Embracing the idea of financial well-being: Insights from India using the Global Findex database, 2021

by Aakash Mehrotra, Lakshay Jain and Monica Dutta

Nov 29, 2022

4 min

The Global Findex 2021 describes well-being as a person’s financial resilience to deal with unexpected economic events, stress generated by common financial issues, and confidence in using financial resources. Our blog emphasizes the importance of financial well-being based on the Findex 2021 data to provide a more holistic view of financial inclusion in the country.

Sunita, a domestic worker from Delhi, receives her monthly income through India’s United Payments Interface (UPI). She has a smartphone and a functional bank account and is well-versed in how financial technology works. However, Sunita is worried about not having enough savings for a medical emergency or old age.

Since UPI’s launch in 2017, India has improved financial inclusion at a CAGR of more than 5%. Further, the country has witnessed growth in the value and volume of UPI transactions since 2018. The value of UPI transactions increased from about USD 85 billion to USD 742 billion in 2022, while the volume increased from USD 3.8 billion to USD 32 billion, as per the Reserve Bank of India’s extensive Digital Payments Index and Financial Inclusion Index.

India has experienced the deepening of financial inclusion through an increase in access and usage. However, a study of financial well-being to understand true inclusion is important. The US Consumer Financial Protection Bureau has defined financial well-being as the freedom to meet current financial obligations and adequate savings to manage short-term emergency needs and long-term future needs. The Global Findex 2021 describes well-being as a person’s financial resilience to deal with unexpected financial events, stress generated by common financial issues, and confidence in using financial resources.

Trends in financial well-being

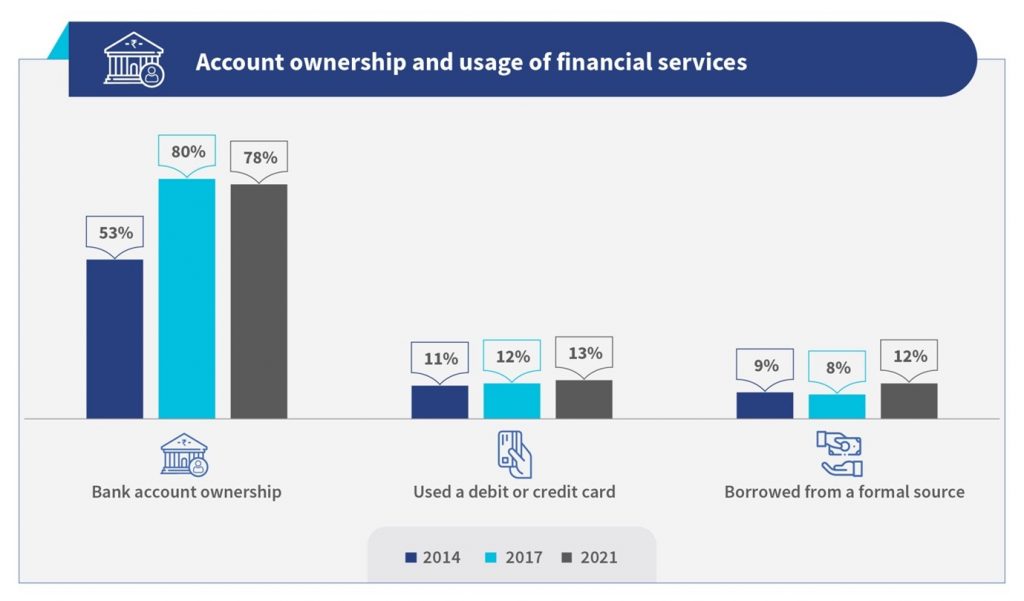

India has shown improvements in bank account ownership and usage of formal financial instruments from 2014 to 2021, as shown in Figure 1. Bank account ownership has jumped by around 50% from 2014 to 2021.

However, the data on financial well-being from India reflects high financial vulnerability. We used the Global Findex database 2021 data that included variables on individuals’ financial well-being in 2021 to gather insights in India.

Insight 1: People struggle to arrange emergency funds

In a survey, nearly 60% of the respondents in the higher-income group failed to meet their monthly expenses due to higher unexpected medical expenses during the COVID-19 pandemic and loan repayments. In the lower income group, 33% fell into a debt trap due to inadequate financial safety net, highlighting the importance of people being able to access and build an emergency fund.

