack of appropriately structured products, and limited outreach by formal financial institutions. Financial service providers have an opportunity to serve this segment in a profitable and sustainable manner if they build long-term relationships with schools, understand their needs, and design a suite of products that meet those needs.

Written by

Olivia Obiero

Manager

by

by  Jun 19, 2018

Jun 19, 2018 5 min

5 min

Leave comments