Empowering youth through entrepreneurship and financial inclusion

by Shalom Mbugua, Jilan Jauhara and Aditi Chaurasia

by Shalom Mbugua, Jilan Jauhara and Aditi Chaurasia Nov 29, 2023

Nov 29, 2023 5 min

5 min

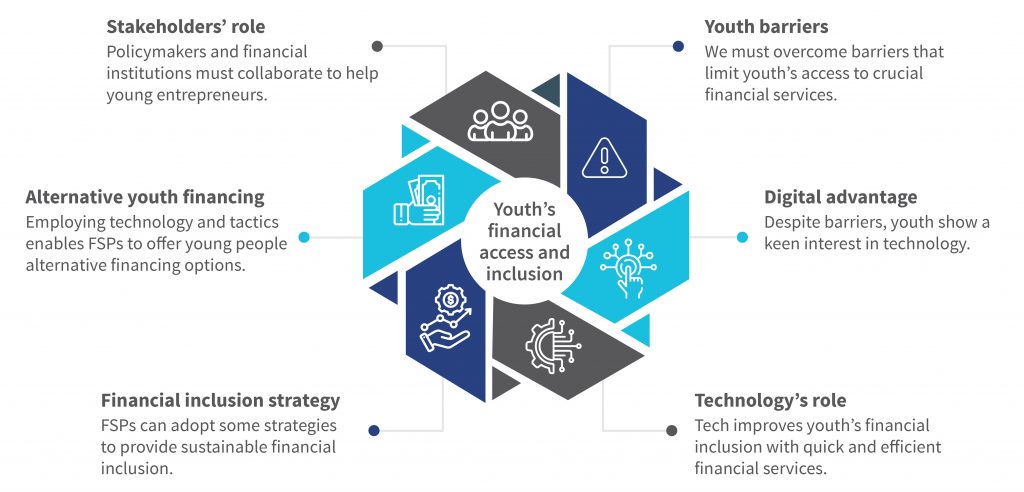

Limited access to financial services often keeps youth from realizing their potential. This blog explains how technology and innovative solutions can break down these barriers to make access to finance a reality for young entrepreneurs.

Youth financial inclusion

Imagine a world where young people are not just tomorrow’s leaders but today’s sustainable business creators. Youth can achieve this vision through provisions, such as access to funding and co-working spaces, mentorship, business incubation, networking opportunities, and an enabling environment. Such provisions can enable them to drive innovation and entrepreneurship, strengthen their communities, and contribute to their continent’s progress.

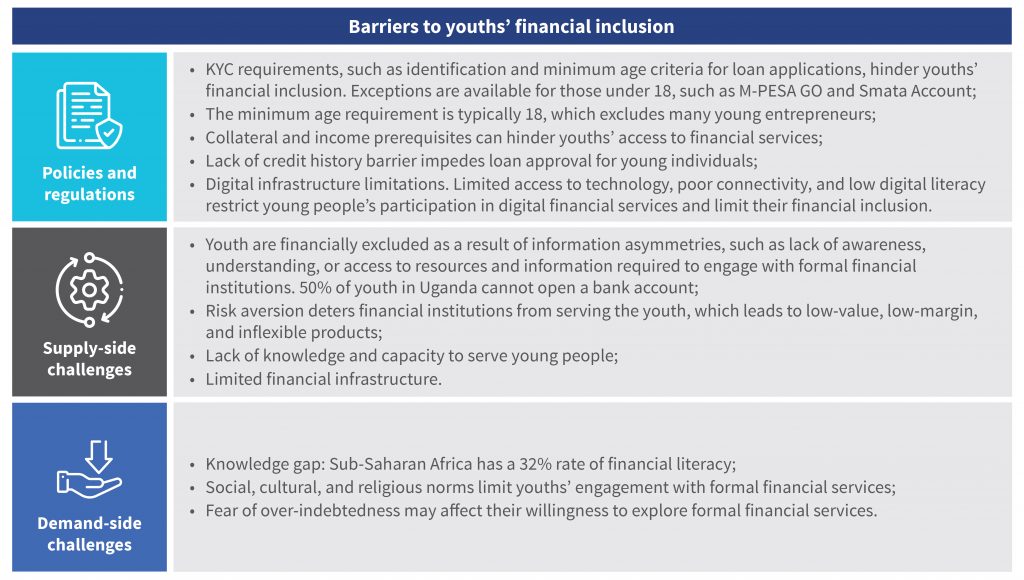

However, several significant barriers hinder youths’ access to essential financial services and thus stop them from achieving this vision. Only 40% of young people in Sub-Saharan Africa have access to financial services. This exclusion hinders how well they can start and sustain a business. It leads to lower revenue, limited growth prospects, and staffing shortages. MSC’s study for FMO’s Making Cents International Youth Compendium Project revealed barriers on multiple fronts, from policy and regulatory constraints to supply- and demand-side challenges.

