EasyPlan: Easing the middle-income segment into a more robust savings behavior

by Disha Bhavnani and Manali Jain

Aug 19, 2021

4 min

EasyPlan is a platform that helps the middle-income segment in India invest simply and conveniently through its digital savings app. This blog examines EasyPlan’s journey in identifying its target audience to refine the services it provides on its platform.

This blog looks at EasyPlan, a startup that was part of the Financial Inclusion Lab accelerator program, which receives support from some of the largest philanthropic organizations across the world—Bill & Melinda Gates Foundation, J.P. Morgan, Michael & Susan Dell Foundation, MetLife Foundation, and Omidyar Network

EasyPlan’s journey till now

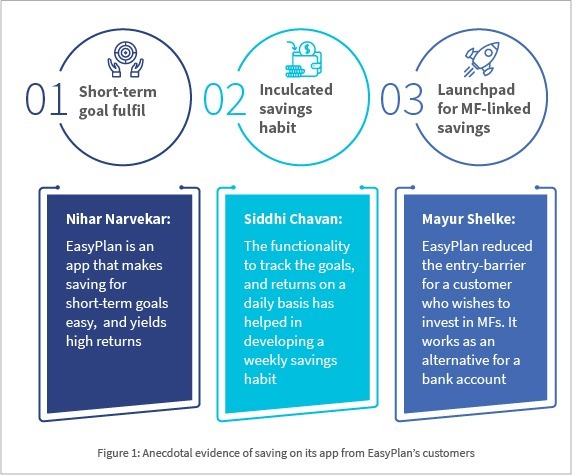

Nihar, Siddhi, and Mayur are in their mid-twenties and reside in India’s urban locations. They fall under the middle-income segment (Figure 1) and prefer flexible saving options to achieve their short-term goals. Earlier, they could not save efficiently as most banks do not offer short-term saving instruments at desirable interest rates. Thus, they ended up spending their income on discretionary expenses. EasyPlan emerged as a solution with its offering of mutual fund-linked savings. It gives its customers the flexibility to save as much as possible, withdraw within a day’s notice, and earn higher returns than traditional savings products. These features encouraged Nihar, Siddhi, and Mayur to try EasyPlan’s simple and intuitive mobile application, and soon they started saving money. (See our previous blog for more on EasyPlan).

EasyPlan has reached a customer base of 200,000 in India. The startup has impacted the lives of its customers in several ways. As illustrated below, EasyPlan has helped Nihar, Siddhi, and Mayur fulfill their goals by helping them build regular saving habits and providing them accessible and flexible options to invest in.

The COVID-19 pandemic altered the behavior of EasyPlan’s customers and redefined the startup’s business approach

As COVID-19 ravaged people’s lives, India witnessed a significant change in consumer sentiments. With economic instability and job losses leaving profound impacts on all strata of society, people from across income segments changed their financial behavior. While the GDP fell, people grew increasingly uncertain about future incomes and started to save whatever they could, fearing “rainy days” ahead. People’s saving levels as a share of GDP increased from 10% in the first quarter of FY 2019-20 (Jan-Mar, 2020) to 21% during the same period in FY 2020-21 (Apr-June).

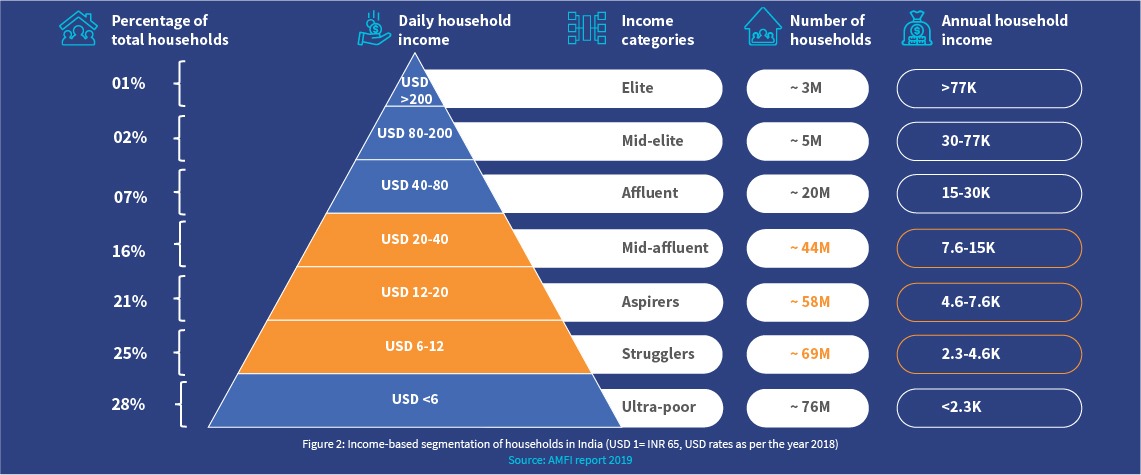

Likewise, people in the middle-income segments too saw the pandemic upending their lives. In India, the middle-income segment can be divided into three sub-segments—strugglers, aspirers, and the mid-affluent, as indicated in orange in Figure 2 above. Each sub-segment’s financial behavior is characterized by its financial health, demographic, socioeconomic, and behavioral factors. These differences play a crucial role in determining their perception, uptake, and preferences toward various savings and investment instruments.