Figure 2: Source: Global Findex Database 2021

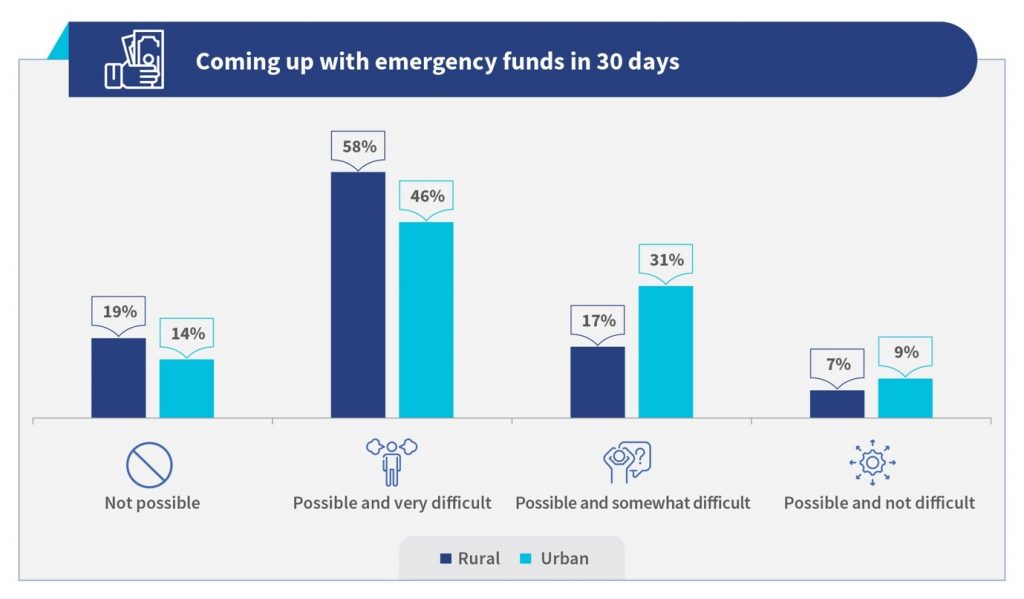

The data shown in Figure 2 captures a similar reality: most people lack a sufficient cushion for unforeseen expenses and find it “not possible” or “possible and very difficult.” Only less than 10% of the respondents across rural and urban areas were in a comfortable position to arrange emergency funds.

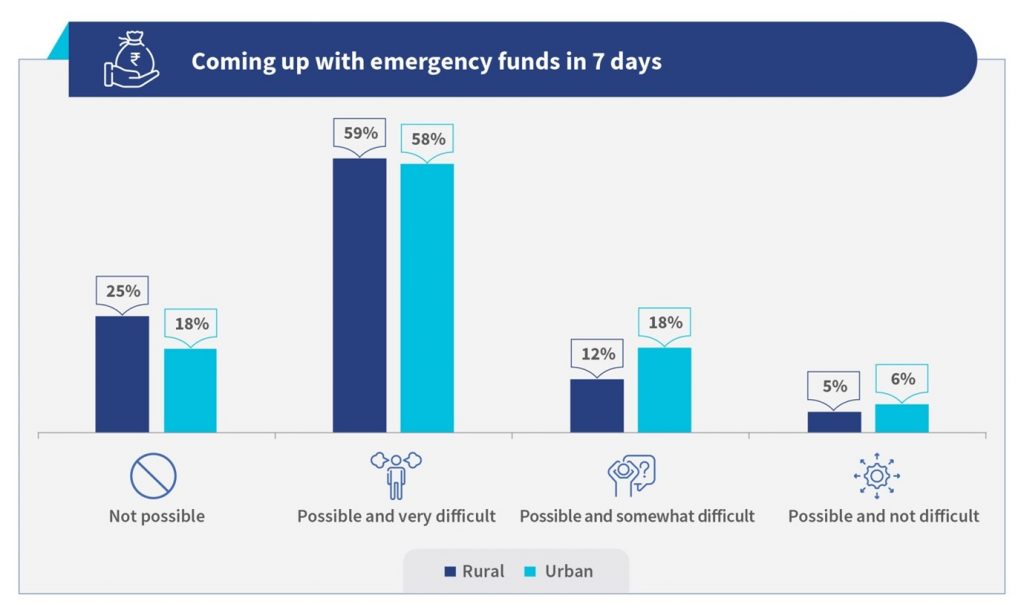

The situation was more acute when asked to manage funds within a week. See Figure 3. More than 80% of respondents found managing funds “not possible” or “possible and very difficult” to manage.