Despite substantial barriers, Africa’s youth possess drive and innovation. They constitute 70% of Sub-Saharan Africa’s population and will be key to achieve the sustainable development goals. They need support from governments and development stakeholders to overcome unemployment and underemployment challenges.

The digital advantage in bridging the financial gap for youth

In recent years, African youth have shown a strong interest in technology. As per the GSMA’s reports, approximately 50% of people in Sub-Saharan Africa adopted smartphones. The region has experienced a rise in digital entrepreneurship—with 618 active tech hubs in Africa, online learning, and mobile banking. Youth’s preference for digital over traditional banking is evident as a higher percentage of young people in various countries prefer mobile money accounts. These countries include Uganda, where 51% of young people have a mobile money account compared to 29% who use traditional bank accounts, and Senegal, where 27% of the youth use mobile money accounts while only 13% use traditional bank accounts. This showcases mobile technology’s potential to bridge financial gaps.

Using technology for youth financial inclusion

Technology can enhance youth financial inclusion through efficient and swift financial services. The electronic Know Your Customer (e-KYC) process simplifies account opening for youth who lack the necessary documents. For example, Opportunity Bank Uganda Ltd (OBUL) built a mobile app with an online wallet feature called “SmartPocket.” It only asks users to provide a mobile number for registration. This simplified account helps youth build a credit history and subsequently improves their access to credit.

Digital savings and loans offer features that simplify how young people save and borrow. For instance, M-Shwari in Kenya allows users to connect their M-PESA mobile money wallet to a savings account with no required minimum savings, no fees, a fixed interest rate, and the option to make microdeposits.

Moreover, technology provides the opportunity to integrate financial services with non-financial services that young people require. These services include information, training, networking, and mentoring. Financial service providers (FSPs) can partner with FinTech companies to lower the technology’s cost. For instance, Ecobank Ghana collaborated with OZÉ to develop a mobile app for youth-owned MSMEs to help them track their sales, expenses, and customer information. OZÉ subsequently used the data to evaluate the MSMEs’ creditworthiness and link them to funding provided by Ecobank. The data also created tailored recommendations, reports, and training.

Digital financial solutions are transformative. Yet, they face challenges that hinder their adoption and effectiveness, such as limited digital literacy and access, cybersecurity risks, and regulatory hurdles. We must also address cultural resistance, the risk of over-indebtedness, infrastructure deficiencies, and interoperability issues to ensure inclusive and sustainable financial access for all youth.

Strategies for sustainable youth financial inclusion

Contrary to popular belief, financial education is not the ultimate solution for many youth barriers and cannot guarantee sustainable financial inclusion. As per a recent meta-analysis, conventional financial education falls short in both its content and instructional methods. Interventions that involve the youth’s experiences or surroundings are more effective for accelerated financial inclusion. FSPs can use the strategies below to deliver financial and non-financial services or products for sustainable youth financial inclusion:

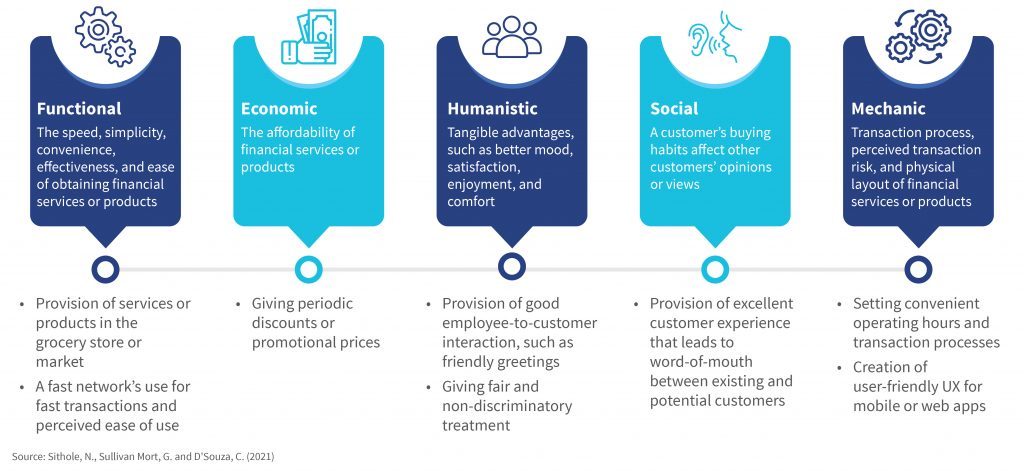

- FSPs should incorporate five dimensions of customer experience value when they craft products and services. These are functional, economic, humanistic, social, and mechanic. They contribute positively to financial inclusion’s access, usage, and quality.