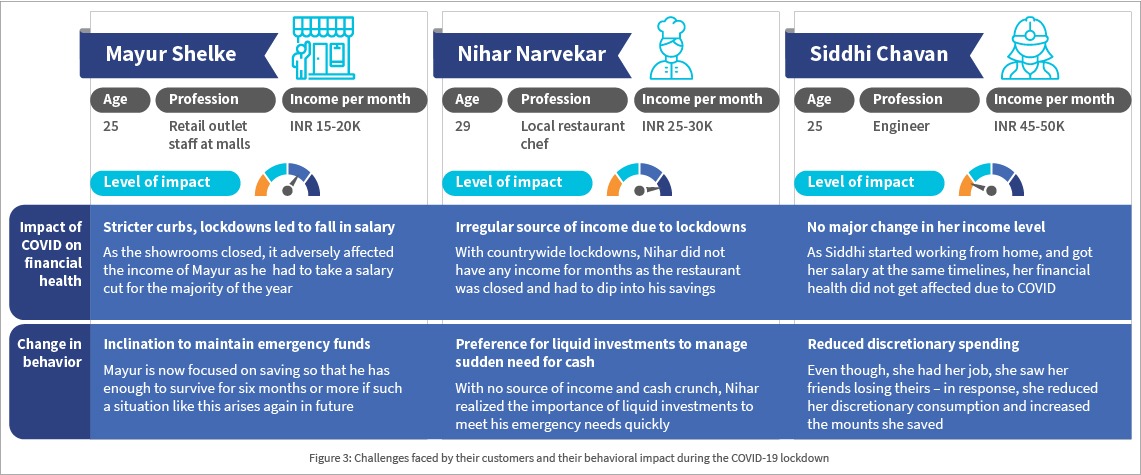

In the wake of the pandemic, each sub-segment faced distinct sets of challenges that affected their livelihood (as depicted in Figure 2). Many of them saw their income decrease and faced a cash crunch during emergencies. EasyPlan observed similar changes for its customer base across these sub-segments. It analyzed the savings behavior of its existing base, which revealed that even though the income of people during the pandemic became irregular, the pandemic has strengthened savings behavior. This change in behavior also snowballed into EasyPan acquiring new customers from the middle-income segments. However, before doing so, it delved into understanding how the middle-income segment portrays diversity across the wider income range that builds this segment.

EasyPlan then moved forward with a much more nuanced understanding of the savings requirements, risk appetite, and needs of the various sub-segments, as highlighted in Figure 2 above. This understanding helped them target the new customers as per their needs and support them throughout the pandemic. As a result, EasyPlan could retain its existing customer base while onboarding a new set of customers by tapping into their savings needs.

As seen in figure 3, the Lab investigated challenges that Mayur, Nihar, and Siddhi faced. The investigation identified factors that affected the behaviors of the sub-segments, as represented by the three personas, and influenced their perspectives toward different financial instruments. These factors include demography, socioeconomic situation, financial health, and goals. The Lab assessed various internal and external factors that play a vital role encouraging the adoption of mutual funds among customers, such as their level of financial literacy, preferences around liquidity, time horizon, risk resilience, complexity of products, and availability of the overall infrastructure.

With deeper insights based on market research and the Lab’s support, EasyPlan narrowed the target market to “Aspirers.” Accordingly, the EasyPlan team was tweaking its business strategy at the time of writing to stay ahead of the competition.

“This analysis helped us highlight the sub-segments that form a part of the bigger monolith of the middle-income segment in India and learn how these sub-segments portray varied needs in choosing savings instruments and possessing different levels of risk appetite. We also understood how their savings behavior changed during the pandemic.” — Manisha Pandita, co-founder, EasyPlan

Way forward

EasyPlan’s simple yet powerful business concept of goal-based savings for its target segment found resonance with a promising Indian neobank, Jupiter. Through collaboration and partnership, it envisions building a mobile banking application for India’s smartphone users. The platform will not act merely as a technology-empowered banking platform. Instead, it will serve as a finance app for users by giving a single view of their accounts across other banks along with their savings and spending patterns. EasyPlan’s savings solution will be an integral, and independent part of the platform—and it will complement Jupiter’s objective of acquiring new customers to use their savings products, along with its existing customer base which will get access to an advanced savings product.

This blog post is part of a series that covers promising FinTechs that have been making a difference to underserved communities. These startups receive support from the Financial Inclusion Lab accelerator program. The Lab is a part of CIIE.CO’s Bharat Inclusion Initiative, and co-powered by MSC. #TechForAll, #BuildingForBharat.

Written by

by

by  Aug 19, 2021

Aug 19, 2021 4 min

4 min

Leave comments