Figure 3: Source: Global Findex Database 2021

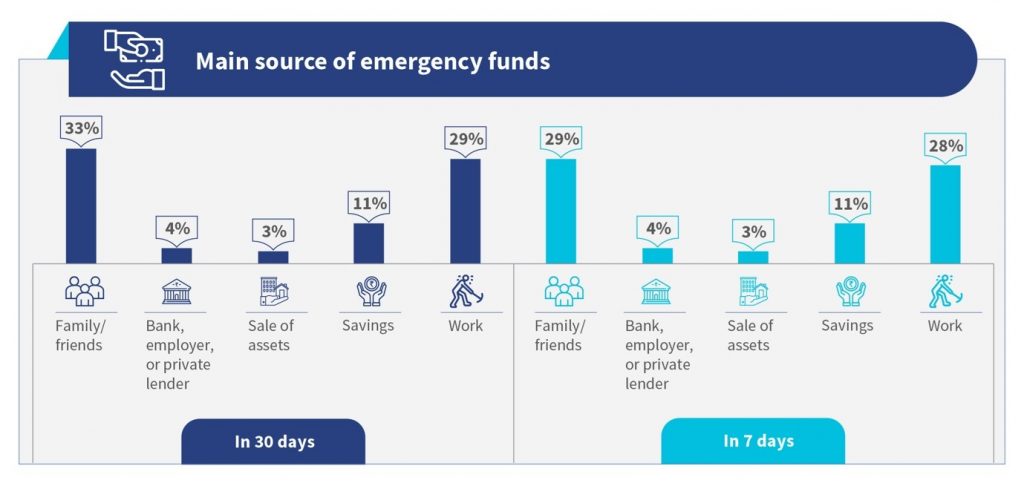

This data also highlights a deepened financial insecurity within social networks as most individuals rely on their family, friends, or employer to finance their emergency needs. Only 11% responded that they would access savings to meet emergency needs, as shown in Figure 4.

Figure 4: Source: Global Findex Database 2021

Insight 2: Medical illness remains the major cause of worry among Indians

Most Indians are one medical bill away from poverty. According to a study by the Public Health Foundation of India, about 55 million Indians were pushed into poverty in a year due to patient-care costs.

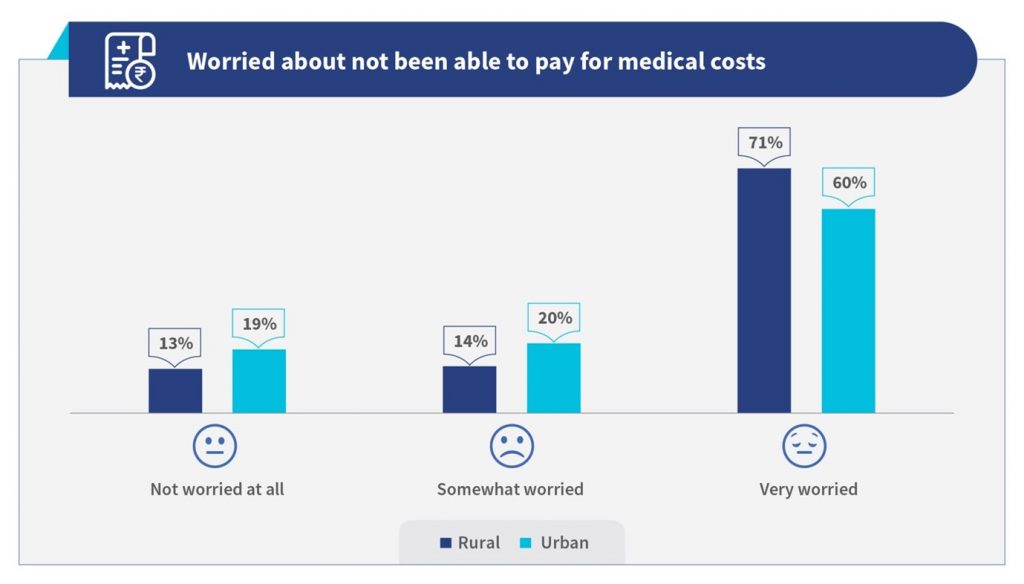

Figure 5: Source: Global Findex Database 2021

The Findex 2021 data shows that the most worrying financial issue for individuals is the inability to meet medical expenses. About 71% of respondents in rural and 60% in urban areas were “very worried” about lacking sufficient money to pay for medical expenses, see Figure 5. Moreover, even though health insurance coverage has increased over the years, it remains far from satisfactory. As per the National Family Health Survey (NFHS)-5, about 41% of households in India have at least one member insured. The fear of the inability to pay for medical illness varies with age and education level. About 72% of the people with primary or less education reported being “very worried” about the medical costs compared to just 53% who were educated at least up to the secondary level. About 70% of older people were also more worried about medical costs compared to 57% of the younger population, as per the Findex 2021 data.