- FSPs can use existing touchpoints and seize relevant moments in young people’s lives to make financial services more relatable to them. Some examples of touchpoints are civic classes in schools and weekly savings group meetings. Some suitable “teachable” life moments FSPs can use include the time an individual earns an income for the first time, starts a business or a family, and buys a first home.

- FSPs can integrate critical influencers into youth life when they introduce services or products. These include parents, teachers, or community leaders. Financial socialization by parental figures can lead to positive financial habits, such as budgeting and financial planning. It is more effective than traditional financial education.

- FSPs can create an issue map and adopt a portfolio approach to employ different solutions to tackle financial inclusion challenges based on the issue map.

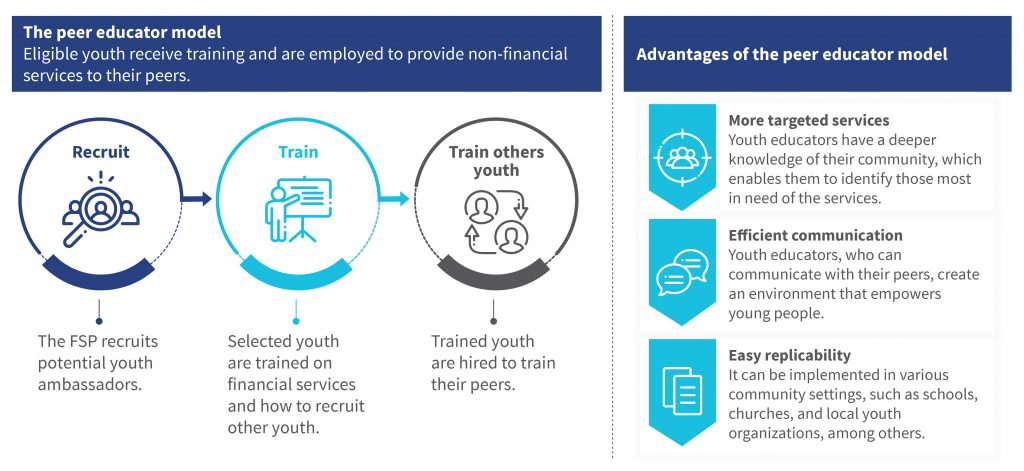

- FSPs can adopt a peer educator model to make youth more comfortable and increase their trust in FSPs. Word-of-mouth from family and peers is crucial to influence youth’s decisions.

- FSPs can use a unified or parallel model when they integrate non-financial services into financial services. In the unified model, FSP staff will provide non-financial services directly, while the parallel model delegates the non-financial services to another department inside the FSP. They can lower the cost since they use their internal resources.

Alternative financing for the youth

In today’s dynamic financial landscape, we must explore alternative financing options to cater to the different youth segments’ unique needs. These segments include urban and rural youth, young women, and entrepreneurs. Barriers for youth are more pronounced for young women. Therefore, addressing the gender divide in financial inclusion is essential for economic development.

One innovative financing option is crowdfunding. It offers access to seed capital without traditional collateral. Crowdfunding allows entrepreneurs to build a financial history that may lower their collateral requirements and interest rates. Peer-to-peer (P2P) lending platforms directly connect borrowers and lenders online. Such platforms offer an alternative financing option for young entrepreneurs who lack access to seed capital and collateral. E-commerce platforms have transformed into innovation hubs. They provide accessible, convenient, and affordable financing options.

Crowdfunding and P2P lending carry risks despite their innovative approach to financing. These risks include the potential for fraud due to fewer regulations, the possibility of non-repayment or default on loans, and the volatility of funding amounts, which can be unpredictable and may not meet the target capital required. Moreover, these platforms may lack the financial protections offered by traditional banks and, thus, expose youth to financial losses without recourse for recovery.

Conclusion

The call to action is clear. Policymakers, financial institutions, and young entrepreneurs should collaborate and take resolute steps. Financial institutions should develop tailored financial products and services that cater to young people’s unique financial needs. Policymakers should create an enabling environment that provides access to financial services and the skills needed to create a more inclusive financial landscape. Together, they can help young entrepreneurs accumulate assets, generate income, manage financial risks, and fully participate in the economy.

Leave comments