Digital payments in India—democratizing financial services for the masses

by Manali Jain, Shweta Menon, Akshat Pathak and Pramiti Lonkar

Oct 3, 2023

4 min

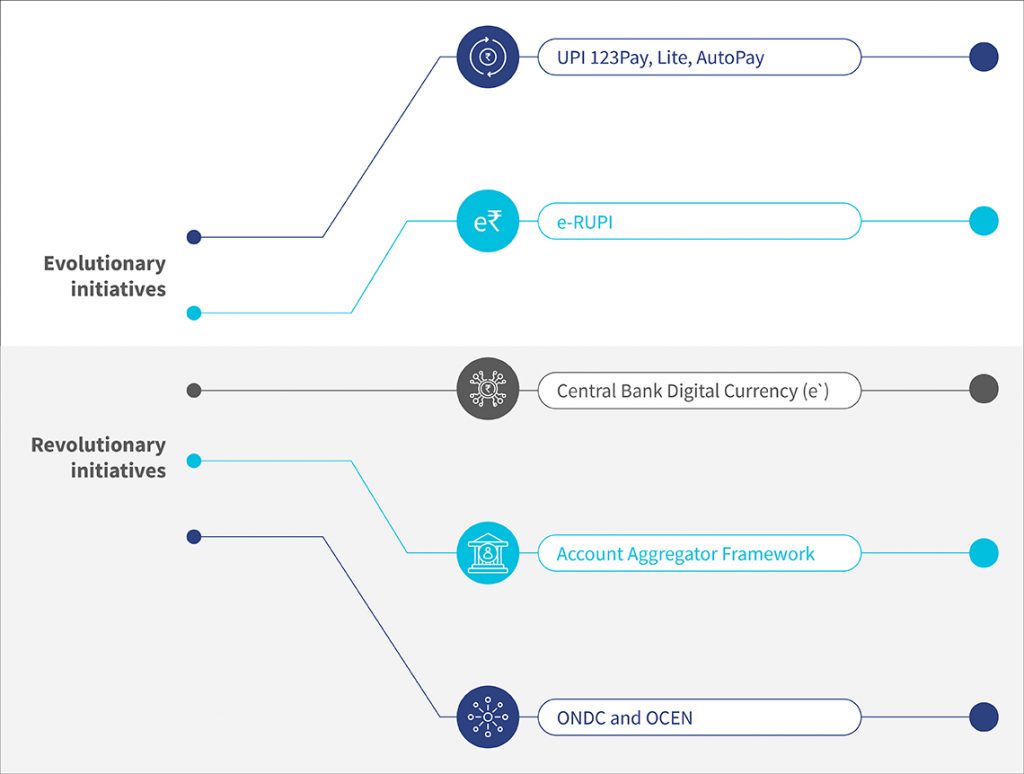

Digital payments in India are about to reach an inflection point where we expect a threefold growth in value to USD 10 trillion by 2026, with every two out of three payments being non-cash. Our two-part series highlights the evolutionary and revolutionary initiatives in India that are currently driving the growth of digital payments.

In our previous blog, we discussed the various factors that led to the rise of digital payments in the country, and also highlighted the evolutionary measures that will help us unlock the USD 10 trillion opportunity. In this blog, we highlight a few revolutionary initiatives that have bridged the gap further for the historic transformation of India’s digital financial services space.

Revolutionary initiatives

Central Bank Digital Currency (e₹)

The RBI’s Central Bank Digital Currency (CBDC) is a significant step in the evolution of currency that can change the way money works. The RBI defines CBDC as the legal tender issued by a central bank in a digital form akin to sovereign paper currency. CBDCs are exchangeable at par with the existing currency and shall be accepted as a medium of payment, legal tender, and a safe store of value.

The RBI launched CBDC’s first pilot in the retail segment in December 2022, known as digital Rupee-Retail (e₹-R), within a closed user group comprising participating customers and merchants. Mumbai, New Delhi, Bengaluru, and Bhubaneswar. State Bank of India, ICICI Bank, Yes Bank, and IDFC First Bank issue e₹-R in the form of a digital token representing legal tender in the same denominations that paper currency and coins are currently issued.

Users can make P2P and P2M transactions with e₹-R through a digital wallet the participating banks offer and stored on mobile phones or devices. As in the case of cash, e₹-R will not earn any interest and will be converted to other forms of money, such as bank deposits. Through this product, CBDC expects to reduce operational costs involved in physical cash management, foster financial inclusion, and bring resilience, efficiency, and innovation to the payments system. The use of e₹-R will also add efficiency to the settlement system, boost innovation in the cross-border payments space, and provide the public with use cases private virtual currencies provide without the associated risks. CBDC’s offline functionality would also benefit users in remote locations with limited electricity or mobile networks.

Account aggregator framework

India’s account aggregator (AA) framework is a consent-based system under IndiaStack that enables data sharing across financial institutions. In this case, account aggregators will serve as consent managers who permit an easy flow of financial data by serving as a conduit between customers’ financial information providers and users. The AA framework enables users to link all financial accounts securely to one data handle and provide consent to share the data with other financial institutions. Currently, 56 banks, FinTechs, NBFCs, and ~1.1 billion customer accounts are live on the AA system.

The AA framework will democratize financial services through easy, secure, and consent-based data transfer, give customers more control over their data, and reduce processing costs for banks and NBFCs through better access to data. More recently, the RBI included the Goods and Services Tax Network (GSTN) in the AA network as a financial information provider to facilitate cash flow-based lending to the micro, small, and medium enterprises that lack credit history based on their GSTIN records.

However, we are yet to learn how it will impact low and middle-income segments in rural markets that have limited or no digital footprint with low financial literacy. Our blog on the DEPA framework discusses one of AA’s most highlighted use cases—lending.

Open Network for Digital Commerce (ONDC)

India has the third-largest online shopper base globally, with 140 million e-retail shoppers. However, this number comprises only 18% of the country’s 761 million mobile internet users. On the supply side, around 12 million kiranas, which are hyperlocal neighborhood provision stores ubiquitous across the country, account for 80% of the retail sector in India. Among them, 90% are unorganized or self-organized, and most remain digitally excluded. Moreover, ~63 million MSMEs in the country can potentially unlock innovation and scale their operations through digital commerce. ONDC with OCEN can potentially support the growth of these kiranas and MSMEs and many customers by building a data trail, increasing outreach, and providing access to credit.

ONDC is an initiative to promote open networks for exchanging goods and services over digital or electronic networks at a population scale. The neutral platform is designed to set protocols for cataloging, vendor matching, and price discovery on an open-source basis. It enables sellers and buyers to be digitally visible and transact through an open network, regardless of the platform or application they use. Adding on the OCEN layer, ONDC will enable customers and businesses to borrow through any of these e-commerce or other apps. This will involve a standardized process with APIs for every stage of the customer lending lifecycle to support the integration of lenders with other digital platforms, including e-commerce.

Conclusion

These initiatives can potentially drive India’s digital payments growth and unlock the USD-10 trillion opportunity by 2026. Embedded payments via 5G and the Internet of Things (IoT) will provide further impetus. Building customer trust through better fraud management and easy digital onboarding remains imperative. So does improving economics for payment players.

Entities such as the RBI, NPCI, and FinTechs will prove crucial to facilitating this growth. How these initiatives will affect the digital divide and the low and middle-income segments, especially vulnerable communities, remain to be seen. Regulators and service providers can address some of these concerns by enabling customer-centric interfaces, agent-assisted support, last-mile distribution networks, and robust grievance resolution mechanisms.

by

by  Oct 3, 2023

Oct 3, 2023 4 min

4 min

Leave comments