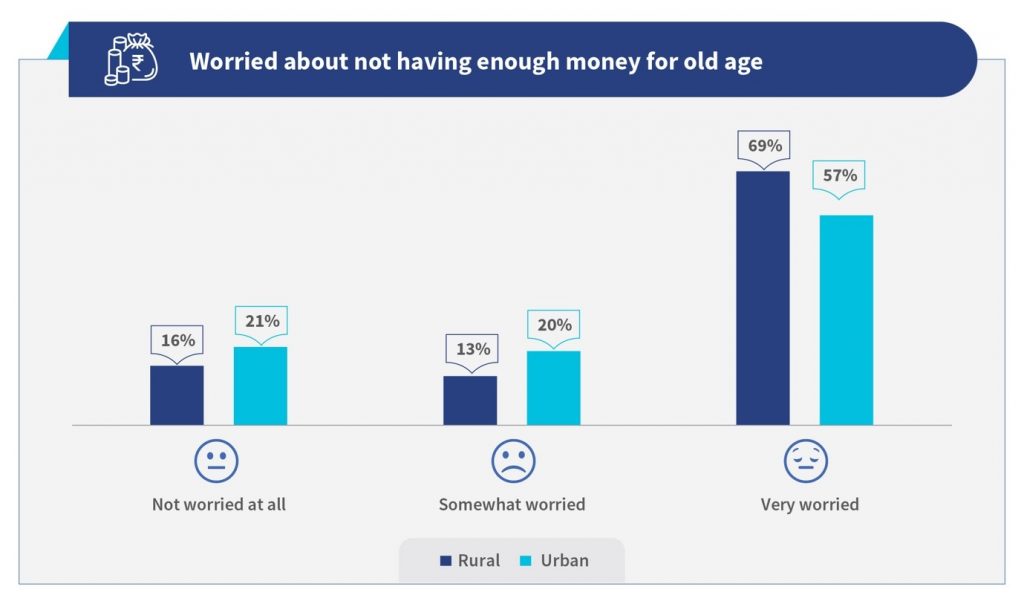

Insight 3: An increasing number of people are worried about not having enough for old age

The Findex database also measured another dimension of financial well-being—the perceived financial security for old age. Nearly 70% were “very worried” about insufficient savings to meet old-age needs, see Figure 6. The fears are corroborated by a UN report, which states that 52% of respondents think the current social security net for the elderly is insufficient in India. An August, 2017, report of RBI’s committee on household finance paints a similar picture that only 23% of Indians were saving or planning to save for retirement.

Figure 6: Source: Global Findex Database 2021

Insight 4: People are worried about not having enough for education or monthly expenses

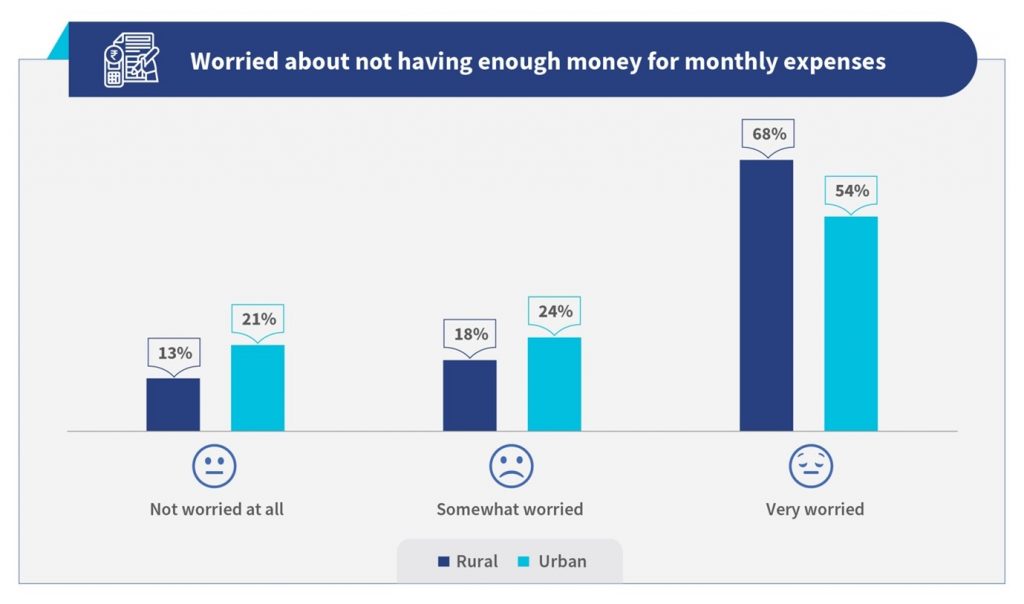

The Findex data estimates that the majority of the people in rural (68%) and urban (54%) are “very worried” about not having enough funds for monthly expenses.

Further, about 59% of the people in rural areas and 44% in urban areas reported being worried about not having enough to pay for education (Findex, 2021).

Figure 7: Source: Global Findex Database 2021

Shifting focus toward financial well-being

Poor financial well-being has far-reaching consequences that affect the wallet and an individual’s physical and mental health. Further research is needed on individuals’ financial behavior and personality traits to measure financial inclusion through financial well-being and build effective strategies that do not solely focus on access or usage. This will build a story where Sunita and the many like her belonging to the LMI segment have the ability to absorb shocks, and are investing enough to meet emergencies and their financial goals.

by

by  Nov 29, 2022

Nov 29, 2022 4 min

4 min

Leave comments